Memo Published February 10, 2014 · Updated December 10, 2014 · 8 minute read

Capital Requirements and Bank Balance Sheets: Reviewing the Basics

Lauren Oppenheimer & David Hollingsworth

What’s on a bank’s balance sheet? There has been renewed focus on capital requirements for banks—particularly for the largest financial institutions. Yet despite the continuing attention, there remains a lot of confusion about the basics of a bank’s balance sheet.

This memo reviews some of those basics, with a particular emphasis on capital requirements.

What’s on a bank’s balance sheet?

Assets and Liabilities

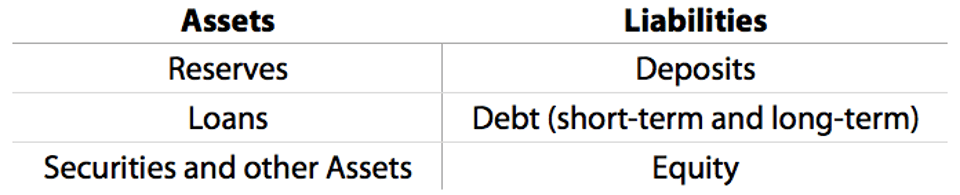

Here’s what the balance sheet of a financial institution looks like. Like all companies, the balance sheet is divided into two parts, assets and liabilities.

Financial Institution Balance Sheet1

Assets

Assets are what a bank owns. In other words, what a bank does with its money.

Reserves: This is cash in bank vaults to meet the everyday demands of depositors as well as reserve accounts at the Federal Reserve.

Loans: These are consumer and business loans that create a stream of income from regular interest payments.

Securities and Other Investments: These assets are divided into two categories, the banking book and the trading book.

- The banking book includes securities that aren’t intended to be sold. For example, when banks don’t believe they have profitable lending opportunities with their available funds, they tend to buy low-risk securities to earn a return on otherwise idle cash.

- The trading book contains assets that have to be marked-to-market, meaning that these assets must be valued every day at their market price. This category includes derivatives—used to hedge risk for clients (and sometimes the bank itself)—and securities that banks hold in their capacity as market makers. Market makers are willing to quote a price to buy or sell a security at any time. This means that banks hold securities on their balance sheet both to sell to clients on demand and when they buy securities from a client without a buyer already lined-up.

Liabilities

Liabilities are what a financial institution owes, and they fund the assets of a financial institution.

Deposits: This includes transaction deposits like a checking account at your local bank and non-transaction deposits such as a savings account or a certificate of deposit (CD). These are liabilities because they are owed to depositors, who can withdraw their funds on demand.

Debt: Includes both short-term loans to address immediate funding needs and long-term borrowing.

Equity: The difference between a bank’s assets and liabilities. It is the portion of a bank that the shareholders own a claim to. Shareholder’s equity is mostly made up of the profits the bank has retained—and not paid out to shareholders as dividends—in addition to the proceeds the bank has received from selling its shares to investors.2 In other words, the book value of its outstanding stock.

Two Types of Balance Sheet Requirements

1. Capital Requirements

The term ‘capital’ can mean a lot of things in different business and financial contexts. When the term capital is used in regard to the balance sheet of financial institutions, it is referring specifically to equity on the liability side of the balance sheet.

Capital requirements are the amount of equity a financial institution must have in relation to its assets. If capital requirements are 5%, it means that a bank must have $1 in equity for every $20 dollars of assets.

However, when it comes to computing bank capital in today’s regulatory environment, all assets are not created equal. Regulators allow financial institutions to risk-weight assets based on their probability of default. For example, U.S. Treasuries are considered the safest asset in the world, with a 0% chance of default (recent shenanigans in DC notwithstanding). Therefore, Treasuries have a zero-risk weight, which means that Treasuries do not count as assets for the purpose of calculating regulatory capital.

Riskier assets like mortgage loans, corporate loans, and commercial real estate loans have a higher probability of default than the safest government bonds, and therefore have higher risk weights. Under the Basel III proposals recently adopted by the Federal Reserve, the risk weight for residential mortgage loans is 50%.3 Therefore, a bank with $100 billion worth of mortgage loans would only count those mortgages as $50 billion of assets for the purposes of calculating capital requirements.

Again, assume capital requirements are 5%. A bank whose only assets were $100 billion in residential mortgage loans would be required to have $2.5 billion worth of equity ($100 billion x .5 risk weight x .05 capital requirement = $2.5 billion).*

* The actual calculation of risk weights under Basel III is more complex, based on intricate models taking into account probability of default and the losses resulting from default. However, the principle is the same.

Why Is Equity Important?

Equity is not “held” on the asset side of a balance sheet like a pile of cash that can’t be used. Equity funds assets in the same way that debt and deposits fund assets. It is available for loans and other investments. This is why equity is on the liability side of the balance sheet, even though it is not technically a liability.

The difference between equity and other forms of bank funding is that equity is loss absorbing. Depositors and creditors have a contractual right to be paid back in full. If the value of a bank’s assets drops below its liabilities to creditors (debt holders) and depositors, the bank is insolvent. Equity, on the other hand, is not a debt contract, but rather the shareholders stake in the value of a company. In other words, unlike creditors and depositors, shareholders do not have a contractual right to be paid back their initial investment.

Banks make money by getting interest payments on the loans and investments they undertake, in addition to fees for services rendered. Their profits are what’s left after subtracting interest payments on their liabilities and the costs of deposit maintenance. The bank can either pay their profits out to shareholders as dividends, or can keep them on their balance sheet as retained earnings. Shareholders hold an ownership stake in the profits of a bank—whether paid out to shareholders or retained on the balance sheet—but they are not entitled to any specific payment regardless of how a bank performs.

This is what makes equity loss absorbing. If a bank takes losses on its assets, they can come out of equity, with shareholders taking the hit. The bank can remain solvent and continue to operate. Regulators want a portion of bank liabilities to be equity so banks can experience losses on their assets without becoming insolvent.

Leverage Ratio

A leverage ratio is a specific type of capital requirement—it does not take risk weights into account. Or put another way, a leverage ratio is a capital requirement that treats all assets as if they had 100% risk weights. If the leverage ratio for a bank is 5%, then it would be required to have $1 of equity for every $20 in assets regardless of the riskiness of those assets.

In the wake of the financial crisis, regulators have considered imposing leverage requirements on banks. The idea behind the leverage ratio is—as the name suggests—to limit the leverage of a bank by ensuring that banks maintain a minimum level of equity regardless of the presumed riskiness of the assets that they hold. As we’ve seen, risk weights are far from a perfect measure of the risks an asset poses.

Before the financial crisis, the bonds of sovereign nations were given a 0% risk weight, but as we’ve seen some of these bonds were a significantly riskier proposition. In retrospect, Greek bonds clearly had a greater chance of default than 0%. And the October 17 debt crisis shows that even U.S. Treasuries have some risk of default.

However, there are downsides to relying exclusively on a leverage ratio for capital requirements. If every asset must be backed by the same amount of equity, regardless of its level of risk, then banks have strong incentives to acquire riskier assets—making the banking system less stable. The Bank of International Settlements, the body that issued the Basel III requirements, thinks of a leverage ratio as a supplementary measure to be used in tandem with risk-based requirements.4

2. Reserve Requirements

Reserve requirements specify what percentage of funds a financial institution must hold in reserve on the asset side of their balance sheet against their deposits. Reserve requirements are designed to protect banks against runs by depositors; capital requirements are designed to absorb losses on loans and other investments. These reserves can be held as vault cash or as deposits at the Federal Reserve.5

For example, say reserve requirements are set at10%. If a bank has $20 billion in deposits, it is required to keep $2 billion either in cash or in a reserve account at the Federal Reserve. Unlike equity, reserves are actually piles of cash that can’t be lent. They are set aside to ensure the daily withdrawal demands of depositors can be met.

Conclusion

Five years after the financial crisis, ensuring the health and safety of the banking sector is still a hot topic of debate. Yet the way bank capital requirements are discussed in the media and DC policy circles can be confusing. As the debate goes forward, it is important for policymakers to understand the basics of a bank’s balance sheet, including the fact that bank capital requirements are referring to the amount of equity a bank must hold in relation to its assets.