Report Published August 4, 2022 · Updated August 9, 2022 · 10 minute read

Delivering Health Care Savings to Americans

David Kendall, Zach Moller, Ladan Ahmadi, & Kylie Murdock

Takeaways

Millions of Americans will soon see their health care costs fall thanks to the reconciliation deal moving through Congress coupled with President Biden’s proposed rule to fix the family glitch.

- The Inflation Reduction Act of 2022 would lower drug prices and extend the cap on health care premiums. The family glitch fix would make coverage more affordable for many families.

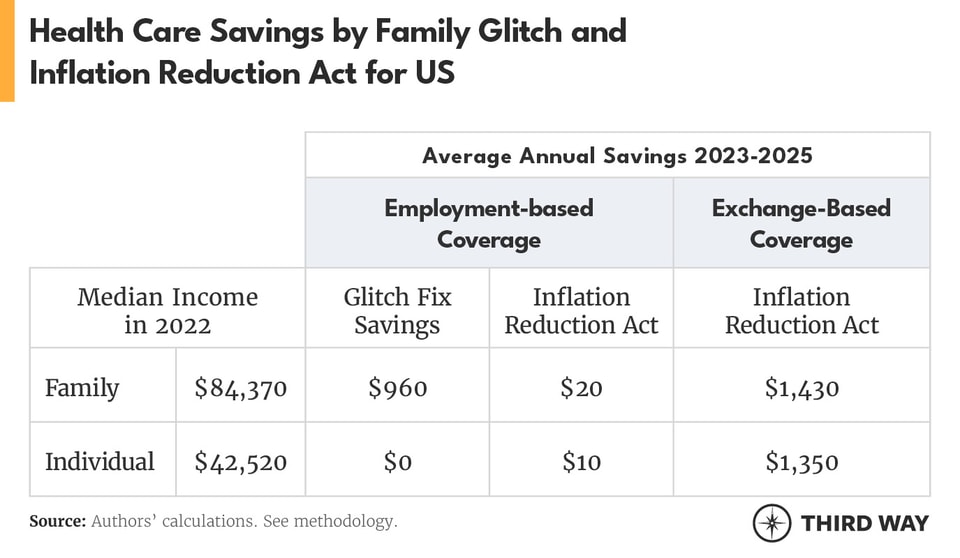

- A typical family with health coverage at work will save about $1,000 a year, and a family with coverage through an exchange will save about $1,400 a year.

Note: This report was further updated on September 12, 2022 based on the Congressional Budget Office’s final score of the the Inflation Reduction Act.

How much will Americans save?

Most Americans will see health care savings from the Inflation Reduction Act of 2022. The savings will vary by the source, the type of their coverage (individual vs. family), their income, current cost of coverage, and state. Overall, here’s how much Americans will save:

Savings in employer coverage

- Families with children who have median income ($84,370) and do not have affordable family coverage at work will save an average of $970 a year from 2023 through 2025 from the family glitch fix and less costly coverage because of the prescription drug price provisions in the Inflation Reduction Act.

- The top three states for annual family savings as shown in the chart below are New Mexico ($3,410), Oklahoma ($3,320), and West Virginia ($3,260).

Savings in exchange coverage

- Families with children at the median income with coverage through a marketplace exchange will save an average of $1,430 a year from 2023 through 2025 from the extended caps on premiums and the prescription drug provisions in the Inflation Reduction Act. Individuals who have a median income ($42,520) will save an average of $1,350 over that period.

- The top three states for family savings in the exchanges are Vermont ($17,650), New York ($16,570), and Wyoming ($15,500).

The charts below show the average savings from 2023 to 2025 by state for employment-based coverage and exchange-based coverage.

Some people will save even more if they have lower incomes (see below). Others will save more if they take prescription drugs subject to the price provisions in the Inflation Reduction Act or if they have prescription drug coverage through Medicare. Estimating those savings is beyond the scope of this report.

In addition to the three-year average savings, we also calculated the prescription drug savings over a nine-year period because that is the period available for the CBO’s estimates. Median-income families with coverage at work will save a total of $320 over nine years, and those with individual coverage will save $110. Families with coverage through the exchanges will save a total of $140 over nine years, and those with individual coverage will save $70.The exchange savings are for a three-year period, which is the length of time Congress chose to extend the enhanced premium tax credits. If the enhanced premium tax credits are extended, savings will continue.

Where do the health care savings come from?

Americans will see health care savings from four different sources included in the Inflation Reduction Act of 2022 and the Administration’s rule on the family glitch: 1) lower pharmaceutical prices; 2) a cap on premiums for families with coverage at work; 3) extended caps on premiums for people who get their own coverage; and 4) cost caps on drugs for people with Medicare. All but the last one are included in the estimates of savings.

1. Lower pharmaceutical prices.

The Inflation Reduction Act of 2022 would lower pharmaceutical prices in two ways. First, it requires the Secretary of the Department of Health and Human Services (HHS) to negotiate prices on behalf of Medicare for a specified group of drugs.1 The group will include the costliest drugs in Medicare without competition. The number of drugs in the group will increase from 10 in 2026 to 20 in 2029 and thereafter.2Drug manufacturers that did not negotiate would pay a tax penalty. The second way the bill lowers prices is to require manufacturers to limit price increases to inflation or rebate the excess increases back to Medicare starting in 2023. As result of the Senate parliamentarian’s guidance, the calculation of the rebate changed. Now as before, the rebate is calculated from how much a drug price increase exceeds the average price in the whole market, including public and private coverage. However, the excess price increase is now multiplied by the number of prescriptions for that drug in Medicare instead of in the whole market. Pharmaceutical companies still have an incentive to keep drug price increases below inflation, but the incentive is not as strong as it would be if the rebate were based on the number of prescriptions in the whole market.

These lower drug prices also lower the cost of coverage (i.e., insurance premiums) for families and individuals. Our analysis covers only the savings through the lower cost of coverage. Some individuals and families will save even more if they use prescription drugs in the group of drugs subject to drug price provisions. See the methodology section at the end of this report for more details.

2. Premium cap for families with employment-based coverage.

The Biden Administration has proposed to cap premium costs for employees with family coverage that is not affordable at work, a problem known as the family glitch.3 The cap is based on the Affordable Care Act (ACA) cap on premium contributions for individual coverage, which is 9.61% of an employee’s income in 2022. The original rule implementing the ACA did not extend the cap on individual coverage to family coverage. As a result, five million people are in a health plan that costs their family more than 9.61% of their income.4 The Biden Administration’s proposed rule to extend the 9.61% cap to family coverage would allow spouses and dependents to seek affordable coverage through the exchanges if the employee’s cost for family coverage at work exceeded the cap. Families can start receiving savings in 2023 once they enroll in coverage for a spouse and children through the exchanges. Third Way previously analyzed families’ savings by state and income levels from the Administration’s family glitch fix.5 This new analysis is based on a family’s median income in each state.

3. Extension of enhanced premium cap for people with exchange-based coverage.

For people who get coverage on their own through the exchanges, the American Rescue Plan capped premiums at 8.5% of incomes at four times the federal poverty level or less, which is $65,880 for a family of three.6 For people with lower incomes, the cap is a tax credit based on sliding scale. For example, the cap is 2% for people with an income of twice the poverty level ($43,920 for a family of three). The Inflation Reduction Act of 2022 extends these caps from 2023 through 2025.7 The cap lowers the premiums people in the exchanges pay based on their incomes. This cost cap also expands coverage on the exchanges for 1.2 million people who today cannot afford it.8

4. Cost caps on drugs for Medicare beneficiaries.

The Inflation Reduction Act caps drug costs for beneficiaries in two ways. It caps high out-of-pocket costs for drugs in Medicare part D at $2,000 per year and caps premium increases at 6% per year from 2024 through 2029. Surprisingly, Medicare Part D doesn’t have a cap on costs for very expensive drugs. Currently, when beneficiaries’ personal spending on drugs exceeds the current $5,100 annual limit, they must continue to pay 5% of the cost for each drug.9 That leaves older and disabled Americans—particularly those with multiple chronic conditions or expensive specialty drugs—unprotected. Medicare does have a cap on out-of-pocket costs for low-income beneficiaries through the Low-Income Subsidy Program. The Inflation Reduction Act would expand eligibility for Low-Income Subsidy program to individuals with incomes up to 150% of the federal poverty level (FPL). Currently, the threshold is up to 135% FPL, which is about $18,000 a year in 2022.

What about people with lower incomes?

The Inflation Reduction Act and the family glitch fix provide even lower caps on premiums for people with modest incomes. For example, a family of three with an income of $60,000, which is 273% of the federal poverty level, will not have to pay more than 4.93% of their income for exchange coverage.10 This cap also applies to families who have coverage through an employer but is not affordable. Here are some specific state examples:

- In Michigan, a family with a $60,000 income will save an average of $1,210 a year from 2023 to 2025 if they have employment-based coverage and $2,660 for exchange-based coverage.

- In New Hampshire, that same family will save an average of $1,920 a year from 2023 to 2025 if they have employment-based coverage and $2,660 for exchange-based coverage.

- In New York, that family will save an average of $2,180 a year from 2023 to 2025 if they have employment-based coverage and $2,660 for exchange-based coverage.

For additional information about state savings, please contact us at [email protected].

Appendix

The chart below shows the three-year average savings from 2023 to 2025 by employment-based and exchange-based coverage from the family glitch fix and the Inflation Reduction Act. It is important to note that the savings from the family glitch fix are higher because of interactions with the Inflation Reduction Act. Specifically, the family glitch savings are higher due to the extension of the enhanced premium cap for people with exchange-based coverage because families with employment-based coverage will be able to seek coverage through the exchanges when employment-based coverage is unaffordable.

Methodology

The estimated savings in this report come from three calculations: 1) the impact of prescription drug savings on premiums; 2) savings from the family glitch fix; and 3) savings from the exchange-based coverage cap. All calculations are based on median income for families with their own children and individuals in non-family households according to the U.S. Census Bureau’s American Community Survey. The ACS 2020 median income is adjusted to 2022 by the growth in weekly earnings from the BLS jobs report.11

Prescription drug savings. We used CBO’s final score of the Inflation Reduction Act to estimate the savings in the cost of coverage from lower prescription drug prices.12 Specifically, CBO estimated the increased revenue that is primarily due to the shift in compensation from health benefits and to wages. As compensation shifts from untaxed health benefits to taxable wages, federal revenue from income and payroll taxes goes up. We calculated a percent reduction in the cost of coverage by dividing the CBO estimate of increased revenue by the baseline for tax expenditures for untaxed health benefits, which is known as a tax exclusion.13 To determine the average savings, we multiplied the percentage reduction by the cost of coverage for families and individuals for each year of the CBO estimate. We reduced the savings by the marginal tax rates for a median income family and individual with employment-based coverage to account for the additional taxes they will have to pay due to the shift of compensation from health benefits to wages. 14

Family glitch fix. We updated Third Way’s previous report on savings from the family glitch fix based on new numbers from the federal Medical Expenditure Panel Survey (MEPS) Insurance Component. See the methodology of the previous report for more details.15 The nine-year projection accounts for the difference in the cost of coverage after the extension of the American Rescue Plan enhanced tax credits expires in 2025 as specified in the Inflation Reduction Act.

Exchange-based coverage cap savings. We estimated the savings from extending cost caps in the American Rescue Plan enhanced tax credits for three years as specified in the Inflation Reduction Act. We used a subsidy calculator to determine the savings in each state for the cost of coverage for median-income individuals and families with two parents aged 35 and one child aged 10 in the most populated zip code for each state.16 We projected the increase in savings for 2023 and 2024 based on the per person health cost from the National Health Expenditure Projections by the Centers for Medicare and Medicaid Services.17 We also used those projections as the basis for all projected increases in baseline costs throughout the report.