Memo Published May 20, 2015 · Updated May 20, 2015 · 6 minute read

Local Examples: Innovations in Target Pricing

Jacqueline Garry Lampert

Health insurance rightly protects consumers from catastrophic financial costs, but the financial insulation that comes with insurance also makes it easy for everyone—from patients to providers—to ignore differences in the price and quality of care. Most health plans assemble a network of health care providers and encourage people to see those providers by lowering their out-of-pockets costs for in-network care. But when a health plan covers most (or all) of the cost of care, the actual price is no longer much of a concern to patients. As a result, providers end up varying the price of care without any difference in the quality of care.

One of the innovative payment reforms and value-based purchasing efforts— target pricing, which is also known as reference pricing—addresses price variation and improves value. Under target pricing, consumers are responsible for paying the full additional cost above the target price, but the target price has a huge effect on the high prices charged by some providers—they drop dramatically. It is meant to encourage patients to comparison-shop for providers who offer high quality care at the lowest price.

Below are three stories that show how target pricing coupled with price transparency can lower health care costs while maintaining or improving care quality.

Castlight Health and Self-Insured Employers, Multiple States:

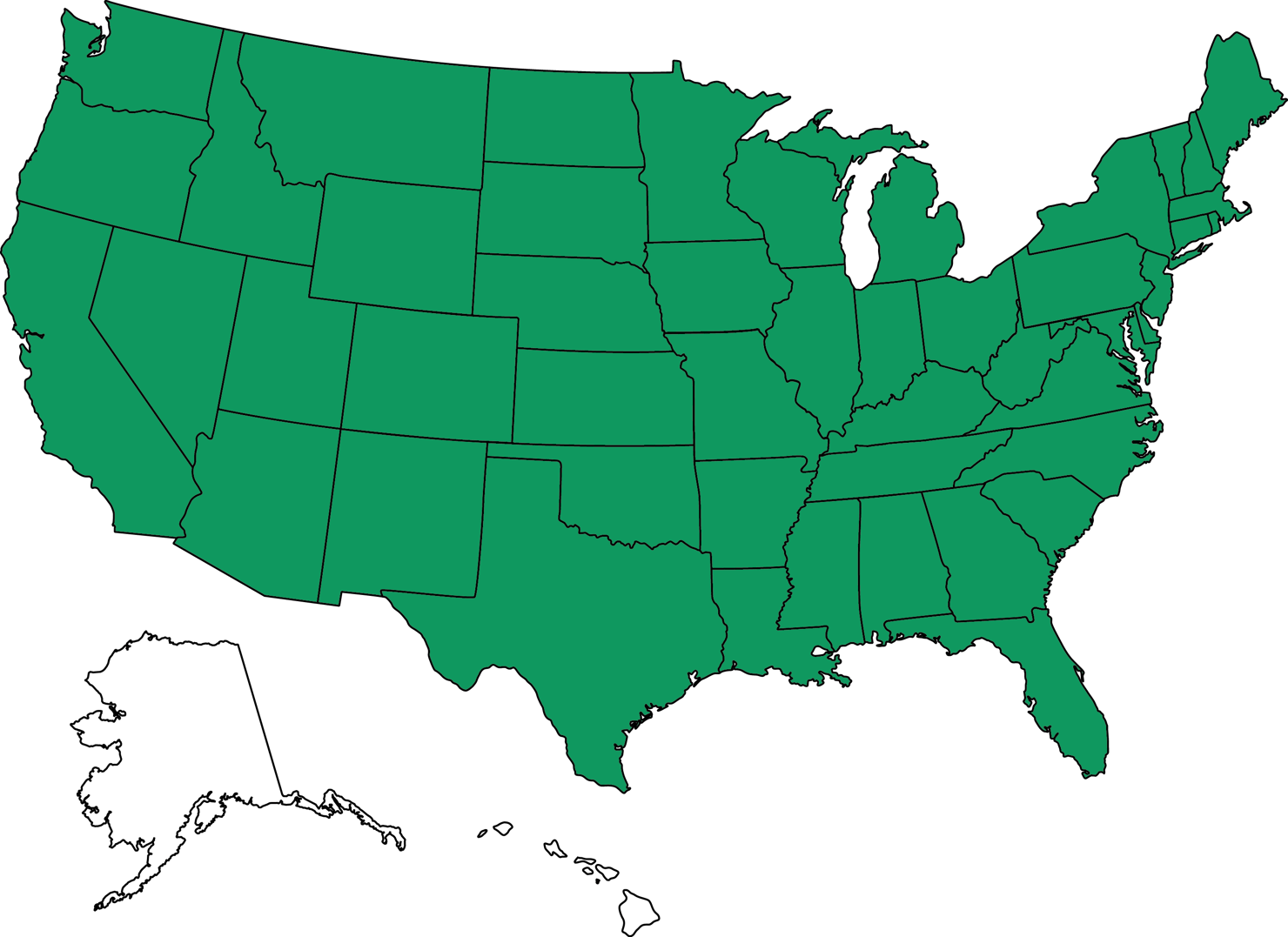

Target pricing simply won’t work without price transparency, and initiatives in nearly every state as well as private sector efforts are working toward improving consumer information about health care prices. One company, Castlight Health, works with employers to provide employees and dependents with access to personalized out-of-pocket costs and quality information for medical care to help consumers make informed choices. In a recent study that covered the contiguous United States, Castlight Health analyzed claims data for lab tests, advanced imaging services, and clinician office visits from 18 large, self-insured employers who provided their employees with access to Castlight Health’s price transparency tools. Consumers could access price information online or by phone. After having access to the platform, 5.9% of lab test claims, 6.9% of all advanced imaging claims, and 26.8% of all clinician office visits were associated with a search on the price transparency platform. Claims payments for those who searched for price information within 14 days of receiving services were lower than payments for those who did not search; payments were 14% lower for lab tests, 13% lower for advanced imaging, and 1% lower for clinician visits. These reductions translate into savings of $3.45 for lab tests, $124.74 for advanced imaging, and $1.18 for clinical office visits.

California Public Employees’ Retirement System and Anthem Blue Cross, California:

In partnership with Anthem Blue Cross, the California Public Employees’ Retirement System (CalPERS) is using target pricing for hip and knee replacement in California. After analyzing the market for cost and quality information, CalPERS and Anthem set a target price of $30,000 for an episode of inpatient hospital care for a routine hip or knee replacement. The procedures, while requiring inpatient care, are common and relatively standardized and therefore suitable for a target pricing system. CalPERS identified providers throughout California who met quality standards and offered hip and knee replacements at or close to the target price. It distributed educational materials to enrollees about the change in coinsurance and on the providers who could meet the target price.

Evidence shows the CalPERS target pricing initiative has both successfully lowered costs and moved patient volume for hip and knee replacements towards providers who fall at or below the target price. After one year, the number of surgeries performed at facilities that charged below the $30,000 target price increased almost 7% and the average amount paid per surgery nearly 25% lower. In the first two years, CalPERS saved $5.5 million (excluding savings in consumer cost-sharing) and expects the change in benefits to reduce overall expenses by 1.6%. Eighty-five percent of the cost savings was attributable to price reductions at both hospitals that accepted the target price and at those that did not. Outreach from providers to Anthem was significant: the hip and knee target pricing initiative was discussed in every 2011 hospital contract renewal, resulting in improved pricing in a number of cases. A number of providers even sought to renegotiate their contracts—for all Anthem subscribers, not just CalPERS members—to lower their fees in order to meet the target price. In addition, some hospitals that were unwilling to renegotiate their fees agreed to waive amounts above $30,000 for CalPERS members in order to keep their business. CalPERS expanded its target pricing initiative to include facility payments for outpatient colonoscopies, cataract surgeries, and arthroscopies. A recent analysis found that target pricing for cataract removal surgery caused an 8.6 percentage point increase in the use of less expensive ambulatory surgery centers, rather than hospital outpatient departments, reduced total payments per procedure by nearly 20%, and saved CalPERS $1.3 million in the first two years following implementation.

Kroger, Ohio:

The nation’s largest supermarket chain, Cincinnati-based Kroger, also utilizes a target price of $800 for certain imaging scans in 10 or the 31 states in which it operates. In those states, the price variation in abdomen CT scans fell by 32% over two years compared to an increase of 14% variation in states without target pricing. Kroger saved $4.3 million in 2012 after implementing target pricing for prescription medication. The company closely monitors employees’ medication adherence to ensure people don’t stop taking their medication due to its cost.

Safeway, Inc., California:

Safeway Inc., a California-based supermarket chain, was also an early innovator of target pricing starting in 2008. The following year, after observing a tenfold variation in colonoscopy prices within a market, Safeway extended target pricing to colonoscopies for their employees, establishing $1,500 facility fee for non-emergent, uncomplicated procedures. Safeway also applied target pricing for half of all laboratory test codes, providing employees with an online shopping tool to provide information about the cost, location, and type of lab services in their area to assist in making choices about obtaining services. With more employees using labs that accepted the target price, Safeway’s average lab unit costs dropped by $4.45. As a result of these and other efforts, the company reduced its total annual spending increases per person (including employees’ costs) to zero from 2005 to 2011 at the same time that national spending increased 60% on average.