Memo Published January 18, 2024 · 17 minute read

Government Funding Opportunities to Help Decarbonize the Steel Industry

Catherine Grossman

The landmark Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA)–along with other actions taken by the Biden-Harris Administration–are providing billions of dollars to accelerate the decarbonization of US manufacturing and create demand for low-carbon materials. These efforts will strengthen the US economy, invest in the long-term stability of our domestic manufacturing base, and create good-paying jobs across the country. Increasing the demand for and availability of low-carbon materials will result in economic benefits to producers and consumers while simultaneously decreasing climate-and human health-damaging emissions.

This paper aids US iron and steel producers, particularly small and medium-sized producers, in identifying federal incentives for industrial decarbonization, including loans, grants, procurement incentives, and tax credits. This resource also offers some guidance on the Department of Energy (DOE) funding application process, including the development of Community Benefit Plans (CBPs).

Please note that additional technical assistance, tools, and other resources are available for free from DOE here. Examples of available technical assistance include access to software tools for energy management, resources to help meet voluntary energy, water, and waste reduction goals, and information on available partnership programs.

Department of Energy Funding Opportunities and Application Process

The federal government is dedicated to robust investments in decarbonization across the development spectrum, incorporating funding for research, development, demonstration, and deployment (RDD&D). In this section, we delve into two grant programs focusing on research and development, along with available loan guarantees to support the demonstration and deployment of innovative technologies. Additionally, we present a “Case-in-point” to illustrate an example of where steel sector projects have already been selected for funding.

In most cases, DOE requires submissions of brief Concept Papers with preliminary details on project plans, objectives, and a high-level summary of a “Community Benefits Plan” (CBP)–described in more detail at the end of this section. Following submission of a Concept Paper and review by DOE, the agency notifies applicants whether they are “encouraged” or “discouraged” to submit a Full Application.

For many of its funding opportunities, DOE has taken steps to ease the application process. In addition to no-cost, no-commitment consultations available for some programs, DOE also helps facilitate efforts to partner with other organizations–such as research universities and other US manufacturers—through what is typically referred to as a Teaming Partner List.

There are also related programs, not detailed in the sections below, for which the government is currently reviewing submissions or concept papers are due very soon. This includes $6.3 billion in funding for DOE's Industrial Demonstrations Program that will support the advancement of transformational technologies specific to decarbonizing the US industrial sector—including steel. That program will distribute grants, rebates, direct loans, or establish cooperative agreements in values ranging from $35-500 million.

DOE FY24 Energy—and Emissions-Intensive Industries Funding

DOE has announced their intention to launch an $83 million funding opportunity in early 2024 focusing on industry-specific applied research, development, and demonstration (RD&D) for the highest emitting industrial subsectors, including iron and steel.

Background: Specific to decarbonizing iron and steel production, the Notice of Intent to Issue Funding states that “potential areas of interest include RD&D in alternative ironmaking, iron ore quality improvements including ore beneficiation, improving circularity through minimizing/removing elemental contamination, and low-carbon steelmaking technologies.”

DOE also anticipates that the funding announcement will include opportunities for “pre-Front-End Engineering and Design (pre-FEED) studies that support the development of decarbonized industrial processes using approaches that include pre-commercial technologies. Potential pre-FEED areas of interest could include: (a) integration of green hydrogen as a feedstock in chemicals, iron, and steel production; (b) carbon capture for select industrial sectors; and (c) integrated process and capture for chemical production, mineral processing, and iron and steel.” The program aims to ensure the advancement and adoption in the United States of "innovative low-energy and low-emitting technologies that have cost, performance, and resource efficiency advantages over traditional manufacturing.”

Collaborations between industry, universities, national laboratories, and federal agencies are critical for the type of technological advancement necessary to decarbonize iron and steel manufacturing. DOE is currently compiling a Teaming Partner List to enable formation of new project teams that could work together to respond to the funding announcement. If you are interested in being included on this list, you can submit your organization’s information (including a brief description of capabilities and area of interest) via the eXCHANGE platform.

Funding Amount & Type: This Notice of Intent proposed $83 million for research, development, and protype or pilot-scale technology validation and demonstration activities. Projects are anticipated to be considered for funding in the form of cooperative agreements with periods of performance ranging from approximately one to three years.

Status: The Funding Opportunity Announcement (FOA) will be made available on the eXCHANGE website upon issuance.

DOE Industrial Assessment Centers Implementation Grant Program

Background: BIL provides a total funding amount of $400 million to DOE’s Industrial Research and Assessment Center Implementation Grants Program, which offers both funding and technical assistance for small and medium-sized manufacturers to help them decarbonize and save energy. Industrial Assessment Centers (IACs) are regional centers that help manufacturers evaluate their energy performance and identify opportunities to improve efficiency and productivity while reducing energy waste and emissions. Small and medium-sized manufacturers may be eligible for a free assessment from an IAC if they meet . Under this program, support is available for manufacturers to make upgrades recommended through an IAC or an IAC-equivalent assessment. In 2023, an initial round of $5.2 million was announced (see awarded projects ), and an additional round of $80 million is now available, with applications being accepted on a rolling basis. DOE expects to make more funding available through FY 2026.

Funding Amount & Type: Selected applicants can receive grants of up to $300,000 at a 50 percent cost share to incorporate suggestions made in IAC assessments and/or DOE Combined Heat and Power Technical Assistance Partnership (CHP TAP) assessments.

Status: Currently, there is an open solicitation for this grant with applications being accepted on a rolling basis. The next quarterly review date is likely to be in March 2024.

Additional information can be found from DOE here, and the link to apply can be found here.

DOE Loan Programs Office

Background: DOE’s Loan Programs Office (LPO) supports industrial decarbonization projects through multiple programs, including the Title 17 Clean Energy Financing Program. The IRA authorized DOE to guarantee $40 billion in loans and appropriated $3.6 billion to DOE for costs of extending or guaranteeing the loans. Generally, industrial decarbonization projects—including for iron and steel production—that deploy a new or significantly improved technology are eligible. The goal of the program is to provide a bridge to bankability and help new and innovative technologies move from the demonstration phase to commercial deployment. The loan guarantees DOE can provide help reduce risk in the early stages of deployment and make it easier for projects to secure additional financing.

Funding Amount & Type: LPO does not set a minimum loan size; however, due to some of the fixed costs associated with receiving a loan guarantee from LPO, LPO loan guarantees are typically $100 million or more. LPO can guarantee up to 80 percent of eligible project costs, although most projects end up in the 50 to 70 percent range.

LPO's loan guarantees can be stacked with clean energy tax credits; however, DOE cannot issue loan guarantees to projects that are expected to benefit from certain other forms of federal support, such as grants or cooperative agreements.

Status: DOE accepts applications on a rolling basis and offers a no-fee, no-commitment pre-application consultation to discuss the program and whether a project is eligible for financing.

More information from DOE here.

Case-in-Point: Funding Decision Announcement

On June 15, 2023, DOE awarded $135 million in grants to 40 industrial efficiency and decarbonization projects across six topics. $31.9 million of that funding will go towards ten major projects aimed at decarbonization of iron and steel production. Of the six topic areas, these ten efforts to decarbonize iron and steel represent the largest number of projects selected and the second highest level of funding. Examples of selected projects include:

- $1,857,208 to Idaho National Laboratory who, in partnership with Cleveland-Cliffs and Andritz Metals USA, aims to design a full-scale electric furnace and then partially convert an existing gas-powered furnace at an operating steel mill to demonstrate the ability to use novel heating elements for slab reheat furnace electrification without increasing the physical footprint of the furnace.

- $1,651,316 to Hertha Metals, Inc. based in Middleton, DE, to lead efforts to develop a low-carbon production technology to convert low grades of direct shipping iron ores into high-purity iron and steel products.

- $3,094,435 to Carnegie Mellon University, in partnership with Nucor, U.S. Steel, and Purdue University, for their project evaluating hydrogen-based systems for elimination of process emissions involved in reducing iron ore into direct reduced iron (DRI). The project involves building and evaluation of a physical demonstration plant and development of a computational fluid dynamics (CFD) model.

- $5,391,728 to Molten Industries based in Oakland, CA, in partnership with CPFD Software and U.S. Steel, to design, build, and test a pilot-scale system using hydrogen produced from methane pyrolysis as the iron reduction agent.

The full list of projects is available at https://www.energy.gov/eere/iedo/funding-selections-industrial-efficiency-and-decarbonization-foa-0.

Community Benefits Plans

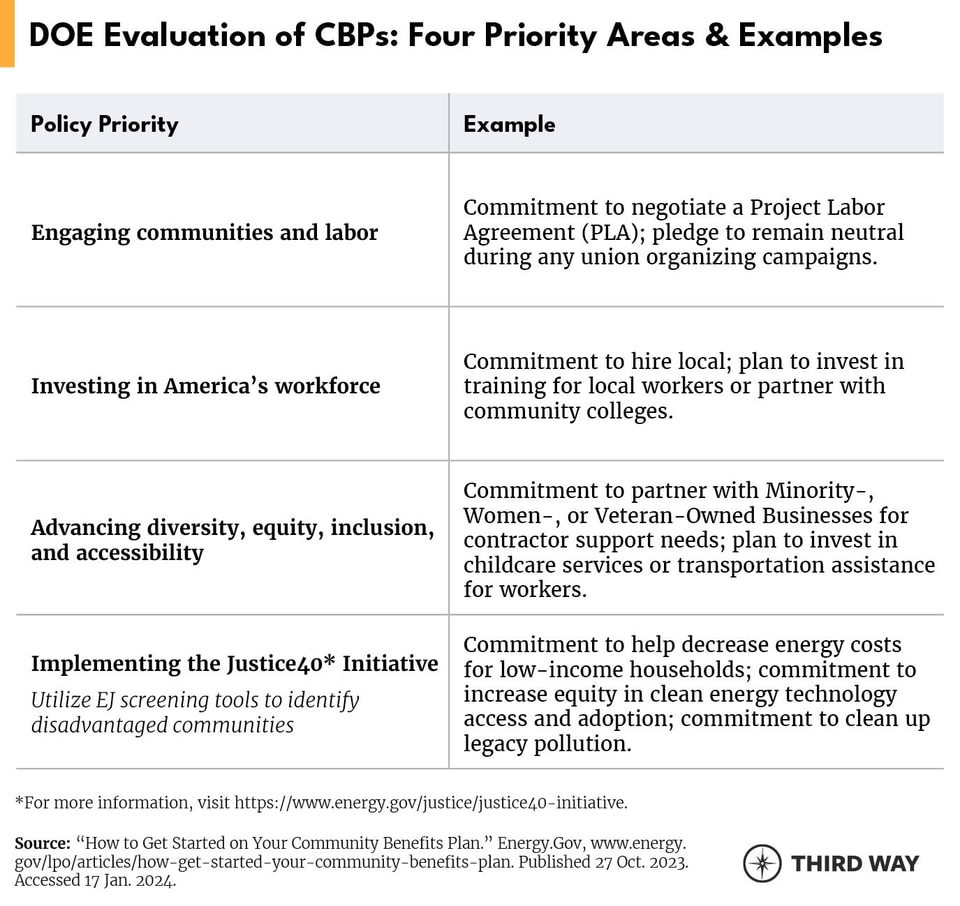

To demonstrate how entities receiving federal funding will leverage investments to the benefit of communities and workers, many funding opportunities require applicants to submit a CBP. CBPs help ensure that the socioeconomic benefits of DOE-funded projects are felt widely and equitably throughout a community and that any potential harms are mitigated to the greatest extent possible. For projects seeking funding from DOE, CBPs generally represent 20 percent of the technical scoring on proposals.

While CBPs are nonbinding, they can include legally-binding arrangements, e.g., a Project Labor Agreement (PLA) or a Community Benefits Agreement (CBA). More information from DOE here.

Government Efforts to Define and Create Demand for Low-Carbon Steel

The US government is making substantial investments in defining and procuring low-carbon materials, also referred to as lower embodied carbon (LEC) materials. By leveraging the federal government’s buying power, they are sending a signal that a market for these cleaner products exists. Manufacturers should invest and plan accordingly to take advantage of it.

Separate from DOE, several government agencies are taking a proactive role in helping reduce industrial emissions. The IRA provided funding to EPA to advance the development of Environmental Product Declarations (EPDs), and to the General Services Administration (GSA) and Federal Highway Administration (FHWA) to procure low-carbon construction materials.

The IRA also directed EPA to develop standards for what classifies as low-carbon products and materials. EPA issued an Interim Determination on the topic in December 2022, available here.

EPA Environmental Product Declaration Assistance Program

Background: The IRA provides $250 million to the EPA to develop a program focused on the advancement of product-specific EPDs. An EPD is a standardized, independently-verified document providing information about a product’s environmental impact (including carbon emissions). EPDs include measurements of the embodied greenhouse gas emissions associated with all stages of production, use, and disposal of a product or material. Improving transparency and disclosure through EPDs will facilitate the procurement of lower embodied carbon construction materials and products throughout the US.

To help manufacturers—and other stakeholders—develop and verify EPDs, EPA can use the IRA funding to provide grants, technical assistance, and other assistive activities. The funding is available until September 30, 2031.

Applications for the EPD Assistance Program will be evaluated on the extent to which the project supports a diverse workforce through recruiting, training, and fostering the participation of individuals from underserved communities, as well how it ensures mitigation of environmental impacts that could disproportionally affect those in disadvantaged communities.

Funding Amount & Type: In FY 2024, EPA plans to award up to 40 grants and/or cooperative agreements ranging from $250,000 to $10 million to help manufacturers, States, Indian Tribes, and nonprofits create and validate EPDs.

Status: The application deadline for an initial round of $100 million in funding was January 16, 2024.

General Services Administration Low-embodied Carbon Program

Background: The IRA provides $3.375 billion for GSA to invest in federal buildings to help reduce carbon emissions, including $2.15 billion to procure LEC materials for construction and renovation projects.

Award/Status: GSA has selected more than 150 construction projects across the country that are anticipated to utilize low-carbon steel, asphalt, concrete, and glass. Approximately 20 percent of the funding ($388 million) is anticipated to go towards low-carbon steel materials. In late 2023, GSA completed the initial phase of an 11-project pilot program, which helped GSA acquire market insights on the procurement process and will inform future project implementation. There were 137 published steel EPDs at the end of the pilot, demonstrating the shift toward increased transparency and standardized documentation of emissions derived from steel manufacturing.

More information from GSA here.

Federal Highway Administration Low-Carbon Transportation Materials Grant Program

Background: The IRA provided $2 billion to establish and carry out the Low-Carbon Transportation Materials (LCTM) Grants program, housed within the Department of Transportation’s FHWA. The goal of the program is to increase the use of low-carbon materials and products in FHWA-funded projects.

Award/Status: FHWA anticipates announcing instructions for applying for funding opportunities in Winter of 2023/2024. The funding will be awarded to non-Federal public-sector entities (e.g., States, local governments and Tribes) for eligible construction projects, such as highway projects and transportation facilities–which will result in increased demand for low-carbon materials.

Tax Credits for Clean Energy Production and Domestic Content

The IRA established a new tax credit (§ 45X) for the domestic production of clean energy technology components. Eligible components include solar components, wind turbine and offshore wind components, inverters, certain battery parts, and the critical minerals needed to produce these products and their component parts. The credit begins to phase out in 2029 and phases out completely in 2032. Steel producers should consider their product lines, assess whether their customers and end markets include the clean energy sector, and, in turn, determine their eligibility for new IRA tax credits.

More information from the Internal Revenue Service (IRS) available here. Additional guidance is expected.

The IRA credits listed below include “bonus credits” for meeting domestic manufacturing requirements for steel, iron, or manufactured components.

- Extension of Energy Investment Tax Credit (ITC) (§ 48)

- Extension of Renewable Electricity Production Tax Credit (PTC) (§ Section 45)

- Clean Electricity Investment Tax Credit (§ 48E)

- Clean Electricity Production Tax Credit (§ 45Y)

More information from the IRS available here. Formal regulations are forthcoming.

Other Government Efforts to Reduce Steel Manufacturing Emissions

DOE Regional Clean Hydrogen Hubs

Background: BIL provides $8 billion for DOE’s H2Hubs, which will demonstrate the production, processing, delivery, storage, and end-use of clean hydrogen. Hard-to-decarbonize industries including steel are expected to benefit from these projects as hydrogen consumers.

Incentive: On October 13, 2023, DOE announced $7 billion to launch seven H2Hubs across the nation. According to the department, the hubs are expected to collectively produce three million metric tons of hydrogen annually. The program is expected to catalyze more than $40 billion in private investments, bringing the total public-private investment to nearly $50 billion.

Status: More information from DOE here.

Hydrogen Demand-Side Assistance Program

Background: DOE is exploring entering into one or multiple agreements with independent, not-for-profit US entities to assist in the de-risking of clean hydrogen through demand certainty or other means. These entities will create market mechanisms that help connect clean hydrogen producers with steel mills, chemicals facilities, fleet vehicle owners, and others who wish to purchase this hydrogen. The goal is to “accelerate commercialization of clean hydrogen by providing medium-term revenue certainty” to projects affiliated with DOE-selected H2Hubs.

Incentive: The selected entity or entities will work with the H2Hubs to accelerate the commercialization and adoption of clean hydrogen using demand-side mechanisms (e.g., pay-for-difference contracts). DOE anticipates the overall program will be at least 5 years in duration and total funding will be between $500 million and $1 billion.

It is likely that stakeholders who are not officially part of the winning H2Hubs will still have the opportunity to benefit from reduced-cost hydrogen through this demand side program, as long as they are somehow furthering the success of an awarded hub. For example, a steel producer that was not part of a hub application could still potentially enter into a contract to purchase clean hydrogen at a subsidized rate from a hydrogen producer within an awarded hub and, in turn, benefit from the subsidized pricing the Hydrogen Demand-Side Assistance Program has generated.

Status: Submissions were due to DOE in late October and the department is expected to select the non-profit entity or entities by early 2024. The entity or entities would then begin work with DOE, likely throughout the first half of 2024, to design and establish the demand-side support program, which manufacturers will then be able to take advantage of. DOE will be soliciting input from industry and other stakeholders during this time to understand their needs and suggestions for the program.

See Request for Proposal (RFP) here.

Clean Hydrogen Production Tax Credit (§ 45V)

Background: Section 45V of the IRA, the Clean Hydrogen Production Tax Credit, provides up to $3.00/kilogram for the production of clean hydrogen. This credit applies for 10 years after the date a project begins operation. Projects must begin construction by 2033.

Incentive: Projects that meet the requirements of this tax credit may earn up to $3.00/kilogram, as well as claim up to a 30 percent investment tax credit under Section 48. This cannot be stacked with the Enhanced Carbon Capture Tax Credit (45Q).

Status: Currently, there is an open comment period on the proposed guidance. Comments must be submitted by February 26, 2024. A public hearing will take place on March 25, 2024. Further information and deadlines can be found here.

Advanced Energy Tax Credit (§ 48C)

Background: The IRA allocated $10 billion for a revitalized Section 48C tax credit. Among other qualifying projects are those that re-equip an industrial or manufacturing facility with equipment designed to reduce greenhouse gases (GHG) emissions by at least 20 percent. For these projects, the IRS has specifically called out “energy-intensive manufacturing sectors” including cement, iron, and steel, among others.

Incentive: Selected projects will receive a six percent Investment Tax Credit, which will be increased to 30 percent if the IRA’s prevailing wage and apprenticeship requirements are met.

Status: DOE and the IRS are currently processing first-round applications, and a second application period–for allocations totaling up to $6 billion–is expected to open in 2024.

More information from DOE here.

Enhanced Carbon Capture Tax Credit (§ 45Q)

Background: The IRA increases the credit amount per ton of carbon permanently sequestered from $50 to $85 through a revision to the Section 45Q tax credit. The bill also increases the credit for carbon captured and used from $35 to $60 and expands the scope of industrial facilities that qualify for the 45Q credit. The IRA also significantly expanded the scope of industrial facilities that qualify for the 45Q credit by reducing the capture threshold from a minimum of 100,000 tons of carbon captured annually to 12,500 tons. The enhanced tax credit may further incentivize the incorporation of carbon capture equipment into industrial facility projects.

Incentive: Any carbon capture, direct air capture, or carbon utilization project that begins construction before January 1, 2033, will qualify for the revised 45Q tax credit, assuming they meet other eligibility requirements.

Status: More information from IRS here.

Conclusion

As the federal government, led by the Biden-Harris Administration, continues to incentivize industrial decarbonization initiatives and stimulate greater demand for low-carbon materials, we look forward to seeing the results of market-leading innovation by US iron and steel manufacturers. Industry leadership will ensure the long-term growth and stability of the US manufacturing base, create economic benefits for both producers and consumers, and result in a meaningful reduction of harmful emissions.