Blog Published March 27, 2024 · 7 minute read

Nuclear Fuel 101: Front-End Processes, Prospects, and Policy

Rowen Price

Nuclear energy has the potential to be a huge clean energy source for the US and its allies. The Biden Administration is committed to expanding US nuclear energy, joining the historic COP28 agreement with 24 countries to triple nuclear energy by 2050. Increasing nuclear energy deployment won’t just reduce emissions—it will also support US national security and boost global competitiveness. But the US cannot deploy the nuclear energy needed to meet our goals without reliable fuel to power our nuclear reactors, which requires developing robust domestic capacity at every step of the uranium fuel production process. While uranium enrichment is by far the largest US fuel supply bottleneck, it is pivotal to ensure smooth transitions between all steps of the fuel supply chain and enhance our capabilities to scale with one another to avoid further logjams.

How Do We Make Nuclear Fuel?

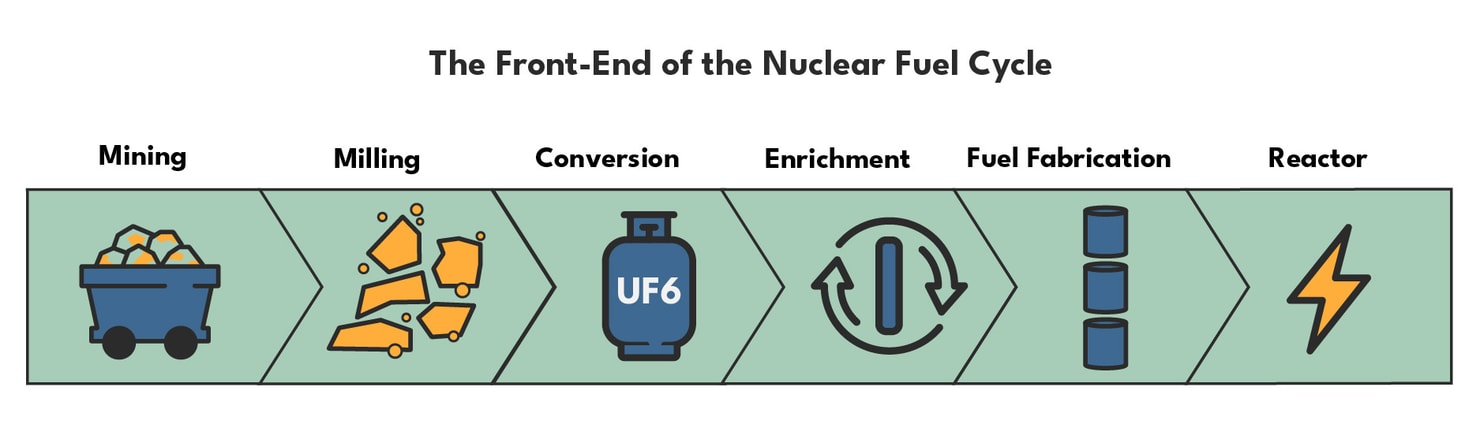

Movies and TV have mischaracterized nuclear fuel as bubbling radioactive green sludge when, in reality, it’s actually more like the graphite in pencils, made up of long rods of ore surrounded by metal. To use nuclear fuel in a reactor, you need to do more than just mine uranium and make it into solid fuel rods. You’ll need several steps of refinement and production—known as the front-end of the nuclear fuel cycle—to make it usable in most reactors. Without these steps, you’ve just got empty nuclear plants that can’t operate. Here’s a look at what this cycle looks like from mining to fuel fabrication.

Mining and Milling

Uranium is mined as an ore in many countries around the world, including Canada, Kazakhstan, Australia, and the United States. Once mined, uranium needs to be “milled” into yellowcake—a solid form of the ore that contains concentrated uranium. Right now, the US has a diverse mined uranium supply chain and can depend on multiple reliable mining and milling sources for generations to come.

Conversion

The milled yellowcake can’t be further concentrated into reactor-usable fuel in its solid form. Instead, the solid yellowcake must be converted to uranium hexafluoride gas, which is then used for enrichment (more on that in a moment). At conversion facilities, different chemicals are added to the yellowcake to purify the uranium and create uranium hexafluoride gas (UF6). The West is a leader in uranium conversion, with Canada and France making up over 50% of total global conversion capacity. The US is on track to join global conversion leaders once the ConverDyn nuclear facility in Illinois, which will account for 11% of the world’s total conversation capacity, comes online, strengthening our domestic supply chain and potentially allowing the US to deepen its relationships with other countries looking to purchase our conversion services.

The US Department of Energy is also encouraging further capacity expansion through its solicitation of proposals for deconversion activities—a subsection of conversion processes—for more concentrated nuclear fuel. By expanding domestic conversion and deconversion capacity, the US can ensure diverse and distributed capability, which will promote a robust and durable supply chain for US and partner country customers. It’s essential that conversion can operate at sufficient and flexible rates to keep uranium moving smoothly through the fuel cycle.

Enrichment

The largest roadblock to developing nuclear fuel supply in the United States is enrichment, which concentrates the amount of reactive uranium (U-235) into fuel. This process takes place within a series of gas centrifuges, called a cascade.

Almost all existing reactors use uranium enriched to 3-5% (up to 5% is low-enriched uranium or LEU), meaning the fuel contains up to 5% reactive uranium. But to build new smaller reactors we need a reliable supply of fuel enriched to between 5 and 19.75% (high-assay low-enriched uranium or HALEU).

The largest obstacle to enrichment in the US is that we lack the capacity to produce enough LEU and HALEU to fuel our own reactor fleet. That makes us dangerously dependent on unreliable countries to supply our LEU and HALEU, particularly Russia, which controls 33% of the global LEU supply and 100% of the commercial HALEU capacity. Domestic enrichment currently meets just one-third of US demand. Meanwhile, we continue to rely on Russia to supply 24% of our enriched uranium and uranium services annually—despite the fact that this revenue helps fund its war effort in Ukraine and keep us vulnerable to geopolitical leveraging.

Fortunately, western enrichment companies Urenco and Orano have indicated intent to increase their enrichment capacity and Centrus’s demonstration HALEU plant has already begun delivering HALEU for a Department of Energy contract. In addition, DOE recently released a request for proposals from enrichers to facilitate contract awards guaranteeing government offtake for up to ten years total, thereby encouraging near-term commercial expansion.

These are significant advances, but it’s not enough. We may need up to $3.8B of initial federal funding total to improve our prospects. To that end, a multi-pronged legislative approach is moving through Congress, and it will be essential to create a stable legislative foundation for further fuel cycle growth.

Fuel Fabrication

This step makes the enriched uranium into reactor-ready fuel by chemically processing the incoming enriched uranium gas into solid uranium oxide pellets. Those pellets are then stacked into fuel rods, which are fixed into position in larger grids called fuel assemblies which are loaded vertically into specific positions in the reactor core.

There are three fuel fabrication facilities producing power plant fuel in the US. There are also multiple competitors in other countries including Russia, but some nuclear energy facilities in the US and elsewhere are decisively turning away from Russian fuel fabrication.

As interest in advanced reactors grows and more countries opt to avoid Russian fuel, the number of fuel fabrication facilities will increase, and advanced reactors’ diverse fuel types will require different fabrication processes. We’re seeing new facilities pursuing licensing in the US to fabricate fuel into spherical “TRISO” fuel, in addition to the multiple facilities in Western countries continuing to produce the classic fuel rods. The diversity of capabilities will help meet US advanced reactor demonstration project goals by ensuring specialized fabrication processes are in place to meet the varied fuel needs that will arise.

Where Do We Go From Here?

US policymakers are taking action to bolster LEU and HALEU supply chains to enhance our energy security and national security and free the US supply chain from unreliable suppliers. New nuclear legislation is at the center of this effort. Congress has pressed forward with a multi-pronged policy approach authorizing and appropriating $2.72B for nuclear fuel supply development, coupled with an (as yet unpassed) bill banning Russian uranium imports. As this legislative effort moves forward, the US interagency is gearing up to work with the private sector and international partners. Looking ahead, successful fuel supply will rely on efficient implementation of these new priorities.

Conclusion

Developing the US nuclear energy infrastructure goes far beyond building new reactors. A reliable, sustainable fuel supply chain is key to unlocking nuclear energy’s vast potential. Awareness is growing about the national security imperative for enhancing US—and more broadly Western—controlled nuclear enrichment capacity, and to successfully free ourselves from precarious reliance on Russia and China we must develop our nuclear fuel supply system as a whole. Both policymakers and implementers must consider how to actively promote a holistic nuclear fuel supply chain to efficiently and sustainably move our nuclear energy future forward.