Memo Published April 28, 2021 · 15 minute read

Breaking Down Barriers: How the Department of Energy Can Immediately Advance Racial and Gender Equity for Entrepreneurs

Nicholas Montoni, Ph.D. & Doug Rand

It’s hard to be a startup, given that most small businesses don’t survive past five years. It’s really hard to be a clean energy startup, given that venture capital firms underinvest in tough technology challenges. And it’s hardest of all to be a woman- and/or minority-led clean energy startup, given that venture capital firms underinvest even more egregiously in underrepresented founders.

All of these barriers prevent the United States from achieving its full potential in terms of both entrepreneurial dynamism and climate leadership. Technology startups provide outsized economic benefits by creating employment opportunities, competing with established companies, and paying their workers higher wages than the national median—yet startup activity has experienced a decades-long decline. Despite a long drought of private-sector underinvestment, clean energy startups are an especially important part of the U.S. innovation ecosystem required to develop and deploy the technologies needed to mitigate climate change. And as long as structural barriers stifle entry into the clean energy ecosystem by innovators who are women and Black, Indigenous, and people of color (BIPOC), we will squander essential entrepreneurial talent.

In this memo, we provide a menu of actions that the Department of Energy (DOE) can take immediately, without additional congressional action, to support clean energy startups and make important progress on three of the Biden Administration’s highest priorities: economic recovery, tackling the climate emergency, and racial equity.

After a candid review of the status quo, we present a short overview of programs granted new authority by the Energy Act of 2020 and covered in recent Third Way and Breakthrough Energy reports. Next, we go in-depth on two DOE programs, Small Business Innovation Research (SBIR) and Innovation Pathways, to highlight how executive action can help level the economic playing field for women and BIPOC as both founders and funders of clean energy startups.

The Urgent Need for Racial and Gender Equity in Clean Tech

Venture capital (VC) firms provide funding for only a handful of entrepreneurs who are women, Black, and/or Latinx, far below the share of science and engineering advanced degree holders in these demographic groups. Even fewer venture capital investors are women, Black, and/or Latinx themselves. One study of venture-backed startups between 1990–2016 found fewer women (92% male, 7% female) and Hispanic (86% white, 10% Asian, 3% Hispanic) entrepreneurs in the energy and utility sector relative to other industries, and no Black founders at all.

We can’t expect to solve the nation’s toughest technology challenges by leaving so much of our entrepreneurial talent on the bench.

While this may sound like faint praise, the federal government does have a slightly better track record than the venture capital industry for funding underrepresented entrepreneurs, likely due in part to its reliance on (more or less) blind peer review rather than the “old boy’s network” exemplified by many VCs. But there is still plenty of room for progress, for example in the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs (which we refer to collectively as “SBIR” in this paper for simplicity).

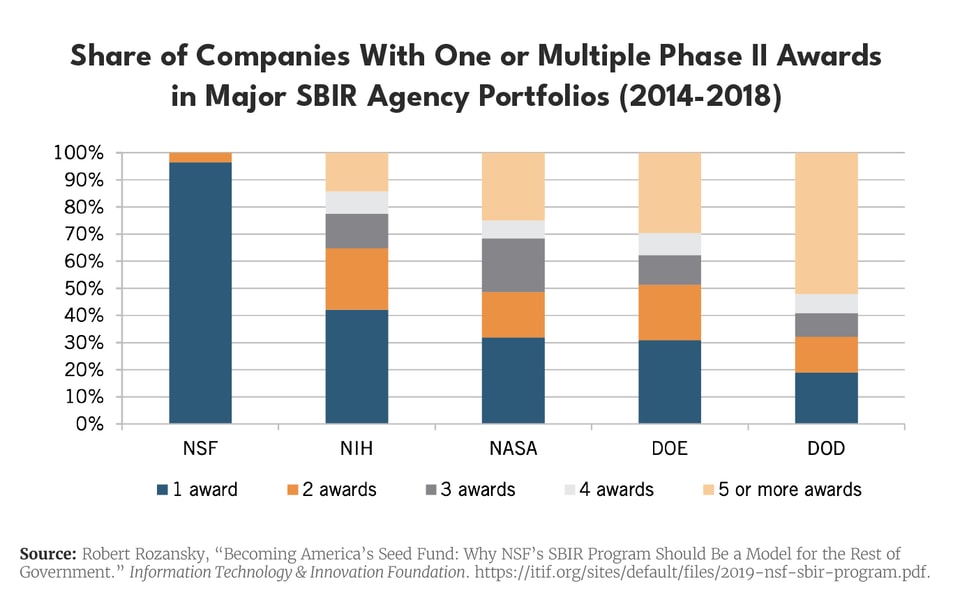

First, a significant share of DOE SBIR awards go to repeat players rather than first-timers. This suggests that relatively few startups are successfully navigating the award process, in contrast with the program’s branding as “America’s Seed Fund.” As a general matter, DOE can achieve more “shots on goal” by ensuring that a steady stream of new startups have ample opportunity to obtain pre-venture SBIR awards and then graduate from federal funding.

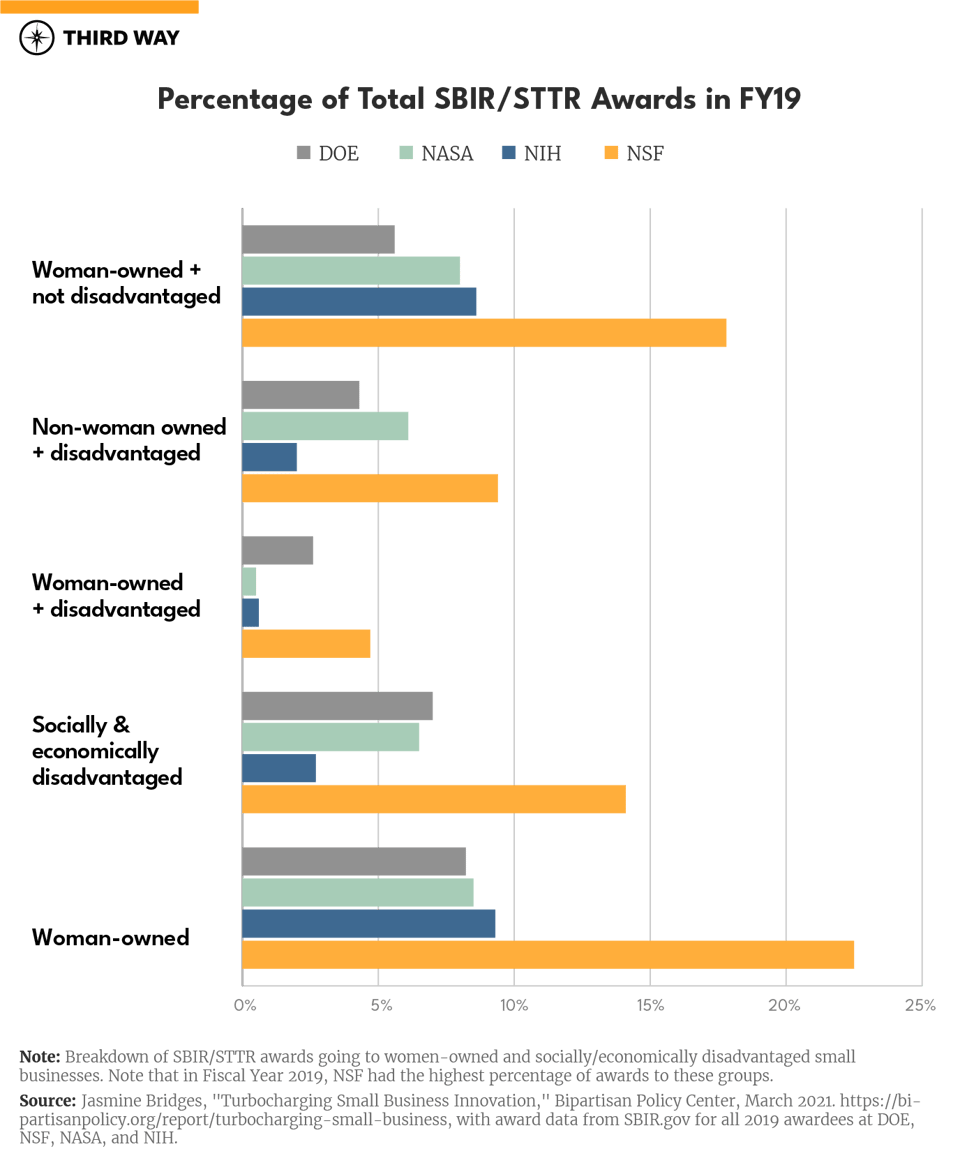

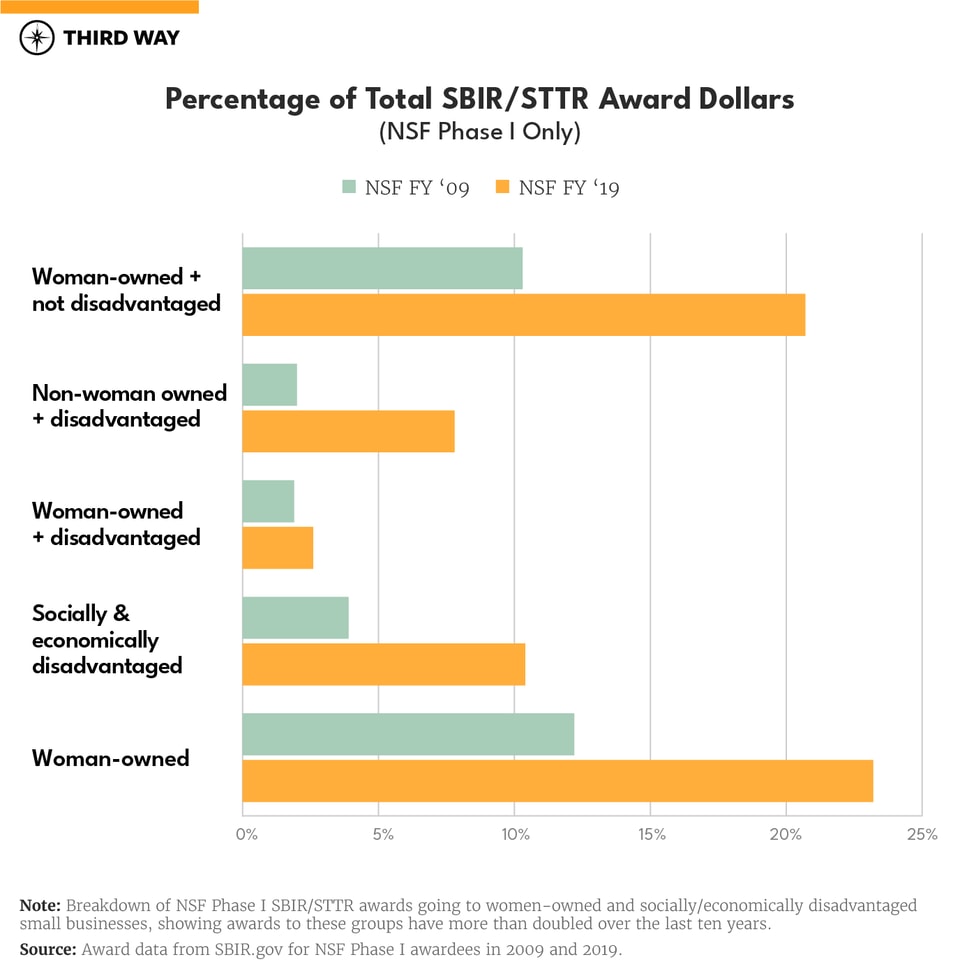

Second, as Jasmine Bridges demonstrated in her paper Turbocharging Small Business Innovation, only a relatively small fraction of DOE SBIR dollars are obtained by companies that are majority-owned by women (8.2%) or “socially and economically disadvantaged” individuals (7.0%). The United States Small Business Administration defines “socially disadvantaged” and “economically disadvantaged” broadly, but as a general matter, the category includes any individual from a racial or ethnic minority group or other demonstrably disadvantaged group, such as the disabled community, as long as that individual has a net worth less than $750,000 and an average annual adjusted gross income of less than $350,000. Unfortunately, this expansive definition does not allow for finer-grained analysis of SBIR data as currently collected by the agencies.. However, this data is more than sufficient to conclude that the percentage of SBIR funds provided to these groups is nowhere near population parity, and is also much lower than the relative share of women and individuals from underrepresented minority groups receiving STEM degrees from US universities.

The underrepresentation of first-timers, women, and BIPOC entrepreneurs in the SBIR program are linked, since the small businesses that have obtained the most SBIR awards over time—sometimes over 100 awards per company—are much less likely to be owned by women or socially and economically disadvantaged individuals. We have found no evidence that these repeat awardees are more likely to advance from Phase I to Phase II—in fact, the opposite may be true in many cases.

Notably, we found that the National Science Foundation has achieved a much more equitable distribution of SBIR awards, compared with its peer agencies and with its own track record just 10 years ago.

DOE has a moral and economic imperative to achieve a more diverse pipeline of clean energy entrepreneurs and investors—and it already has the tools to do so.

In the next two sections, we argue for a range of programs and policies that DOE can embrace—without the need for new Congressional action—all of which would help reduce these barriers and expand entrepreneurial opportunity.

New and Improved DOE Tools to Support Startups

At the very end of 2020, Congress passed a giant bill that not only delivered $1.4 trillion in regular government appropriations and an extra $900 billion in COVID-19 relief, but also made promising bipartisan changes to the Department of Energy. Tucked into this Energy Act of 2020 (itself tucked into the larger bill) are several provisions that give the Secretary of Energy new authorities to break down barriers facing clean energy startups. Below is an overview of these provisions with recommendations on how DOE can take full advantage of them. For more detail on these programs and recommendations, check out Third Way’s report on actions to support startups during and after the COVID-19 pandemic, as well as Breakthrough Energy’s report on executive actions to support American clean energy entrepreneurship.

- Encouraging entrepreneurship: Congress authorized DOE Secretary to develop programs that “encourage students, energy researchers, and national laboratory employees to develop entrepreneurial skillsets and engage in entrepreneurial opportunities.” First, DOE should durably establish American-Made Challenges across all of its applied research offices, as a proven way to advance clean energy entrepreneurs through a rapid series of prize competitions, from an initial idea to a commercial demonstration. Second, the Energy I-Corps program should be expanded from an entrepreneurial boot camp tailored for DOE lab researchers to a training regimen also available to DOE’s academic and SBIR awardees.

- Giving startups vouchers to collaborate with labs: Congress has now green-lit the Small Business Vouchers program, piloted in 2015, which makes it much easier for small startups and large national labs to collaborate on high-impact research. These collaborations, worth $50,000–300,000 at no cost to the startup, should be revitalized across all DOE applied technology offices, whether as a standalone competition or as an extra benefit of receiving an award from other programs, such as SBIR and American-Made Challenges.

- Active startup/lab matchmaking: Congress has also codified the Lab Partnering Service, first piloted in 2018, which provides a helpful public directory of technical experts, facilities, and intellectual property across all DOE National Labs. This service should be expanded beyond information delivery, with staff dedicated to active matchmaking between startups and DOE lab personnel, and uncomplicated partnering mechanisms for these startups to obtain initial technical assistance (for free) and more complex follow-on partnerships (for a reasonable fee), especially those from underserved communities.

- Optimizing the Technology Commercialization Fund: First established in 2005, the Technology Commercialization Fund (TCF) is a mandatory carve-out of 0.9% of DOE’s applied research, development, and demonstration funds—some $30 million annually. Congress just updated the TCF in a number of helpful ways, including explicit authority for the Secretary of Energy to waive cost-share requirements—an excellent idea to level the playing field for smaller companies—and to give special consideration to applicants who have previously participated in entrepreneurial training such as I-Corps. This reliable funding stream should be used to scale up proven models like those described above—for example, running a larger number of American-Made Challenges with lab vouchers provided to each participating startup.

- Supporting regional energy innovation and entrepreneurial fellowships: DOE was given authority to build on the success of startup incubators that provide essential technical validation, including the Wells Fargo Innovation Incubator (IN2), which enables entrepreneurs to access the world-class expertise and facilities of DOE National Renewable Energy Laboratory; and the Incubatenergy Network, which facilitates testing and validation with electric utilities. To support more entrepreneurial fellows at Lab-Embedded Entrepreneurship Programs, DOE should provide expanded funding from ARPA-E, the applied technology offices, and/or the administrative funding allocation of the SBIR program.

- Sending strong market signals for energy innovation: How will DOE fulfill new congressional mandates to streamline its authorities for prizes and “other transactions,” establish milestone-based demonstration projects, and launch a new $175 million prize competition for carbon removal technologies? The Secretary of Energy should create a dedicated Energy Technology Markets Office to design and implement such programs, in close collaboration with the private sector and other federal agencies that can commit significant resources for the procurement of emerging energy technologies.

Leveling the Playing Field for DOE Seed Grants

The Small Business Innovation Research (SBIR) program is the federal government’s largest funding opportunity devoted exclusively to technology startups and small businesses, with over $3.5 billion awarded to nearly 3,800 firms in Fiscal Year 2019—including about $300 million awarded to over 400 firms by DOE. This funding is non-dilutive (i.e., the government takes no ownership stake), and is divided into a Phase I award ($150,000–225,000 over 6–12 months) and a subsequent Phase II award ($750,000–1,000,000 over 2 years).

As previously mentioned, SBIR awards at DOE frequently go to repeat awardees rather than new applicants, and most often go to men who are socially and economically non-disadvantaged (i.e. typically white). The former phenomenon tends to influence the latter, discouraging new entrants into the SBIR program who may be of different backgrounds than previous awardees. Both of these realities contribute to racial, gender, and economic inequity in clean energy startups. However, they can be addressed by rapidly adopting several best practices that reduce barriers for startup founders of all backgrounds:

- Hire dedicated program managers: At present, there are no DOE program managers who focus their time and attention exclusively on a portfolio of SBIR awardees. While the administrative and operational functions of the SBIR program are centralized at DOE Office of Science, the essential tasks of recruiting, vetting, and coaching awardees are farmed out to scores of DOE program managers who have numerous competing priorities. As is common at NSF, DARPA, and ARPA-E, DOE should hire a dedicated and diverse team of program managers who focus exclusively on startup awardees, who have relevant private-sector experience, and who can provide clean energy entrepreneurs with ample time and attention—which will be particularly helpful to the success of applicants and awardees who have not had prior experience with SBIR.

- Welcome entrepreneur-driven proposals: A typical DOE SBIR award notice runs to hundreds of pages, filled with narrow pre-defined research topics that may exclude entrepreneurs who are not intimately familiar with the program. DOE can significantly streamline these funding opportunity announcements, putting forward broad technologies of interest and clearly inviting a diverse set of entrepreneurs to propose their own topics, in addition to focused topics of particular interest to the program office.

- Optimize program design for equity: To its credit, DOE SBIR program has pioneered efforts to provide application assistance for first-time participants and a short-form pre-application to reduce barriers. These efforts should be rigorously evaluated to determine whether they are delivering a more diverse applicant pipeline, and optimized accordingly. Other promising approaches include: reducing paperwork by fusing Phase I and Phase II into one initial award, as is common at ARPA-E; and funding a network of trusted “power connectors,” which the American-Made Challenges program has used to reduce barriers for applicants.

Leveling the Playing Field for Venture Investment

Entrepreneurs ultimately need to transition from government research funding to private sources of capital, but absent well-designed public policy, venture capital (VC) funds will continue to underinvest in science-intensive clean energy startups. The VC industry also suffers from a pronounced lack of diversity: 65% of funds have no female investors and 81% have no Black investors, who account for only 2% of senior positions industry-wide.

To the limited extent that DOE has backed clean energy technology investors thus far, the results have been more equitable, perhaps because the agency’s peer review process is less prone to bias. For example, in 2017, DOE Innovative Pathways program provided seed funding for 10 organizations proving out different models for sustainable long-term investment in clean energy technologies. At the time, one third of these organizations had a woman in the top job—far more than the 5.6% among venture capital firms overall.

Research suggests that the homogeneity of venture capital funders is related to the homogeneity of startup founders. Conversely, diversity in venture capital funding teams could expand opportunities for racially, ethnically, and gender diverse startups. To “crowd in” more private-sector clean energy investment from a more diverse community of VCs, DOE should expand the following programs, with an explicit focus on equity and inclusion:

- Exploratory grants for new funding models: As described above, the Innovative Pathways program was extremely effective in promoting gender equity in clean energy investing. It ultimately helped launch a new venture capital fund with a focus on ocean technologies (AiiM Partners) and a blended venture/philanthropic fund for early-stage climate solutions (Prime Impact Fund), among others, which in turn have equity and inclusion as a core part of their investment strategy. This further supports the premise that a more diverse community of funders can lead to a more diverse community of founders. DOE should revive this program to fund a regular series of cohorts exploring new models for clean technology finance.

- Startup-friendly matching funds: To incentivize private-sector investment in SBIR grantees, some agencies offer extra matching funds for use after the Phase II award—which can also serve to provide opportunities for emerging investors and allow them to ultimately invest in more startups. For example, the National Science Foundation (NSF) offers a 1:2 supplemental match to private-sector investment (up to $500,000:$1,000,000). The National Cancer Institute, part of the National Institutes of Health (NIH), has a similar bridge program. Although DOE offers a “Phase IIC” program with 1:1 public/private matching, no startup can qualify until it has obtained a Phase I and two successive Phase II awards—and this can take 6–7 years, even though the startup could be ready for VC fundraising much sooner.

- Leverage for clean energy investors: A thriving venture capital industry does not emerge from a vacuum. Many of the first VCs in the United States were backed by the U.S. Small Business Administration and the U.S. International Development Finance Program (DFC) regularly provides support for emerging market private equity funds facing a shortfall of private-sector investment capital. Yet today, there is no federal government program designed to advance domestic venture capital investment funds for national-priority technologies. ARPA-E has not traditionally made awards to financial intermediaries, but it has broad authorities for “accelerating transformational technological advances in areas that industry by itself is not likely to undertake because of technical and financial uncertainty.” As importantly, ARPA-E also has a high level of in-house expertise on the needs of early-stage startups and investors, along with hiring authorities to bring in more experts as needed. As an immediate first step, ARPA-E should issue a request for information (RFI) soliciting public input and reaching out in particular to underrepresented investors on the best way to design a DFC-like program to expand the availability of private-sector capital for clean energy startups in the United States.

Conclusion

Entrepreneurship can be a powerful driver of economic recovery, racial and gender equity, and—in the case of clean tech startups—climate change mitigation. It’s hard to start and grow a business, but the Department of Energy has a suite of tools and new authorities that can make this journey smoother for everyone, especially BIPOC and women founders. Addressing these inequities can get more of our innovative talent onto the playing field, speeding up the post-pandemic recovery and the response to climate change.

The Department of Energy can make important reforms to its SBIR program to remove barriers to funding for entrepreneurs of all backgrounds by hiring dedicated program managers, welcoming entrepreneur-driven proposals, and optimizing program design for equity (e.g. helping first-time founders with the application process).

Similarly, it is critical to empower more BIPOC and women investors to become funders of startups. This can create a much-needed feedback loop—more VC coming from women- and BIPOC-run firms likely means more startups founded by BIPOC and women entrepreneurs, creating a more equitable environment for more people going into entrepreneurship and VC…and so on. There are several programs DOE can deploy to foster diversity and equity in clean energy venture capital firms, like exploratory grants for new funding models, startup-friendly matching funds, and leverage for clean energy investors.

We must harness all of our resources to boost the economy and respond to climate change, and that means breaking down barriers and eliminating structural inequities. The Department of Energy has a golden opportunity to tap the full measure of America’s talent and raise up a new generation of clean energy entrepreneurs and investors.