Memo Published December 14, 2022 · 11 minute read

Clean Steel: Policies to Help America Lead

John Milko

Takeaways

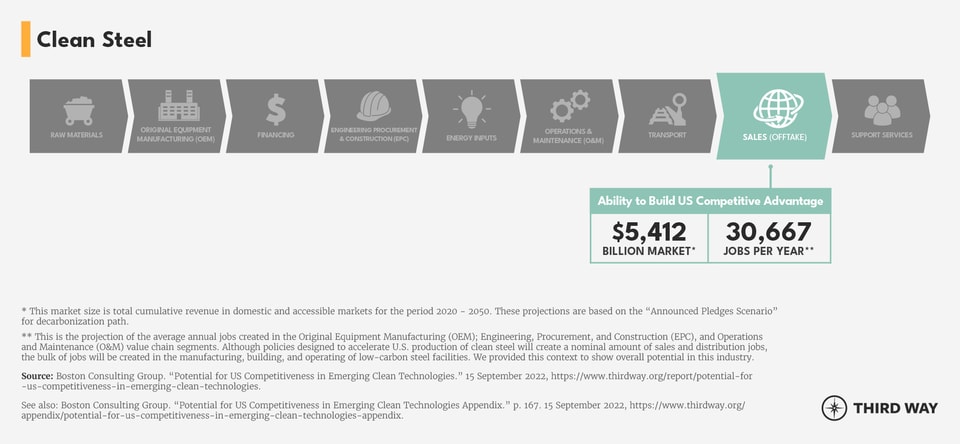

- The U.S. will compete for a portion of a $5.4 trillion market for low-carbon steel sales through 2050, with North America representing the greatest opportunity to pick up market share.

- Policies that incentivize the purchase of low-carbon steel would advantage American manufacturers, which already have a lower carbon footprint than most competitors.

- Reducing the cost premium for low-carbon steel and continuing to invest in advanced decarbonization technologies could result in the creation of more than 30,000 average annual jobs building, constructing, and operating clean steel facilities in the U.S through 2050.

Why the US Should Compete in the Clean Steel Market

Unlike the other nascent technologies included in a recent study by Boston Consulting Group (BCG) on U.S. competitiveness in clean energy, steel production is an established industry in the United States that has literally helped build our country. Steel manufacturers employ over 130,000 workers in the U.S., with major presences in states throughout the South and Midwest and represent a key supply chain component for a wide variety of goods, from buildings, to cars, to industrial machinery. Given its use in a wide variety of products, including those in the national defense sector, maintaining a healthy domestic steel industry is vital to U.S. economic and national security interests.

Steelmaking is a carbon-intensive process that, for most manufacturers across the world, involves using fossil fuels to heat and react with iron ore at high temperatures and accounts for roughly 11% of total global carbon emissions. However, as public and private sector actors across the world seek to decarbonize their supply chains, the demand for clean steel will continue to increase, presenting an opportunity for U.S. manufacturers to capture a greater market share.

Clean steel is shorthand for steel with low embodied carbon. Embodied carbon measures the amount of carbon emitted over the lifecycle of a product, from mining the raw ingredients, transporting them, running the kiln or furnace to produce the material, and then using it to produce end goods. While advancements in carbon-free power and transportation will help reduce the embodied carbon of steel on the margins, the process of manufacturing steel accounts for the majority of its embodied carbon. The global clean steel market is estimated to be 20,000-25,000 million tons through 2050, reflecting a potential market of $10-15 trillion from cumulative steel sales. The U.S. domestic market alone is expected to require 600-700 million tons, representing a market value of $400-480 billion.

While growth of a clean steel industry will create new opportunities across the value chain from mining raw materials to manufacturing equipment for steel mills to maintaining facilities, BCG found that the “offtake” value chain segment presents both the greatest market value and competitive advantage for the U.S. Simply put, America’s focus should be on selling as much steel as possible from facilities here in the U.S.

On average, U.S. steelmakers produce lower-carbon steel than competitors in major steel-producing countries and stand to benefit from policies that reward this low-carbon advantage. Further policy support is also needed to attract additional capital and develop transformational clean steel technologies, enabling the U.S. steel industry to maintain its competitive edge.

With demand for clean steel poised to grow, particularly in the domestic market as funding provided by the bipartisan infrastructure law is deployed to rebuild our nation’s buildings and transportation infrastructure, it is critical that Congress act to position the U.S. clean steel industry to compete for this growing opportunity and retake market share in a vital sector of the economy.

Policy Recommendations

Technology Wide

How can U.S. manufacturers begin to decarbonize their processes and establish a durable competitive advantage among major steel-making countries like China, India, and Russia? The federal government must continue to support the development of advanced decarbonization technologies including carbon capture, utilization, and storage (CCUS) and molten oxide electrolysis (MOE), while making the investments necessary to help commercialize these emerging technologies and ensure domestic steelmakers can manufacture both primary and secondary steel with low embodied carbon.

Allocate funding for industrial facility improvements: The Inflation Reduction Act of 2022 (IRA) includes the Advanced Industrial Facilities Deployment Program, which will leverage nearly $12b in federal and private capital to cut emissions at energy-intensive industrial facilities, including steel plants. This funding can advance technologies like CCUS, direct reduced iron via clean hydrogen, and MOE, which are at various stages of development and not yet commercially viable. According to BCG’s findings, the U.S. has a global lead in developing point-source CCUS and MOE technologies and could leverage these advantages to realize value across the steel value chain, particularly in the original equipment manufacturing (OEM) and the engineering, procurement, and construction (EPC) segments that build and install plant equipment. Direct federal funding will allow steel manufacturers to continue developing cleaner processes and accelerate the commercialization of industrial CCUS, enabling the U.S. to manufacture cleaner steel at home while exporting decarbonization technologies to countries that manufacture primary steel using blast furnaces.

Leverage tax credits to lower facility emissions: This policy tool has recently been turbocharged. In addition to direct funding, the IRA includes tax credits that will incentivize further private capital investment in decarbonization technologies. The 45Q tax credit for carbon capture will increase and extend a decade, which independent studies conclude is sufficient to spur commercial CCUS deployment for blast furnace facilities.The 48c tax credit for advanced manufacturing projects will also extend and include projects that reduce industrial facility emissions by greater than 20%, incentivizing investments in low-carbon industrial heat, CCUS, and equipment for recycling, waste reduction, and energy efficiency.

IRA also includes a hydrogen production tax credit to scale up the production and deployment of clean hydrogen, which could play a significant role in decarbonizing steel manufacturing facilities by replacing fossil fuels in the production process. Lastly, extending investment and production tax credits to continue scaling up renewable and zero carbon power is not only essential to meeting our climate goals in the power sector, it also decreases the embodied carbon of steel when facilities switch to lower carbon options as their costs decline.

Continue developing next generation of clean steel technologies: Steelmakers now have incentives to adopt technologies and practices to cut emissions, but many will be through incremental steps. We still need RD&D for transformational emissions reduction. This could lead to breakthroughs in steelmaking that allow the U.S. to be more competitive in the original equipment manufacturer (OEM) segment of the value chain as investment in new, low-carbon steel plants grows to meet the growing global demand for clean steel.

The Steel Upgrading Partnerships and Emissions Reduction (SUPER) Act was included in the CHIPS and Science Act signed into law by President Biden earlier this year. It authorizes the Department of Energy to establish its first dedicated research and development (R&D) program for low-emission steel production, including applied R&D on new production methods and public-private partnerships to scale up and commercialize new low-emissions technologies. Congressional appropriations committees must ensure this program is fully funded in the next federal budget.

United States Steel (USS), the second-largest domestic steel company by volume in 2021, producing over 16 million tons of both primary and secondary steel, has committed to reaching net zero emissions by 2050. This ambitious pledge recognizes the need to incorporate a suite of strategic and technological solutions to decarbonize - including investing in new secondary steel production capacity, implementing advanced production methods using natural gas and hydrogen, and deploying carbon capture technologies to cut emissions at primary steel facilities.

Offtake

BCG found that the “Offtake” segment of the value chain, or facilitating increased sales and distribution of U.S.-manufactured clean steel products, presents the greatest opportunity for growth over the coming decades. The U.S. will have access to a clean steel market worth $5.4 trillion cumulatively through 2050—this is what BCG calls the “serviceable addressable market.” BCG anticipates the U.S. can obtain a $570-810 billion share of that market by focusing on opportunities in North America, and on the US market in particular. Capturing this market share could result in the creation of more than 30,000 average annual jobs in key segments of the clean steel value chain that relate directly to building and operating clean steel facilities.

But in order to establish a robust market for clean steel, the U.S. must first implement a policy framework that enables companies to monetize their current carbon advantage and incentivizes them to continue investing in carbon mitigation efforts.

Prioritizing low-carbon materials in federal procurement: The federal government can leverage its considerable purchasing to create a robust early market for low-carbon materials and incentivize manufacturers to disclose and ultimately lower the embodied emissions of their products. Pursuant to its December 2021 Executive Order on federal sustainability, the Biden Administration created the Buy Clean Task Force to convene leaders from across the federal government and make recommendations for administering a low-carbon materials procurement program. The federal Buy Clean program will continue to develop over the next several years, incorporating feedback from the industry, labor, and environmental communities to ensure it accomplishes its goal of rewarding cleaner materials manufacturers and lowering industrial emissions in the process.

The IRA includes programs at several federal agencies (FHWA, GSA, FEMA, among them) that will make clean steel more cost competitive and further incentivize its use in public works projects at the federal and state levels. The government can amplify its demand signal for cleaner steel by funding additional procurement programs that cover the price premium of low-carbon materials and drive transformational change in how carbon-intensive products – like steel – are made. This could include expanding procurement incentives to additional federal agencies, as well as broadening its application to include materials used in federally-funded infrastructure projects at the state level.

Tracking embodied carbon emissions: In order to incorporate embodied carbon as an evaluation metric in procurement decisions, there first needs to be a standardized method of measuring it. This is where environmental product declarations (EPDs) can help. EPDs are being increasingly used throughout the world as a mechanism for disclosing a product’s embodied carbon, based on an underlying life cycle assessment that calculates GHG emissions over its lifespan. Procurement officials and public works contractors can use EPDs to compare products and make more climate-friendly choices when possible.

Recognizing that many manufacturers may not have the technical or financial resources to create EPDs, the IRA includes an EPD Assistance Program at EPA to ensure all manufacturers can calculate and disclose the embodied carbon of their products. The government must also continue to invest in life cycle data collection efforts to ensure EPDs are accurate and comparable.

Implementing embodied carbon trade policy: Establishing a standardized way to measure and disclose embodied carbon would also allow the US to evaluate imported products on the basis of carbon intensity and levy fees on imports that exceed a certain standard. As a result, producers of steel in countries with less stringent environmental regulations and less sustainable manufacturing practices would see the cost of their products rise, making U.S.-made steel more competitive in the process. This policy mechanism, called a border carbon adjustment, would send another strong demand signal for clean steel and benefit domestic manufacturers in the near term, who on average produce cleaner steel from both blast furnace and electric arc facilities than foreign competitors. It is also important, therefore, to harmonize product category rules (PCRs) - which are used to create EPDs - and embodied carbon disclosure practices internationally. This will help ensure that comparable products are properly evaluated against one another and ease export opportunities to partnering countries.

Accounting for types of steel: Whether for procurement or trade, policy needs to distinguish between primary and secondary steel. While secondary steel made from melting scrap in an electric arc furnace facility is less carbon intensive than primary steel made from converting iron ore to steel in a blast furnace facility, they are not direct substitutes. Large buyers in the building and automotive industries, for example, require higher-quality primary steel to meet regulatory requirements for their products.

Furthermore, secondary steel is largely dependent on the scrap metal market, which is subject to foreign supply chain constraints that impact price and availability. Maintaining primary steelmaking facilities in the US can help insulate the domestic steel industry, and its customers, from these potential disruptions. In a low-carbon materials procurement or trade framework, disaggregating primary and secondary steel as different products is appropriate, given the inherent carbon advantage of electric arc furnaces, until primary steel making facilities have had time to leverage new policies to implement carbon mitigating technologies.

Impacts from Policy Recommendations

Establishing mechanisms to incorporate the cost of embodied carbon in valuing steel could immediately bolster the competitive position of US manufacturers. Complementary policies that accelerate the commercial deployment of CCUS and other advanced technologies to decarbonize steel manufacturing facilities will ensure that US-based companies are able to maintain their advantage. These demand- and supply-side policies, in concert with the deployment of infrastructure funding, will effectively grow US demand for US-made steel, providing manufacturers with the regulatory and economic certainty they need to invest in expanding production. We can onshore production and rebuild our country’s infrastructure with its own steel as we once did, only this time with much fewer carbon emissions in the process.