Transcript Published August 3, 2015 · Updated August 3, 2015 · 47 minute read

Inside the Jobs Report

Third Way

Third Way

Inside the Jobs Report

Speaker:

Jason Furman,

Chairman,

Council of Economic Advisers

Introduction and Moderator:

Jim Kessler,

Senior Vice President for Policy,

Third Way

Location: 562 Dirksen Senate Office Building, Washington, D.C.

Time: 12:30 p.m. EDT

Date: Friday, July 24, 2015

Transcript By

Superior Transcriptions LLC

www.superiortranscriptions.com

---

JIM KESSLER: So I’m going to stand up here. This mic is actually fake. It’s a prop.

So thank you, everybody. Thanks for coming out today, actually, on a beautiful Washington summer Friday afternoon. My name is Jim Kessler. I am senior vice president for policy at Third Way.

Our goal today, for those in the room and those who are watching at home, is to make us better consumers of economic news and economic reports; in essence, to be our own Wonkblog. To help us achieve that mission, we are fortunate to have with us Jason Furman. Jason – early in his first term, President Obama said of Peter Orszag that he made being a nerd cool. Well, Peter was cool; Jason Furman is ice. He is chairman of the President’s Council of Economic Advisers. He’s been serving President Obama since day one as his senior economic adviser. He helped steer the nation out of the Great Recession. He also served under President Bill Clinton, which means that between the two presidents Jason is responsible, at least partly, for about 30 million private-sector jobs. He has a Ph.D. from Harvard, a long pedigree of books and articles on economics. He’s a father of three and a brand new father – three weeks now – of his son Felix.

And he was also the subject last year of the best Washington Post profile I have ever read, and I’m just going to give you a couple of highlights. One is he can juggle six flaming torches at once. Number two, he unsuccessfully argued to his wife that chopping wood failed the comparative economic advantages benefits test. (Laughter.) And he is far less successful than his college freshman roommate, Matt Damon. (Laughter.)

So, with that, Jason, thank you for joining us today. Jason’s going to lead off with a presentation, then I’ll ask questions, then you’ll ask questions. So, Jason, lead us off. Help us make us better economic consumers.

JASON FURMAN: OK, great.

Jim, thanks so much for organizing it. Thanks for everyone here in the room and for the people watching this at home.

I’m going to take you through some slides that have 10 tips, although it pretty much boils down to one really important tip that I’ll be giving you. And this is a set of slides which, if they’re of interest to you, a little bit later this afternoon they’ll be up on the website of the Council of Economic Advisers. So if you just Google the Council of Economic Advisers, look for our speeches, this will be up there, the presentation I’m going to give you.

In terms of economic data, I’ve been following economic data carefully for the last 20 years, and it began when I worked as a staff economist at the Council of Economic Advisers in 1996. And one of the great things about the Council of Economic Advisers is we’re responsible for conveying all of the economic data to the president. So the statistical agencies will give us the statistics a day in advance, embargoed, just for us to see. And we spend a couple hours and analyze them, and put that in a memo which goes to the president so the evening before the data he can understand what’s happening in the economy. For a particularly significant release like the jobs numbers, which I’ll spend a lot of time on today, and often GDP, we’ll brief him – the president – in person as well. We also share those data with the secretary of the Treasury and the chair of the Federal Reserve to make sure that they have the information they need to understand what’s going to be happening the next day in markets and the economy.

What’s great about this is it gives you a real opportunity to think hard, but you also think without the noise of everyone else. You know, anyone who gets the data, the jobs numbers, GDP, they come out at 8:30 a.m. and there’s instantly tons of tweets, tons of analysis, tons of people’s opinions. And that’s great, and I’d recommend looking at all of that and aggregating it, but there’s something to just locking yourself in a room and trying to digest it yourself, unbiased, un-, you know, -interrupted by the other people who are taking a look at those data too. And then you test what you think against it. And sometimes, you know, you found things other people didn’t; sometimes the wisdom of crowds comes up with an insight that you wouldn’t have had.

The biggest tip I have – and it’s underlying, and you’ll see a pattern in the 10 different tips I have – is to never get too exercised and too excited about any one piece of economic data. The economy’s a big, complicated thing. It bounces around a lot from month to month and quarter to quarter. Any given statistic we have only captures one aspect of the economy; it doesn’t capture the entire economy. And the statistics we have are imperfect. They depend on limited samples that have sampling error. They depend on complicated statistical adjustment algorithms to make sure – you know, every December people spend a lot more on consumer goods. That doesn’t mean the economy grew a lot in September. That means that, yet again, Christmas happened in December. So there’s statistical errors, seasonal adjustment errors, parts of the economy, and then just longer-term trends.

So really everything I have to say boils down to – if there’s one bias I see in the newspapers – I think the newspaper commentary on economic data tends to be really good and really informative, and I learn a lot about it. The only thing I – bias I would say it has is it tends to get too excited. “Oh, this was a great month, the economy’s zooming ahead.” “Oh, this month was terrible, we must be collapsing.” “Oh, this month, you know, we can’t tell what’s going on.” And the truth is, sometimes the economy does turn on a dime, and you want to be attentive to that and you want to be looking for those data. But more often than not, you know, trends continue, and it’s better to look at a lot of pieces of data and look at it over a longer period of time. So that’s the big, you know, meta piece of advice I have here.

Let me now go through a number of specific ways that this manifests itself and specific examples, and in the course of this tell you some of the numbers that, you know, I most like to look at, not just in the jobs report but in GDP and economic data more generally.

So the first thing is some numbers bounce around a lot more than other numbers. So every month we have two different versions of the number of jobs added to the economy. One is the number of jobs added by employers. The other is the number of people whose employment went up or down. The blue one is what employers tell the Bureau of Labor Statistics. The red line is what individuals tell the Bureau of Labor Statistics. Now, there’s some conceptual differences in terms of people who are self-employed or multiple job holders, but for the most part these two numbers should be the same.

If you look at that red one, you see it bounces around all over the place. In October of last year it said that employment went up by 800,000. You would have thought that was the most phenomenal month ever. And then this March you would have thought the economy was collapsing; employment went down by 500,000. In both of those months, if you had thought either of those things, you probably would have been wrong, and you would have been wrong because you’re relying on a survey that samples 60,000 households and has a decent amount of error and volatility in it.

The reason that the markets and the newspapers concentrate on what’s called the establishment number, or the payroll survey, is because there you’re surveying nearly 600,000 worksites that employ millions of workers. That also has some error associated with it, but the error is a lot smaller. And so those two months I showed, you know, October certainly was probably a better month than March – 200,000 rather than 100,000 – but not the same dramatic differences. So that’s the first lesson, is when you have a choice choose things that are less volatile. Things that are less volatile are often going to be things that rely on a larger sample size.

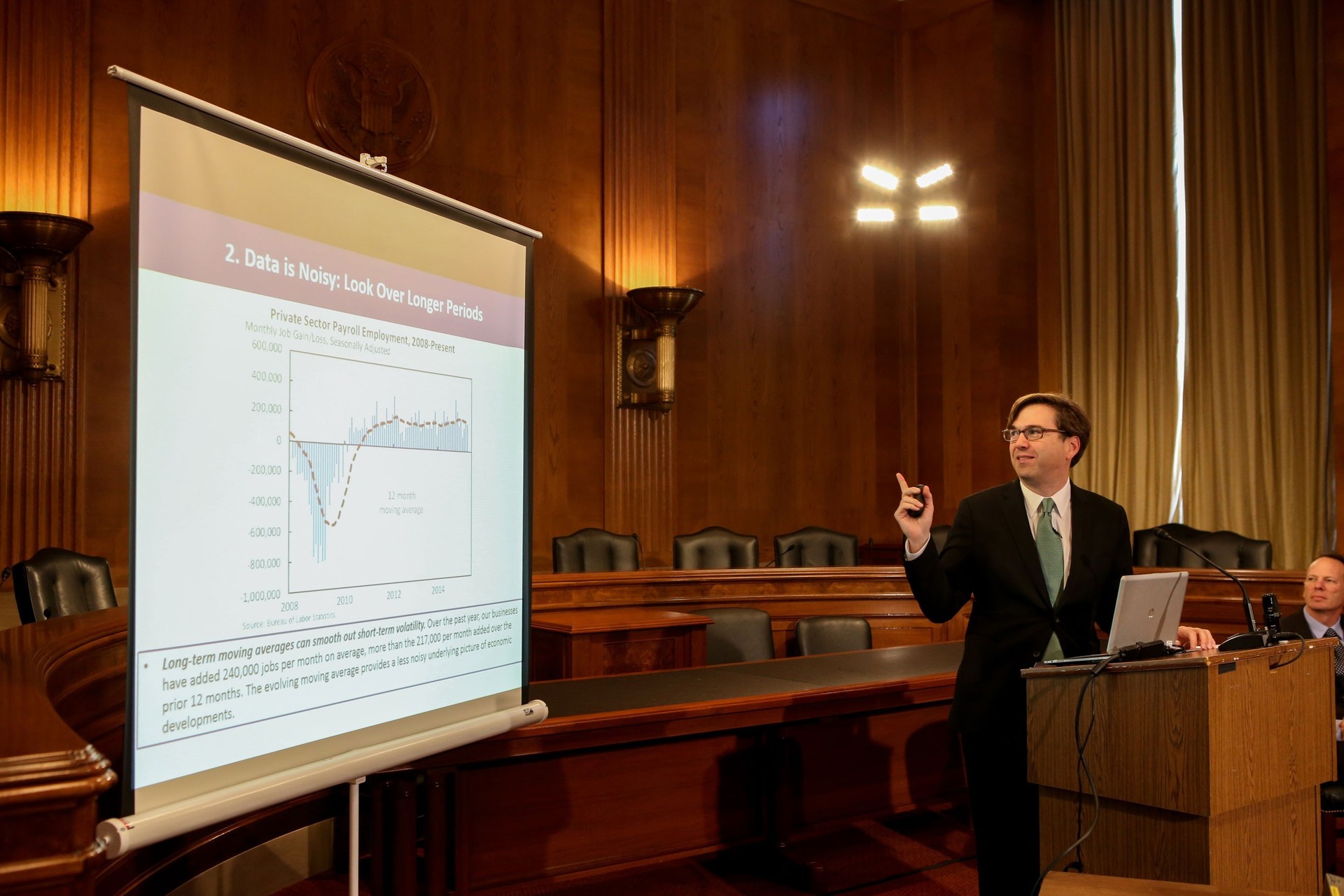

The second piece of advice I’d have is just to look over longer periods of time. So those blue bars are the establishment survey or payroll survey jobs. That tells you the number of jobs added each month. And there you see once again, you know, March looks really bad, but then, you know, May looks pretty good and, you know, it bounces around from month to month. I spend some time looking at those blue bars. I try to spend a lot of time looking at that red dotted line, and that red dotted line is the average over the last 12 months. And if you look at that average over the last 12 months lately, what it tells you is the pace of job growth has picked up a bit – 240,000 jobs per month on average for the last 12 months, as opposed to 217,000 before that. The 217(,000) is a little bit higher than earlier. But it broadly conveys a picture of stability, and that’s an accurate picture because, you know, some months you go way up, some months you go way down. But it roughly, for the last several years, has averaged out to this pace of a bit over 200,000 jobs a month. The red line, when you’re at a real turning point in the economy, is going to lag a little bit. You’re not going to pick things up as quickly when you look at a 12-month moving average. But generally looking over a longer period of time is going to get you a little bit less excited about each month-to-month blip and a little bit more focused on the trend in the economy.

This tip also applies, or it especially applies, with something like unemployment insurance claims. Here these are every week we find out how many people made an initial claim of unemployment insurance. This is actually administrative data. This isn’t based on a survey. This isn’t based on a guess. This is based on, if you apply for unemployment insurance, that has to get reported in. We count the number of people that apply – the states do. They tell the Department of Labor. It adds it up and reports it. It’s great because you get it very week, so every week you can have a new piece of information about the economy. The problem is two weeks ago you would have panicked because it jumped up to about 300,000. This week you would have, you know, uncorked the champagne when it fell to the lowest it’s been since 1973, 255,000. You know, both of those numbers are probably too extreme. And again, if you look at – here people tend to look at a four-week moving average. It’s much smoother than that red line, which bounces around and zigzags a lot from week to week.

When confronted with noisy data, one thing you could do is look to better data with larger samples. Another thing you can do is look over longer periods of time. But a third thing you can do is find different measures of the same concept and combine them. This is something you’re increasingly seeing being done in comments of Federal Reserve officials – talk about this in the context of labor market indicators; investment banks and analysis – analysts do it, which is take indexes that combine a number of different measures. And there are over a dozen measures of wages and compensation, and they’re all slightly conceptually different but they also all embody different errors and different quirks. And this shows three of them – compensation per hour, the average hourly earnings, and the employment cost index – and they’re all bouncing around in different ways.

There’s a statistical technique called principal component analysis which says imagine there’s some underlying component that’s moving all three of these and let’s try to estimate it. It’s actually just as simple as a weighted average of the three, but it uses statistics to find out what weights you should put on the three. And that black line there is probably a better measure of wage growth than any one of those three underlying series are. So you take a lot of different series looking at the same thing and average them together or, if you have a statistical package at your fingertips, do a fancier average and call it the first principal component. If you look there you’ll see wage growth went down and that wage growth lately, the tentative signs of the pickup of wage growth you see in that black line that – the number people have referred to lately.

Another place where I really like combining data is when it comes to the GDP statistics. And a little-known fact is the – when the GDP numbers come out, they always report – or not always, but they eventually report two different numbers. One is gross domestic product, and that adds up how much everyone bought in a given quarter – how much consumers bought, how much businesses bought in terms of plants and equipment, how much the government bought. And if you look at that for the first quarter of this year, it said the economy contracted -0.2 (percent). The other thing the statisticians do, though, is they add up all the income in the first quarter – how much wages were, how much profits were, a few other concepts as well – and that grew at 1.9 percent. Turns out, when you go through the arithmetic, those two are the same exact thing; they’re two different ways of measuring the economy. And the simplest way to think about that imagine we don’t trade and imagine people can’t save their income; then everything you make in a given quarter you’re going to spend in a given quarter, so income has to equal spending. You go through something a little bit fancier and it turns out that’s still true.

So one way of measuring the exact same thing was -0.2 (percent). Another was +1.9 (percent). Well, which of those two is better, GDP or GDI? Turns out the answer is that an average of them – and here doing it 50/50, which would tell you 0.9 (percent) – is much better than using either one of those numbers individually. It’s a much more accurate reading of how the economic data will eventually be revised. It’s much more predictive of what’s going to happen in the economy going forward. And it’s just a – if you could pick one number for growth, you would pick the average of the two.

The good news I have for all of you is right now if you want the average of the two you need to add them together and divide by two. Starting next week, the Bureau of Economic Analysis for the GDP numbers are going to, for the first time ever, start publishing that as a regular thing. It won’t be in the headline. It’ll be towards the bottom of the release. But I know I’ll be turning to that first before I look back up at the headline because that will be the best measure of how much the economy grew that quarter.

There’s another thing you can do with noise. As I said, you can look over a longer period, you can find the best data to look at, you can combine different measures, but the other thing is every measure of the economy tells you some different facet of the economy, and so it can be good to look at a number of different ones. So this first quarter, GDP fell by 0.2 (percent), appropriately colored red in this graph. But employment rose by 2.2 (percent), which was quite a strong increase in employment. Income went up 1.9 (percent). Consumer spending went up 2.1 (percent) and industrial production was 0.0 (percent). There’s a lot of other indicators, too, but these are five particular ones to look at. So if you just saw GDP, you’d be more nervous about the economy in the first quarter than if you take in the full context and the full set of data that one might choose to look at.

One of the reasons why we’re so concerned about data and why you don’t want to overreact to any one piece of data and you want to put everything in context is that the data we get is revised a lot, and the reason it’s revised a lot is it’s all based on surveys. And in the case of GDP, for example, you don’t have a – the first time they publish it they don’t have a lot of the most recent trade data or inventories data, for example, and they only get that as time goes on. And so the successive revisions to growth, if you look at the fourth quarter of 2001 for example, the first estimate was 0.2 (percent). It was revised up to 1.4 (percent) and then revised up to 1.7 (percent). The first quarter of this year was – went from positive to a big negative to a small negative, and you see that all the time. So if you get really attached to a narrative around that first estimate, 0.2 (percent), and 0.2 (percent) – turns out you might be attached to a narrative that subsequently you need to have some new story to explain that it was actually really good the first – that fourth quarter of 2001 and relatively weak that first quarter of 2015, at least measured in this way.

This is probably a little bit obscure for some, but it’s a neat point so I thought I’d share it with you, which is that not all revisions are created equally. So if you look at something like real durable goods consumption and you look at the first estimate and the third estimate, those are almost exactly the same. And that’s because when the GDP numbers come out they have a very good measure on consumer spending. They don’t learn much by the time they do the third revision, and so they basically publish the same thing. Real health care consumption, the first estimate and the third estimate are almost entirely unrelated, and that’s because there they use a survey of the service sector to figure out health spending and they don’t get the results of that survey until after they publish the first estimate. So they have to use very approximate guesses to do that first estimate of health spending, and then they revise it quite a lot for the third one. That’s important because this year, for example, people – or last year people looked at some of the health spending data and constructed a whole narrative of it’s growing really quickly, that tells you blank, and then two months later it as revised and turned out that that wasn’t what the data actually said. We at the Council of Economic Advisers had written something saying don’t even look at this; this data’s going to be revised and it’s going to be revised quite a lot, so once we get the data, you know, we’ll tell you what we think, but the first estimate for health isn’t worth looking at. For real durable goods consumption, it is. And that’s just by way of example of an educated consumer of data has a sense of what’s going to be revised and what’s not going to be revised.

Part of why data is noisy is all these statistical quirks – these small sample sizes, that you don’t get the survey you need on time, that you need to do seasonal adjustment, all these different things. But the economy itself, the underlying truth itself, is noisy, and just weird things bounce around from quarter to quarter. The first quarter of this year, for example, we had really bad weather, and that temporarily impacted the economy, not in a long-run way. You can look at the economic data and get a better sense of which things are pretty transitory, bounce around a lot and tend to reverse themselves, and which things tend to continue.

So within GDP, inventories bounce around. They can be positive. They can be negative. And what they are one quarter – you know, if they’re great one quarter, that doesn’t mean they’re going to be great the next; in fact, it might even mean the opposite. Consumption is, you know, more stable. And one way we use that at the Council of Economic Advisers is we’re very focused on the growth rate not of GDP as a whole, but of consumption plus investment, because those are the two parts of GDP that in our statistical analysis we have found are the most stable, which means they’re the best predictors of what GDP is going to be in the next quarter or over the next year.

And so if you look there are the blue, that’s GDP. It was really negative at the beginning of 2014. A lot of that was for these noisy reasons. So if you were looking at the variable we like, the orange one, it wasn’t a great quarter because of the winter, but you know, didn’t look quite as bad. Then you had this huge rebound in the blue bars – in GDP. You didn’t get as much of a rebound in this other because it’s a more stable measure. So in general those orange bars don’t bounce around a lot because they’re giving you more of the signal. The blue bars, which is GDP, are noise.

Another great piece of news for all of you: As of next week, this also is going to be added to the release along with the GDP numbers. You’ll be able to look this up yourself. And again, it’ll be one of the first things that I know I’ll turn to when I get the data next week.

Want to just put, you know, a few more things down on the table for you, and then, you know, we’ll open it up to discussion with Jim and with all of you.

One is that there’s a real tradeoff between some data, which can be really up to the moment – you know, the ISM Manufacturing Survey; the market moves a lot in response to the ISM Manufacturing Survey, or it can move a lot. And that’s because you get it – we’re going to get it – you know, the week after next, the very beginning of August, we’ll get the number for July. And that’s great because it’s about as up-to-the-minute as you get in economic data, but it’s really noisy. And if you asked me how the economy was doing in July of this year and you ask me that two weeks from now, I’ll look at the ISM Manufacturing Survey because that’ll be the only piece of data I have for July. If you ask me how the economy was doing in July of 2005 or July of 1995, I wouldn’t look at this piece of data. I’d look at everything else we have, which takes longer to compile but then is ultimately more accurate.

You know, at the other extreme, real median household income, the latest data we have for that is 2013. We’re going to find out the 2014 number in September of this year, so you find out basically more than a year after it elapses. The market couldn’t care less about those numbers because they don’t care about the economy a year – a year-and-a-half ago. But if you want to ask, you know, what happened to the typical family in the ’90s, what happened to the typical family in the recession, those are the data you’re going to want to use. They’re, you know, less timely, but more complete.

Just to put, you know, two more things down on the table before we open it up is be careful about longer-run trends. Some people like to look at the participation rate or the employment-population ratio, for example. Those are really useful variables, but they don’t just tell you is the economy going up or down in a business cycle. They also tell you about underlying societal forces like demography, the age of the workforce, whether women are participating. So the example I have here is if you looked at the fraction of the population that was working, you would have thought 2009 was a better year than 1955. If you look at the labor force participation rate, you would have thought 2009 was a better year than 1995. That’s why, when we want to compare those two years, you know, we use the unemployment rate – in 1955 is quite low and in 2009 we were in the Great Recession and the unemployment rate was very high.

I would do the same thing now as well. When we go month-to-month, a lot of people are looking at EPOP, a lot of people are looking at LFPR. Those are important variables. They help fill out the big picture. But there’s a reason why the unemployment rate is the headline. That’s more comparable over time because it’s less subject to some of those other bigger, broader demographic trends.

And finally – and this is the simplest one – always make sure you’re distinguishing between real and nominal data. In 1981, wages rose 8.6 percent. In 2014, wages rose 2.3 percent. Which one of those years would you rather have been a worker in? The answer is definitely 2014 because the inflation rate was quite low in that year, so you got a real wage boost, as opposed to 1981 when the inflation rate was really high and that cut into your real wages. So this isn’t just true of wages, it’s true of everything: always make sure you’re looking at whether things are adjusted for inflation.

Would summarize, you know, and be a little bit specific. As I look at the employment situation, we’ll get it two weeks from Friday. It’ll tell us about the month of July, so it’s timely. The establishment jobs number is the first thing to look at. Watch for the revisions we get for May and June, and for the average over the last six months or a year. The unemployment rate can rise or fall for good reasons, but it’s the best thing to look at. When you look at the participation rate, remember it doesn’t just tell you did the economy get better or worse; it also tells you, did the population get older or not get older, for example. And when you’re doing wages, make sure you adjust for inflation, which will be hard to do because you’ll have to wait a week or two for the CPI data. When it comes to GDP, watch for the average of GDP and GDI. And then look at that private domestic final purchases I was showing you, which gives you a little bit more of a signal than the noise, and look over the last four quarters because weather and all sorts of things, you know, jerk the number up and down from quarter to quarter. That’s what I try to do when looking at data and some advice for all of you.

MR. KESSLER: Thank you. (Applause.) That was really terrific. I appreciate you taking the time to put together those tips, and I look forward to seeing that on your website.

And for folks who don’t do this already, you put out after the jobs report a monthly blog on this that I just think is invaluable, and it usually comes out in the afternoon of that.

MR. FURMAN: Oh, no, we usually get it out by 9:30, maybe 9:40 a.m.

MR. KESSLER: I usually read it in the afternoon. (Laughter.)

MR. FURMAN: OK. Fair enough.

MR. KESSLER: But I think that it – what it does is it cuts through the noise and the clutter, which is what you talked about here, but I think just as importantly is really one of the most understandable while the at the same time deep dive into the economic, employment and wage situation in the country that I read on a monthly basis. So I appreciate the readability of that report, and everybody should take a look at it.

Let’s start with wages, OK, because there’s definitely a lot of talk about how the middle class needs a raise and – but we’re also seeing some upward trends. One of your later slides, the 2013 numbers, you’re definitely seeing some upswing. And one of the frustrations I have when I’m looking at economic data, they talk about how wages only rose 2 percent while inflation is under 2 percent. And I worked in 1981; I don’t remember getting an 8.6 percent raise, but inflation was something like that at that point or even higher. What are you seeing in wages? And what do you look at in the wage area?

MR. FURMAN: So, you know, in terms of what data I actually look to, the jobs numbers, when you get those, they also include wages. Those wages are based on a survey of employers. And that’s, you know quite a useful number to look at.

But the two important lessons I had in all – three important lessons I had in all of this is, one, look at a couple different measures of wages. So lately something called the ECI, the employment compensation index, has grown more quickly than this other wage measure. Does that mean that’s true? Does it mean the other’s true? The truth with – anytime these things tell different stories is usually that it’s somewhere in between, and that’s what I tried to show you with that average. So the totality of it, I think you do see some pickup in nominal wage growth. Not enough pickup; we’d like to see more. But you see some pickup.

And then the second is make sure you’re adjusting for inflation. So if you look at real wages for the last two-and-a-half years, they’ve been rising. They’ve been rising at more than twice the pace that real wages rose over the course of the last economic expansion, from 2001 to 2007. So I think you actually have seen real wage growth. Again, we’d like to see more. We have a lot ideas to see more if you want to talk about policy. But I think you really are seeing real wages grow. And something that I think, you know, makes it hard for people to compare across times is inflation has just generally trended down over time. It’s been, you know – I mean, partly lately idiosyncratic things like a fall in the price of gasoline that we can’t expect to – you know, gasoline to always fall in price, but just the overall target or average for inflation has also fallen over time. And so, you know, the nominal wage increase you need for a given increase in purchasing power is different than what it was in the past.

MR. KESSLER: Mmm hmm.

In a talk that you gave recently – I believe it was at the Peterson Institute, or – was that where it was?

MR. FURMAN: Yeah.

MR. KESSLER: You talked about productivity and you also talked about total-factor productivity. And what that reminded me of, that total-factor productivity was in some ways like the dark matter in the universe, where it is both the cause of and the solution to all of the universe’s mysteries. But can you explain a little bit what you’re seeing in productivity and what total-factor productivity is?

MR. FURMAN: Right. So productivity, and especially total-factor productivity, are, you know, among the most important things in the economy. Labor productivity is how much output you get for one hour of labor input. And the reasons why you can get more output for a given amount of input is your workers can be better educated; your workers can have more capital, machinery at their disposal; or because you combine labor and capital better because you have better technology, larger scales of markets, better ways of managing your inventory, what have you. That last thing is called total-factor productivity, and you know, it’s the most exciting thing you can have in the economy because it says, just for a fixed amount of labor or a fixed amount of capital, you’re getting more and more stuff out of it.

If you want to understand our fiscal situation, you need to know what productivity growth is going to be in the future. If you want to understand why wages have stagnated since the 1970s, you need to understand why productivity growth has been slower since the 1970s. If you want to have a recipe for faster income growth going forward, there’s a lot of things you need, but one of them is faster productivity. So this is central to everything in the economy.

In terms of measurement and some of the issues we’re talking about, it’s just about the noisiest economic variable you have because the numerator has output, the denominator has hours. Both of those have errors. And when you divide one by the other, the errors get even bigger. So I like to look at productivity over periods of, you know, 10 years, 15 years, sometimes even longer. I never look at the quarterly numbers on it because they just bounce – you know, they make you dizzy. They bounce around all over the place. To try to discern, you know, longer trends – and statistically there’s evidence that, if you want to predict productivity in the future, the best thing is not to look at the last year or two; those pick up a lot of noise. It’s to really smooth that noise out, look over the last 10 years, 15 years, and that gives you a sense of what the potential of the economy going forward is.

MR. KESSLER: We had about 30 years of very, very high productivity growth after World War II. It declines for maybe about two decades, then it rebounds a little bit. Is there a predictive nature to productivity? Is that period after World War II a unique period that is never to be repeated again unless we have World War III and then we have a nice aftermath after that?

MR. FURMAN: No.

MR. KESSLER: I’m not rooting for World War III, just to be clear. (Laughter.)

MR. FURMAN: Yeah, I mean, you know, predicting productivity involves predicting what inventions people are going to come up with in the future that they haven’t come up with yet, and if I knew the answer to that I’d invent those things and wouldn’t be sitting here with all of you talking about economic data. So I have a certain amount of humility in answering your question. I don’t think anyone knows the answer to it.

I think the end of World War II is partly – you know, those decades were partly a special period, as the global economy came back together after this terrible collapse, as we figured out how to commercialize a lot of the innovations – like the jet engine – that we developed for fighting the war. But I think other things could be reproduced. That was a period of tremendous infrastructure investment and very high levels of public investment in basic research. There’s no reason why we can’t do that again. And if we did that again, we’d certainly get higher productivity growth as a result.

MR. KESSLER: I’m going to ask one more question and then we’re going to turn it over to the audience, so get ready to raise your hand and ask questions. Go over to that microphone and ask questions.

So again, kind of looking backward, from 1950 to 2000, U.S. economic growth averaged 3.7 percent. And then, from 2001 through the first quarter of 2015, it averaged 1.9 percent. Are there things besides – you know, again, you’ve noted that you can’t predict the inventions that are going to come in the future, but are there factors demographically that say, look, there is a limit to the growth that the – that a country like the U.S. can have on a sustained basis; 3.7 percent is not a realistic place for us. I mean, are there – what are the factors that go into growth that say, like, maybe this – maybe this low a growth isn’t as bad as what I just pronounced?

MR. FURMAN: Right. So maybe I’ll do one equation with all of you: output equals output per hour times hours. So output divided by hours times hours, the hours cancel; output equals output. That I’m quite confident is true. (Laughter.)

So to understand the future of growth, you need to understand the future of output per hour and you need to understand the future of hours. Output per hour is productivity. That’s what we were just talking about. I think there’s a lot to be excited about in terms of productivity, with, you know, the Internet, cloud computing, mobile devices, advanced materials, personalized medicine, clean energy, you know, you name it. There’s all sorts of really exciting things going on, many of which themselves could potentially increase the pace of innovation. So I think there’s reason for cautious optimism on the output per hour.

We’re not going to get the hours growth, though, that we had in the ’50s and ’60s and ’70s again, for two reasons. One, that hours growth was a result of a baby boom – people that were born starting in 1946 started to enter the workforce in the 1960s and 1970s, and that led to a big bulge in hours. And the other thing is the percentage of prime-age women in the workforce went from about I think a quarter to, you know, more than two-thirds over that period. You saw a big influx of women into the workforce. And you know, we’re just – we’re definitely not at a ceiling – there’s definitely, you know, more room to grow, but nothing like the huge transformation we had.

So on the hours side, there’s a unique non-repeatable story. On the thing that’s more important – the output per hour, because that’s what we’ll ultimately get for what we do – there’s no reason why we couldn’t make choices to do a lot better in the future.

MR. KESSLER: Just to follow up on that, we also have an aging population, so that output per hour is going to have to cover benefits for people who are no longer in the workforce and will never be back in the workforce. Do these – do the future prime-age workers, do they have a bigger burden on their hands? Do we – do they need to become even more productive than previous generations?

MR. FURMAN: Right. They have – you have two things going on. One is you’re going to be supporting more people and another is you’re going to be producing more with each hour. And you know, to understand – that’s what I was saying before – to understand the magnitude of the fiscal challenge, we can predict reasonably well how many more people you’re going to be supporting, because certainly, you know, you can sort of watch the Baby Boomers as they move through the generations. You don’t know exactly what life expectancy will be, exactly what fertility rates will be, but it’s all reasonably predictable. But to really get a sense as to what that fiscal challenge – you know, how much you can produce with each of your hours, what the future of productivity is – is critical.

MR. KESSLER: Over here.

Q: Hi, Chairman Furman. Thank you for this opportunity.

I wanted to ask a question about the physical jobs report and the time series that it uses in standardizing that data. I know that, you know, you want to have a standard dataset that goes back many years and even decades so that you can look at trends over time, but are there any trends in the new economy that you’re seeing that isn’t being captured by the jobs report, the GDP report, or these other statistical, you know, sources of information?

MR. FURMAN: That’s something we’ve been putting some thought into. And, you know, I don’t have a definitive answer for you. I have a hunch that that all matters, but it probably matters a little bit. And most jobs are still not new economy jobs, and so most jobs are being picked up there. But certainly when you look at something like the household survey, they call you and ask you, are you working or not? For most people, that’s really – the answer is straightforward, you know, yes or no. But for some people, if you’re doing something very part-time in the sharing economy, do you tell the person yes or tell them no?

The establishment survey goes to businesses and says: How many people do you employ? Well, again, if you’re working in the sharing economy, you’re not necessarily working for a business and, you know, Uber isn’t going to list you as an employee unless you’re sitting in their headquarters routing traffic or whatever it is that they do.

So I think this does present, with all the different ways we look at it, a set of challenges. I’m just not sure how large those are relative to the overall story we’re seeing.

Q: Thank you.

Q: It’s Dana Marshall with Transnational Strategy Group. It’s good to see you again, Jason.

MR. FURMAN: Dana.

Q: Thank you very much for this, and for Jim to put it on.

I wonder if we can connect a couple of big-picture items that have come up. One, of course, we’ve talked about productivity and the challenges in driving that. I wonder if you could help us marry that, to the extent that these things are connected, with another very big issue that has arisen with respect to too large of a focus on the short term, what Hillary Clinton calls “quarterly capitalism.” Are corporations somehow depressing the amount of capital that may be going into, for example, productivity-enhancing types of technologies, or are there things because of a drive to show better quarterly results? Are those connected? And if so, how would you look at them?

MR. FURMAN: Right. There’s, you know, two different issues here. One is the set of data issues I was talking about. And I was certainly trying to tell you that I try not to get too obsessed with a given week, a given month, a given quarter – try to look at what the longer-term trends are, understand where we’ve come from, where we’re going. So I certainly try to take, you know, a longer-term perspective in understanding what’s going on in the economy because otherwise you’ll, you know, as I said, you’re too exuberant or too depressed depending on the week.

You know, in terms of the public policy question, which is at the heart of your question, I think that’s a really important discussion to be had, is what can you do to make sure incentives are aligned? And you know, I was talking before – and to some degree this is related to the government and government policy too – you know, basic research. That’s something that businesses are going to underinvest in because they don’t capture the full benefits from – even if you take a long-term perspective, a business still isn’t going to invest enough in really basic research because it benefits everyone.

The government is the people that can do it. And that’s why funding for places like NSF and NIH is so important. And if you – we’ve seen a shift in our research portfolio away from basic research and towards more applied research and development. And you know, that’s important, that’s terrific too, but it doesn’t make up for some of what you need over the longer run. So I do think a longer-run perspective is important and shows up in a lot of different places.

MR. KESSLER: Great. And for the folks, let’s limit the questions to those who are already in line because we do have some time constraints.

Q: Kent Hughes at the Woodrow Wilson Center. And, Jim, thank you for arranging this.

MR. KESSLER: Thank you.

Q: A terrific presentation. If they lure you back to the classroom, your students will be very lucky.

One figure you didn’t mention is the trade and current account deficit, which can, of course, affect growth, but also over time the industrial structure that you have, which often is linked to the innovation system, which gets back to that magic figure of productivity growth. Do you think of making more focus on the trade deficit? And how should we ourselves think about it over time?

MR. FURMAN: Yeah, so that’s a terrific question. And just to clarify, my goal here was just to give you, you know, not an up-to-date perspective on where the U.S. economy is right now, but just some ideas about, you know, how to read numbers and, you know, unspin them, combine them. The trade deficit – or a similar concept, the current account deficit – is definitely important. It shows up in GDP. GDP is what we domestically plus our trade balance. So mechanically, a trade deficit subtracts from GDP.

You know, the underlying economics are a little bit more complicated. So when our economy is doing really well, we’ll draw in more imports as Americans can buy more imports. So that’ll cause our trade deficit to go up, rather than the trade deficit causing the economy. Similarly, when our economy weakens, we’ll buy less from abroad. You know, our trade deficit will go down, but that was bad news in that case not good news. So it’s a little bit complicated to understand when is the trade deficit causing the overall economy and when is the overall economy causing the trade deficit.

But you know, certainly, as you said, it also affects composition. So when certain countries run persistent surpluses because – trade surpluses because of their macroeconomic policies or their currency policies – another thing I’m quite sure of is that for the world as a whole the trade balance should, at least measured correctly, add up to zero. And so if some have large surpluses, that means others have deficits.

And, you know, there’s a certain – some major countries in the global economy that are very committed to macroeconomic or exchange policies that give them persistent surpluses. The United States often is at the flipside of that. And as a result, it can, you know, have some effects on the structure of our economy. And that’s why, in our international economic diplomacy and arrangements, we’re pushing quite hard on those macroeconomic policies, those currency policies, to help redress and reduce some of those global imbalances.

Q: I should preface my question by saying that I’m a non-economist trying to wrap my caveman brain around this stuff. But you often see a lot of people point to the graph showing the disparity between climbing productivity and stagnating wages. Do you have any advice on how a non-economist should interpret that? Do we look at real median compensation versus labor productivity or total factor, or? For someone who doesn’t really deal with economics day to day, do you have any advice?

MR. FURMAN: Right. So that’s a graph that’s been reproduced a lot. It’s a graph I’ve used, and it’s one that has a very important message. One message that people usually don’t see in that graph that’s a really important one is one that Jim brought up earlier, which is productivity growth since the 1970s has been slower than productivity growth from the 1940s through the 1970s, and so part of why wage growth has slowed is because productivity growth has slowed.

One reason why sometimes you don’t – that doesn’t leap out at you in the graph is that the graph might show a shorter period of time or, you know, most egregiously, somebody doesn’t do the graph in logarithms, which is just an unforgivable error when people do that graph and don’t do it in logarithms. Logarithms give you – the same unit of distance in logarithms is a growth rate. And so if something keeps going up by the same unit, the growth stays the same. If you do it in levels, that’s not the case. So the growth, you know, looks straight, but the growth rate is actually slowing over time. Sorry if this is a discursion into a pet peeve of mine that may not resonate with everyone in this room, but I’ll stick with it anyway. So that’s the first thing. (Laughter.)

The second thing is then there’s a gap between those two lines, between the productivity and the wages. That gap is a result of two things. One is an increase in inequity and increasing failure of workers to get the full benefit of what it is they produce, a shift in the overall allocation of income in our society towards capital and away from labor. And all of that, to me at least, is concerning and really important. The other reason those two lines diverge is a set of statistical quirks. For example, the productivity line uses one price index and the wages line uses a different price index, and they are behaving differently over time.

MR. KESSLER: I had no idea.

MR. FURMAN: And that doesn’t tell you – that’s a big part. About half of the difference is those types of statistical quirks. About half of it is the real underlying inequality and set of issues.

The reason I draw it to your attention is there are some conservatives who have come out and said, oh, look at all these statistical quirks, so don’t pay attention to this picture. And you know, they are right that there are a bunch of statistical quirks, but even correcting for them, you know, that picture remains. So that was a long way of saying, you know, slowing productivity growth is part of the story, the failure of workers to fully capture productivity is part of the story, and then, you know, there’s a whole bunch of complications and epicycles around the data. But even after you go through those, you’re still left with those first two conclusions.

MR. KESSLER: Is the rising cost of nonwage compensation part of that too, or would nonwage compensation be caught in that, in the numbers?

MR. FURMAN: People show that graph in different ways. Sometimes they show wages. Sometimes they show comp. I think about 10 percent of the difference between those two lines is nonwage compensation, but it’s a smaller part of the story than the other two things.

MR. KESSLER: Good to know.

And our final question.

Q: Thank you, Dr. Furman, for taking a question. And thank you, Jim, for putting this together.

I think one thing I wanted to ask about is the concept of hysteresis, and to what extent you think that’s playing a more pronounced role in this recovery or not in terms of labor markets and the unemployment rate. So on the first kind of prong, do we have good measures for that? And do we have a good understanding of how that works in measure? And, two, can policy affect – can policy affect that much, I guess is my basic question.

MR. FURMAN: Right. Great. So let me, in the course of repeating that question, explain that a little bit for those that don’t know the word “hysteresis.” The concept was introduced into the economics literature because Europe had a really low unemployment rate for decades, and then in the 1980s it went way up and it stayed up. And so Olivier Blanchard and Larry Summers advanced an argument that that was an example of hysteresis; that European economies got stuck in this new bad place and stayed there.

There was and still is evidence that the United States labor markets are much more flexible, and that that flexibility means you’re less likely if you end up in a bad place to get stuck there. When this recession first hit, we had unemployment at rates we hadn’t seen since the ’80s, and we had sustained long-term unemployment at rates we hadn’t seen, you know, in the entire postwar period. And so a lot of people, myself included, were nervous: What if this long-term unemployment is here to stay? What if we get stuck? What if we’re subject to hysteresis?

You know, at the time I was cautiously hopeful that the flexibility of the U.S. labor market would be more important and would mean that we could rebound. And you know, I think the data has become increasingly clear that that view was justified. The unemployment rate now is 5.3 percent. That’s back to the average of what it was in the previous economic expansion. The long-term unemployment rate remains elevated relative to what it was before, but even there it’s come down and it’s come down even faster in the last year or two than the short-term unemployment rate. So it seems like that’s also on track to being, you know, in the neighborhood of where it was before the recession.

So I’m feeling decently good about hysteresis in the U.S. economy, but I would never take it for granted. And one reason why I think it’s so important to be aggressive in dealing with unemployment is the longer the unemployment lasts the more likely it is somebody, you know, loses the skills to have a job, to find a job, employers don’t want to hire them, et cetera, and so what is temporary unemployment becomes permanent unemployment. And I think we probably for the most part avoided that this time around, but I don’t think it’s something we can take for granted in the future. And it’s why we’ll always need to be vigorous in dealing with business cycles.

MR. KESSLER: Jason, thank you so much. I consider this hour a gift. I mean, this was really, to me, just a spectacular lesson of how to look at economic data that I know is going to make a difference with me and with our offices. And I hope the people here and the people watching at home really appreciate the way you broke this down in a very, very simple, but very informative way. So thank you so much for taking the time out of an incredibly busy day that I’m sure you must have and joining us today. So thank you.

MR. FURMAN: Thank you. (Applause.)

MR. KESSLER: Thanks, everybody. Have a wonderful weekend. I don’t know what our next Capital Markets Initiative event will be, but we will certainly let you know about it and we hope that you’ll join us again.

(END)