Report Published November 2, 2011 · Updated November 2, 2011 · 10 minute read

Nothing Ventured: The Crisis in Clean Tech Investment

Josh Freed & Mae Stevens

Over the next decade, global demand for clean energy products is expected to exceed a whopping $2.3 trillion, providing a big economic opportunity for American companies and workers.1 The U.S. could invent, manufacture, and sell many of these clean tech goods. But to do this, we must understand the risk posed by the dramatic decline in private sector investment that helps make these clean tech inventions a reality—investment from venture capitalists, who are consistently a first major source of funding for early-stage companies.

Venture capitalists fund a crucial step in taking new technology from a back of the envelope idea to a widely marketed business or consumer product. Venture investment in companies in the U.S. helps keep America competitive and leads ultimately to millions of new manufacturing jobs in America. And venture capital spreads widely through the economy—in 2010 alone, venture capitalists invested in more than 2,700 companies.2

Yet today, we’re in the middle of a quiet but severe crisis for clean tech venture investment. Using original research and secondary sources, this paper documents that crisis in detail, citing four major findings: a steep drop in U.S. venture investment; a corresponding decline in clean tech venture funding; a shift away from early-stage clean tech backing; and a striking expansion in clean tech investment by our global competitors.

Venture Capital noun

(ven•ture cap•i•tal) funding for high-risk, high-reward start-up companies.

Taken together, these findings suggest stark consequences for the young companies that venture firms invest in,3 with the clean tech sector hit hard.4 That means the innovations we need now—to boost the economy, create demand for 21st century manufacturing, capture our slice of the clean tech market, and make clean energy as cheap as fossil fuels like oil, coal and natural gas—are being left on the drawing board. As a result, the U.S. is falling further behind in the global clean energy race.

Finding #1

U.S. venture investment has dropped sharply.

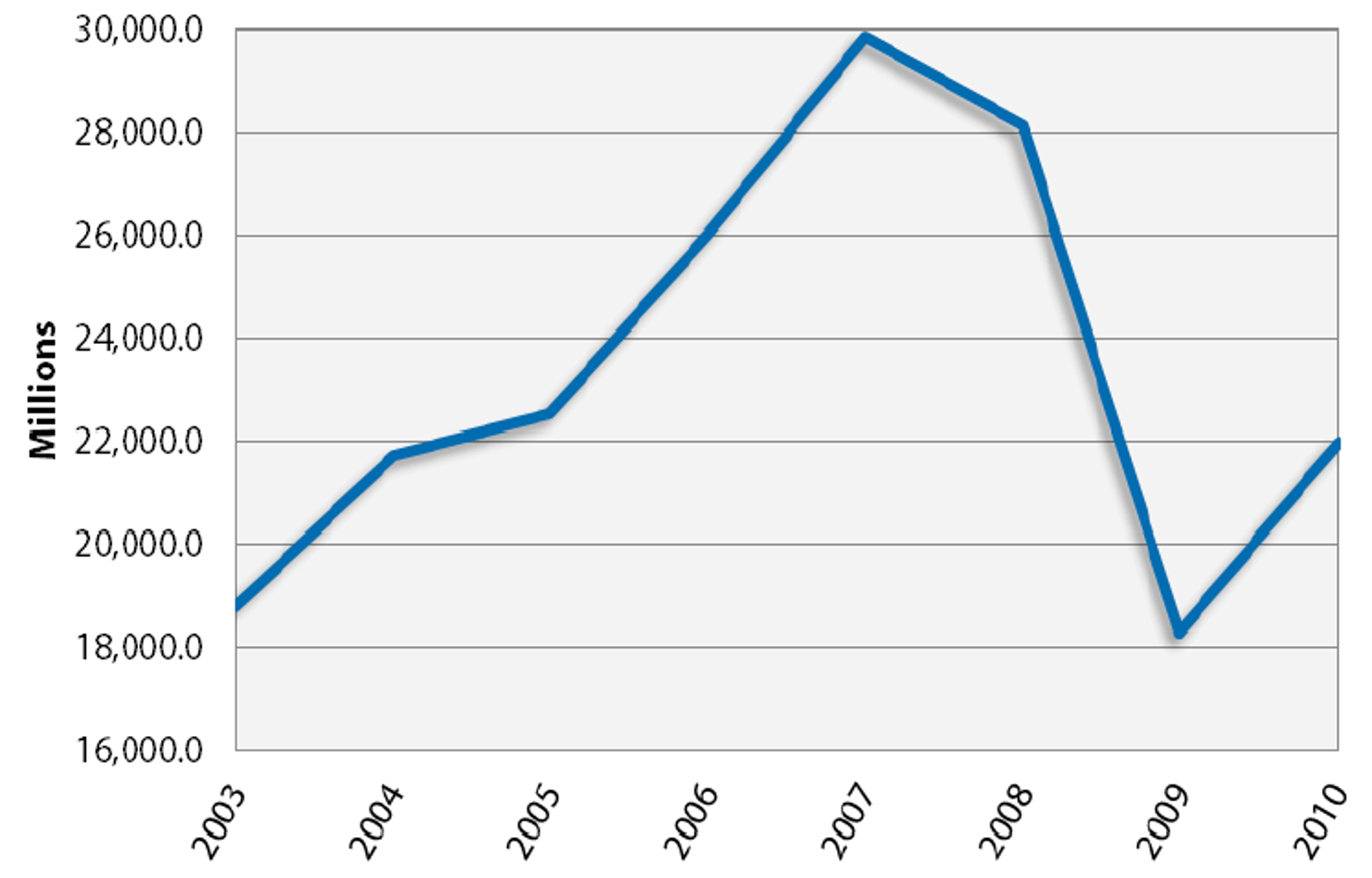

In 2010, total venture capital (VC) firm investment was $22 billion, 26% below 2007 levels.5 In fact, according to analysis done by Third Way, the remarkable decline between 2007 and 2009 erased more than all of the gains made by all venture firms in the boom period between 2003 and 2007, as can be seen in Chart A below.

Moreover, with venture capital, it is crucial to look both at the total amount invested and the number of firms receiving venture funding. Here too, the data are troubling—the overall number of VC investments fell by 18% in the same period.6 Whatever the reasons, such an uncontrolled collapse in the VC market isn’t good for investors, start-ups, or the economy as a whole.

Chart A - Total Venture Capital Investment7 (In Millions, By Year)

Finding #2

Clean tech venture investment has also plummeted.

The clean tech sector has been particularly vulnerable to, and seriously affected by, this drop in venture investment.

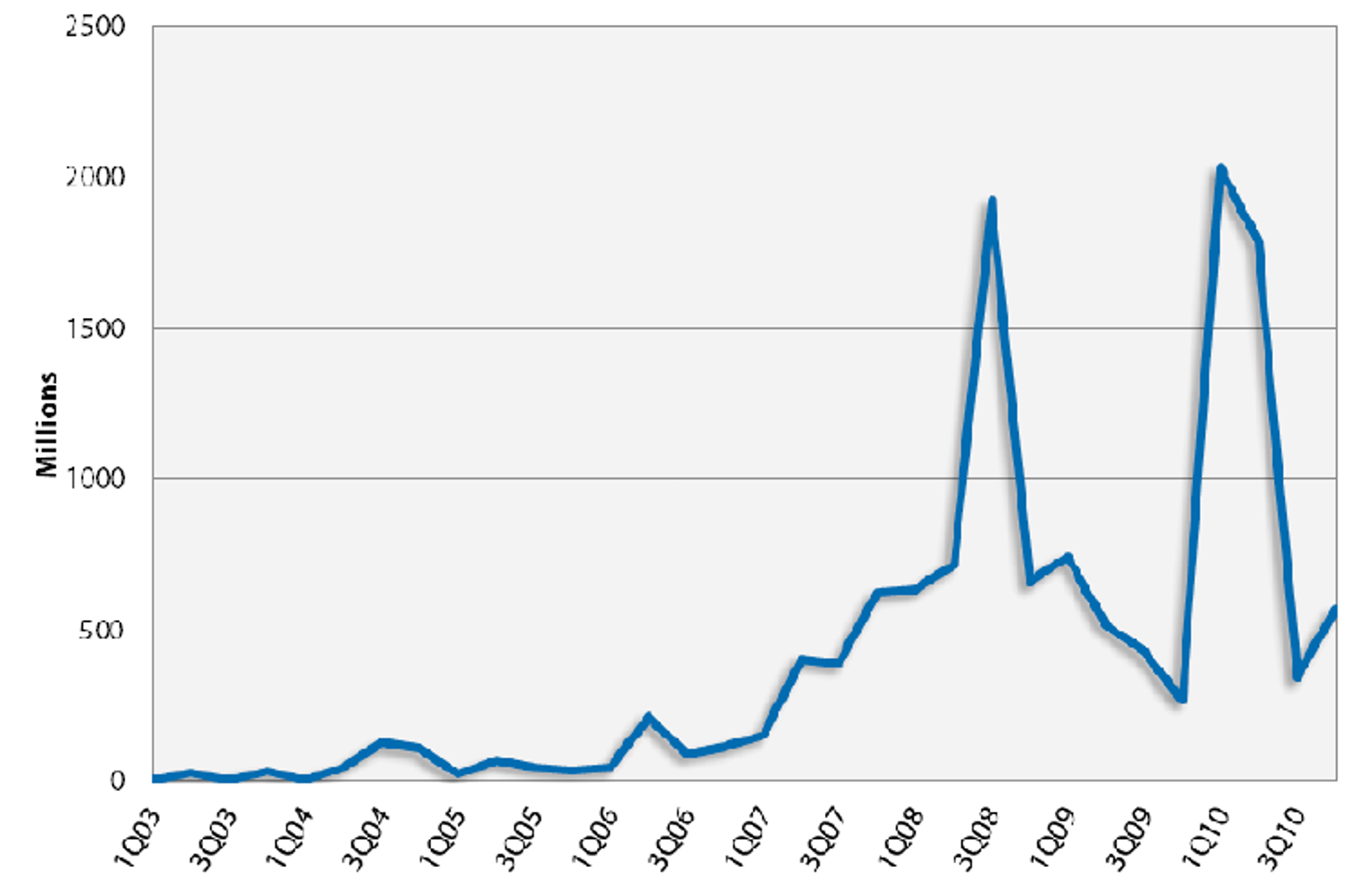

There was a rapid rise in venture investment in clean tech that began in the 4th quarter of 2007, according to our analysis of investment data from Dow Jones VentureSource, displayed in Chart B below. During that period, Congress authorized ARPA-E8 (a new Department of Energy program to help spur clean energy innovation), and the Bush Administration began implementing loan guarantees for clean tech companies.9 Even small amounts of government support like these act as a vote of confidence in the clean tech industry and signal to investors that this is an area of future U.S. growth.

Unfortunately, after this clean energy venture funding peaked in the 2nd quarter of 2008, it fell precipitously as capital disappeared when the economy slid into recession. Confidence and investment in this sector were temporarily restored in late 2009-early 2010 because government support in the Recovery Act acted as a signal to investors (similar to the signal sent by ARPA-E funding and the Bush Administration’s loan guarantees).

.

Chart B - Clean Tech Investment10 (In Millions, By Quarter)

But the clean tech financing roller coaster soon resumed with a steep drop in clean tech venture investment in the 2nd quarter of 2010. According to an analysis by Ernst & Young,11 investments in clean tech tumbled 44% from the 2nd quarter of 2010 to the 2nd quarter of 2011. Overall, the number of venture capital clean tech deals dropped 12% during the same period.12

As the number of deals and dollars invested fell, clean tech inventors strained to stay afloat. Some succumbed to the Valley of Death—the period when a company requires a large amount of funding to scale-up production of a new technology. Others simply could not raise sufficient start-up capital at a time when all venture—especially clean tech—is struggling.13

Finding #3

There’s been a quick shift in clean tech funding away from start-ups.

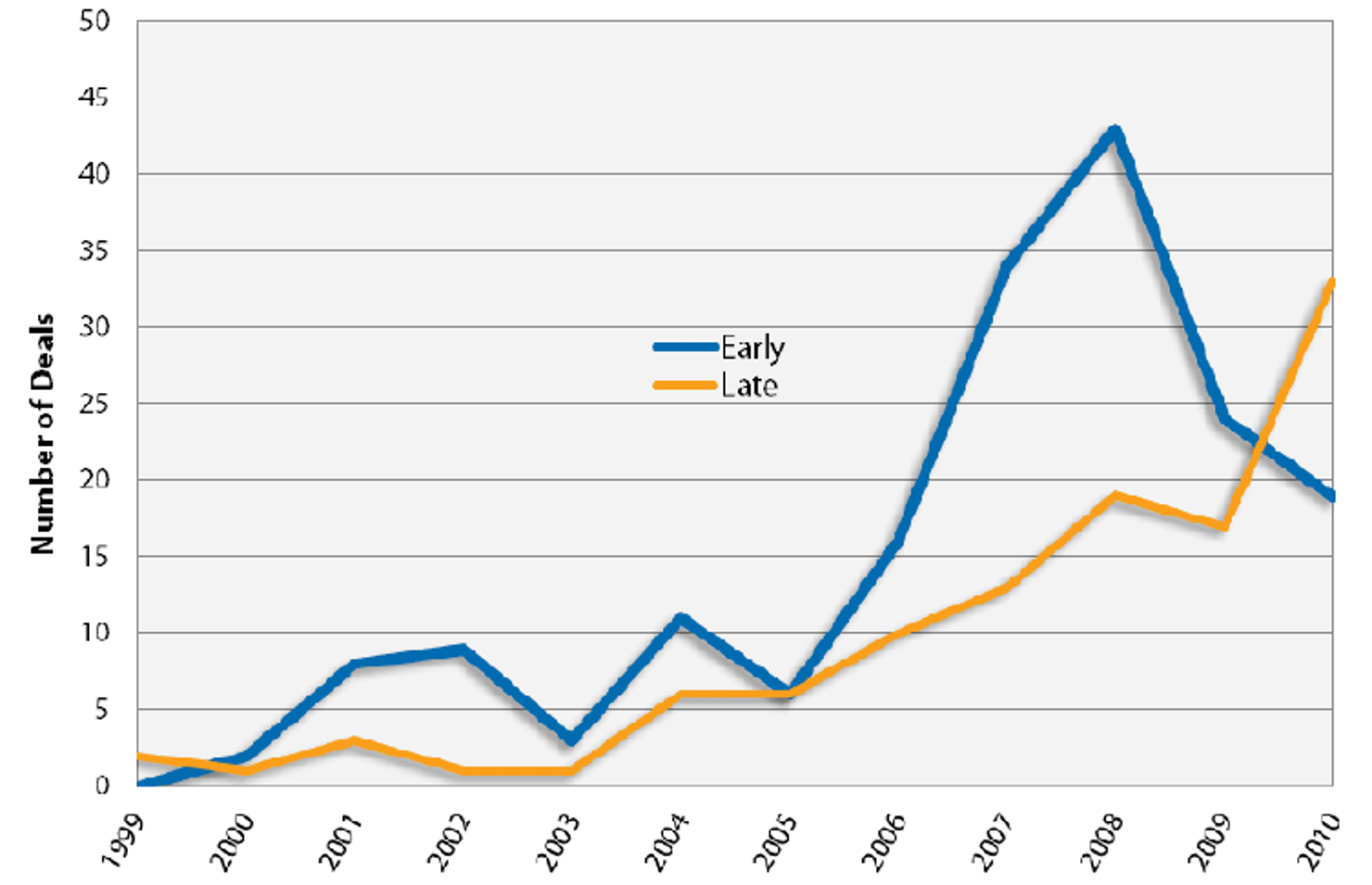

Compounding this startling drop in overall clean tech venture funding is an equally troubling trend: remaining investment in clean tech is moving toward the later, less-risky stages of innovation. Since the beginning of 2010, clean tech venture capital funding is increasingly shifting to late-stage investments, according to our analysis of investment data from Dow Jones VentureSource. In 2010 there were more late-stage deals than early-stage deals in clean tech—by a margin of 2 to 1—for the first time since 1999, as can be seen in Chart C.

Clean tech hasn’t been a failure. It’s VC investment in clean tech that has been troubled.

-Daniel Yates, CEO of Opower14

Investments in early stages of new technologies are particularly important. This is the point when companies have proven concepts and perhaps a small handful of customers, but they are not yet making a profit. Starved for cash, they cannot implement a business plan that reaches profitability without outside investment.15 Indeed, an early-stage company that cannot secure capital is likely to go bankrupt or move overseas where there is better access to funding. Either way, we risk the loss in economic benefits for the United States.

Late-stage investments, where much of the clean tech venture is now flowing, are in maturing companies near or at profitability that are seeking a financial leg-up on their competitors.16 These companies have far more options to raise capital and are more likely to survive without an immediate infusion of new funds.

Chart C - Number of Clean Tech Deals*17 (By Stage)

*Early investment includes Seed, Angel and First Round. Late includes all other rounds.

Finding #4

Our competitors are greatly expanding clean tech investment.

As American clean tech investment declines, other countries are making more and more money available to clean tech entrepreneurs.18 Foreign governments are enticing U.S. clean tech companies to move overseas with low interest loans, with generous repayment schemes, and promises by host governments to share in the costs of operating their factories.19

A report by the United Nations Environment Programme and Bloomberg New Energy Finance found that, worldwide, investment in renewable energy hit a record $211 billion in 2010.20 Venture investment in clean tech helped drive this growth, soaring 59% in 2010 to $2.4 billion.21 This is part of a long-term global trend. Between 2004 and 2010, global venture investment in renewable energy rose 36%.22 While the United States remains the dominant force in venture investment, a 2011 study by the Pew Charitable Trust’s Environmental Group warns that the rapid expansion of clean energy in Asia is driving investment east, away from the United States.23

In many parts of the world, renewable energies are expanding, in terms of capital investment, diversity of projects, and geographical distribution.24 For the first time, in history, more money has been invested in clean energy in developing countries than in developed economies. A survey of global climate policies by Deutsche Bank concluded that clean tech innovations are more likely to emerge and succeed in Brazil, China, India, Germany, and the United Kingdom than they are in the United States. These countries have used a combination of investments and national energy standards, feed-in tariffs, efficiency standards, and a carbon price to create domestic demand.25

As Mark Fulton, Managing Director of the Energy Practice at Deutsche Bank, explained at a recent Third Way ideas forum, other countries have created policies that provide a clear path for investors and emerging technologies. Germany’s feed-in tariff has spurred solar development. The United Kingdom government is incentivizing offshore wind. China is putting a suite of policies in place to stimulate clean tech demand and deployment. “If you look at its peer group, the U.S. federal policy and the way it’s thinking about [clean energy] in America just is really different.”26

Our biggest competitor, China, has twice as many initiatives in place to boost clean tech development at the federal level than the U.S. These include a national renewable electricity standard, a feed-in tariff, a long-term government-invested “green bank,” and long-term funding programs.27

China now leads the world as both the largest source of, and destination for, clean energy investment.28 According to Ernst and Young, in 2011 China beat the U.S. in terms of its attractiveness for renewable energy investment for the first time.29 China attracted $54.4 billion clean energy financing in 2010, a 39% increase over 2009 and equal to the entire amount of clean energy investment worldwide in 2004.30 Such financing in the U.S. stagnated last year at $34.4 billion, approximately equal to 2007 levels.31 As Fulton noted: “[The Chinese are] going to be the scalers; America is going to get the benefits of that, but the real question is simply whether America, yet again, ends up importing everything from China.”32

Conclusion

Today, even as the $2.3 trillion global clean energy market33 emerges, American clean tech entrepreneurs are at risk. The loss of venture capital in the U.S. will not derail technological innovation in clean energy worldwide, but it could severely set back and undermine American-owned clean energy innovation.

As we have illustrated, overall venture investment has plummeted since 2007. This, in turn, led to a sharp decrease in venture funding for clean tech innovations at all stages, but particularly earlier stage investments. Finally, this challenging investment environment has caused innovators to close their doors entirely, or to take their products overseas where they can find sufficient capital. Regardless of the cause, the U.S. is left without the economic rewards of these innovations. As venture firms struggle and investment recedes in the U.S., our international economic competitors—like China, India, Brazil, the United Kingdom, and Germany—are filling the gap.

The crisis in clean tech venture capital today is a warning sign for the American economy. We must heed it and respond if we aspire to the kind of economic growth in the 21st century that we had in the 20th.

Appendix

Definitions of Clean Energy in Data Analysis

In our analysis of Dow Jones VentureSource data, Third Way used the following criteria to define venture capital investment in clean tech:

Type: Angel, Seed, first, second, 3rd, 4th, 5th, 6th, 7th, 8th, 9th, later, restart, other early-stage, other late-stage, Mezzanine.

Industry Segment: Within the Energy and Utilities category: Fuel cells, nuclear, Renewable energy: other, Renewable energy: TBA, solar, wind/water/geothermal.

Region: United States.

Data Current as of: 08/22/2011