Memo Published December 9, 2020 · 11 minute read

How a Biden Administration Can Rebuild Small Businesses

Zach Moller & Jillian McGrath

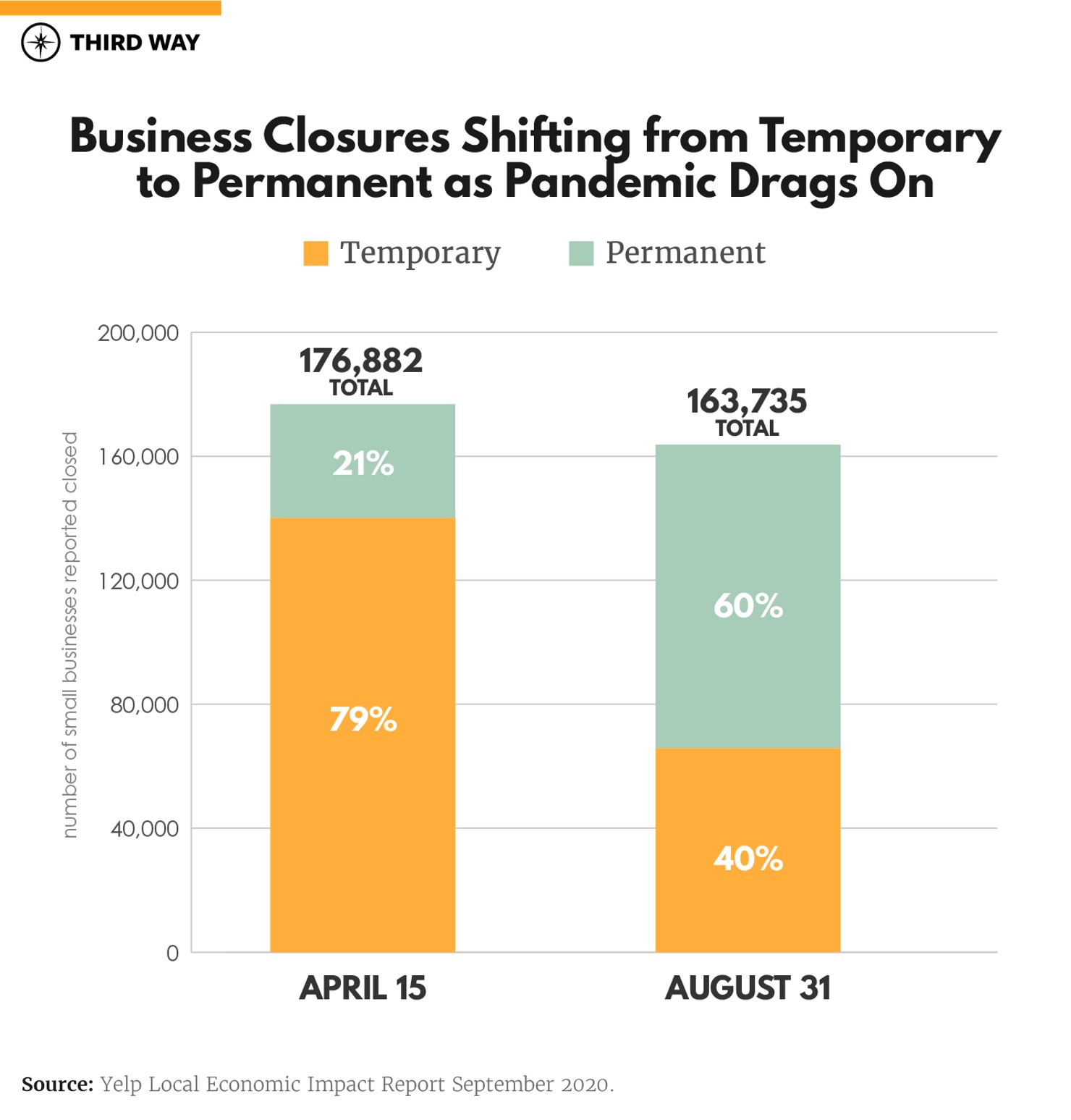

When President-elect Joe Biden called for support so that American small businesses could “survive, recover, and build back better,” it wasn’t just rhetorical.1 The COVID-19 pandemic has led to the swiftest economic drop in memory—and one that upended small businesses everywhere. Ninety percent of small businesses were negatively affected.2 In September, data from Yelp showed that 60% of business closures this year became permanent.3 And the inequities present before this crisis have been deeply exacerbated. For example, while 22% of small businesses closed in the first few months of this crisis, nearly double that amount of Black-owned businesses closed.4

Small business challenges are nothing new, but the pandemic and economic collapse have shone a spotlight on two seemingly intractable issues plaguing our nation’s entrepreneurs and small business owners.

First, capital is far too concentrated—both geographically and demographically. Look no further than who gets venture capital dollars. Just four metro areas (Silicon Valley, Boston, New York, and Los Angeles) get a whopping 80% of venture dollars.5It is also unfairly concentrated among certain people. In 2016, just 15% of all businesses receiving venture capital were women-owned, 8% were Hispanic-owned, and 3% were Black-owned.6The onset of the COVID-19 economic disaster has made the capital problem even worse. While capital has remained available for large businesses, small businesses have not been helped as much by low interest rates and federal COVID relief. For example, it is well documented how minority-owned small businesses had widespread difficulties accessing the Paycheck Protection Program. Hispanic and Black-owned businesses are less likely to work with the established banks that were administering the program and distributing the initial tranche of PPP funding. As a result, these businesses didn’t get as much help as needed.7

Second, there is not an adequate safety net for small businesses. Sixty percent of small businesses have less than two months of operations costs in reserve.8If you are a gig worker or start your own business, traditional unemployment insurance and other support programs are either off limits or hard to access. And while programs like the Paycheck Protection Program supposedly build a safety net for small businesses, lack of a permanent program means small businesses are subject to the whims of Congress, or federal inaction.

In this memo, we lay out what the Biden campaign has called for to support small businesses. We then show how to expand that agenda to tackle the two key problems noted above.

Biden’s Plan for Small Businesses

Over the past year, President-elect Biden placed clear emphasis on promoting and securing small business in America. His campaign ideas fall into four categories: expanding capital, supporting entrepreneurs, creating more market opportunities, and recovering from the COVID-19 economic crisis. A summary of Biden’s major recommendations is noted below:

Expanding Capital

- The Biden campaign’s Small Business Opportunity Plan will create more than $50 billion in investment to Black and Brown entrepreneurs by solidifying the New Markets Tax Credit and funding various successful state and local initiatives. It’ll also strengthen Community Development Financial Institutions (CDFIs), Minority Depository Institutions (MDIs), and the Community Reinvestment Act, expanding access to over $100 billion in low-interest loans.

- Biden also commits to raising the funding and stature of the Minority Business Development Agency (MBDA), providing it with an additional $5 billion in lending and investment authority, and raising the MBDA director to the Assistant Secretary level.

- Biden plans to dedicate a portion of his “Made in All of America” fund to create a Small Business Opportunity Fund to leverage private investment. He also plans to allocate an additional $10 billion from the Small Business Opportunity Fund to reach entrepreneurs in lower-income urban, tribal, and rural areas.

- The Biden plan builds on the Obama Administration’s State Small Business Credit Initiative (SSBCI), extending it through 2025, creating $30 billion in private sector investment.

- Biden would also expand the Rural Microentrepreneur Assistance Program.

Support Entrepreneurs

- A Biden Administration would direct the Small Business Administration (SBA) to focus time and resources on supporting entrepreneurs with disabilities, entrepreneurs identifying as transgender or nonbinary, and entrepreneurs of color. He’d also work to create incentives for states to adopt programs targeted to these underrepresented entrepreneurs

- Additionally, Biden aims to invest $500 million in a Department of Defense military spouse entrepreneurship program, which will provide funding, technical assistance, and mentorship to military spouses wanting to start or grow a small enterprise.

Creating More Market Opportunities

- Biden’s “Made in All of America” plan would focus federal procurement efforts to benefit small businesses owned by people of color and women.

- Biden would quadruple the Manufacturing Extension Partnership to help small and medium manufacturers compete for Buy America contracts.

- He also proposes to promote green entrepreneurship and reform Opportunity Zones.

Recover from the COVID-19 Economic Crisis

- Biden proposes to reform the Paycheck Protection Program (PPP) to better prioritize small businesses. He will dedicate half of all new PPP loans to businesses with 50 employees or less and authorize more generous loans to allow businesses to cover capital costs, as opposed to only labor costs. Finally, a Biden Administration would create a PPP tracking dashboard to provide timely data on loan applications and recipience rates.

- Biden also proposes to expand and rebrand Unemployment Insurance into Employment Insurance by promoting and expanding the existing Short-Term Compensation (STC) program. The expansion would provide full federal funding for the program, ensure all states and territories participate in the program, create a tax credit to cover employer’s health care costs, and raise the cap on employer work reductions which make the program prohibitive.

How Biden Can Go Even Further to Support Small Businesses

The Biden Administration is clear-sighted about the challenge ahead, and the strong agenda above would help small businesses emerge from the COVID-19 pandemic and contribute to a robust economic recovery. Building from this foundation, there are two areas in which Biden can go even further to ensure small businesses can build back better: boosting access to capital and establishing a formal safety net for entrepreneurs and small business owners. Here are four ways to do that:

1. Diversify access to equity capital

There is already legislation that could start diversifying access to capital. The New Business Preservation Act, introduced by Senator Amy Klobuchar and Representative Dean Phillips, would provide federal funding to states to invest in new businesses located in parts of the country that do not attract significant equity investment. Further, the bill puts a special focus on women- and minority-owned businesses and ensures returns to the government would be reinvested in additional new businesses in the years ahead.9

In order to ensure that this and additional funding reaches minority-owned businesses in particular, policymakers should take a series of steps. Additional funding should be distributed to organizations that help build connectivity and provide technical and training resources, such as innovator support organizations and community-based centers. Funding should be distributed beyond just economic development bureaus in cities and states to ensure it reaches more people in more places. And there must be far greater reporting and standards to ensure the programs are working as intended.

2. Reform, diversify, and expand lending programs

Boosting equitable access to capital is part of the solution, but far more needs to be done on lending to ensure that more resources are available to more small businesses. And as we saw with implementation of the Paycheck Protection Program, SBA has serious capacity issues. Loan programs at SBA, including the 7(a) program, should be stronger and not a backwater for capital access. Additional steps should be taken for SBA loans to reach deeper into minority communities and thus create networks of capital that can continue to foster diverse entrepreneurship.

To start, the Biden Administration can signal support in the President’s FY 2022 budget. The budget should increase the permanent staffing and capacity for loan processing at SBA, while modernizing existing systems. Next the budget should include higher funding requests for 7(a) loan guarantees, boosting the volume of loans guaranteed by the federal government. In addition, policymakers can increase the loan guarantee amount, making it less risky to lend money to small businesses. It’s also time to cut fees for small business owners, especially those on smaller dollar loans. And the incoming Administration should evaluate the process by which businesses are approved or denied for loans to ensure they are truly reaching those who need the most help.

In addition to loan program reforms, policymakers should dramatically expand government-backed microloans for new and existing small businesses in low-income areas using Community Development Financial Institutions (CDFIs). This will help combat initial problems with PPP loans concentrated among large financial institutions that are less likely to have ties in underserved low-income communities. Existing businesses in these communities should qualify for a loan worth up to $50,000 or two months of verifiable operating expenses, whichever is less, and new businesses should qualify for an amount up to 2.5 months of rent and utilities payments. Use of these funds would not be restricted to payroll or rent. And during the global pandemic, at least half of these loans’ value should be able to be forgiven.

3. A safety net for entrepreneurs, the self-employed, and gig workers

Earlier this year, Congress took a series of steps to start weaving together a safety net for entrepreneurs and the self-employed. But the support is temporary, leaving far too many vulnerable in the coming weeks and with no protection for downturns in the future. To fix that and establish permanent support, policymakers should take two steps.

First, it’s time to extend and expand the Pandemic Unemployment Assistance (PUA) program. PUA dramatically broadened unemployment insurance eligibility to many individuals that otherwise do not qualify for state-based UI programs, such as entrepreneurs and self-employed small business owners. Currently, 9 million Americans are receiving support through PUA, which expires on December 31st.10 The program must be extended beyond this year to get us through the pandemic, but then a permanent program should be implemented, especially if policymakers wish to make broader UI reforms. UI for the self-employed and entrepreneurs could be structured as a new federal program or as mandate for states to give these workers access to traditional UI. To ensure proper administration of this program, clear rules about availability of benefits and job searching will be needed.

Second, the Biden Administration should ensure entrepreneurs, the self-employed, and gig workers have access to other safety programs. For example, many of these individuals may already qualify for SNAP, Medicaid, and Affordable Care Act subsidies, but the administrative burden for tracking and reporting self-employment income makes access difficult.11 Policymakers should address these issues by streamlining access to all of these programs in one-stop administrative applications with an eye to small business owners and the self-employed. While many of these essential programs are administered at the state level, the federal government should provide technical and financial assistance for the transition.

4. Build a safety net for small businesses

A small business safety net should not just help those running a small business, it should be available for the business itself. There are two legislative models policymakers could build off when constructing a safety net.

First, Representative Madeline Dean’s Restore America’s Main Street Act proposes direct grants of 30% of gross receipts, up to $120,000, to all adversely affected small businesses in the current crisis with less than fifty employees and under $1.5 million in gross receipts in 2019 or 2020. This good idea should be expanded so that it is available on a more permanent basis beyond the current crisis. To ensure that small businesses have confidence in this aspect of a safety net, triggers should be used to automatically turn on aid if specific economic and industry-level criteria are met.

Second, the Saving Our Street (SOS) Act introduced by then-Senator Kamala Harris and Representative Ayanna Pressley establishes a “Microbusiness Assistance Fund.”12 This would be administered by the Treasury Department and Internal Revenue Service and would enable “microbusinesses” to apply for grants of up to $250,000 to cover costs and keep the doors open during prolonged closures. While this bill is specifically designed as COVID relief, a permanent program can be established using this as a model for economic downturns or other major business disruptions.

Conclusion

As winter unfolds, it is widely expected that economic challenges resulting from COVID-19 will get worse. Amid this, small businesses are going to need help to survive this era and thrive in a post-COVID economy. And while this memo has focused on capital and safety net ideas, small businesses will also need help with accessing more markets, more support systems, and more accountability from the government.

Luckily, President-elect Biden and Vice President-elect Harris have a deep appreciation for the needs of small businesses and Americans and have an agenda to back it up. Between their policies and more, now is the time to ensure small businesses can truly build back better.