Memo Published July 23, 2024 · 11 minute read

Status Report: US Competitiveness in the Clean Hydrogen Economy

Mary Sagatelova & Ryan Fitzpatrick

Low-carbon hydrogen could help decarbonize some of the most carbon-intensive and economically important sectors of our economy, including heavy industry and transportation. These are sectors with few existing clean options, and, with projected cost reductions and deployment rates, clean hydrogen could cut emissions in these and other sectors by 10% compared to 2005 levels by 2050.

Clean hydrogen deployment is also set to build a global market valued at trillions of dollars and create over 540,000 annual jobs through 2050. The US stands to capture a significant share of this burgeoning market and solidify our global leadership in clean hydrogen technology. But with established industry leaders in Europe and rising powerhouses in Asia, the US faces stiff competition. To achieve our ambitious emissions goals and seize a significant portion of the emerging market opportunity, we have to be strategic. Luckily, the US is ready for the challenge.

This memo spotlights key federal policies propelling low-carbon hydrogen investment forward and showcases milestones of how America is charging ahead in the global hydrogen race.

How Federal Investments are Boosting the American Clean Hydrogen Industry

Landmark provisions across the Bipartisan Infrastructure Law (BIL), the CHIPS and Science Act, and the Inflation Reduction Act (IRA) will make it easier to produce, transport, and use low-carbon hydrogen at a large scale. These incentives, which will be distributed over the course of several years, are giving producers the confidence to invest boldly and expand rapidly to become more competitive in the global market. Some of the most impactful federal incentives include:

- $23 billion in tax credits designed to promote hydrogen production and to support manufacturing for related technologies like electrolyzers and fuel cells;

- $9.5 billion in grant funding to support clean hydrogen manufacturing and recycling, advance research and development, and fund regional clean hydrogen hubs; and

- $1.25 billion in grant funding to deploy fueling infrastructure for hydrogen-fueled vehicles and EVs.

These federal investments will be distributed over the course of more than a decade and will continue to pay dividends long after. And based on our analysis of Rhodium Group and MIT CEEPR’s Clean Investment Monitor, it’s clear that these policies are already working. Public and private investment in clean hydrogen technologies in the past three years alone has reached $6 billion, with nearly $5 billion of that coming in just since June of 2023.

Road to Victory: Growing US Hydrogen Leadership

Competition in clean energy markets—especially for clean hydrogen—is intense and the US is not starting from the front. Seasoned leaders in Europe and emerging powerhouses in Asia are fiercely vying for global leadership and we have a lot of catching up to do to compete. But we shouldn’t count ourselves out just yet. The potential pay-off is massive and well worth the fight.

Third Way’s landmark analysis, in partnership with Breakthrough Energy and Boston Consulting Group, found that there are 4 segments of the hydrogen supply chain where the US should make the most effort to build or maintain its advantage. These segments were identified based on their market size and the potential for American leadership—and we’re already seeing significant progress in these key areas. Our strategic investments and the clean energy industrial strategy we’re putting into play are securing major victories in each of these value chain segments, proving that the US is in it to win it. Let’s break this down:

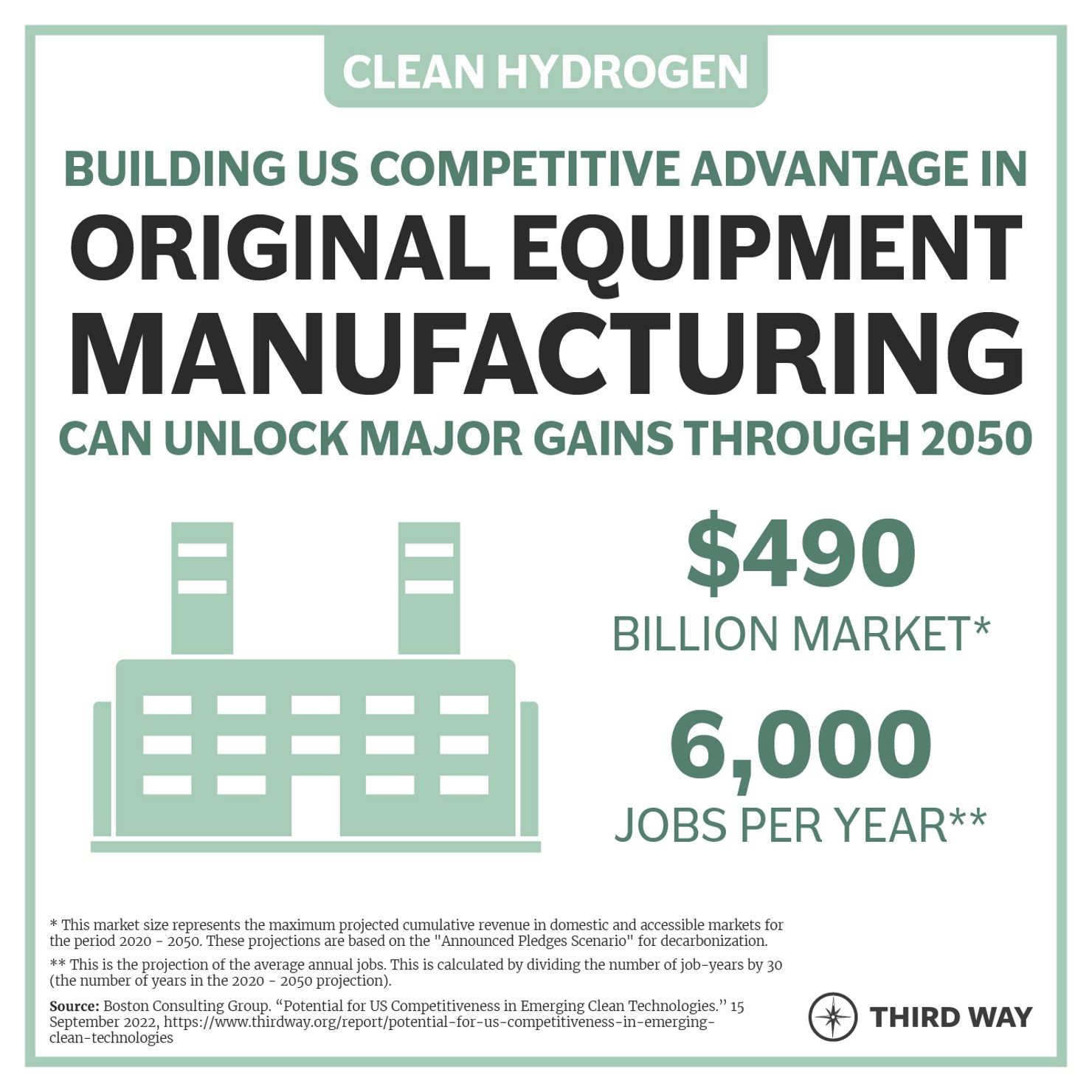

Original Equipment Manufacturing (OEM)

While China holds a strong advantage in low-carbon hydrogen production—due to a track record of producing electrolyzers at low-cost—the US has a strong potential to compete. With cutting-edge intellectual property, impactful research, and globally leading private investments in electrolyzer technology—over $650 million in combined private and public investment within just three years—we are well-positioned to scale up industry-level electrolyzer manufacturing and compete with China in the global marketplace. Capitalizing on these strengths will allow the US to boost hydrogen fuel production at low cost and at scale, meeting domestic needs and exporting to other countries—allowing us to seize a significant share of a market projected to be worth up to $490 billion by 2050 and create 6,000 jobs through 2050. Here are some examples of how we’re already winning in this regard:

- Suporting Small-Scale Hydrogen Innovation: The Department of Energy announced $8.6 million for small business research and development grants, funding 43 hydrogen and fuel cell projects across 16 states. By backing small business, the Department is fostering broad-based industry growth and proving the US is serious about growing the clean hydrogen value chain.

- Homeshoring Electrolyzer Manufacturing: EvolOH is building a green hydrogen electrolyzer manufacturing facility in Massachusetts that will use low-cost materials and rely solely on domestic supply chains. When fully operational, the facility will support up to 3.75 GW of electrolyzer stacks annually—the largest in the world.

- Building Long-Term Public-Private Partnerships: The Department of Energy announced phase one winners of the Hydrogen Shot Incubator Prize, awarding $60,000 each to nine early-stage hydrogen production projects and laying the foundation for long-term partnerships between project developers and national laboratories. These partnerships will continue to drive innovation and strengthen the hydrogen value chain—helping solidify American leadership in the global clean hydrogen market.

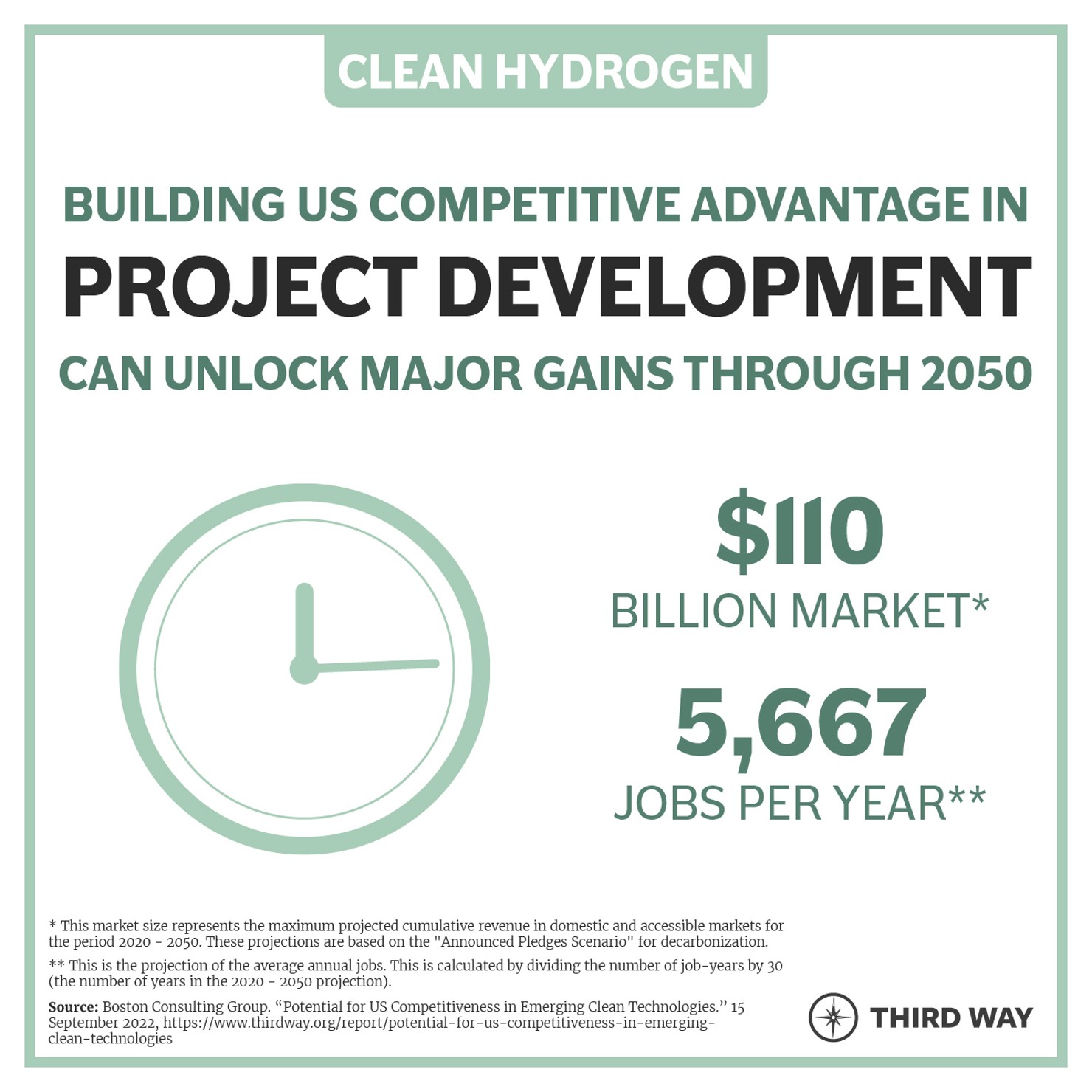

Project Development

Still relatively nascent, large-scale, low-carbon hydrogen projects demand a high level of expertise and access to substantial financing. The US has a workforce in the oil and gas industry ready to transfer those skills to low-carbon hydrogen projects and meet growing labor demands. And with nearly $6 billion in public and private investment in hydrogen in the past three years, we have the financial ecosystem needed to seize a significant portion of global market worth up to $110 billion and create over 5,000 jobs every year through 2050. Here’s how we’re already making headways in this value chain segment:

- Pioneering a Whole-Systems Hydrogen Hub: The California-based ARCHES Hydrogen Hub has secured a $12.6B agreement with the Department of Energy, which includes $1.2B of federal funding. This hub will demonstrate renewables-based hydrogen production, transport and offtake at scale, while decarbonizing transport sectors trucks, buses, and shipping, and creating roughly 220,000 jobs. The ARCHES hub also meets Justice40 requirements, ensuring that 40% of the benefits go to underserved communities through investments, workforce training, and well-paying jobs. ARCHES not only demonstrates the US’ ability to manage and deliver large-scale hydrogen projects but highlights the strength of US project development in the global hydrogen industry.

- Showcasing Large-Scale American Hydrogen Production: Plug Power Inc. has launched the largest liquid green hydrogen production plant in the US, producing 15 tons of liquid green hydrogen per day and delivering it to customer fuel stations using their cryogenic trailers. Not only is this the largest deployment of PEM electrolyzers in the country, but it represents one of the first vertically-integrated hydrogen ecosystems in the US—underscoring our capability to develop and operate large-scale hydrogen projects and set global benchmarks for clean hydrogen technology.

- Leading in Complex Hydrogen Ecosystem Design: Air Products is partnering with World Energy to build a $2 billion expansion at World Energy’s sustainable aviation fuel (SAF) production facility in Southern California. As the first commercial-scale project of its kind, Air Products will extend its hydrogen pipeline network to ensure a reliable supply of clean hydrogen for SAF production—showcasing our capability to design and develop a complex hydrogen technological ecosystem that includes hydrogen production, transport, and storage.

- Leveraging Existing Infrastructure: Chevron is developing its first green hydrogen plant in California, leveraging its existing solar infrastructure and by-products from its oil field operations to produce two tons of low-carbon hydrogen per day. The facility integrates the entire value chain in California—including solar-powered production and a network of refueling stations—and demonstrates America’s ability to design and deploy sustainable, large-scale hydrogen projects.

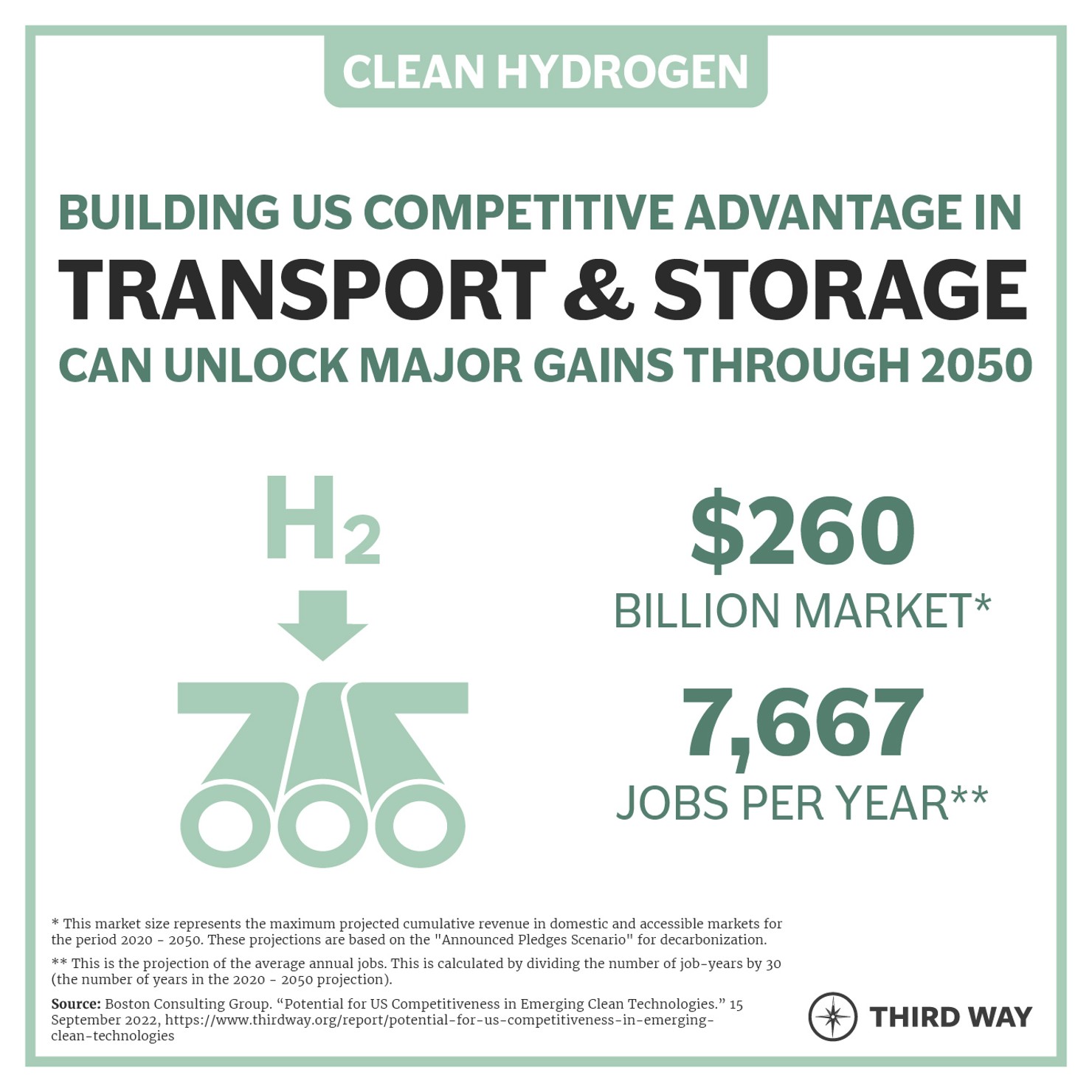

Transport and Storage

Scaling low-carbon hydrogen production requires robust geological storage and pipeline access. The US has a distinct advantage here, with access to a significant portion of global salt cavern storage sites and approximately 1,600 miles of hydrogen pipelines currently operating in the US. And with the potential to retrofit some portions of our extensive network of natural gas pipelines at a third of the cost of building new hydrogen pipelines, the US can leverage existing infrastructure and a skilled workforce from the oil and gas industries. We’re well-positioned to capture a big portion of a $260 billion global market and create over 7,000 US jobs every year through 2050. Here’s how we’re already making progress:

- Expanding New Industries While Protecting Old Ones: The Biden-Harris Administration announced $90 million in grants to support building hydrogen fueling stations in Texas, California, and Colorado for light-, medium-, and heavy-duty vehicles. This funding will build out the critical infrastructure we need to expand hydrogen corridors in the Southwest but preserves and strengthens American heavy-duty trucking jobs. Our approach, which expands an emerging industry while safeguarding an existing one, sets the US apart in the global clean energy market.

- Setting Global Standards: The Department of Energy issued a $504.4 million loan guarantee for a facility in Delta, Utah, to use excess renewable energy, convert it into hydrogen, and store it in two salt caverns. This project, part of the Intermountain Power Agency’s IPP Renewed Project, will be the world’s largest green hydrogen storage facility, setting a global benchmark for hydrogen storage and showcasing American leadership in clean energy innovation.

- Laying the Blueprint: The Department of Energy’s Regional Hydrogen Hub Program is establishing a national network of clean hydrogen producers, consumers, and infrastructure. This initiative is providing a blueprint for decarbonizing public and heavy-duty transportation in key regions like California, where transportation is a major emitter, and in the Midwest, a crucial industrial transportation corridor, and is demonstrating American leadership in building a comprehensive hydrogen economy.

Offtake

Low-carbon hydrogen has many uses, including as feedstock and fuel for applications like ammonia, chemical, steel and cement production, and long-haul trucking. While the US currently lags behind competitors in developing hydrogen use-case projects, our commitment to executing a National Clean Hydrogen Strategy is helping us build offtake demand. By fostering domestic offtake and enabling exports, we are positioning ourselves to capture a significant share of a market projected to reach up to $3 trillion by 2050. Here’s how we’re making progress:

- Building American-Made Demand: The Department of Energy is working with a consortium of private firms to design and implement smart demand-side mechanisms to facilitate long-term offtake agreements for the clean hydrogen being produced by the Regional Hydrogen Hub projects. These public-private partnerships will leverage American industry, finance, and commercial contracting expertise to de-risk clean hydrogen projects and boost demand.

- Growing International Partnerships: OCI Global signed an agreement with New Fortress Energy to purchase all volumes of clean hydrogen produced at its Texas facility, which will then be used to produce green ammonia. At 46 tons of hydrogen per day, this deal is one of the largest clean hydrogen agreements in the US, securing the US as both a reliable partner and an efficient international supplier.

- Demonstrating American-Made Innovation: Caltrans signed an $80 million contract with Stadler Rail, Inc. to deliver four hydrogen-powered trainsets in San Bernardino County, California—with the option to expand to 25 trainsets throughout California. This offtake agreement is not only a first for hydrogen fuel cell technology in rail transport but underscores American leadership in demonstrating and expanding innovative end-uses for clean hydrogen.

Other Value Chain Segments

As a whole, the American low-carbon hydrogen industry has several overarching wins worth noting:

- Driving Down Costs: The Department of Energy’s Hydrogen Shot is working to reduce the cost of clean hydrogen by 80%, reaching $1 per kilogram within the decade. By developing and deploying a national framework that guides federal funding, public-private partnerships, and project development to drive down costs, the US will rapidly grow its expertise in clean hydrogen technology.

- Fostering Cooperation: The DOE H2@Scale Initiative is bringing diverse stakeholders together and fostering cooperation between industry players, academic institutions, and non-profit organizations to drive down costs of all segments of the hydrogen value chain. This unified approach is helping identify and overcome technical and economic barriers, propelling the US to the forefront of the global hydrogen market.

- Deployment a Whole-of-Government Approach: The Hydrogen Interagency Task Force is enhancing coordination between agencies to build a cohesive, government-wide strategy to achieve our national clean hydrogen goals. By combining agency expertise, the US can tackle major technological, economic, and social challenges facing clean hydrogen deployment and ensure that we remain at the forefront of this evolving industry.

So, What’s Next?

The US is undeniably facing fierce competition in the global low-carbon hydrogen market. But with continued strategic investments, abundant natural resources, forward-thinking policies, and key partnerships, the US is well-positioned to not only compete, but to lead. We have already racked up significant wins and demonstrated our capacity to lead in this critical sector. If we continue to build on this momentum, America can emerge as a global leader in the clean hydrogen economy.