Memo Published January 31, 2025 · 11 minute read

Trump Has Been a China Hawk on Nuclear Energy. But Congress Could Compromise That During Reconciliation.

Christel Hiltibran, Rowen Price, Ryan Norman, & Alan Ahn

Takeaways

- A strong US nuclear energy strategy is pivotal to prevent China and other rivals from eroding US influence in a critical global industry and beating the US to form valuable hundred-year geopolitical relationships.

- Despite extensive US investment in nuclear energy, the United States is falling behind our competitors in deploying reactors at home and abroad.

- Anticipated increases in European defense spending could limit EU investments in US nuclear energy imports, compounding the need for US government nuclear funding.

- The Trump Administration and Congress can improve our national security and global competitiveness by robustly funding critical federal nuclear energy programs.

President Trump has long considered himself a China hawk, stoking a trade war with the country, supporting ever-increasing tariffs on its goods, and using aggressive rhetoric to combat its growing global influence. But his approach has a blind spot, failing to mitigate China’s increasing dominance in the energy sector, especially in nuclear energy development and deployment. Until we confront China’s rising role in global energy markets, the US will continue to cede market share and lose geopolitical influence, threatening national security both in the US and among our allied nations. The US needs a synchronized foreign policy to counter Chinese attacks on American hegemony. But since the election, the incoming administration and Congress have signaled misaligned approaches to foreign energy policy. The Trump Administration’s Day 1 executive orders reaffirmed the President’s commitment to domestic energy production—now it’s up to Congress to ensure legislation is going to support energy goals.

Nuclear Energy Must Be a Foreign Policy Priority

Beyond bilateral trade barriers, the US must also dominate critical global industries to remain competitive. There is broad consensus that investments in national defense, space, artificial intelligence, and quantum computing will help make America more secure and more prosperous. The same is true of investments in nuclear energy. A robust domestic nuclear supply chain has corollary benefits, including reliable energy supply, that are foundational to our defense and technology sectors. Moreover, the strength of our nuclear industry directly supports our competitiveness abroad, which in turn affects our ability to uphold the highest global norms in nuclear security and nonproliferation. Failure to compete overseas will enable China, Russia, and other rivals to erode our influence on these international standards and cement century-long geostrategic partnerships around the world. Putting the US at the forefront of global civil nuclear markets will make us stronger, more secure, and more influential on the global stage.

Our adversaries understand the stakes. China and Russia have state-owned, heavily subsidized nuclear industries that are a key part of their efforts to gain allies and influence throughout the developing world. China and Russia view nuclear exports as a way to develop century long partnerships in Africa, Asia, and Eastern Europe. Their interest in advanced nuclear power is less about economics, and more about influence. The competition is well underway and the United States is losing. According to the International Atomic Energy Agency, 85% of all new reactors currently under construction in 2024 are Russian or PRC designs; 0% are US designs.

This year, President Trump and the new Republican Congress have an opportunity to do just that—through budget reconciliation.

Trump Could Cede Critical Geopolitical “Energy Dominance” to China in His First 100 Days by Compromising America’s Nuclear Industry—But It’s Not Too Late

Put simply, if we want to outcompete China, Congress needs to continue to prioritize clean energy.

The incoming Trump administration has made no secret of its hostility to the Inflation Reduction Act (IRA) and its clean energy provisions, especially its investments in wind and solar. But despite recent bipartisan alignment in support of nuclear energy, Trump’s agenda not only targets renewables but may also incidentally deal a significant blow to programs supporting nuclear development and demonstration in the US.

During the 117th Congress, IRA and the Bipartisan Infrastructure Law (BIL) created tax credits, grants, and loan programs to finance the research, development, demonstration, and even the deployment of emerging clean energy technologies, including nuclear. In a flurry of signals issued during the lame-duck period, the incoming administration and Republican Congressional leadership have made clear that many of these programs are on the chopping block in the first 100 days of the second Trump administration. In competition with state-backed civil nuclear programs such as China, the US needs to bolster its federal government funding for nuclear, not decrease it.

China is churning out large reactors at home, demonstrating (i.e., building and operating) advanced reactor technologies, and marketing advanced reactors cheaply along its “Belt and Road.” To stay relevant in this race for international market share, the US must rapidly finance the demonstration and subsequent commercialization of US nuclear small modular reactors (SMRs) and advanced nuclear reactors. The time is now, in the 2025 reconciliation process, to save this critical sector from opening its global market to China. Why? The decisions the US government makes this year will dictate whether US nuclear developers have the resources they need to keep pace and ground test these technologies. In the interest of national security and to ensure US competitiveness, Congress must robustly appropriate funding for advanced nuclear demonstrations and maintain federal programs critical to the scale-up of these technologies. The following programs are all essential to preserve or expand during budget reconciliation.

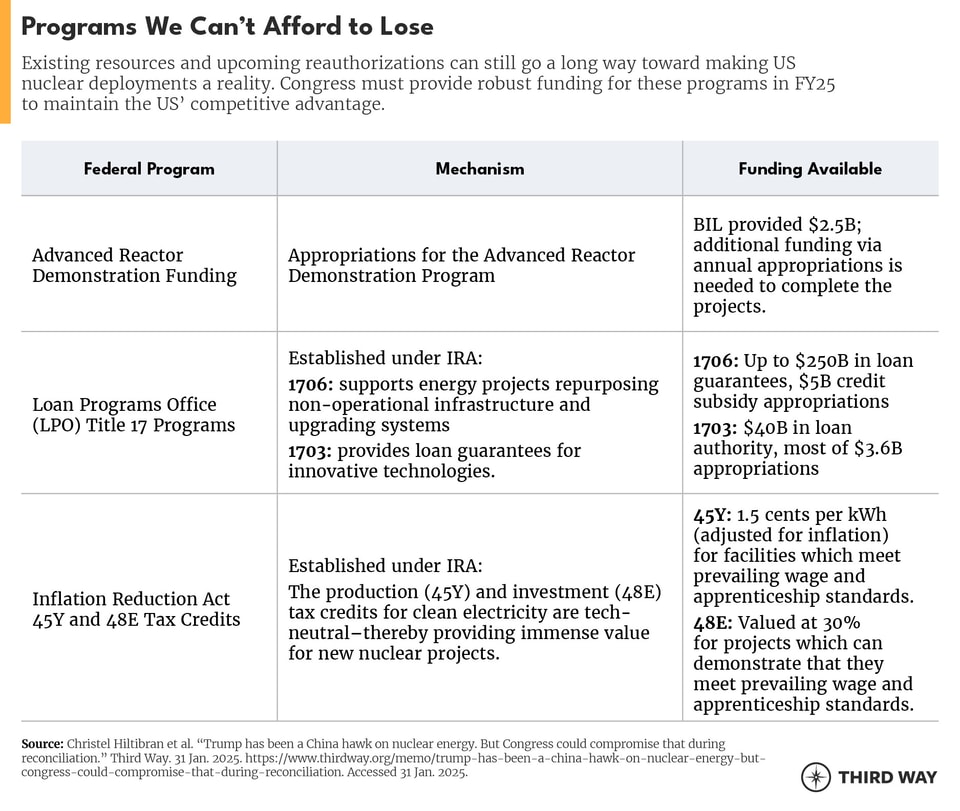

Advanced Reactor Demonstration Funding

What it is: Appropriations for DOE’s Advanced Reactor Demonstration Program. This first-of-its-kind program provides multi-billion-dollar public-private partnerships for some of the US’s leading advanced nuclear power plants.

Why it’s essential: Very few foreign customers will buy American nuclear technology until that technology has been demonstrated at home. BIL provided $2.5B initial award funding for these programs. Since then, the two cost-share grants supported by this program have relied on annual appropriations. As of 2025, neither award has been fully funded yet. The successful and on-time completion of these projects requires robust annual appropriations. As such, the FY2025 Energy and Water Appropriations bills that have passed through the relevant committees contain significant funding for nuclear demonstrations. The Senate bill, drafted by Democratic Appropriations Chair Patty Murray (D-WA), makes up to $800M for nuclear demonstrations, and the House bill, drafted by GOP Chair Chuck Fleischmann (R-TN) contains $9B for nuclear demonstrations (although much of this funding comes from effectively eliminating loan programs that are important for nuclear energy). President Trump and Congress must ensure that the US fully funds both leading US advanced nuclear demonstrations and delivers on the bipartisan investments that lawmakers have made in the program.

Loan Programs Office (LPO) Title 17 Programs

What it is: Title 17 can finance a variety of projects across the nuclear industry, including nuclear reactor supply chain and manufacturing, new SMR and microreactor deployment, new large Gen III+ reactor deployment, and even nuclear fuel cycle projects.

Why it’s essential: Through the Energy Infrastructure Reinvestment Program (known as Section 1706) and Innovative Clean Energy Program (known as Section 1703), LPO can finance almost every type of new nuclear project from innovative greenfield plant builds to energy infrastructure retrofits, such as Holtec’s Palisades Plant restart. Indeed, the most recent new nuclear project in the United States, Units 3 and 4 at Plant Vogtle, were financed with over $12 billion in loan guarantees, awarded in both the Obama and Trump Administrations.

In September of 2024, LPO identified $65B in existing or incoming advanced nuclear project applications to be funded through the program's existing loan authority. This includes a suite of innovative projects, such as the restart of Constellation’s Three Mile Island, which could be one of the first nuclear projects brought online to serve America’s AI boom. Many other advanced nuclear developers, utilities, and data center developers are counting on LPO funding to finance the construction of nuclear projects in the next few years. In addition to funding, Congress must commit to growing the US nuclear industry by extending LPO’s Title 17 authority lending authority, which is set to expire on September 31st, 2026.

Inflation Reduction Act 45Y and 48E Credits

What it is: Established under the IRA, the production (45Y) and investment (48E) tax credits for clean electricity are tech-neutral–thereby providing immense value for new nuclear projects.

Why it’s essential: These credits provide much needed value for new nuclear projects across the US, making them more attractive to private investors and even providing a financial hedge against inflated first-of-a-kind project costs. The 45Y production credit is 1.5 cents per kWh (adjusted for inflation) for facilities which meet prevailing wage and apprenticeship standards; the 48E investment credit is valued at 30% for projects which can demonstrate that they meet prevailing wage and apprenticeship standards.

To accelerate the growth of American nuclear, President Trump and Congress must harness the value of the 45Y and 48E through the credit bonus framework. Under current law, eligible projects may receive a 10% bonus to the base value of the tax credit by locating the project in an energy community and/or meeting domestic content standards. These incentives are critical to ensuring that nuclear energy projects can be profitable and attract financing, and also to ensure that coal, gas, and other energy communities can benefit from the growth of new nuclear power. Ensuring that such valuable bonuses remain available and accessible to new nuclear projects will incentivize substantial private investment and make first of a kind technology more affordable.

Why Do Nuclear Investments Matter?

There has never been a greater demand and critical need for nuclear energy—including to help meet AI’s massive energy demand projections—and never greater bipartisan agreement on its role in US “energy dominance,” energy security, and national security. The demand for “clean firm” energy comes not only from policy mandates around the world, but from buyers and investors looking for pollution-free, reliable energy sources that deliver power around-the-clock. These include all sorts of clean energy buyers—utilities, communities, and corporates with emissions targets.

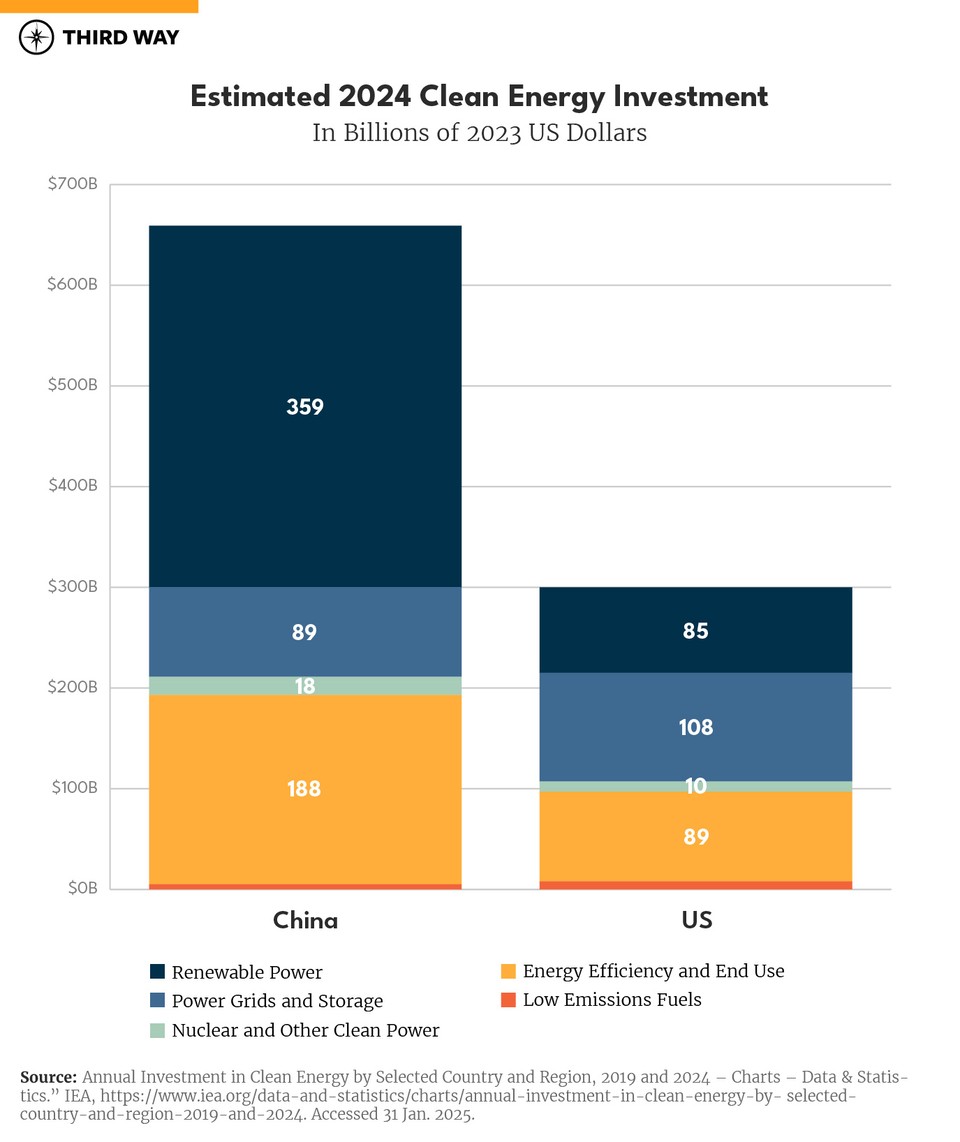

Estimated 2024 Clean Energy Investment

In comparison to state-backed nuclear programs in Russia, China, France and the Republic of Korea, the US is already lagging on both financial investment and deployment of reactors both at home and abroad. In order to make US nuclear reactors affordable enough to manufacture and sell, we need 5-10 units of one reactor design to achieve an orderbook. The nuclear energy market is projected to reach $387 billion by 2050, and the US cannot afford to cede this economic and geopolitical opportunity to the current leader in the industry: China. If we give up this key national security advantage, we also weaken global safety, security, and nonproliferation standards, not to mention century-long government-to-government alliances formed under nuclear energy export programs.

How US Defense Policy Can Negatively Impact Nuclear Export Markets

The consequences of backsliding on nuclear will ripple for generations, potentially due to the impending decision to cut US funding for the war in Ukraine.

If Trump cuts funding and arms support to Ukraine, this may result in a ceasefire deal and introduce billions in reconstruction costs. The European Union (EU) coalition, led by Poland, will likely pick up these huge costs, which may syphon funding out of Europe’s clean energy transition budget. Eastern Europe is a key market for US nuclear exports but soon may have an even smaller budget for the financing of these projects. In the short term, EU member states interested in importing US clean tech may not be able to prioritize or afford nuclear energy, which could close a critical US market.

Without robust foreign investment to augment US private capital in filling out a nuclear orderbook, the path to US advanced nuclear design commercialization will rely more heavily on domestic deployment. That’s why we need to preserve and reauthorize US government nuclear energy funding programs. Once the US can manufacture cheaper reactors at scale, this will drive down capital expenditure costs for key European export markets, reopening the door for the US-European cleantech trade.

In the meantime—with China actively commercializing new nuclear technologies and thus offering comparatively cheaper reactors around the world, the US must not allow the European market to open to Chinese exports. We’ve seen an attempt in Romania, which the US salvaged. Chinese attempts at European markets can—and will—happen again. Congress and the Trump administration must prioritize nuclear energy programs as a national security imperative.

There is still a chance that the US can get ahead—will the second Trump administration be known for its “energy dominance,” or energy inferiority?