Report Published February 13, 2024 · 13 minute read

A National Charity Care Law to Improve Nonprofit Hospitals

Darbin Wofford, Kylie Murdock, & David Kendall

Takeaways

Nearly half of all hospitals in the United States are nonprofits. These nonprofit hospitals are exempt from nearly $15 billion in annual federal taxes and another $15 billion in annual local and state taxes. But these tax breaks don’t help patients and their communities nearly as much as they should. Government regulation is lacking. And these hospitals are often using aggressive debt collection tactics against the most vulnerable.

The solution: it’s time for a national charity care law that better regulates nonprofit hospitals and ensures taxpayer dollars are helping those that need it most. This policy would modernize requirements for charity care, simplify how patients receive that care, and cut back on aggressive debt collection.

Providence Health was founded in 1856 by a bishop and four nuns with the goal of providing medical care for anyone in need. What started off as a single room with four beds charging just $1 a day is now one of the largest nonprofit hospital systems in the country. Last year, however, the Washington state Attorney General filed a lawsuit against Providence St. Joseph Health for using “unfair and deceptive” tactics against 36,000 patients who were wrongfully subjected to debt collection despite being eligible for charity care under the state’s Charity Care Act.1 Providence’s nonprofit status grants them $1 billion in savings from taxes, but they spend less than 2% of their expenses on charity care despite federal requirements that nonprofit hospitals provide a community benefit.2

Providence Health isn’t an outlier—there are approximately 3,000 nonprofit hospitals in the United States, all of whom receive generous tax exemptions. In 2020, the tax exemption saved nonprofit hospitals $28 billion, but these hospitals only provided $16 billion in lower-cost or free care.3 Like Providence St. Joseph Health, most non-profit hospitals no longer have local boards that can direct the hospital towards community benefits but instead are part of a large hospital chains.4 Moreover, the Internal Revenue Service does not require nonprofit hospitals to provide a minimum level of community benefits.

With inadequate accountability for serving their community, nonprofit hospitals need a clear standard for the tax benefits they receive. Congress should pass a national charity care law that better regulates nonprofit hospitals with three key measures: 1) restrict the use of aggressive and deceptive debt collection tactics against patients; 2) set a standard for how much charity care nonprofits should provide; and 3) simplify how patients receive charity care.

This report is part of a series called Fixing America’s Broken Hospitals, which seeks to explore and modernize a foundation of our health care system. A raft of structural issues, including lack of competition, misaligned incentives, and outdated safety net policies, have led to unsustainable practices. The result is too many instances of hospitals charging unchecked prices, using questionable billing and aggressive debt collection practices, abusing public programs, and failing to identify and serve community needs. Our work will shed light on issues facing hospitals and advance proposals so they can have a financially and socially sustainable future.

What is a nonprofit hospital?

Fast Facts:

- Of the over 6,000 hospitals in the United States, nearly half are private nonprofits.5

- Nonprofit hospitals are exempt from local, state, and federal taxes. The total value of those tax breaks in 2020 was $28.1 billion—$14.4 billion in federal exemptions and $13.7 billion in state and local.6

- On top of federal requirements for nonprofit status, states and localities can impose their own laws and exemptions for nonprofit hospitals.

Originally, the condition for hospitals’ nonprofit tax status was to provide lower-cost or free charity care to the best of their ability. Following the Tax Reform Act of 1969, that condition was broadened to require hospitals to provide general benefits for the community. The Internal Revenue Service (IRS) sets these community benefit requirements with a key condition to provide care to all patients regardless of their coverage status and ability to pay.7 The Affordable Care Act expanded requirements for nonprofit hospitals to include limiting aggressive debt collection, maintaining financial assistance policies for charity care, and limiting charges for those eligible for financial assistance.8 The IRS must review the community benefits of nonprofit hospitals every three years, but the Government Accountability Office was unable to find evidence the IRS is fulfilling this obligation.9

In addition to tax benefits, nonprofit hospitals reap several other benefits. Most nonprofit hospitals are Disproportionate Share Hospitals (DSH), meaning they receive higher reimbursement rates from Medicare and Medicaid due to servicing higher levels of low-income and publicly insured patients. A majority of nonprofit hospitals are also part of the 340B Drug Pricing Program, which requires drug manufacturers to provide deep discounts to qualifying hospitals. 340B hospitals are then often reimbursed at their typical rates for these medicines and keep the “spread” (i.e., the difference between the reimbursement amount and the 340B price) with no requirement that low-income or uninsured patients benefit from these discounts.10

The Problem: Inadequate Community Benefits

Despite the billions of dollars in tax breaks, nonprofit hospitals are not providing enough charity care as part of their community benefits. Due to lackluster requirements for how much these hospitals must provide in charity care and community investments, patients that would otherwise qualify for free or discounted care are left with high medical bills and aggressive hospital debt collection. We explore each of these aspects below:

Tax breaks for nonprofit hospitals are exceeding charity care.

As tax breaks neared $30 billion among all nonprofit hospitals in 2020, only $16 billion was provided in charity care. While charity care is not the only type of community benefit nonprofit hospitals may provide, it is the most effective method for ensuring patients have access to affordable care. Over time, the tax benefits for these hospitals have grown from $19.4 billion in 2011 to $28.1 billion in 2020, a 45% increase. Despite this trend, a study shows no accompanying growth in charity care.11 The vast majority (86%) of nonprofit hospitals did not provide more charity care than the value of their tax exemption.12 When hospitals do report charity care, it is reported at the higher prices for uninsured patients rather that the lower net-costs negotiated for insured patients.13

In 2020, the Government Accountability Office reported at least 30 hospitals that spent zero dollars in total community benefits.14 Later in 2023, they testified to Congress that community benefit standards lack clarity and are difficult for the IRS to administer.15

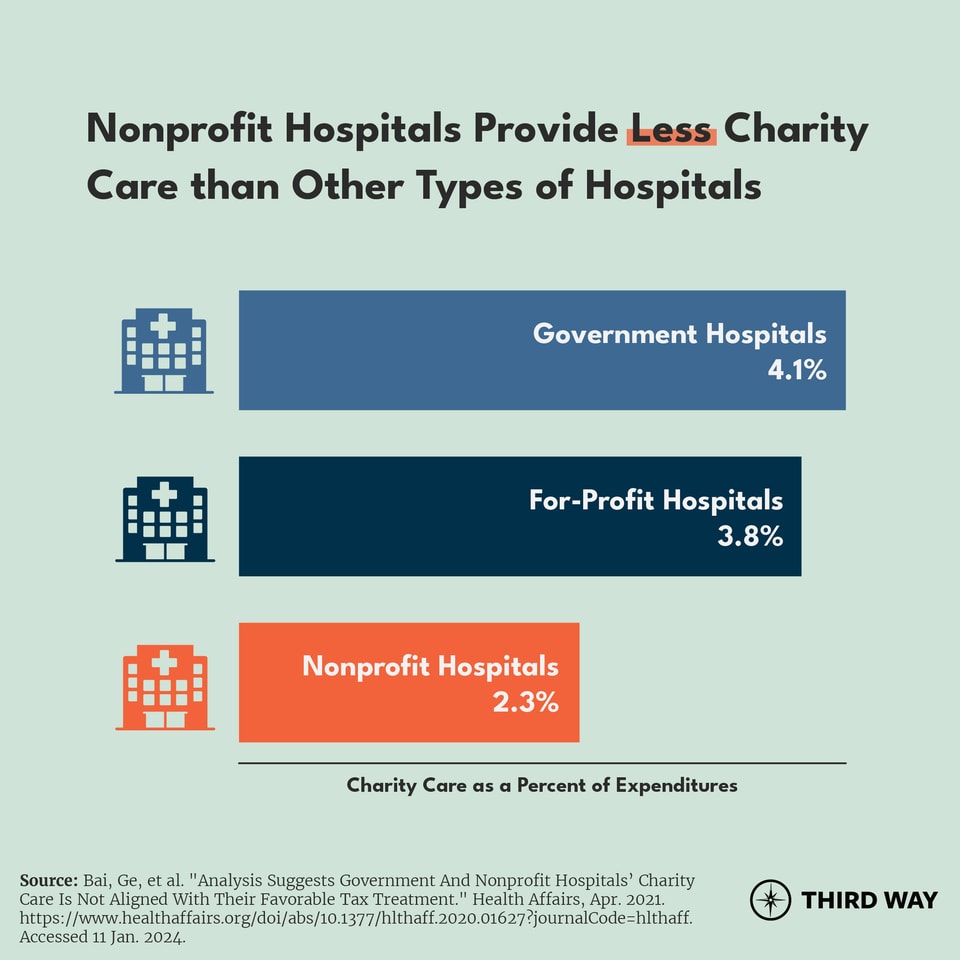

Compared to other types of hospitals, nonprofits spend the least on charity care. For every $100 in expenses, government hospitals spent $4.10 on charity care, for-profit hospitals spent $3.80, and nonprofits spent $2.30. Government hospitals, operated largely by states and counties, maintain similar tax benefits as nonprofits but spend nearly double on charity care.16

Government regulation and enforcement is lacking.

The purpose of nonprofit hospital tax subsidies is to provide a public good. However, this insufficient level of charity care shows how community benefit standards require tightening. While community benefits may range from economic development, environmental improvement, housing investment, and more, the IRS does not require hospitals to spend a minimum amount on community benefits.17 Collectively, nonprofit hospitals invested $19 billion in mission-driven investments, while spending 10 times that ($190 billion) in securities, hedge funds, and private equity.18 One study found that as profits grow for nonprofit hospitals, additional funding goes towards cash reserves rather than charity care.19

The bureaucratic process for obtaining financial assistance (including charity care) is often too complex. Under the ACA, nonprofit hospitals are required to have policies describing their financial assistance program. But the process for qualifying for assistance can be complicated and arbitrary. Hospitals generally have flexibility to specify requirements for patients to be eligible for assistance under these programs, which can include income thresholds and amounts of financial assistance they may qualify for. There are also no federal requirements for what settings charity care is provided in, such as inpatient hospital stays, outpatient medical services, or hospital-owned or contract pharmacies.

In order to qualify for financial assistance, a patient usually must navigate a hospital’s financial assistance program application forms, which may be administratively burdensome. The applications are often long, with questions on income, rent/mortgage payments, and other expenses, and may require patients to submit supporting documents such as pay stubs or tax returns. Administrative barriers like these can prevent low-income patients from receiving assistance.

Nonprofit hospitals are engaged in aggressive debt collection practices.

Hospitals’ failure to provide charity care means more low-income Americans are stuck with medical bills they can’t pay. Forty-one percent of Americans reported having medical debt in 2023, with higher shares of Black and Hispanic adults impacted.20 Half of nonprofit hospital systems billed low-income patients that should’ve qualified for charity care in 2019.21 And when their patients can’t pay, they often come after them using a slew of tactics, some of which break existing regulatory requirements.

Half of nonprofit hospital systems billed low-income patients that should’ve qualified for charity care in 2019.

Many hospitals sue their patients or take other legal action, such as wage garnishment. Hospitals also report patients with outstanding bills to credit rating agencies, hurting their credit rating, and making it harder to rent an apartment, buy a car, or take out a loan. Some sell their patients’ debt to debt collectors who have the resources to pursue and pester patients for years. One of their most shocking tactics, though, is denying nonemergency care to patients with outstanding debts.22

These debt collection practices can be devastating–both financially and medically–for American families, particularly Black and Hispanic families. Lawsuits can drain savings and retirement accounts, resulting in home foreclosures and even bankruptcy. Medical debt is the leading cause of bankruptcies in the United States.23 Hits to credit scores can make it impossible to find adequate housing or even a job. And if patients aren’t outright denied care by providers, many will decide not to seek it out due to fear of retribution. It creates a negative feedback loop, making poor people poorer and sick people sicker.

The Solution: A National Charity Care Law

It’s time for a national charity care law that better regulates nonprofit hospitals and ensures taxpayer dollars are helping those that need it most.

The Affordable Care Act took steps to improve community benefit requirements, but hospitals have exploited loopholes in the law, fail to meet current community benefit requirements, and continue to harass patients. Nonprofit hospitals should be held to higher standards in providing charity care to fulfill community benefit requirements. In a prior report, we proposed allowing the Federal Trade Commission to investigate nonprofit hospitals’ anticompetitive activity.24 Below, we lay out a companion to that—a national charity care law to rebuild public trust in institutions receiving tax benefits meant to serve their communities. The national charity care law would have three components:

First, modernize the requirements for charity care. Nonprofit hospitals should be providing a level of charity care that are commensurate with their tax breaks. To start, we propose requiring nonprofit hospitals to offer charity care to individuals at a sliding scale based on income up to 400% of the federal poverty line. For example, individuals under the poverty line would receive charity care that fully covers their costs at nonprofit hospitals, those from 100% to 200% of poverty would receive a 50% percent discount off of their required cost sharing, and so on. This would ensure that the patients most in need receive free care, and those with lower income will receive sufficient levels of discounted care.

If that charity care is less than the tax benefits the nonprofit hospital receives, the difference should be dedicated towards other community benefits as defined by the IRS. Those benefits include research and health promotion, but the priority should be for charity care.

This approach is similar to Washington State’s requirement that charity care be given to those who meet certain income thresholds.25 Another approach can be found in Texas, which requires nonprofit hospitals to provide at least the total amount of their tax exclusions in charity care.26 Creating a standard for charity care was part of a report released by the Senate Health, Education, Labor, and Pensions Committee in 2023.27

Second, simplify how patients receive charity care. Because of the complexity and paperwork associated with applying for financial assistance, the federal government should require nonprofit hospitals to simplify the process. Nonprofit hospitals should outline financial assistance policies to patients in writing and verbally before being discharged—and provide that information on every bill. In order to streamline verification, the federal government should give access to federal income data with the patient’s permission. Once a hospital verifies eligibility, the patient should receive notice of free or discounted care from the hospital. This measure would ensure that patients who deserve charity care get it and reduce the hospital’s burden when finding out who is qualified to receive it.

Third, expand restrictions on aggressive debt collection tactics. Nonprofit hospitals are currently required to make a “reasonable effort” to inform patients of financial assistance programs before taking “extraordinary measures” to collect debt. These requirements are inadequate and ambiguous. Policymakers should prohibit nonprofit hospitals from engaging in extraordinary collection practices, specifically lawsuits and wage garnishment. Diligent enforcement of regulations is also necessary as many non-profit hospitals are currently violating the law and should be held accountable.

Hospitals should also be required to meet the federal minimum for charity care spending before they’re allowed to send debt to collection agencies. As part of this change, Medicare's program for reimbursing hospitals' bad debt should be adjusted to accommodate the federal minimum requirement. Additionally, hospitals should not be permitted to send debt to collections for those up to 200% of poverty.28

The Consumer Financial Protection Bureau (CFPB) has taken steps to hold credit reporting agencies and medical debt collectors accountable. After pressure from the CFPB and the Biden Administration, the three nationwide credit reporting agencies removed medical debt under $500 and under a year old while also paying medical debt from consumer credit reports.29 Recently, the CFPB announced a joint venture with the Department of Health and Human Services (HHS) and Department of Treasury to investigate predatory medical payment products that are often pushed onto patients who can’t afford to pay their bills.30

To build on this, Congress should pass the Strengthening Consumer Protections and Medical Debt Transparency Act, a bipartisan bill introduced by Senators Chris Murphy (D-CT) and Mike Braun (R-IN). This bill would improve consumer protections, cap the annual interest rate for medical debt, and increase transparency over medical debt practices.31 It would also require HHS to create a public database with information from health care entities on their debt collection practices.

Conclusion

To make sure patients are getting adequate charity care, Congress must ensure the tax benefits for non-profit hospitals are put to good use. Restricting aggressive debt collection, providing minimum requirements for charity care, and simplifying how charity care is provided would fulfill the goal of nonprofit hospitals: to promote health for the benefit of the community.