Memo Published September 12, 2016 · Updated September 12, 2016 · 4 minute read

History Says Trade Protectionism Has Never Worked

Jay Chittooran

A central tenet of Donald Trump’s platform is to enact a series of protectionist trade measures to isolate the United States from the rest of the global economy. Specifically, Trump wants to levy tariffs of 45% on Chinese goods and 35% on Mexican goods, in addition to withdrawing from a number of multilateral agreements—all in the hopes of undoing globalization.

Would Trump’s isolationist policy work? If you look back, the United States has implemented protectionist policies on a number of occasions. And the results have been the same: grave economic consequences.

Protectionist Policy |

Background |

Result |

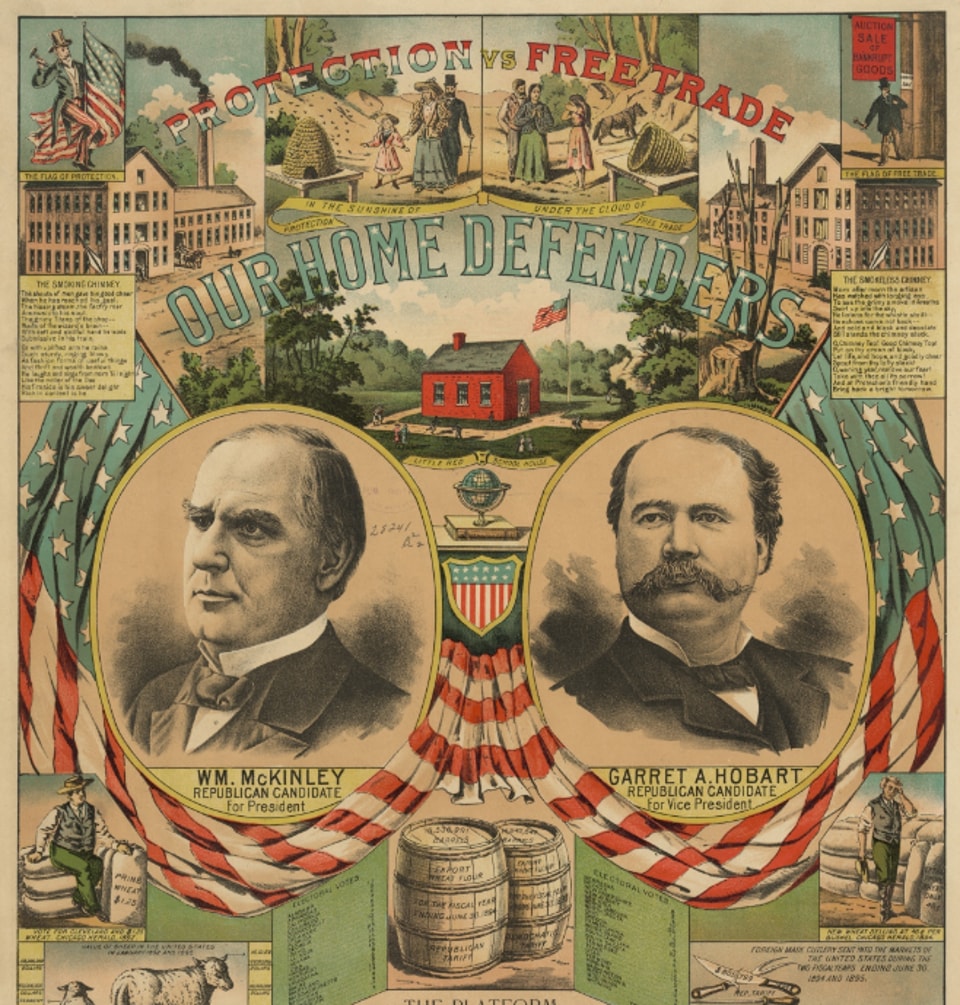

The McKinley Tariff |

The McKinley Tariff, named after the future Republican president, was made law in October 1890. It raised the average duty on all imports from 38% to 49.5% in an attempt to protect agricultural and other producers.1 | This tariff increased consumer costs on everyday goods. For example, tariffs on men’s and women’s clothing jumped by 50%, plates and cutlery faced a 75% tariff, and food faced tariffs of up to 100%.2 Trade was also diverted away from the United States; for instance, Canadian agricultural exports to the U.S. decreased by half, but quadrupled to England.3 From 1890 to 1894, when the increased tariff was in full effect, per capita GDP decreased by more than 2%, while unemployment tripled.4 |

Fordney–McCumber Tariff |

In order to protect American industries, including agriculture, after the boom in demand following World War I, policymakers increased tariffs across the economy in 1922 to an average rate of 38.5%.5 | America’s trading partners retaliated and raised their tariffs, which directly reduced U.S. exports. For example, France raised its tariffs on automobiles from 45% to 100%, Spain raised tariffs on American goods by 40%, and Germany and Italy raised tariffs on wheat. Australia and New Zealand also increased their tariffs.6 These retaliatory tariffs resulted in a 10% drop in U.S. exports in this period.7 The American Farm Bureau Federation has said farmers lost more than $300 million annually, which is more than $4 billion in today’s dollars, as a result of Fordney-McCumber.8 Further, the tariff, which attempted to promote domestic industry and create new jobs, failed to do so; the unemployment rate in this period stayed roughly the same.9 |

Smoot-Hawley Tariff |

Aimed at protecting U.S. agriculture from foreign competition in the heart of the Great Depression, policymakers raised duties on over 20,000 goods starting in 1930. The average tariff level hit 59.1% in 1932—the second-highest level ever.10 This tariff was highly controversial, with Henry Ford, bankers, and economists, for example, calling for this tariff to be eliminated.11 | Before the tariff was even enacted, 23 countries formally complained and threatened retaliatory tariffs. Canada levied tariffs on 16 products that accounted altogether for around 30% of U.S. exports to Canada.12 From 1929 to 1933, American exports declined from about $5.2 billion to $1.7 billion.13 Smoot-Hawley and the ensuing retaliatory tariffs by America's trading partners were responsible for reducing American exports and imports by more than half.14 From 1930 to 1933, U.S. GDP declined by nearly 40%.15 And in the following years, the unemployment rate nearly tripled.16 This tariff, while it didn’t cause the Great Depression, certainly exacerbated it. |

Country of Origin Labeling (COOL) |

In 2009 (and then again in 2013), the United States imposed COOL restrictions on beef, pork, lamb, chicken, goat, certain types of fish, ginseng, all fruits and vegetables, and some nuts.17 This meant that each item had to label where it was produced. While this isn’t an actual tariff, it is a trade barrier. Canada and Mexico both argued to the WTO that this was discriminatory and their producers would unduly suffer as a result. | There is little evidence that consumers bought more food items bearing U.S.-origin labels. But the costs were great for producers and consumers: producers spent $2.6 billion in implementation costs, which translates into higher prices and lower quantities, while consumers spent nearly $9 billion more than they would have without COOL regulations.18 The WTO ultimately ruled that COOL was illegal, and Canada and Mexico could impose tariffs on United States to the tune of $1 billion.19 COOL requirements on beef and pork were lifted in late 2015. |

Trump has said that the goal of his tariff plan is to protect American workers and companies. But as history tells us, protectionism has had terrible, and often unintended, economic consequences.