Memo Published August 21, 2020 · 11 minute read

How Clean Energy Businesses Can Survive and Thrive After COVID-19

Ellen Hughes-Cromwick, John Milko, Ryan Fitzpatrick, & Andres Prieto

Economic Outlook

The health and economic crises from COVID-19 are record-breaking bad. In just two months, job losses in the United States rose to over 22 million. The economy collapsed in the second quarter by nearly 33% and would have cratered far worse if not for massive fiscal and monetary policy stimulus measures. As of the date of this memo, even though businesses have partially reopened, the high rate of infection continues to threaten economic stability. Over 30 million people are receiving some form of unemployment insurance, and the unemployment rate stood at 10.2% in July. The latest Bureau of Labor Statistics employment report shows that businesses across the spectrum are shedding jobs at alarming rates.

The Role of Clean Energy in the New Economy

What about clean energy businesses? Employment in the clean energy sector was growing at an impressive pace prior to the pandemic. Solar photovoltaic installers and wind turbine service technicians were projected to be the fastest growing occupations between 2018 and 2028, according to the US Bureau of Labor Statistics. These sectors eventually will continue to grow over the next decades as demand for low-carbon energy and products expands as part of the fight against climate change. Given the economic strife many of these businesses face, however, the government can expedite this recovery and expanded opportunity by providing policy support to stabilize the industry and help companies survive and thrive.

As of 2019, over 3 million people in the United States held clean energy jobs at businesses cutting across dozens of sectors in the economy. These include businesses working to stand up electric vehicle manufacturing, build out charging infrastructure, develop new public transit options, deploy solar, wind, and biomass, and improve energy efficiency. From data scientists to utility workers, the workforce in this sector is making important contributions to our clean energy economy. The continued growth of these businesses is essential in our efforts to curb emissions and make our economy more resilient.

News reports from early in the COVID-19 crisis made clear that the emergency was taking an economic toll on businesses across the country. However, the extent of the economic downturn’s impact on clean energy companies remained unclear. We wanted to know what actions these businesses were taking to cope and whether they were able to utilize federal assistance to keep employees on their payrolls. We also wanted to understand these companies’ views on which recovery policy tools would have the most positive impact in the months and years ahead.

To learn more about clean energy companies’ experiences since the severity of the pandemic escalated in March, Third Way developed a survey and reached out to a cross-cutting sample of these businesses. The results suggest that the industry was able to utilize federal assistance programs to stem potential job losses but will require additional policy support to weather the economic downturn and continue to grow.

Key Survey Results

- The PPP Program was a success for clean energy: Half of respondents took advantage of the program

- Dark clouds ahead: If federal assistance runs out, 46% said they will have to lay off workers, lower worker wages, cut worker hours, or cease operations

- Two thirds of businesses said their customers have either delayed or postponed orders

- Industry needs the federal government to take action with a combination of supportive policies

Survey Background

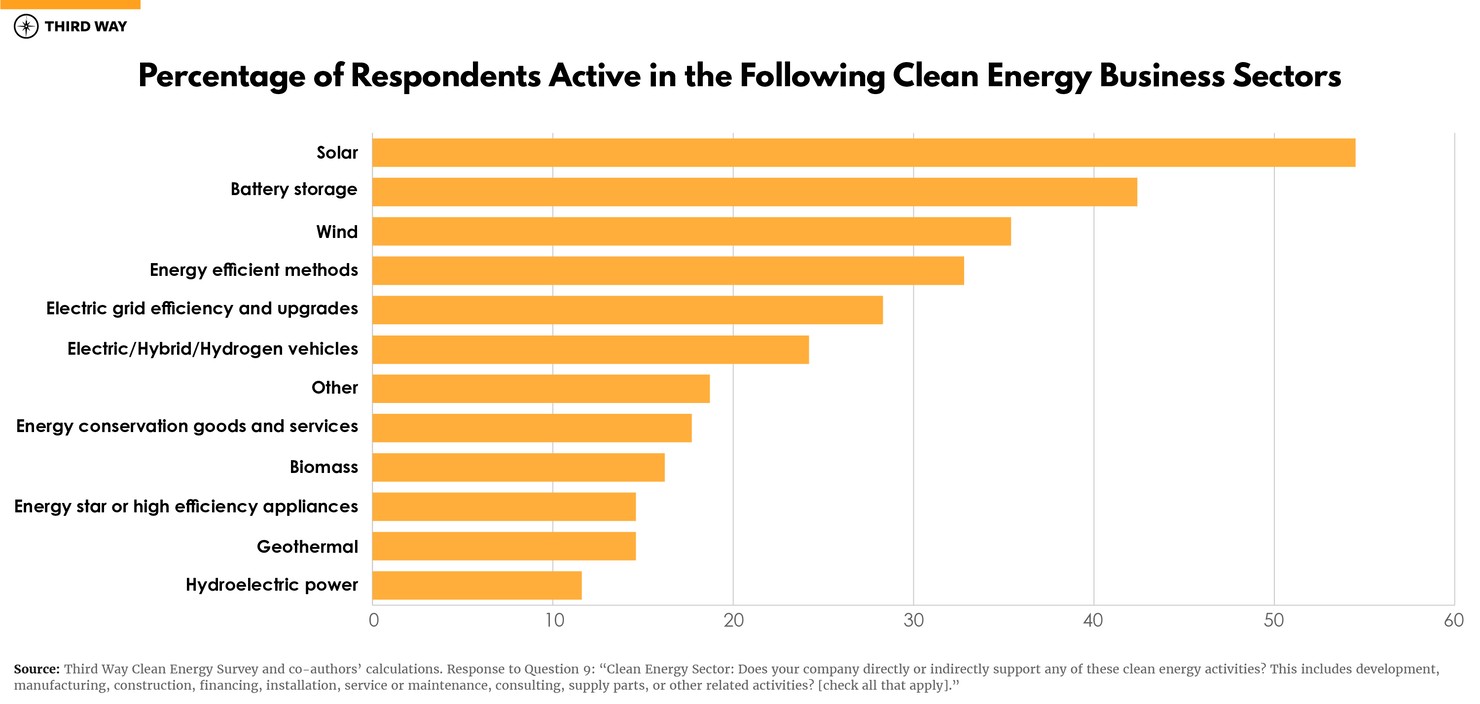

Third Way reached out to companies starting in late June through July 2020, using a variety of methods. We received over 200 responses from a broad range of sectors in the clean energy industry (see graphic below), making our survey unique among the mostly sector-specific research in this field. The appendix to this memo includes our survey questions and additional notes on our methodology.

Comprehensive employment data for the clean energy industry is only released annually, next update likely will not be available until mid-2021. However, Third Way’s survey offers a snapshot of how these companies are addressing the depression-level business conditions they face while we wait for the quantitative report release.

Our direct outreach to these firms also allowed us an insider’s viewpoint on the usefulness of a range of policies, such as tax credits, the Paycheck Protection Program (PPP), and low-cost lending programs.

How have COVID-19-related shutdowns affected these businesses?

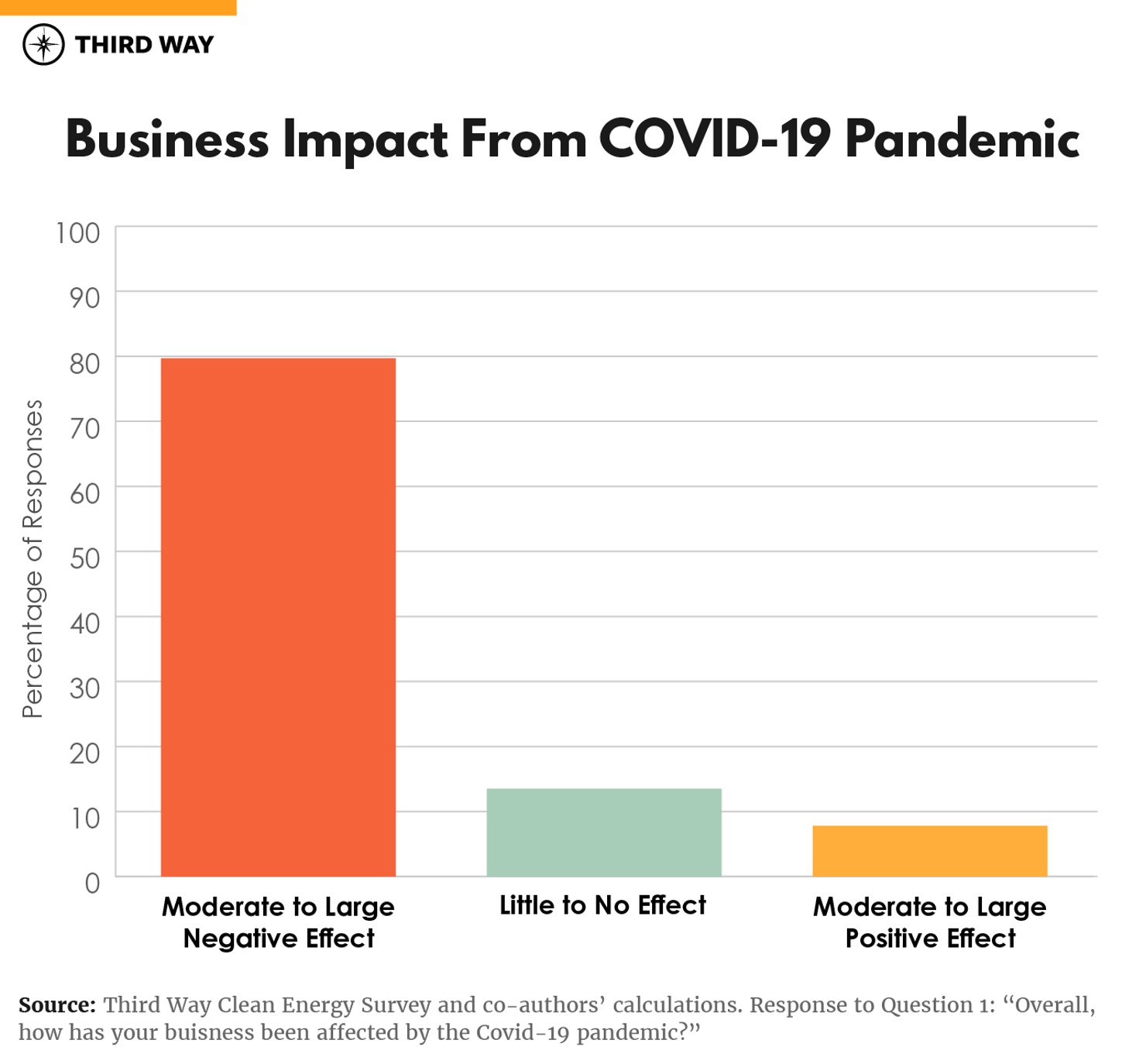

An overwhelming number of respondents – nearly 80% –said that the pandemic had a large negative effect (28%) or moderate negative effect (51%) on their business activities.

Given the scale and scope of the shutdowns that states have implemented to date, this result is not surprising, but nonetheless speaks to the way the pandemic forced many companies to hit the “pause” button. Below are five main takeaways that stood out to us in the survey results.

1. Half of respondents received or expected to receive funding from the Federal Paycheck Protection Program (PPP).

We asked respondents to indicate which, if any, sources of financial assistance they have tapped since March 1, 2020. This date was chosen to capture decisions made during the entire period of pandemic-related shutdowns and onset of the recession. Over 50% of respondents said they received or expected to receive financial support from PPP. After removing respondents at companies that are too large to qualify for PPP, we found that 55% of PPP-eligible companies were taking advantage of this assistance. As of July 31st, the US Treasury Department has reported that 5 million small businesses nationwide have received PPP funding, representing about 17% of the 30 million small businesses in the United States. This significant gap in percentage of recipients between clean energy businesses and all small businesses indicates that PPP played an especially important role for this industry and could signal the possibility of future distress, now that this stimulus measure has expired.

Much smaller, longstanding Small Business Administration programs – the Economic Injury Disaster Loans and Loan Forgiveness – supported 13% and 6% of respondents, respectively. Roughly a third of our clean energy business respondents said they had not received any financial assistance at all, from any source. In follow-on surveys, we are interested to see if this number drops as financial challenges continue as expected.

2. Many businesses may still need to take actions that adversely impact employees.

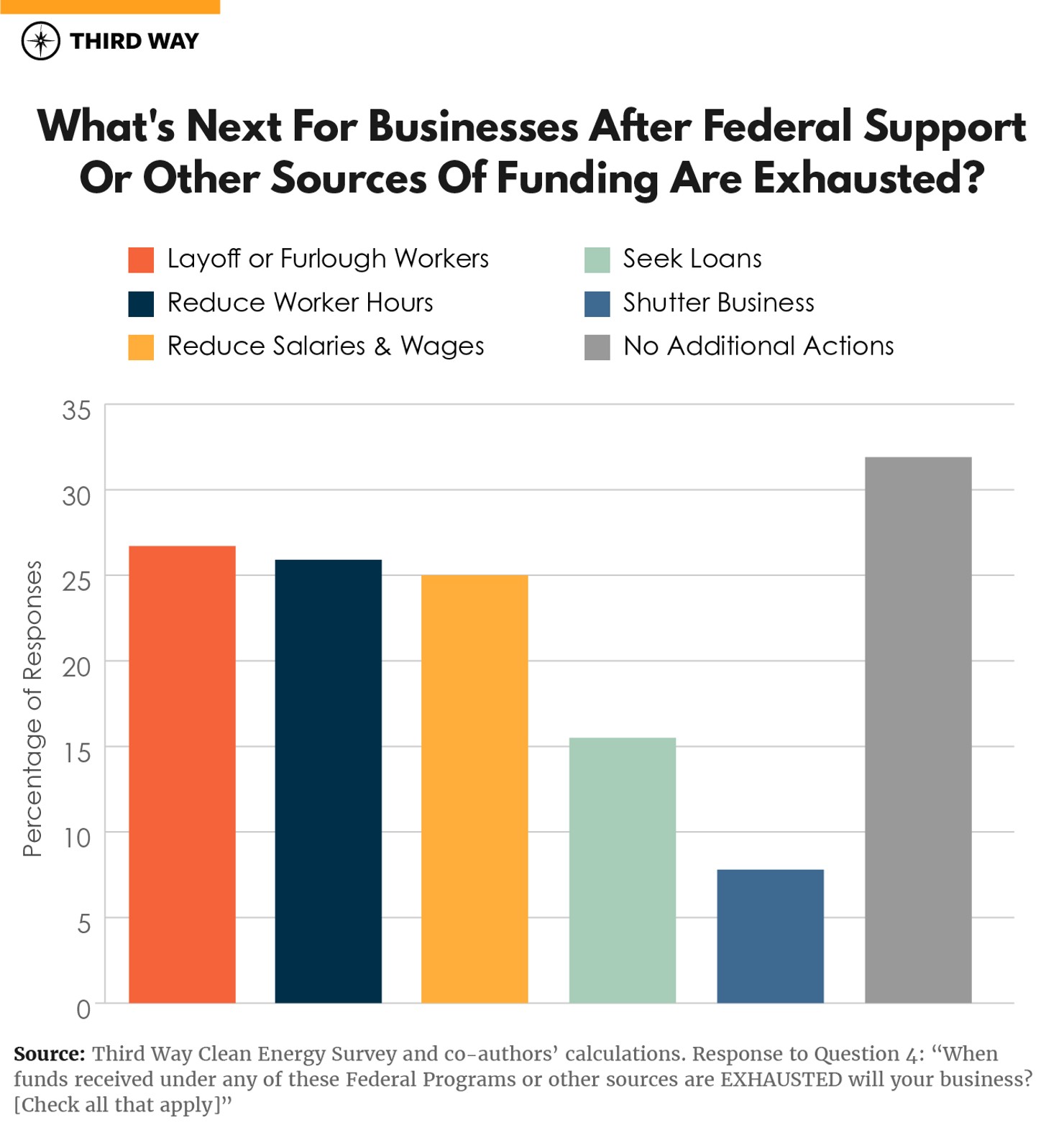

Forty-six percent of respondents indicated that they would need to resort to some combination of furloughs, reductions to workers’ hours or pay or, worse yet, closure of their business once the initial sources of financing since March 1st are exhausted. Twenty-seven percent expect to lay off or furlough workers; 26% say they will reduce workers’ hours; 25% expect to reduce salaries and wages; and 8% may be forced to cease operations. These survey results, combined with the fact that one-half of the businesses surveyed took advantage of the PPP, suggests that a round of cutbacks are an enormous risk during the next several months, particularly if Congress does not extend or expand the PPP.

3. Most respondents indicated that their business has been adversely affected—and they don’t expect it to get much better anytime soon.

Clean energy companies had good reasons to take advantage of programs like PPP. The impact from COVID-19 has been severe. We asked businesses what has happened to customer orders since the beginning of the pandemic, as well as what they expect to happen over the next 3 months. The responses suggest a challenging period may lie ahead for these businesses.

Regarding customer orders, businesses were asked to check any/all response options that applied to them. Sixty-six percent indicated that customers had delayed or postponed orders, while 41% said that customers had reduced their orders. One in four respondents noted that orders had been cancelled, while 7% actually observed an increase in customer orders.

We suspect that this variation may be due to the differences in how physical restrictions have affected specific clean energy business activities. For instance, our solar and efficiency sector respondents experienced a high incidence of order disruptions. This could be due to a number of factors specific to these sectors, including a higher mix of residential customers affected by the shutdown restrictions. Conversely, businesses engaged in longer-term projects may have experienced fewer disruptions than higher-touch businesses.

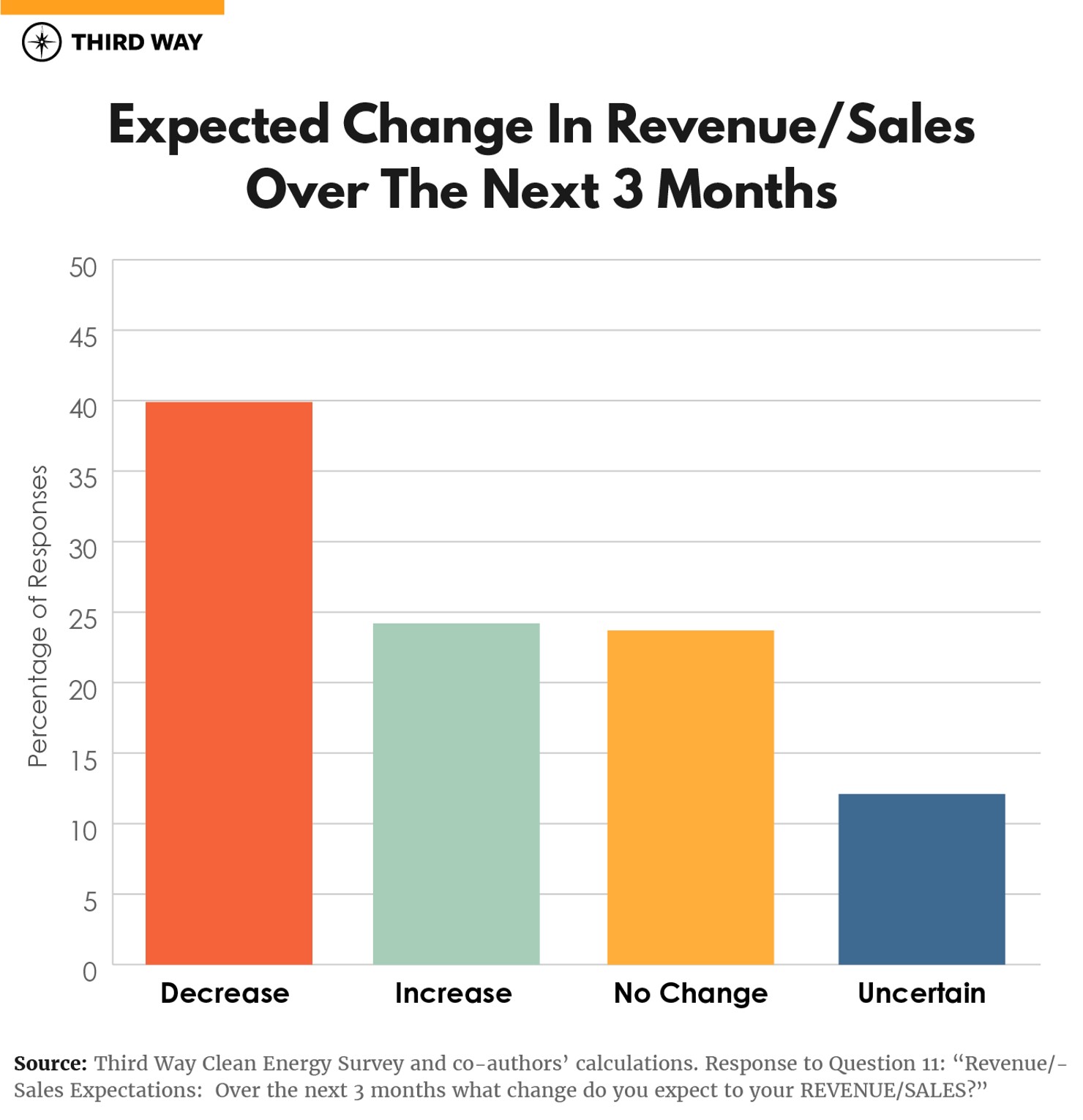

There is cause for concern among these businesses as we look ahead through October: Nearly 40% of respondents expected a decline in company revenue/sales in the next 3 months, while an additional 24% said they expected flat revenue. This speaks to the significant uncertainty clean energy companies face as they navigate their business activities given ongoing physical restrictions and general uncertainty.

4. Businesses regard a variety of government policies as helpful for post-COVID-19 recovery and expansion.

We provided our survey participants with an extensive list of potential policies that the government could enact to help their business recover from the effects of the pandemic.

Forty-four percent of respondents said new tax credits would be most helpful, while 36% of respondents would like to see the ability to convert tax credits into cash grants. Clean energy developers often rely on tax equity investors to help finance their projects. The developers trade the benefits of the tax credit for an equity investment to begin and complete the project. The investors, in turn, realize the tax credits to reduce the amount of taxes they owe. However, with many companies projecting lower tax liabilities given the recent economic downturn, the tax equity market is at risk of drying up, and developers would benefit from the ability to realize tax benefits on their own via direct cash payments.

Additionally, twenty-eight percent of respondents highlighted government infrastructure spending, while 26% said that low-interest loans would be beneficial.

The policy choices varied among different sectors. For example, 58% of businesses working in wind power preferred new tax credits to support their industry, joined by 52% of battery storage respondents. Forty-seven percent of solar business respondents favored this policy tool. Meanwhile, converting tax credits into cash grants was a popular option for both solar (45%) and battery storage companies (50%), but less so among wind energy companies (36%). Clearly, these different sectors have unique conditions and needs. Therefore, a variety of policy solutions will likely be necessary to help the clean energy industry recover.

5. A substantial majority of clean energy businesses we surveyed support legislative solutions for climate change and clean energy.

We asked the following open-ended question about climate change policy and business implications: “Should the Federal Government enact major legislation to fight climate change? If so, how might this impact your business?”

While most survey-takers are eager to get through a questionnaire as quickly as possible, often avoiding optional essay-style questions, we received an astonishing 170 write-in responses to this one. Ninety percent of these responses voiced support for major legislation addressing climate change and/or policies that promote clean energy. Many respondents voiced opinions like this one: “We cannot keep 'kicking this can down the road'. Carbon sequestering, clean energy tax credits, actual penalties for polluting emitters would all make a difference.”

We cannot keep 'kicking this can down the road'. Carbon sequestering, clean energy tax credits, actual penalties for polluting emitters would all make a difference. - Survey Respondent

Respondents identified a number of policy solutions for addressing climate change that overlapped with policies to revive their businesses, as asked in an earlier question. These included tax credits, incentives to help customers purchase clean energy products, and reduced regulatory barriers. Respondents also used this write-in question to voice their support for climate policies that were not offered to them as options in the economic recovery policy question. These included performance standards requiring greenhouse gas emissions reductions, a price on carbon, more federal investment in innovation, smarter use of federal agency procurement power, and an end to fossil fuel subsidies.

Conclusion

The success of clean energy businesses is imperative for protecting our environment and winning the fight against climate change, but it is also critical for reviving the national economy and jumpstarting growth and job creation in the near- and long-term. Third Way’s survey cuts across a host of businesses from a wide variety of clean energy sectors, and provides several guideposts for the months and years ahead. If we take one thing away from this research, it should be that America’s already-struggling clean energy businesses are not out of the woods of this recession. In fact, many are anticipating even further losses that will hurt their employees and their bottom lines.

Third Way plans to conduct a follow-on survey in the Fall of 2020 to determine whether conditions have changed for the clean energy industry, and if the policy needs identified by these businesses have evolved. But we can say with certainty right now that, if the United States wants this industry to survive and thrive, government supports for clean energy will be needed in the very near future.