One-Pager Published March 23, 2017 · Updated March 23, 2017 · 3 minute read

How States Tax Medical Marijuana

Sarah Trumble & Nathan Kasai

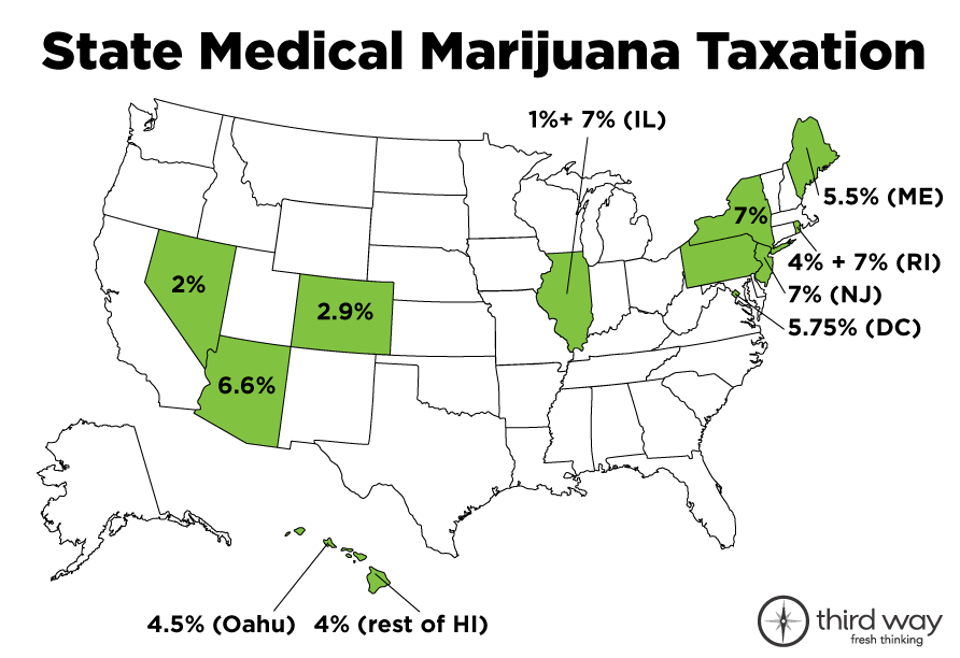

Since 1996, 28 states and the District of Columbia have legalized the use of marijuana for medical purposes. What those medical marijuana systems look like varies from state to state—including which patients are eligible to participate, whether medical marijuana can be smoked or must only be consumed as an edible or used topically, and whether and how medical marijuana is taxed.

Ten states and D.C. have levied some sort of tax on medical marijuana—be it a specific sales tax on medical marijuana paid by the purchaser, an excise or privilege tax paid by the grower and/or seller, a surcharge paid by the seller, the application of a state-wide pharmaceutical rate, or the application of the same generic sales tax required for the purchase of any good. And while in some of those states, that tax money feeds into the same pot as all other tax revenues, others have carefully allocated it to fund the regulation of their medical marijuana systems, address public health concerns, provide for medical marijuana research, and/or assist law enforcement.

Here’s how each state taxes medical marijuana and to what, if anything, that money is specifically allocated:

| Arizona |

|

| Colorado |

|

| Hawaii |

|

| Illinois |

|

| Maine |

|

| Nevada |

|

| New Jersey |

|

| New York |

|

| Pennsylvania |

|

| Rhode Island |

|

| Washington, D.C. |

|

Conclusion

The medical marijuana systems and needs of each state are different, and the variety of ways in which they tax medical marijuana reflect that. States are acting responsibly and compassionately to structure their medical marijuana programs—and levy any taxes necessary—in ways that work best for their communities and allow them to effectively regulate a burgeoning new market.