Report Published January 11, 2017 · Updated January 11, 2017 · 22 minute read

The Economic Benefit of a Stable Financial System

Emily Liner

Takeaways

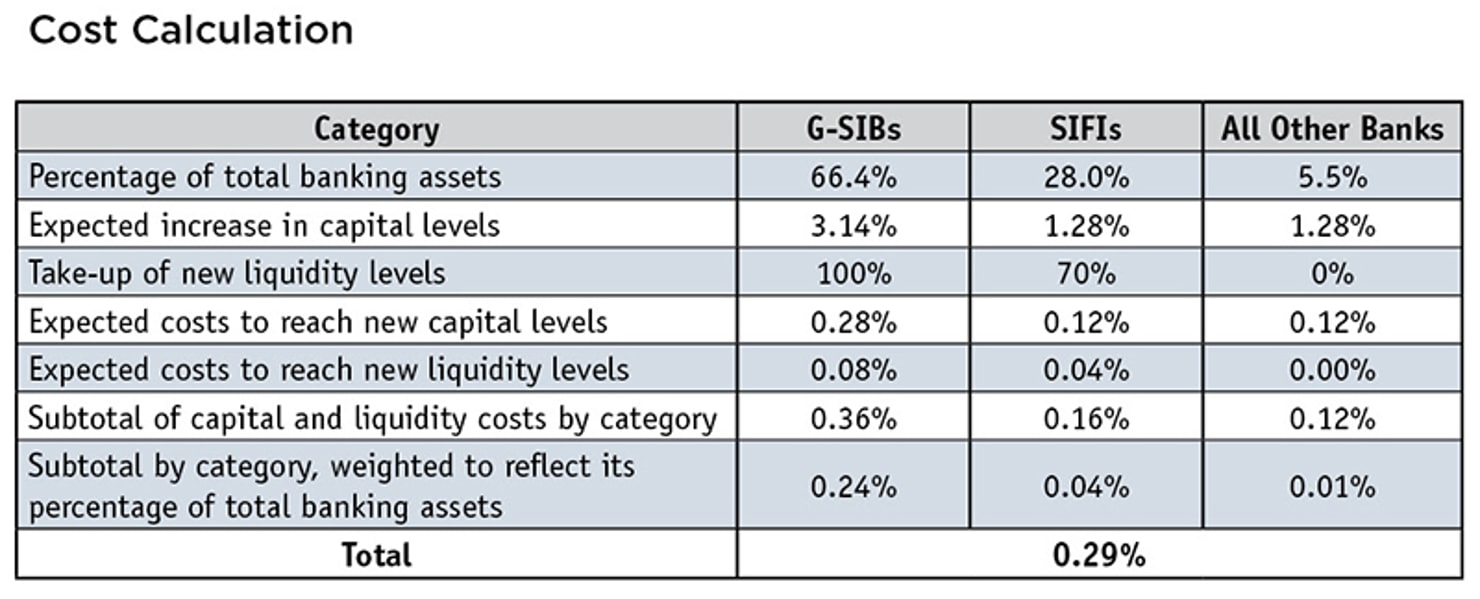

- The costs of new Dodd-Frank regulations will affect GDP. Capital and liquidity requirements reduce bank lending, which lowers the level of investment in the economy. We find that the primary costs of these financial regulations reduce U.S. GDP levels by 0.29% annually.

- On the other hand, Dodd-Frank regulations generate valuable benefits to GDP, because they make future financial crises less likely to occur—and less costly when they do occur. We find that the primary benefits increase U.S. GDP levels by 1.91% annually.

- The resulting net benefit to GDP of 1.62%, while not all-encompassing, indicates that the benefits of Dodd-Frank and enhanced financial stability outweigh the costs. We estimate that these benefits contribute to $351 billion in GDP over a 10-year period.

The Dodd-Frank Act has every making of a 10-round heavyweight bout. In one corner, the right believes that Dodd-Frank has inflicted a brutal uppercut to the economy. In the other corner, the left says that Dodd-Frank lets our guard down and sets up the economy and consumers for a sucker punch. What’s gotten lost amid the sparring is that no law or regulation the size of Dodd-Frank is without meaningful economic costs and real, meaningful economic benefits. In this paper, we look at the tale of the tape and assess whether Dodd-Frank’s benefits exceed its costs.

The most significant costs of Dodd-Frank are captured by decreased bank lending due to three regulatory matters: capital requirements, liquidity requirements, and compliance costs. The benefits, meanwhile, are associated with three components of enhanced financial stability: the decreased probability of a future crisis, decreased expected losses, and decreased costs to society. This also goes for the corresponding Basel III rules proposed by the Bank for International Settlements (BIS), which served as the model for Dodd-Frank’s capital and liquidity requirements.

A robust cost-benefit analysis acknowledges that any new initiative will have both negative and positive effects. The exercise is to determine which one is greater. If the benefits are greater, then it passes the test.

In this paper, we review the literature on the costs and benefits of financial stability regulations. To come up with an “apples-to-apples” comparison of Dodd-Frank’s costs and benefits, we used research conducted by the BIS on capital and liquidity requirements and scaled these estimates to reflect the structure of the U.S. banking sector. We find that the costs of Dodd-Frank regulations are associated with a reduction in GDP on the order of 0.29%, while the benefits of Dodd-Frank regulations are associated with an increase in GDP of 1.91%. The resulting net benefit to GDP of 1.62% indicates that the benefits of enhanced financial stability outweigh the costs. We estimate that this benefit yields $351 billion in GDP over the 10-year period from 2016 to 2026.1

Granted, there are many caveats to this analysis. The BIS is, after all, the organization that is promoting the adoption of capital and liquidity requirements. Yet it is also the most reputable source for research on global banking regulation. Therefore, we have also included research from U.S. government sources, academic sources, and think tanks with differing points of view in order to supplement and contextualize these findings.

Costs

Cost #1: Increased capital requirements

One of the most important reforms made by Dodd-Frank was to increase capital requirements, or the amount of equity that banks need to hold as a cushion against potential losses. Increasing equity has the effect of decreasing banks’ ability to make loans.

Here’s how this tradeoff works. Assume a bank can do only two things with deposits: invest them in very safe assets (like cash or Treasury bonds) or make loans to customers (which are also considered assets, but riskier). If the bank invests it all, it would have a strong balance sheet but wouldn’t be very profitable. If the bank lends it all out, it’s taking on the risk that all of its money may not be repaid. Banks strike a balance between safe and risky assets based on an internal assessment of the amount of risk it can take on.

Now let’s add another layer of complexity. Banks don’t rely on deposits alone to fund loans. They can go out and borrow money from other banks, which they can in turn loan to customers. This is called taking on leverage. Leverage increases returns, but it also increases risk. It can be extremely lucrative when banks are in a position to repay their own debts, and it can be extremely dangerous when they are not.

We learned in the financial crisis that the total of banks’ individual appetites for risk is more than the system can handle. To address this, capital requirements encourage banks to take on less leverage than they might otherwise, and to shore up their liabilities with safer types of assets. Now, there’s a minimum ratio of safe assets that banks must reach in order to pay out bonuses and dividends, and the government has the ability to further raise the minimum when market conditions are rough (the equivalent of driving slowly when it starts raining).2

Banks respond to higher capital minimums in two ways: 1) making fewer loans and 2) raising additional equity. Historically, banks have tended to do the former rather than the latter.3 Either way, banks are forced to increase interest rates on the loans they continue to issue, to make up for lost profit.

This has an effect on economic output. Lending is an important ingredient in consumption and business investment. Firms that have difficulty accessing loans may not be able to expand their capital expenditures or employment. Indeed, a new Fed study finds that an increase in tangible capital of one percentage point is correlated with a reduction in employment of 0.6 percentage points.4 So if lending slows down and gets more expensive, GDP takes a hit. And given that central banks including the Fed are currently trying to encourage lending by keeping interest rates low, regulations that curtail lending may be at odds with economic goals.

The question we need to answer in our cost-benefit analysis is, by how much could GDP fall? The BIS, which sets the agenda for banking regulation worldwide, estimates the following global impacts:

- Lending spreads rise by 13 basis points for each percentage point increase in the capital ratio requirement.5

- GDP declines by 0.09% for each percentage point increase in the capital ratio requirement.6

- In a separate study, the BIS found an additional, temporary drag on annual global GDP growth of 0.07% during the four-year implementation period for these capital requirements and the surcharge on Global Systemically Important Banks (G-SIBs).7

Cost #2: Increased liquidity requirements

One of the most difficult parts about running a bank is managing cash flow. This is why the government requires banks to stash away reserves. It’s hard enough to predict how many customers will withdraw funds from their personal accounts on a given day. Now imagine how much more complicated that gets with large investment accounts. Then, consider how many customers will want to cash out their accounts during a crisis. As we saw with Lehman Brothers and Bear Stearns, a run on a financial institution depletes liquidity so quickly that it may not be able to open the next day.

Liquidity requirements push banks to consider not just how much cash they need to get by on a day-to-day basis, but also on a month-to-month basis. Banks with more than $250 billion in assets, like the G-SIBs, must hold enough cash and cash-like assets (also known as “high quality liquid assets,” or HQLA) to cover 100% of daily net outflows as well as one month’s worth of cash flow. Banks with more than $50 billion in assets, known as Systemically Important Financial Institutions (SIFIs), need to have enough cash for 70% of daily net outflows, plus one month of cash flow.

Similar to capital requirements, liquidity requirements slow down lending because they increase the amount of cash that banks must set aside rather than lend out. Thus, the same chain of cause and effect on the overall economy follows. Therefore, the BIS estimates that liquidity requirements generate the following additional costs:

- Lending spreads increase up to an additional 14 basis points to reach the liquidity ratio requirement.8

- GDP drops by an additional 0.08% to reach the liquidity ratio requirement.9

An analysis by the Federal Reserve Bank of New York replicated these results.10 The New York Fed took the additional step of performing a sensitivity analysis for the U.S. economy based on various levels of capital and liquidity ratios (but excluding the G-SIB surcharge implementation). Its models project annual GDP loss of 0.20% to 0.40% for the combined effects of increased capital and liquidity requirements.11

Cost #3: Increased compliance

Critics of the BIS may argue that it underestimates costs—or overestimates benefits—because it is the entity that has written these rules. In particular, critics feel that international and U.S. regulators have not considered increased costs of doing business.

For starters, there’s a variety of annual and quarterly reporting that banks must submit to industry regulators to disclose their financial positions. SIFIs must file “living wills” to facilitate bankruptcy under Dodd-Frank’s Orderly Liquidation Authority. The process of writing and revising living wills can be time- and resource-intensive, especially for banks that are required to resubmit them after failing initial review. Indeed, just prior to the April 13 announcement that five major banks’ living wills were rejected, the Government Accountability Office (GAO) released a study suggesting that regulators should provide more transparency and guidance so that banks are more prepared to meet expectations.12 (Going forward, regulators have agreed to give banks more time to prepare their living wills, following the GAO’s recommendation.)

SIFIs must also participate in government-run stress tests. Banks with under $1 billion in assets are exempt from capital and liquidity requirements, but they must still comply with new Dodd-Frank consumer protection rules.

This burden, some argue, makes it more difficult and more expensive for banks to serve everyday Americans. These impacts were studied in an in-depth qualitative report by the GAO, which found that some community banks and credit unions were struggling to train employees on new compliance requirements and upgrade technology systems to transmit increased reporting requirements.13

A report by the American Action Forum (AAF) suggests that the combined costs of compliance and capital requirements should be regarded as an additional tax burden on banks. Unlike the BIS and the New York Fed, which project that these new regulations affect the steady-state level of GDP, the American Action Forum believes that they will affect the GDP growth rate, on the order of 0.06% annually.14 Basically, the BIS and New York Fed are saying that these regulations will have a one-time hit on GDP, which will then continue growing at the same rate it otherwise would. AAF, which assessed compliance costs, as opposed to capital and liquidity rules, concludes that GDP will perpetually grow at a slightly slower rate.

Although some banks have shared information about increased costs they have incurred, it still remains to be seen the extent to which Dodd-Frank is raising costs nationwide. Instead of passing the cost of these new regulations directly to customers through higher interest rates, banks could maintain profitability by reducing operating costs—and that seems to be what many banks are doing. The BIS estimates that every percentage point increase in the capital ratio could be absorbed by a 3.5% decrease in operating costs.15 According to the GAO, costs associated with regulation should be reflected on banks’ financial statements as increased noninterest expense, which includes many expenses like employee wages and has generally fallen since Dodd-Frank was signed into law.16

Total costs

Our analysis of costs is based on projections by the BIS’ long-term economic impact (LEI) report, which incorporates the effects of capital and liquidity requirements, but not those of compliance costs. To adjust the BIS analysis for the United States, we have calculated the potential costs based on a weighted average of market share by assets. This addresses two major differences between the U.S. and the rest of the world. First, the U.S. banking sector has a unique structure compared to other advanced economies; while we have the most G-SIBs (eight), we also have many more banks in general, with a particularly well-established community bank industry, which moderates the concentration of the largest banks. Second, the U.S. has a more aggressive interpretation of Basel III than other national governments, as evidenced by the G-SIB “surcharge” fees.17

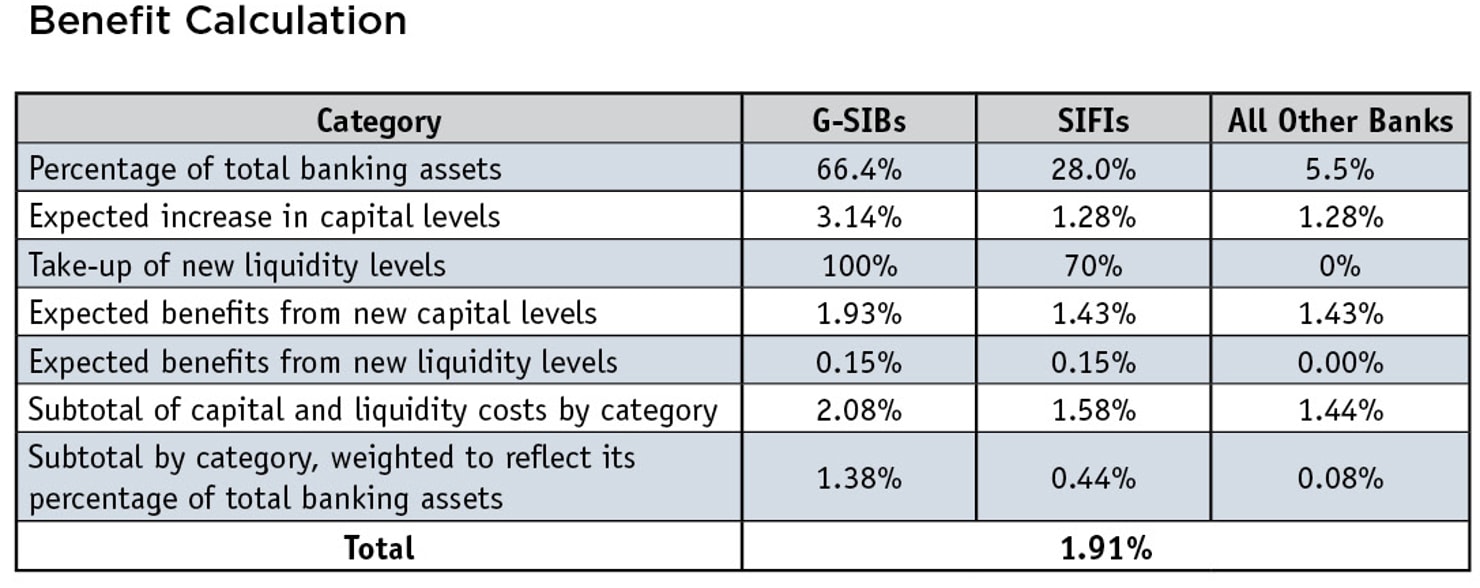

The eight U.S. banks identified as G-SIBs hold two-thirds of the total assets in the banking industry, as of year-end 2015.18 The Fed has imposed supplementary capital requirements on each of these banks between 1 and 4.5 percentage points above the 7% minimum requirement, for a weighted average of 3.14 percentage points.19 G-SIBs must also meet the new liquidity requirement.

For all other banks, which collectively hold one-third of total U.S. bank assets, we refer to data from the FDIC showing that U.S. banking institutions have raised their total risk-based capital by 1.28 percentage points compared to pre-crisis levels.20

SIFIs must meet 70% of the new liquidity requirement, while non-SIFIs are completely exempt. Non-SIFIs make up about 90% of all U.S. bank establishments, but only 5.5% of the banking industry by share of assets.21

Finally, we referred to the BIS’ LEI report to determine the costs for each category’s expected increase in capital levels and expected take-up of liquidity levels.

It should be noted that the LEI report assumes that implementation has already gone into effect.22 A separate analysis of implementation costs by the BIS’ Macroeconomic Assessment Group (MAG) found that there will be an additional, temporary reduction in GDP growth of 0.07% over a four-year implementation period.23

Focusing on permanent economic costs post-implementation, we calculate that the annual cost to GDP equals 0.29%.24 This estimate of annual costs falls in line with the New York Fed’s range of 0.20% to 0.40%.

A note on market liquidity

One potential effect of capital and liquidity requirements could be reduced availability of safe assets. Dodd-Frank rules incentivize banks to replace risky assets on their balance sheets with high-quality liquid assets instead. Some are concerned that this will make it more difficult and more expensive to invest in safe assets like Treasury bonds because banks will need to bolster their inventories of bonds and will be more likely to hold bonds to maturity.

On top of this, others, like Blackstone CEO Stephen Schwarzman, have argued that the Volcker Rule has reduced the number of firms willing to play the role of market maker, which can exacerbate volatile market conditions. He points to the October 15, 2014, “Flash Crash” as evidence.25

That being said, it’s still debated whether Dodd-Frank has affected market liquidity at all. While there is evidence that liquidity has become more fragile, it may also be due to factors like monetary policy, investor behavior, and technological changes.26

Benefits

Psychologically, it can be difficult to conceptualize what we gain from regulation. That’s because when regulations are working, we’re living in a world of the status quo. The benefit of regulation is that we avoid a problem, like a nuclear reactor meltdown, hazardous workplaces, or—in this case—a financial crisis. Direct costs tend to be borne by a small group, but the benefits are thinly spread throughout society.

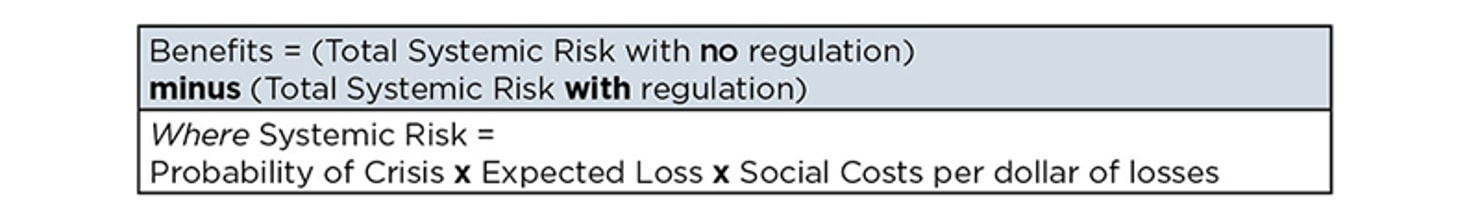

Mathematically, it is possible to quantify the benefit of regulation. There’s a common equation used to determine the cost of bankruptcy. One simply multiplies the probability of a bankruptcy event happening by the losses that would be incurred. Economists use the same equation to estimate the cost of a financial crisis. Avoiding this cost is considered to be the benefit of financial stability. NYU Professors Viral Acharya, Robert Engle (a Nobel Prize winner), and Matthew Richardson add one more variable to consider: social costs.27 This ensures that we take into account personal wealth and jobs lost because of a crisis.

This is what the framework looks like. The hard part is determining which assumptions go into estimating these variables. This is what several researchers have tried to do, as we’ll explain below.

Benefit #1: Decreased probability of a crisis

Those same capital and liquidity requirements that make lending more expensive and bring down GDP also increase GDP. That’s because they discourage excessive, high-risk lending that could get the economy in trouble. Indeed, these rules are among the most effective ways to prevent a future repeat of the financial crisis.

This is what happened during the last financial crisis. When banks discovered that mortgages, and their investments linked to mortgages, were collapsing, the value of their assets took a big hit. But, like everyone else, banks still had debts and bills to pay—and no one gets a pass on these expenses just because their financial situation has changed. That put bank solvency in jeopardy.

This is where capital comes into play. Capital is the equity portion on a balance sheet. It’s considered loss-absorbing because equity holders are the first investors exposed to losses. Essentially, capital increases the level of losses that a bank can handle before it becomes insolvent.

Meanwhile, banks still need to pay the bills that are a regular cost of doing business. Some banks literally ran out of cash to take care of this during the financial crisis. So liquidity requirements ensure that banks have enough liquid assets (i.e. cash and Treasury bonds) to continue day-to-day operations.

According to the BIS, banking crises occur on average once every 20 to 25 years, meaning that the annual probability of a crisis is 4-5%.28 Because banks are now required to meet higher capital and liquidity requirements, they are less likely to fail that often. When banks are less likely to fail, the probability of a crisis decreases. In the absence of a crisis, GDP increases. In fact, the BIS estimates that each percentage point reduction in the annual probability of a crisis yields an expected annual benefit equal to 0.6% of GDP.29

Benefit #2: Decreased losses

Let’s make something clear: Even the strongest capital and liquidity regulations can’t forestall a banking crisis forever. The probability that another one could happen will never be 0%. That’s why it’s also important to decrease the amount of potential losses in a future crisis. More capital helps with this, too.

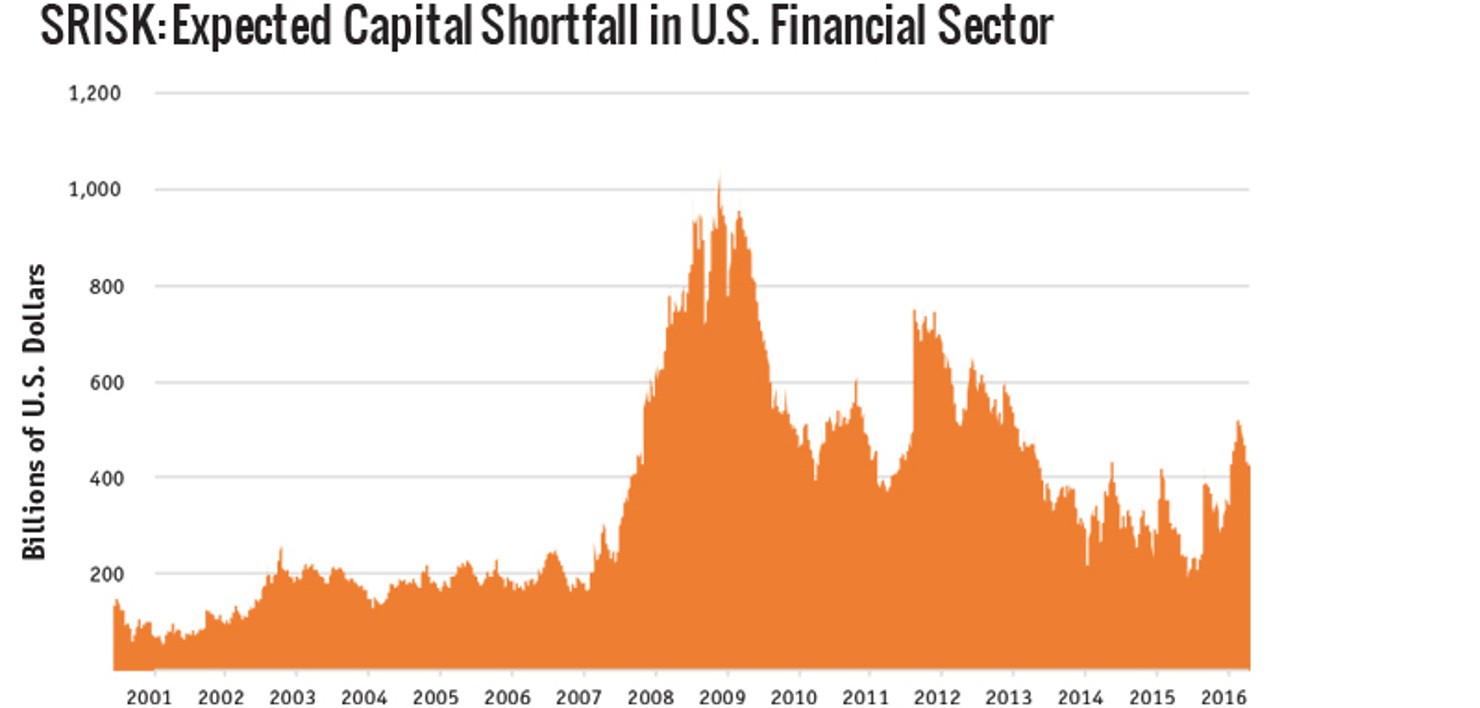

To estimate how much we could expect to lose in a future crisis, NYU professors Acharya and Engel have come up with a statistic called SRISK. They define SRISK as the expected capital shortfall in a crisis. In layman’s terms, that means how much money could be at stake at any given time. In policymaker’s terms, that means how much money the federal government would need to inject into the economy to prevent a complete meltdown.

According to NYU’s Acharya, SRISK peaked at over $1 trillion in late 2008 and early 2009. As he points out, that figure is close to the all-in cost of TARP, FDIC guarantees, and Federal Reserve emergency lending programs.30 If another crisis were to happen now, SRISK estimates that there would be approximately $500 billion at risk—still a lot, but it’s half of what was lost in the crisis.

The ratio of SRISK to GDP can also help reveal the probability that the economy is approaching a crisis. In 2008, this ratio was close to 8%. (When the crisis spread globally, the Eurozone’s SRISK to GDP was as high as 12%.) In 2016, SRISK to GDP in the U.S. has hovered around 2-3%. It’s worth noting that SRISK to GDP hit a post-crisis high of 4% during the standoff over the debt ceiling in August of 2011.31 This political brinksmanship and the ensuing uncertainty about whether the U.S. would miss scheduled debt payments put the entire economy at risk of a self-inflicted crisis.

Source: The Volatility Institute, NYU Stern

Benefit #3: Decreased social costs

There’s an important distinction between expected losses and social costs. Expected losses specifically refer to the losses that the financial sector incurs. This does not include the losses inflicted upon the rest of the real economy in a crisis, like jobs, homes, and household wealth. A total of 8.7 million Americans lost their jobs because of the financial crisis and the ensuing recession.32 According to Better Markets, nearly one-third of mortgages were underwater at one point during the recession, and 15 million homes were foreclosed upon. Americans’ retirement savings were wiped out to the tune of $2.8 trillion.33 This is why it’s critical for policymakers to include social costs in a cost-benefit analysis.

Economists Simon Gilchrist and Egon Zakrajsek derived a new statistic from corporate borrowing data that can help us predict the magnitude of social costs when financial conditions deteriorate. Whenever investors lend money to corporations—by purchasing corporate bonds—they take on a certain amount of risk that exceeds what they would endure by simply holding Treasury bonds. In return for bearing that risk, investors are paid a premium, in the form of higher interest rates, which reflects the perceived risk that the bond will default. But investors don’t always receive a premium perfectly consistent with the amount of default risk presented by the borrower. Sometimes, when investors are collectively upbeat and eager to take on more risk, competition will bid premiums down. But when investors are collectively gloomy, corporations have to bid up the premiums they offer investors, creating what Gilchrist and Zakrajsek call excess bond premium (EBP).

EBP is unique because it provides a link between the financial sector and the economy as a whole. When EBP exists, it is a sign that the flow of credit from financial markets to businesses is slowing down. When credit availability declines, real economic activity suffers, with consumption, investment, and output all dropping off.34 Gilchrist and Zakrajsek found that a shock of one percentage point in EBP during one quarter is associated with a two percentage point reduction in GDP growth and a 1.7 percentage point increase in the unemployment rate over the following year.35 To put this into perspective, EBP jumped from around 0% at the beginning of 2007 to a record high of 2.75% at the end of 2008, with a shock of about 1.5 percentage points in the third quarter of 2008 alone.36

Total benefits

In the BIS’ macroeconomic analysis of the implementation of higher capital and liquidity levels, the mean estimate of annual benefits is 2.55% of GDP—a stark contrast from the magnitude of the anticipated implementation costs.37 This figure represents the median result of multiple mathematical models. The high point of the range, 6.40% of GDP, represents potential benefits assuming that a future financial crisis would cause permanent damage. The most conservative estimate, 0.77% of GDP, assumes that the effects of a future financial crisis would be temporary. Even in this scenario, the benefits continue to outweigh the costs.

To determine the long-term benefits of U.S. capital requirements, we took the additional step of calibrating the benefits from the LEI report. Unlike costs, benefits have a nonlinear relationship with capital levels and an inverse relationship with liquidity levels; therefore, we ran simple regressions to estimate the expected benefits of the U.S. G-SIB surcharge and the reported increase in capital levels by the FDIC, as discussed in the costs section.

We estimate that Dodd-Frank regulations result in a benefit of 1.91% to annual GDP. That means that on average, in any given year after Dodd-Frank is fully phased in, the U.S. economy will be 1.91% larger than it would have been without the law.

A note on volatility

Another way to characterize the benefits of capital and liquidity requirements is tthat they produce smoother business cycles: recessions are less painful and expansions are less booming. Economists say that’s a good thing, because deep recessions tend to cause lasting damage that even the strongest of recoveries can’t recoup.

According to the New York Fed study, each percentage point increase in capital ratios reduces the standard deviation of GDP by one percentage point, and the new liquidity ratio reduces it by another percentage point.# The countercyclical capital buffer established by Dodd-Frank and Basel III should reduce volatility even further, at the time when the economy needs it the most. It requires banks to increase their capital ratios if the economy starts to flash warning signs—the financial equivalent of battening down the hatches.

Altogether, these financial stability reforms will mean that the economy is less volatile. Highs won’t be as high, but lows won’t be as low, either.

Conclusion

Our calculations indicate that the most significant Dodd-Frank regulations result in a net benefit of 1.62% to U.S. GDP. This doesn’t account for all the costs and benefits; incorporating compliance costs would certainly moderate this statistic—but not by enough to change the conclusion: the benefits of enhanced financial stability outweigh the costs of instituting new reforms and regulations. Going forward, further analysis should be undertaken to understand whether the actual results of the costs and benefits match the economic projections.

This being said, an important caveat must be kept in mind: These findings are specific to reforms in the banking sector only. While these new rules may prevent a repeat of the 2008 financial crisis, they don’t eradicate systemic risk for good. Many economists have voiced concerns that action still must be taken to mitigate problems that could arise in shadow banking, mutual funds, and exchange-traded funds (ETFs). Others, such as Paul Krugman, have suggested that the next crisis might be a product of financial turmoil and loose regulation in China, or a debt crisis arising from countries exposed to the unexpected and prolonged bottoming out of oil prices.#

Furthermore, the scope of analysis for this report was limited to the costs and benefits of the Dodd-Frank regulations most directly linked to addressing financial stability: capital and liquidity requirements. The impact of regulations outside of this scope, such as Volcker Rule and the Qualified Mortgage Rule, should be studied as well. But what we can conclude is that the specific regulatory tools designed to improve financial stability should result in a large net benefit to the U.S. economy.