Report Published September 15, 2014 · Updated September 15, 2014 · 20 minute read

Why Not a Minimum Pension?

David Brown & Kimberly Pucher

If we are to improve retirement savings for every American worker, we should have a minimum pension to help create real wealth for the middle and working classes. For an increasing number of Americans, a middle class job does not support a middle class life. One of the big tickets to achieving a middle class life is holding sufficient retirement savings, yet nearly half of workers are not contributing to a retirement account.

To address the gap in retirement savings, we propose a minimum pension law—a requirement that employers contribute a minimum of 50 cents per hour worked, for every worker, into a retirement plan. Many companies will comply by continuing their existing plans, while others may direct contributions to new, simple investment vehicles. In this brief, we lay out three facts about the retirement situation in the United States and how a minimum pension could work.

The Problem: Retirement Insecurity

For many workers, America’s private retirement savings system is working. Employer plans, combined with Social Security and other vehicles, are effectively facilitating savings for secure retirement. But for many others, private retirement savings are not at sufficient levels. Three facts underscore the need for an ambitious expansion of personal retirement savings to more American workers.

1. Return on Capital Outstrips Return on Labor

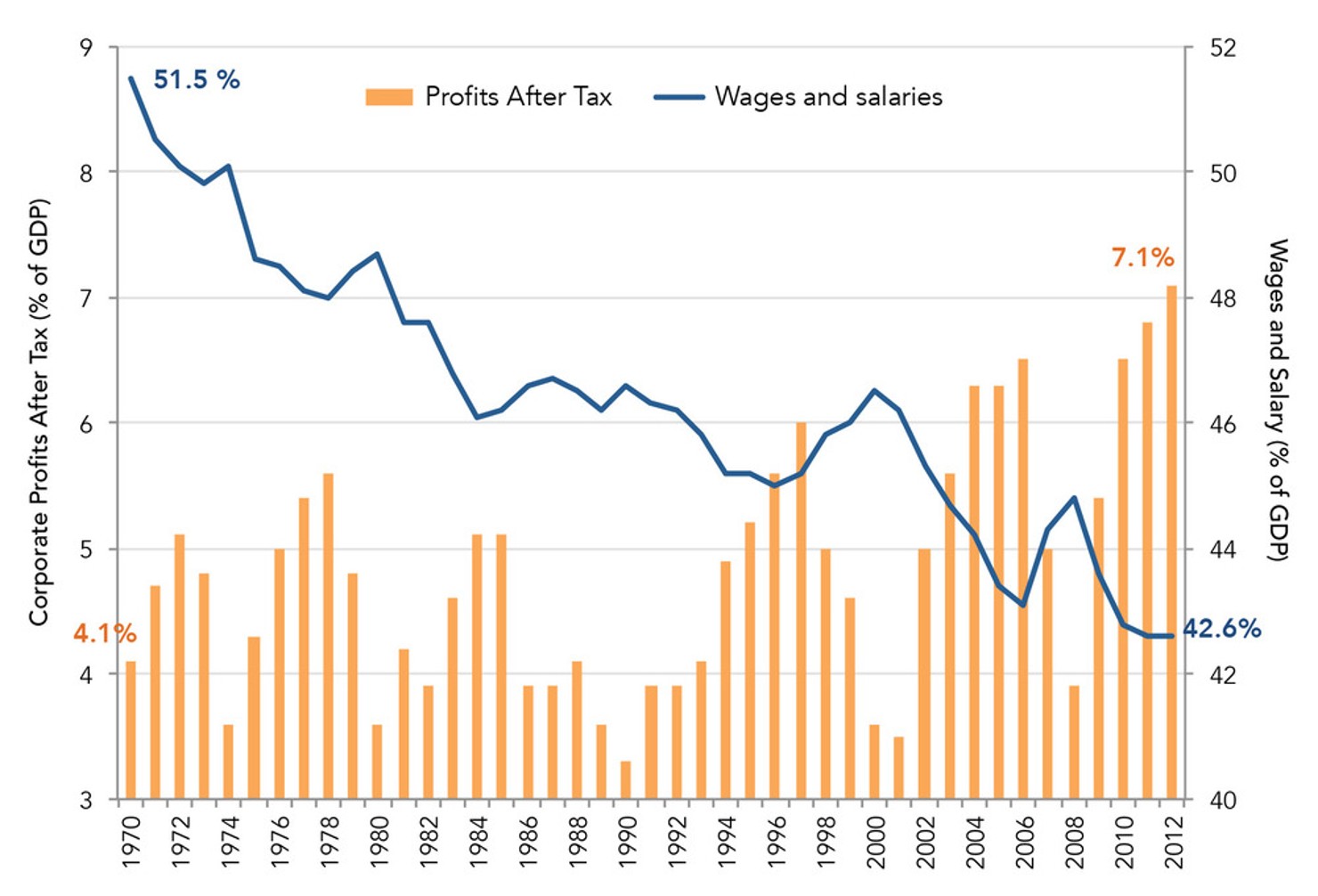

For decades, the benefits of economic growth have been shifting from labor to capital. Since the 1970s, workers’ salaries (not including benefits and other forms of compensation) have been on the decline as a share of national income, from a high of 51.5% in 1970 to a low of 42.6% in 2012. Meanwhile, returns to capital have been on the rise. In 2012, corporate profits reached a 50-year high of 7.1% of national income.1

2

Wages vs. Corporate Profits as a Percent of National Income3

While it is desirable for labor to regain its share, workers could also capitalize on this trend. The more they invest, and the sooner they invest—through a retirement savings vehicle—the more they will share in the promising returns to capital. As workers live longer and defined benefit plans decline, workers will need not only the principal from their savings but also the returns from investing. Of course, investing carries risk, and retirement accounts will fluctuate in value. But over a lifetime of work, with diversification and age-specific risk profiles, workers are practically certain to benefit from increasing their ownership of capital. Further, the guaranteed annuitized income from Social Security gives retirees a backstop against this market risk in at least one stream of their retirement income.

2. Nearly Half of Full-time Workers Aren’t Participating in a Retirement Plan

Reports vary on the extent to which the U.S. workforce is participating in the retirement savings system. But all studies make clear that a significant portion of workers is not participating.

The Federal Reserve in August 2014 found that 31% of non-retired adults have no private retirement savings or pensions—including 19% of those between ages 55 and 64.4

According to the Employee Benefits Research Institute (EBRI), only 53.7% of full-time, full-year workers participate in an employer-provided retirement plan.5 That leaves 49.3 million full-time, full-year workers who, in 2011, did not participate in an employer-sponsored retirement plan. Some workers missed out simply because they elected not to participate in a plan—about 6.4 million according to EBRI. But the remaining 36.5 million did not have an employer-sponsored plan in which they could participate. The data is worse for minorities. Only 34% of working-age Latinos and 51% of African-Americans with full-time jobs participate in employer-sponsored retirement plans, compared with 59% for whites, who also contribute more to these plans.6

Other sources characterize the lack of participation as a large but more limited problem. According to the Department of Labor, 65% of civilian full-time workers participate in an employer-sponsored retirement plan.7 And a report by the Investment Company Institute (ICI) contends that, of the workers who are not offered a plan, most are either not able to save or prefer to save for purposes other than retirement. The report identifies 31.4 million full-time, full-year private sector workers (aged 21 to 64) who were not offered a retirement plan.8 Then it filters out the following groups: workers aged 21 to 29, workers earning less than $26,000 a year, workers aged 30 to 45 earning less than $45,000 a year, and workers whose spouse participates in an employer plan. Of those remaining, only 10.2 million do not have access to an employer plan.

There is also the equally important issue of savings adequacy. Many of those participating in employer plans simply aren’t saving enough. According to the 2010 Survey of Consumer Finances, the median value of private retirement accounts for married couples between 55 and 64 was $42,000.* The majority of single individuals in the same age range have no savings in private retirement accounts.9 Because of large accounts held by wealthy investors, the average private retirement assets for this age range are much higher, both for married households ($251,000) and single households ($61,000).10

* Private retirement accounts include IRAs, 401Ks, and any other tax-preferred DC plan. They do not include defined benefit pensions, Social Security, home equity, or other types of assets.

Poor retirement plan participation and savings rates are the result of many factors, but three factors can be addressed through legislation. First, many employers offer no retirement plan. Their workers may enroll in an IRA on their own, but are significantly less likely to act on their own than if their employer were to offer a plan. Second, participating in any retirement plan can involve difficult and confusing decisions involving risk and investment options. As a result, many individuals avoid making a decision at all, never executing the initial action of joining a plan. Third, many workers have little immediate financial incentive to enroll in or contribute to a retirement plan. The current system incentivizes retirement savings partly through reducing taxable income, providing the greatest incentive to individuals in higher tax brackets. Comparable financial incentives do not exist for workers who have a zero or low marginal income tax rate.11 Some low- to moderate-income workers may qualify for the Savers Credit, but that subsidy is nonrefundable and vastly underutilized.

3. Many Americans Will Outlive Their Savings

According to EBRI’s 2014 Retirement Readiness Ratings, over 40% of adults approaching retirement are at risk of exhausting their savings during their retirement. There are several contributing factors. Americans are entering retirement with too little in savings, they are living longer, and they face years of out-of-pocket medical costs.12

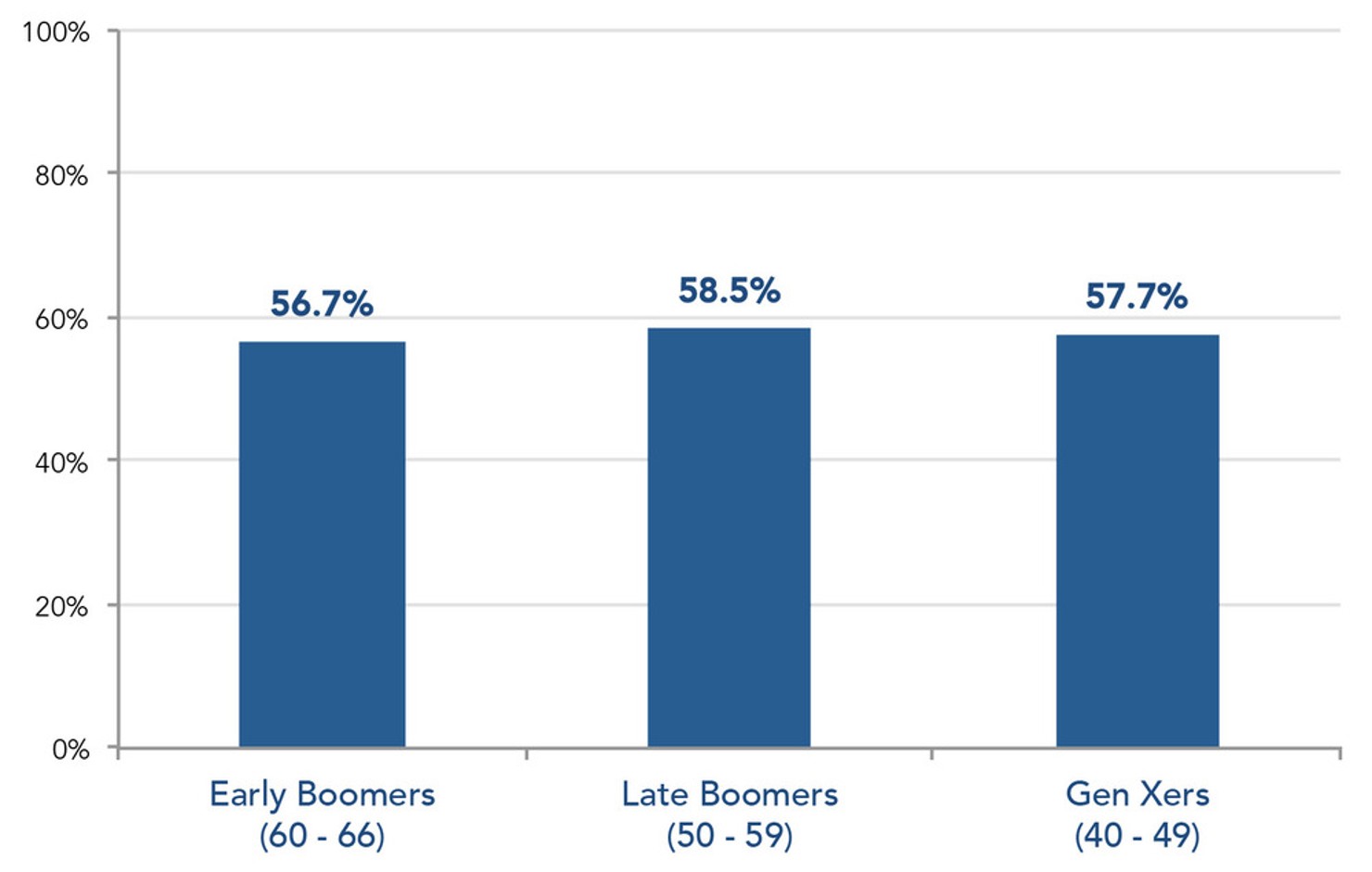

2014 Retirement Readiness Ratings13

Percent of households NOT at risk of exhausting retirement savings

Note: The EBRI 2014 Retirement Readiness Ratings by age cohort demonstrates that regardless of generation, among individuals approaching retirement age 40 and upward, more than 40% of the population is at risk of running short of money in retirement.

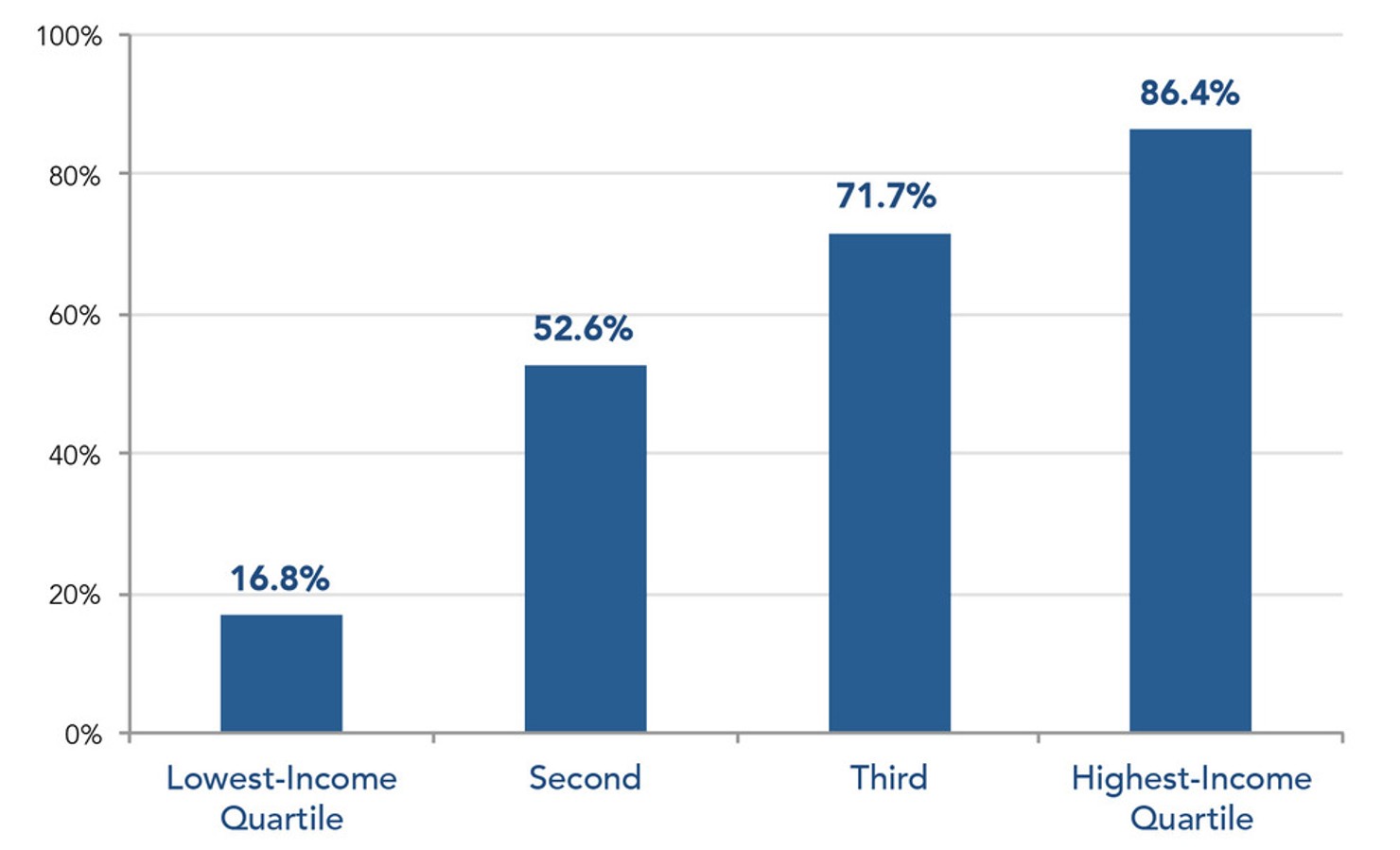

The readiness problem gets worse the lower an individual is on the wage scale. Almost half of the individuals in the second income quartile are not ready for retirement, and more than 80% of individuals in the lowest-income quartile are not adequately prepared. These statistics point to the urgency for new federal policy that would increase private retirement savings for low- to middle-income workers and their families.14

2014 Retirement Readiness Ratings, by Pre-retirement Wage Quartile15

Percent of households NOT at risk of exhausting retirement savings

Note: The EBRI 2014 Retirement Readiness Ratings by preretirement quartiles demonstrates that there is a wide disparity among the income quartiles. On the highest-income quartile end, a maximum value of 86.4% of individuals will not run short of money in retirement, whereas only 16.8% of individuals in the lowest-income quartile will not run short of money in retirement.

The Solution: A Minimum Pension, Real Wealth for Half a Buck

To address the shortfall in retirement savings, we propose a minimum pension law—a requirement that employers contribute a minimum of 50 cents per hour worked, for every worker, into a retirement plan. Combined with existing investment vehicles, and one new one we propose, the plan would greatly improve retirement security for millions of Americans.

The 50 Cent Minimum Pension and the Savings Plan for Universal Retirement (SPUR) Account

- For all workers, employers must contribute a minimum of 50 cents per hour worked to a retirement plan.

- Existing employer-provided defined benefit and defined contribution (DC) plans may satisfy the requirement.

- Any employer with more than 50 workers choosing not to offer a plan will make direct contributions to Auto-IRA Accounts. Firms with fewer than 50 workers may choose to contribute to SPUR Accounts instead.

- Employees may also make contributions to SPUR and Auto-IRA Accounts. Auto-enrollment (with an opt-out capability) will increase worker contributions, which would also be eligible for the Savers’ Credit.

- SPUR Accounts will be unsubsidized, privately managed, portable accounts with the same tax treatment as IRAs.

- Each worker’s default investment will be a lifecycle fund.

- Beginning at age 62, workers may choose how to draw from their savings. The default distribution will guarantee a lifetime income stream, with the option to change.16

- A temporary tax credit will help employers transition into the system.

- Social Security is unaffected by this proposal.

How Does the Minimum Pension Work?

A minimum pension sounds like a minimum wage, and it is. Federal law requires non-exempt employees to receive at least $7.25 an hour in wages. The minimum pension requires that, in addition to wages, employees must receive at least 50 cents an hour in retirement contributions. For full-time, full-year workers, that amounts to a minimum contribution of about $1,000 a year.

For many workers, especially those receiving an annual salary, employers are already doing this and would have to change little or nothing. Public employees such as teachers, police officers, nurses, firefighters, sanitation workers, and congressional aides already have retirement plans that would qualify, as do most private sector white-collar workers. Some companies would have to make adjustments, such as converting at least a portion of their 401(k) match into a hard employer contribution. And organizations with defined benefit plans will have to show that their contributions are at least 50 cents an hour for each worker. Other companies, including those employing the 43 million full-time workers not participating in a retirement plan, would have a new responsibility: sponsor a plan for all your workers, or pay into Auto-IRA or SPUR Accounts on their behalf.17

Where the minimum wage has gaps, the minimum pension should not. The minimum wage is not indexed to inflation, causing its purchasing power to erode over time. The minimum pension should be indexed to inflation. The minimum wage has exemptions for certain workers: farmworkers, full-time students, tipped workers, and some working for very small businesses. As Congress prepares legislation, exemptions like these will be discussed for the minimum pension. For example, some proposals to expand retirement savings include exemptions for companies with fewer than five or ten workers. We urge as few exemptions as possible.

Where Will Minimum Pension Contributions Go?

For workers whose employers satisfy the minimum pension with their own plans, money will continue to go where it has in the past, such as to pension funds and 401(k)s. The passing of a minimum pension law would also be a good time to reduce the regulatory burden on companies who offer employer plans. This would entice companies to offer plans who previously have not. Employers who still choose not to offer a plan would make payroll deposit contributions to one of two types of accounts:

Automatic IRA Accounts: The same as existing IRAs, offered by private financial companies. Employers would select a qualified investment company as the default vehicle, but employees would be allowed to opt into an IRA of their own choosing.18 Auto-IRAs would be available to companies of all sizes.

SPUR Accounts: Employers with fewer than 50 workers could contribute to SPUR Accounts, which would be unsubsidized, privately managed individual accounts overseen by a government board.

When a worker starts a new job, she or he will provide a SPUR Account number or IRA account number (if he or she already has one), along with other payroll information, to the employer. The worker will be automatically enrolled to match the employer’s contribution; however, he or she may opt-out or indicate an amount to contribute above or below the default level.

Auto-IRAs will be easy for employers because the primary administrative tasks are to select an investment company and add one account destination to each worker’s paycheck deposits. SPUR Accounts, available to small employers, will be even easier, as the employer would not have to search for and select an investment company. Additionally, for SPUR Accounts, employers would not be held to the same fiduciary standards as they are for 401(k) plans, due to the program’s oversight by the federal government. Both Auto-IRAs and SPUR Accounts will be easy for workers because they are portable and are linked to the individual, not to the company. When a worker moves to a new job, all she or he has to do is provide a SPUR or IRA Account number. She or he can also make individual contributions without going through an employer, and can roll other retirement savings into a SPUR or IRA Account.

An automatic employee contribution of 50 cents an hour is a simple way to further boost workers’ retirement savings. Workers could choose to opt-out; however, auto-enrollment has shown to be a powerful way to nudge workers toward higher savings rates. In addition, low-income workers who make their own contributions will benefit in the long term as well as the short term. Worker contributions would qualify for the existing, underutilized Saver’s Credit, which provides a tax credit of up to 50% of lower-income workers’ retirement savings. For some, that’s $1,000 cash to spend today for $2,000 saved.

How Will Investments Be Managed?

Contributions to SPUR Accounts and Auto-IRAs (like existing IRAs) and the growth of investments within those accounts are tax-free, and withdrawals during retirement are taxed as ordinary income. Similar to a traditional retirement account, if a withdrawal is made before age 62, a 10% early withdrawal penalty in addition to income tax on the withdrawal must be paid.19

SPUR Accounts and Auto-IRAs should have limited investment options, similar to the Thrift Savings Plan (TSP) for federal employees and members of the military. TSP has five core funds. Some examples include: the G Fund, which invests solely in safe, short-term U.S. Treasury securities; the C Fund, which tracks the S&P 500; and the I Fund, which tracks international stocks. Additionally, five lifecycle funds use different combinations of the core funds to tailor risk-reward profiles to age-specific retirement groups. For example, a worker expecting to retire in about 25 years can choose the L 2040 fund, which holds an appropriately aggressive mix of stocks and bonds; as the employee approaches retirement, L 2040 will shift its investment makeup to a more risk-averse portfolio. SPUR Accounts would be different from TSP, in that all expenses would be covered by plan assets, not subsidized by federal agency spending.

Limiting the number of investment options helps to simplify the process of choosing an appropriate retirement savings vehicle. It also helps keep fees low. That’s why the default option for each SPUR or Auto-IRA participant should be a lifecycle fund matched to his or her age. Investors who wish to choose their own mix may do so, and those who do not will have a responsible portfolio to the day they retire.

How Much Will Retirees Get and How Will They Get It?

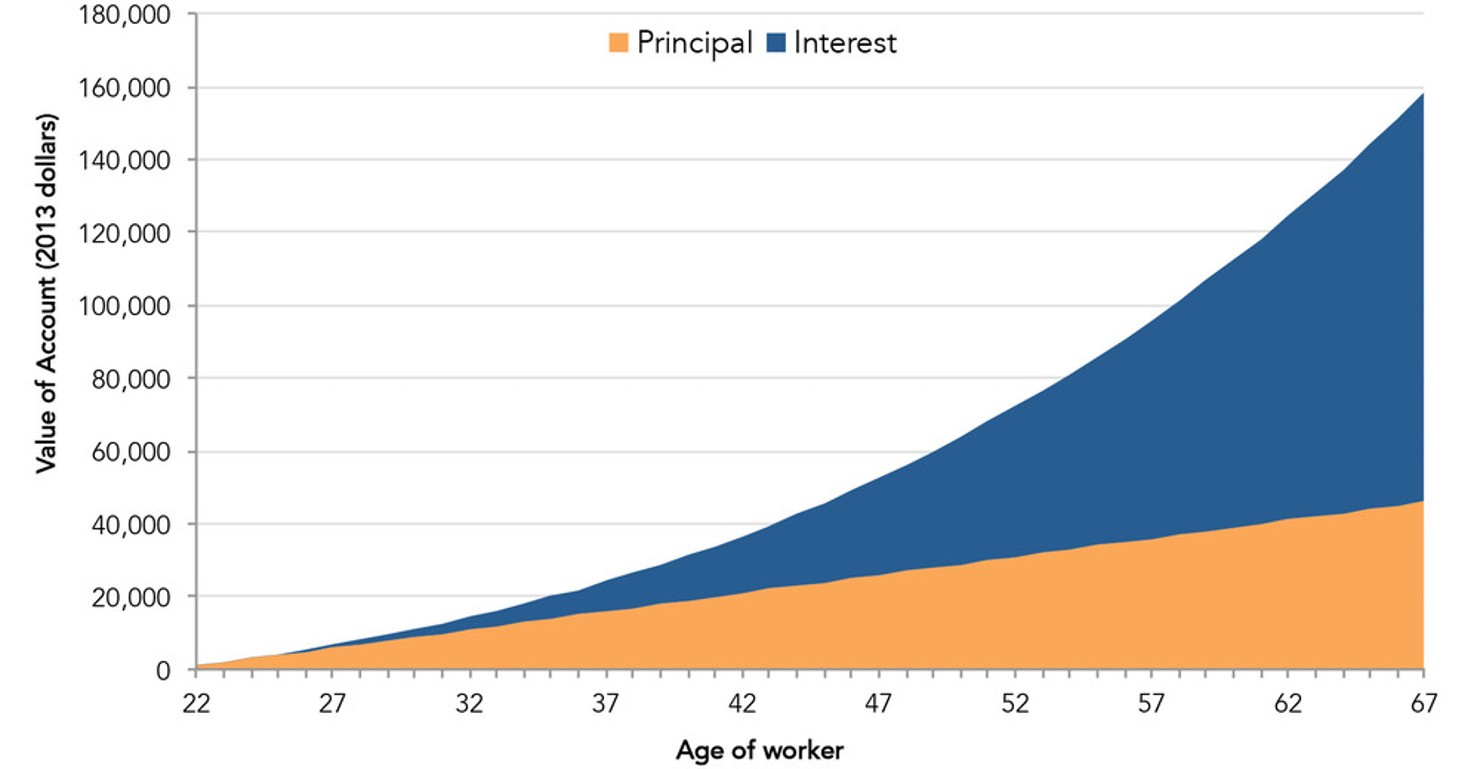

A lifetime of work under the minimum pension will produce a substantial nest egg for even the lowest-paid workers. Consider an individual who begins earning income at age 22, receives the minimum employer contribution each year, personally makes no contributions of his own, and works full-time until retiring at age 67. If stocks and bonds enjoy the same average rates of return as they did over the last 45 years, this worker will have a SPUR or IRA Account balance of approximately $160,000, in 2013 dollars.20 If the worker were to match each employer contribution, his account could be expected to reach $320,000 at retirement. In tandem with Social Security, this would allow for a substantially more secure retirement than a typical couple faces today. In comparison, the median private retirement savings of married couples ages 55 to 64 is only $42,000.21

The nest eggs held in workers’ SPUR or IRA Accounts are their own individual accumulation of and claim to wealth. They will be used to maintain a more secure retirement, but this accumulated wealth can also be passed on to children. That would create a chain of wealth and have a major impact on wealth and income inequality.

Retiring workers over the age of 62 may choose to cash out their SPUR or IRA Accounts in a variety of ways. They may collect a lump sum at retirement, draw down a portion of the account annually, or purchase an annuity—or an annuity-like plan—to guarantee a steady stream of income for life.* As with the issue of investment options, the default is important, because many participants will remain with it. SPUR and Auto-IRA Accounts should have a default disbursement option that provides a lifetime monthly payment that never expires, as that is the best choice to mitigate risk of an ordinary worker—with low to moderate income—outliving his or her retirement savings.

Like existing retirement plans, SPUR Accounts will have to include provisions on withdrawals before retirement. Borrowing from accounts or withdrawing early should be allowed, but penalties and limits should be strong enough to discourage workers from doing so.

On the private annuities market, a 67-year-old with $160,000 can purchase a monthly income of $790 (in 2013 dollars), with an automatic 2% cost-of-living increase each year, that lasts as long as he or she lives.22 An individual who retires earlier—at age 62 with a balance of $124,000—would also receive a significant income stream. That individual could purchase a lifetime monthly income of $520.23 Other annuity-like products offer a smaller monthly payment while leaving principal intact. SPUR Accounts, given the size of the program, are likely to achieve considerably better annuity prices. Considering that the typical Social Security check for a retiree with very low career wages is $755, a SPUR annuity would essentially double income during retirement.24

Portfolio Gains Over 45 Years of Basic Minimum Pension Contribution

Note: This projection of an account balance assumes only the minimum employer contribution and no employee contribution over a 45-year career. Stocks and bonds are assumed to earn the same average rates of return as their historic average over the last 45 years. Actual returns will vary from year to year.

Who Ultimately Pays For This and How?

For many employers with plans already, there is no new cost or burden. For the companies employing the 43 million full-time workers and 30 million part-time workers not participating in retirement plans, the minimum pension will impose some costs. As history has shown, companies will be averse to simply cutting workers’ take-home wages to pay for the benefit. Economists call this phenomenon “sticky-down” wages. When workers see their paychecks shrink, it’s bad for morale and productivity.

If companies add new pension contributions on top of existing compensation—increasing their spending per worker—that will be a good thing. Productivity has famously outstripped compensation for most workers. It’s time workers’ total compensation start rising again. But that transition does pose a challenge to businesses in the near term. Government should help businesses make that transition. By doing so, government can help ensure employers’ new pension payments are in addition to—not subtracted from—existing wages.

There are many ways by which Congress could help businesses adjust to the minimum pension. We estimate that a temporary tax credit, at a cost of less than $100 billion over ten years would help ease businesses’ transition. That cost should be fully offset with budgetary savings.

One way in which Congress can deliver the assistance is through a business tax credit. The credit would be refundable and simple to claim. It would pay a specific sum, particular to that year, for each eligible worker. The credit would be available to all businesses, including those that have previously provided retirement contributions. Otherwise, those firms would effectively be punished, relative to their competitors, for providing retirement benefits. The credit should, however, be limited in two important ways:

- Firms may only claim the credit on up to 100 workers. This will make the credit significantly more valuable for small businesses, which need the most assistance adjusting to the minimum pension.

- Firms may not claim the credit on workers with very high incomes or who work very few hours. Workers earning above the Social Security payroll tax maximum ($117,000 in 2014) will not count for purposes of the credit. Businesses are unlikely to be burdened by a 50-cent minimum contribution for these very high-income workers. Workers who have worked very low numbers of hours should not count either, so that the credit will not reward businesses for employing workers for minimal numbers of hours.*

Worker eligibility could be determined based on payroll taxes paid. Any worker for whom a firm paid the maximum payroll tax of $7,254 would not be eligible. Any worker for whom a firm paid less than $450 in payroll taxes (a half-time, full-year worker at the minimum wage) would be ineligible.

In early years, the value of the credit would be high enough to compensate small businesses, collectively, for most of the additional burden created by the minimum pension. In successive years, the value of the credit would decline as businesses incorporate the minimum pension into their overall labor costs.

This relief to businesses, whether delivered through a tax credit or by other means, will send them a strong message: don’t use the minimum pension as a justification to cut take-home wages. Some may be concerned, however, that the minimum pension would slow the rise of take-home wages over the long run. A 2011 study by economists Eric Toder and Karen Smith asked whether employer contributions to DC plans reduce workers’ take-home wages. The conclusion was instructive for this policy: additional employer contributions tend to reduce money wages for high-income workers, but much less so for low-income workers:

Among male workers, the estimates show that, for any given level of employee contributions, an additional dollar of employer DC contributions replaces 90 cents of wages for workers with high family income, but only 29 cents for workers with low family income. Among female workers, an additional dollar of employer DC contributions replaces 99 cents of wages for those with high family income, but only 11 cents for those with low income.25

Overall, the study concludes that both low- and high-income workers benefit from employer contributions to DC plans. Low-income workers benefit because the contributions tend to be in addition to—not in replacement of—wages. High-income workers benefit because, although some wages are replaced, DC contributions come with a large marginal tax benefit. As a result, policymakers should view the expansion of employer contributions as way of helping workers, not as a shift from wages to benefits.

Conclusion

In order to drastically improve the circumstances of the middle class, policymakers must acknowledge that a middle class job increasingly does not support a middle class life. A minimum pension would profoundly impact this problem. It would provide all Americans with the opportunity to create their own personal wealth— providing for a more secure retirement, the ability to pass on accumulated wealth to children, and a reduction of the current wealth disparity in our country. And it could all be achieved for half a buck.