Report Published August 13, 2021 · 16 minute read

Which College Programs Give Students the Best Bang for Their Buck?

Michael Itzkowitz

Last year, we released an analysis that introduced a new way for students and policymakers to evaluate their return on investment (ROI) in higher education. This Price-to-Earnings Premium (PEP) calculated the time it takes students to recoup their postsecondary educational costs based on the earnings premium that the typical student obtains by attending an institution of higher education.1 And earlier this year, we issued a follow-up report examining the PEP for low-income students at colleges and universities across the country.2 While these first two papers focused on the outcomes of students who had attended particular schools, it did not provide a nuanced look at how students fared at individual college programs within a school.

Luckily, new program-level data released from the US Department of Education (Department) now allows us to dig below the surface at many institutions across the country to explore what kind of ROI the typical student received from the specific college program from which they graduated. Comparing the earnings premium that students obtain relative to the price they paid to earn their credential allows us to calculate the PEP that individual majors within an institution produce for their graduates. This gives those considering pursuing a postsecondary credential—as well as policymakers, researchers, and taxpayers—more actionable data about where students should be investing their time and money if they hope to increase their economic mobility. It also provides college administrators with concrete information about which programs of study are working well for students, in addition to flagging those that leave them with little to no economic ROI after they complete their credential (Click here to download all of the data).

Using a Price-to-Earnings Premium at the Program Level

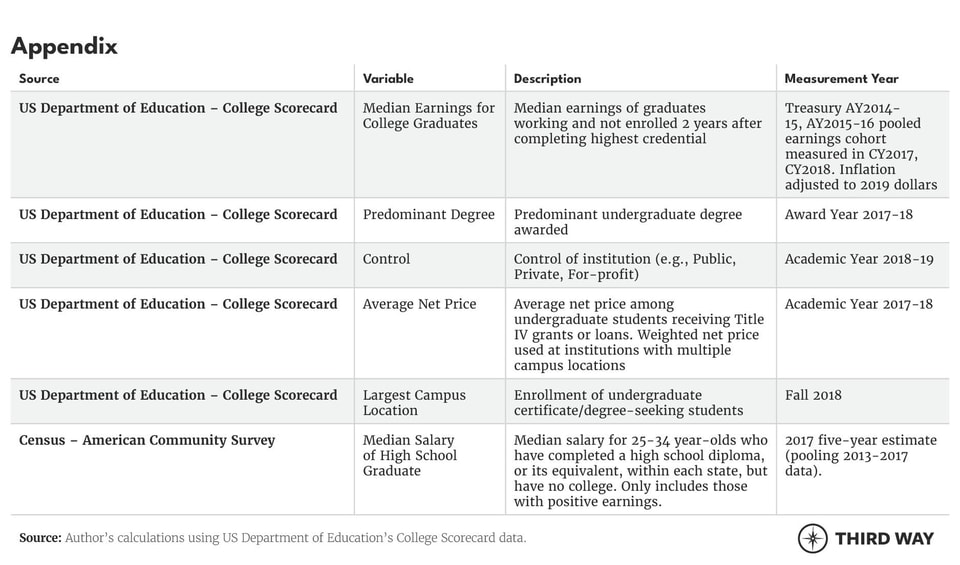

To evaluate a PEP for college programs, we used a similar methodology as in our two previous reports.3 However, the Department’s program-level earnings data offers two key differences.4 First, it only includes students who have graduated from a college program. This essentially means that these students have done everything right: they’ve paid their tuition, stayed in school, and earned the credential they sought. In contrast, the institutional-level data used in previous PEP reports allowed us to look at both students who had obtained their degrees and those who started but never completed. Second, the Department’s program-level data only extends two years after graduation. Institutional earnings data used in previous reports measured earnings 10 years after students had initially enrolled at an institution, regardless if they earned their credential.

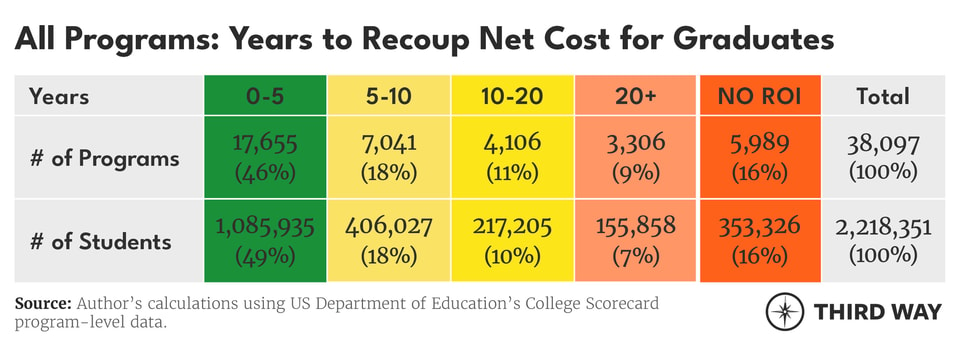

In addition to these differences between institutional- and program-level earnings data, there are some other methodological considerations that should be taken into account when interpreting the data used in this report. For this analysis, we mainly focus on undergraduate-level credentials, such as certificates, associate’s degrees, or bachelor’s degrees. While program-level earnings data are also available at the graduate level, the net price for graduate programs varies and is not provided within Department databases. Lastly, the program-level earnings data made available through the Department only provides outcomes on approximately 20% of all college programs nationwide.5 Other programs have their data privacy suppressed, as their cohorts of students within each program are too small. However, the vast majority of students enroll in these larger programs where the data is available. In total, we analyzed nearly 40,000 undergraduate programs that graduated over 2.2 million students.

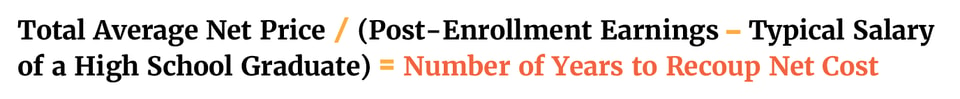

While accounting for these differences, the way we calculated a PEP for college programs is fundamentally the same as in previous reports. First, we look at the total out-of-pocket costs that a graduate would incur (defined as costs after all grants and scholarships are deducted) to complete their college program. For students earning a bachelor’s degree, we assume they will incur four years of annual costs. If the average net price is $15,000 per year at that institution, we estimate the total net price to earn their credential will then be $60,000 ($15,000 x 4 years).6 Similarly, we assume that students will incur two years of annual net costs when completing an associate’s degree and one year of costs when graduating with a certificate. We then look at how much additional income graduates earn compared to the typical high school graduate to figure out how long it would take them to recoup their educational investment.

To calculate the earnings premium that graduates obtain, we compare the median salaries of those who have completed their college program to the median salary of a high school graduate with no college experience whatsoever. If a majority of students who graduated from a college program now earn more than someone who never attended college within the state where their institution is located, we consider that an “earnings premium” that can be used to pay down the cost of earning their educational credential over time.7 If they earn less, we consider them to have obtained no economic ROI, as their income is less than someone with no postsecondary experience.

As in previous reports, the PEP allows us to estimate how long it takes to recoup the educational costs of earning a credential based off of the earnings premium the typical student (at the institutional level) or graduate (at the program level) obtains. For example, if a student graduates with a bachelor’s degree in business and subsequently earns $15,000 more than the typical high school graduate within their state, their earnings premium would be $15,000. If their degree cost them $60,000 to obtain, it would take them four years to recoup their education costs ($60,000 net cost / $15,000 earnings premium). For a more detailed description of the methodology and assumptions, please view our initial report, “Price-to-Earnings Premium: A New Way of Measuring Return on Investment in Higher Ed.”8

The Price-to-Earnings Premium by College Program

To gain a better understanding of what kind of economic ROI specific college programs provide, we took a look at credentials across the US to determine how long it takes graduates to recoup their educational costs.

The good news is that for the more than 2.2 million students who completed college captured in this dataset, most college programs provided them with enough of an earnings premium to recoup their postsecondary educational costs quickly. Almost half (46%) show their graduates earning enough to recoup their costs in five years or less, and nearly two-thirds (64%) show the same result within 10 years after graduation. However, a substantial amount of college programs produced less than stellar results for their students—some quite troubling. Nearly one quarter of all college programs (10,000) show their graduates failing to earn enough to recoup their cost of attending within 20 years after earning their credential. And approximately 6,000 of these programs fail to show any economic premium whatsoever. As a result, over 350,000 students enrolled, paid tuition, and graduated from these programs but saw little to no financial gain after doing so.

Price-to-Earnings Premium at College Programs by Type of Institution

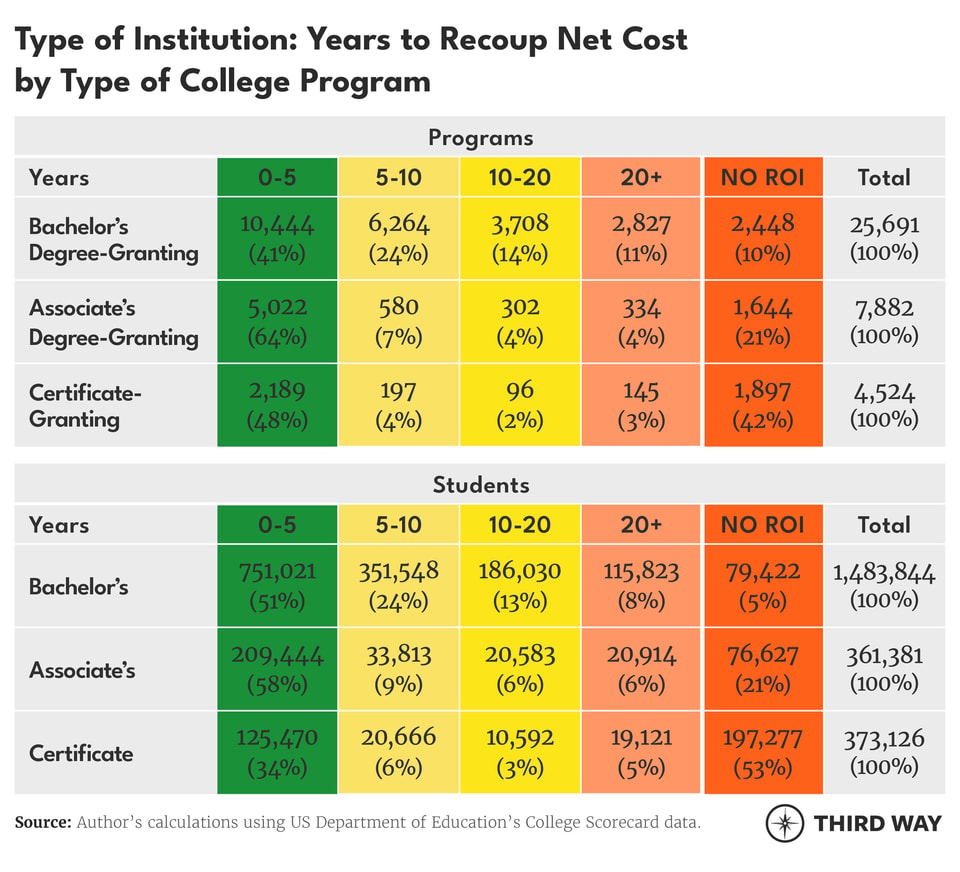

There are also differences across various types of college programs depending on the type of credential they offer. Below, we show the PEPs for college programs that grant bachelor’s degrees, associate’s degrees, and certificates, respectively.

Bachelor’s Degree-Granting Programs: While bachelor’s degree programs take longer to complete—and are often more expensive to obtain—most leave their graduates able to recoup their educational costs rather quickly. Nearly two-thirds (65%) leave the majority of their graduates earning enough to recover their educational costs within 10 years or less—representing 75% of all bachelor-degree holders. Bachelor’s degree programs are also the most likely to show at least some ROI for those who complete a degree, in comparison to associate’s degree or certificate programs. Only 10% of bachelor’s degree programs—representing 5% of four-year students—show their graduates earning less than the typical high school graduate within two years after obtaining a degree.

Associate’s Degree-Granting Programs: The cost of earning an associate’s degree is often less than obtaining a bachelor’s degree, in part because the time to complete is quicker. While a larger proportion of associate’s degree programs lead to no earnings premium whatsoever than among four-year programs, students who earn an associate’s degree have a higher likelihood of recouping their educational costs within the first five years—more than bachelor’s degree and certificate program graduates. Nearly six out of ten (58%) students who graduate with an associate’s degree are able to earn back the cost of obtaining a credential within just five years, higher than any other type of program.

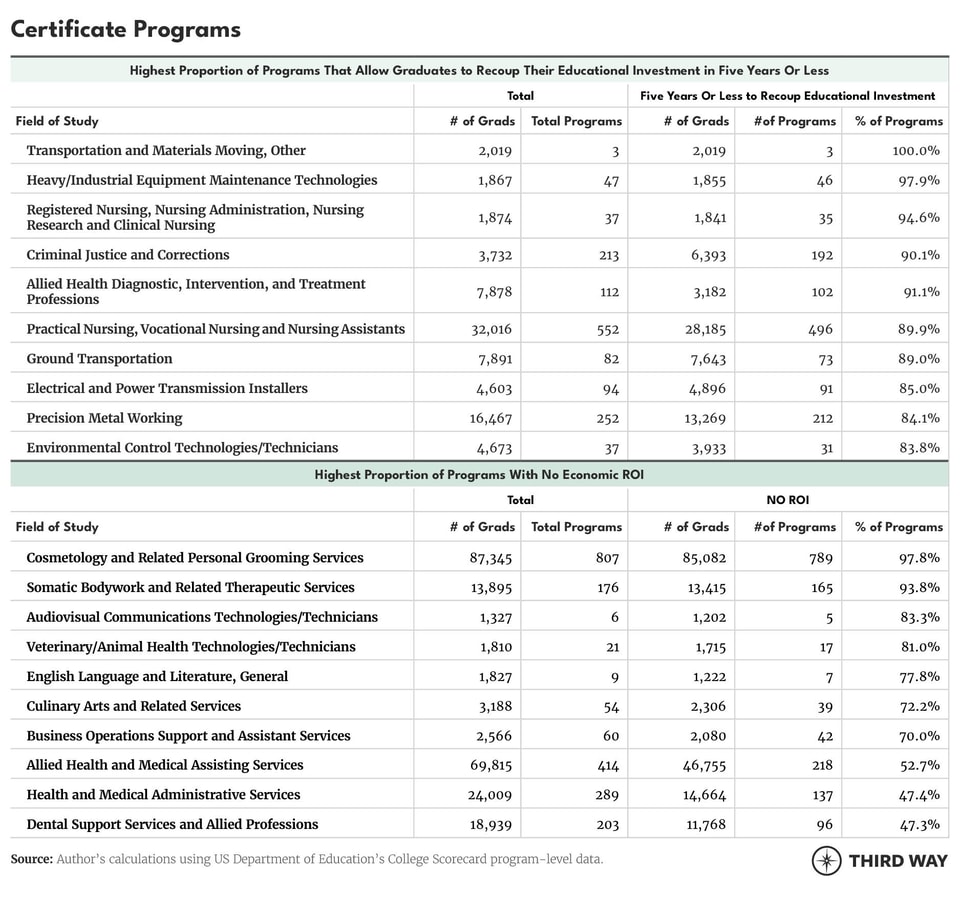

Certificate-Granting Programs: Earning a certificate takes less time than obtaining an associate’s or bachelor’s degree, as they usually range from six to 18 months, depending on the type of certification being sought. The costs of these programs can also vary substantially depending on the length of the program and whether it’s being offered at a public or private institution. These factors, along with the earnings premium they produce, all affect the amount of time it takes graduates to recoup their educational costs. While many certificate programs (48%) show the majority of their graduates able to recoup their educational costs within five years, those that do are generally smaller in scope—representing only 34% of all certificate holders. In contrast, a disproportionate number of graduates that saw no ROI from their program of study had earned a certificate (197,277), rather than an associate’s degree (76,627) or bachelor’s degree (79,422). These results demonstrate wide variation in the earnings premiums at certificate programs throughout the US, with some offering a quick path to fruitful employment opportunities and others resulting in limited to no earning potential after completion.

Price-to-Earnings Premium at College Programs by Sector of Institution

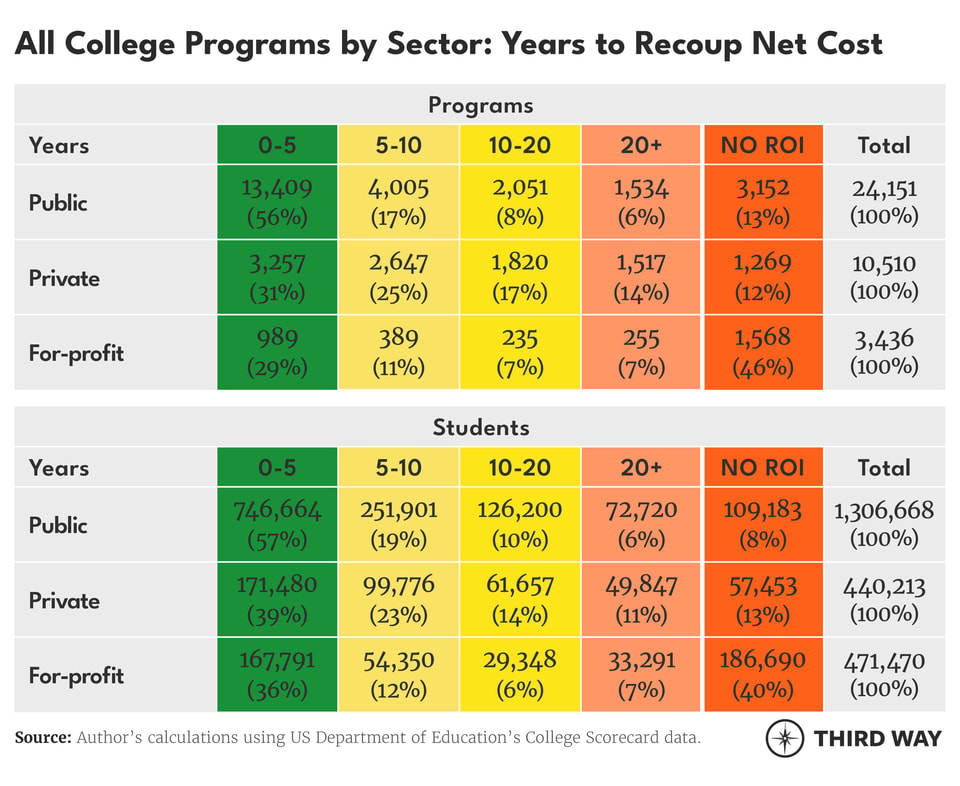

While nearly half of college programs show their graduates able to recoup their educational investment in five years or less, there are noticeable differences depending on whether that program was offered at a public, private non-profit, or for-profit institution.

Public Institutions: College programs offered at public institutions—which make up the majority of both programs and students within the available data—offer the highest likelihood that graduates will be able to recoup their educational investment within five (56%) and 10 years (73%) after completing their program, substantially more than the proportion of programs offered at private non-profit or for-profit institutions that meet those benchmarks. Out of the 1.3 million students who graduated from these programs, approximately 1 million (76%) were earning enough to pay down their educational costs within 10 years or less. Yet even though public college programs are the most likely to pay off quickly, there are still a substantial amount that show no ROI for students who complete a degree. Over 3,000 (13%) still show the majority of graduates—109,183 students—earning less than a typical high school graduate two years after they’ve completed their program of study.

Private Non-Profit Institutions: Programs offered at private non-profit institutions oftentimes result in a longer timeframe for students to recoup their educational costs, as the net cost to attend is frequently higher in comparison to public schools. While nearly six in 10 programs at public institutions show their graduates able to recoup their educational costs in five years or less, less than a third of private non-profit programs (31%) hit the same benchmark. Yet, the majority of programs (56%) still show their students able to recoup their costs within 10 years of graduation, representing 62% of all graduates who earned a credential from a private non-profit institution.

For-profit institutions: College programs offered at for-profit institutions are the least likely to pay off quickly and the most likely to offer no ROI to their graduates. In comparison to the 73% of public and 56% of private college programs that show their graduates recouping their educational costs within 10 years, only 40% of for-profit programs show the same result. Furthermore, nearly half of for-profit programs show no ROI whatsoever (46%), a proportion substantially higher than their public and private counterparts. Out of the 471,470 of for-profit graduates, 186,690 (40%) completed a program that offered no ROI—more than the combined 166,780 graduates of both public and private non-profit programs that fail to meet this minimum economic threshold. That means two-fifths of those who complete for-profit programs likely end up economically worse off by attending, even though they have done everything right to earn their credential.

Price-to-Earnings Premium by Field of Study

Not surprisingly, certain fields of study are substantially more likely to lead to a quick economic return for students who complete a program. Others show a small probability that students will receive any ROI, whether they graduate or not. Below, we take a look at the largest college programs (those with at least 1,000 graduates across the US) that show the highest—and lowest—likelihood that students are able to receive an economic return on their educational investment.

If a high proportion of programs within a specific field of study leave the majority of graduates earning below someone with no college experience whatsoever, it doesn’t necessarily mean that it provides no societal value as a whole. However, it does indicate that the economic return on investment within certain fields may be limited for those who pursue that specific type of credential. It may also highlight that the jobs available within a specific field of study pay too little, offer unstable employment opportunities, or both. As mentioned, the performance of certain fields of study on these metrics can also differ based on the type of credential being pursued and the sector of education at which it’s offered.

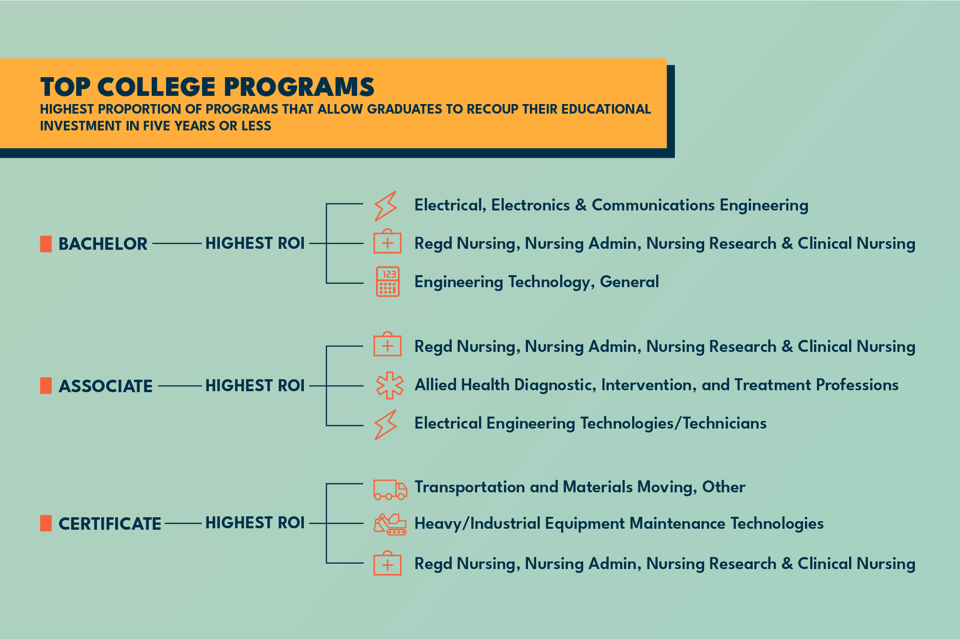

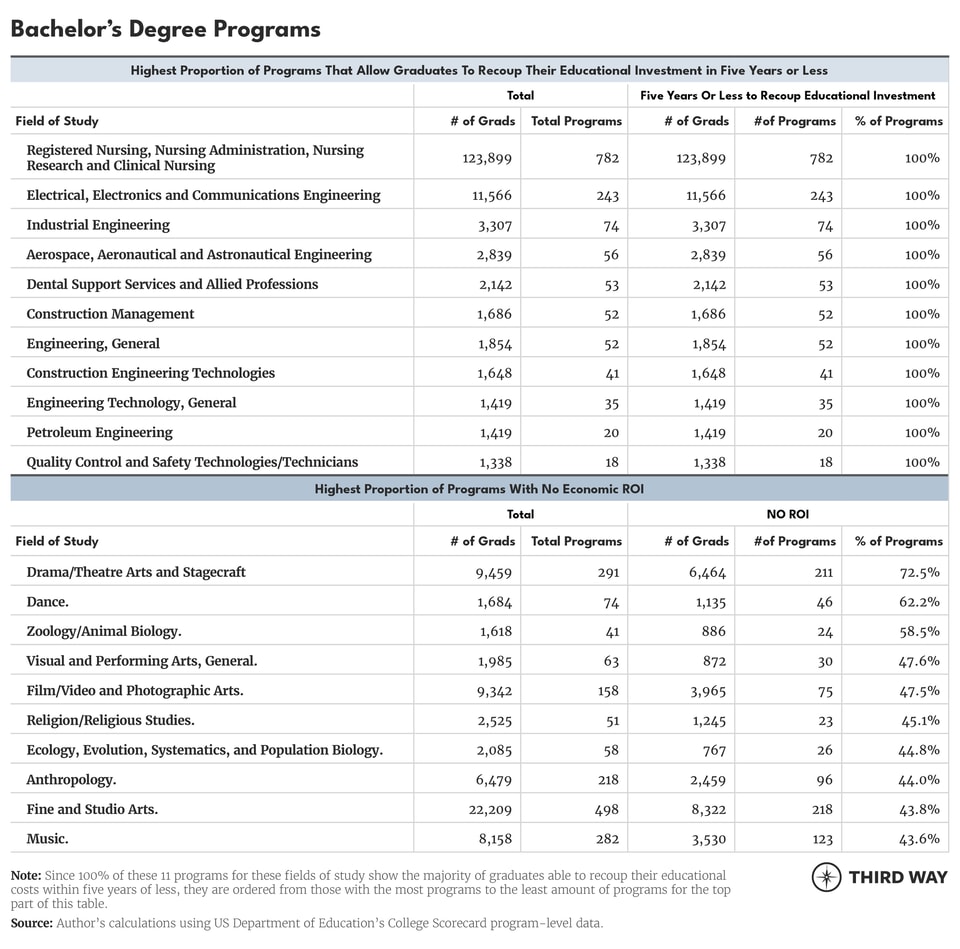

Impressively, there are 11 fields of bachelor’s degree programs that show a quick return on investment for the majority of their graduates 100% of the time. These are mainly concentrated in higher-paying fields, such as science, engineering, and health. Beyond these top bachelor’s degree-granting programs, there are an additional 19 that show at least 90% of programs in a field of study producing the same result (see accompanying spreadsheet attached).

At the bachelor’s degree level, the programs that are the least likely to show the majority of their graduates earning more than the typical high school graduate are primarily focused in the arts, religion, and biology. Yet, only three of the largest bachelor’s degree fields of study show the majority of programs across the US failing to meet this benchmark (Drama/Dance/Zoology). This means that the vast majority of bachelor’s degree programs—regardless of the field of study—are likely to leave the majority of their graduates earning more than they would have if they hadn’t enrolled in higher education.

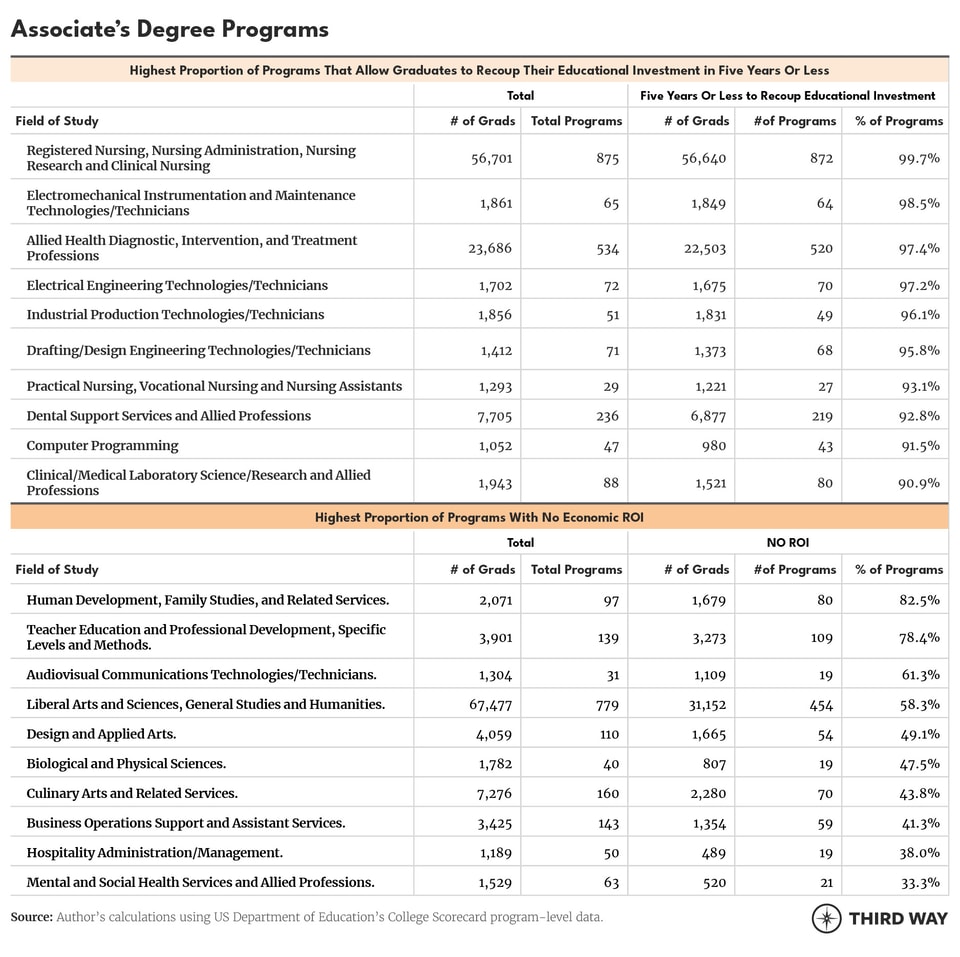

Similar to four-year programs that are most likely to pay off quickly, many of the top performing two-year fields of study are concentrated in health and engineering. The top associate’s degree-granting program—Registered Nursing—shows all but three of the 875 programs across the US leaving the majority of their graduates earning enough to recoup their education costs in five years or less. Other technical fields of study—such as Electrical Engineering, Industrial Production, and Computer Programming—also show a similar likelihood of delivering a quick ROI for those who graduate.

Some programs that show at least defensible ROI at four-year institutions are much less likely to pay off when the student only obtains an associate’s degree in that field. For example, while 83% of associate’s degree programs in Human Development, Family Studies, and Related Services show no economic ROI, only 12.5% of bachelor’s degrees in the same field of study lead to the same result. Similarly, while 58% of associate’s degree programs in Liberal Arts and Sciences, General Studies and Humanities show the majority of their graduates earning less than a high school graduate, only 12% of bachelor’s degree programs in the same field fail to hit this minimum benchmark. While further research is needed, this may indicate that many two-year programs that focus on conceptual skills—rather than technical or practical—may be more likely to show an earnings premium at the bachelor’s degree level.

Similar to associate’s degree-granting programs, undergraduate certificates with the quickest ROI are often grounded in preparing students with the necessary skills to enter a specific profession, such as truck driving, equipment maintenance, or criminal justice. Other programs with broader applications that are highlighted here—such as English Literature—appear less likely to show an earnings premium with only certificate-level preparation. The largest certificate-granting program that has the least likelihood of setting graduates up to make adequate earnings is Cosmetology. At 789 out of 807 cosmetology programs across the US, a majority of graduates reported income less than someone with no college experience, even two years after they’ve earned their credential.9 In total, 85,082 graduates (97%) with certificates in this field attended a cosmetology program that shows no economic ROI. While the American Association of Cosmetology Schools has argued that actual income data is often underreported within the profession, as it mainly operates on cash payments, Secretary DeVos’ administration claimed the association had provided “no evidence that unreported income being an actual—much less widespread—practice among cosmetology program graduates.”

Program-level data also show how related programs can have drastically different outcomes, even when awarded at the same credential level. For example, 90% of programs focusing on Allied Health Diagnostic, Intervention, and Treatment show their graduates earning enough to recoup their educational costs in five years or less. However, over 50% of certificate programs in Allied Health and Medical Assisting Services show no economic ROI whatsoever. While the former is more focused on preparing students to perform examinations or treatments, the latter is more administrative in nature, preparing graduates for more routine office duties, such as patient intake, diagnostic and recording procedures, and pre-examination and examination assistance.10

Conclusion

While institutional data offers a birds-eye view of how well students are succeeding as a whole, program-level data allows students, institutional leaders, researchers, and policymakers to better pinpoint which programs lead to good outcomes within a school and which ones do not. However, even with this newly available data, there is very limited accountability for how well federally-funded schools or programs serve their students. The one administrative rule put in place in 2014 to ensure that certain college programs led graduates to earn enough to pay down their educational debt—known as the Gainful Employment rule—was later scrapped under Secretary DeVos in 2019 before it was ever fully enforced. Yet, even though it was never fully implemented, colleges responded to the data—with over 300 failing programs shut down by their schools voluntarily.11

Without Congressional action, it’s likely the Biden Administration will work to reestablish a bottom line on these programs through another Gainful Employment regulation. If no federal action is taken, these data show that hundreds of thousands of students—even those who have done everything right and completed their credential—may be left worse off after graduating from certain college programs. With students’ livelihoods and taxpayer dollars at risk, it’s imperative that policymakers use available data to fix problems in higher education and work to ensure better outcomes for all who attend.