Memo Published July 23, 2024 · 8 minute read

Status Report: America’s Competitive Advantage in Clean Steel

Mary Sagatelova

As countries and companies strive to meet ambitious climate goals and emissions targets, the demand for low carbon steel is expected to grow significantly. The United States, historically a global leader in steel manufacturing, has the chance to modernize and grow this legacy industry by investing in low carbon steel development and deployment.

The Bipartisan Infrastructure Law (BIL), the Inflation Reduction Act (IRA), and other key efforts from the Biden-Harris Administration have set the US on a path to do just that. In the past three years, billions of dollars in public and private sector investment have been directed towards accelerating the decarbonization of US manufacturing and creating demand for low-carbon materials. These efforts will strengthen the US economy, invest in the long-term stability of our domestic manufacturing base, and create good-paying jobs across the country.

By committing to invest in low-carbon steel, US firms can build on their existing expertise and capture a sizeable piece of this emerging market, while preserving US steelmaking, a long-standing symbol of American strength and innovation. This memo highlights the progress being made to decarbonize steel manufacturing in the US and show leadership in efforts to cut steel-related emissions globally.

How Federal Investments are Boosting the American Clean Steel Industry

Through a trifecta of legislation—the Bipartisan Infrastructure Law (BIL), Inflation Reduction Act (IRA), and the CHIPS and Science Act—we are seeing real progress towards decarbonization of steel manufacturing in the US. American producers have the confidence that the government is serious about decarbonizing while equipping them with the tools they need to achieve it.

These incentives, which range from grants to tax credits to technical assistance, will be distributed over the course of several years and pay dividends over the next the decade. Some of the federal tax incentives include:

- $10 billion in manufacturing tax credits that could be used to incentivize existing facilities like steel mills to retool for cleaner manufacturing

- Over $78 billion in production tax credits to support the production of low-carbon power generation, low-carbon hydrogen, and carbon capture technologies—all of which can be used by the steel industry to decarbonize their production processes; and

- Over $64 billion in investment tax credits designed to support facilities that generate clean electricity, which could be used to produce clean steel, among other uses.

Road to Victory: Growing US Clean Steel Leadership

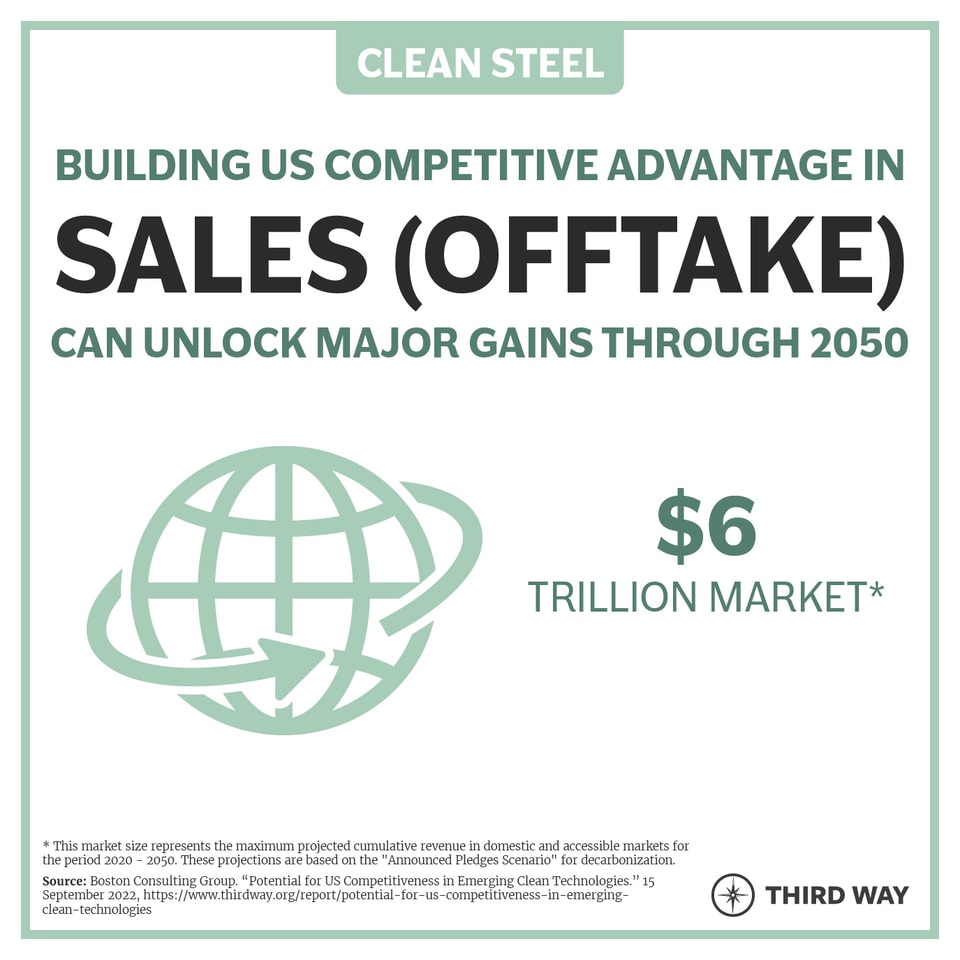

In a landmark report, commissioned by Third Way and Breakthrough Energy, Boston Consulting Group (BCG) examined ten emerging clean technologies. This groundbreaking analysis studied the value chain of each technology, segment by segment, to identify high-value areas where the US could build and maintain a durable advantage in the global market, and assessed what steps might help America compete for its share.

The report estimated that global demand for clean steel will be as much as 25,000 million tons between now and 2050, with an accessible market worth $5.4 trillion (cumulative). The analysis found that there is one particular segment of the clean steel supply chain where the US should make the biggest effort to build and maintain its advantage—offtake. This segment was identified based on its market size and the potential for American leadership.

Offtake

This value chain segment focuses on the sale of clean steel to customers, often referred to as “offtakers”. As more countries, including the US, race to hit emissions targets and quickly deploy clean energy infrastructure, getting the market for low-carbon steel primed and ready will provide America with a major advantage. The BCG report found that the US has the greatest chance of capturing market share if it focuses on meeting more of its own demand for clean steel—a domestic market estimated to be worth as much as $480 billion between now and 2050—and exporting to neighbors in Canada and Mexico. Here are some steps the US is taking to get ahead with potential offtakers:

- Building Private-Sector Demand: Members of the First Movers Coalition—which leverages the purchasing power of the world’s largest companies to expand the market for emerging clean technologies—have committed to purchasing at least 10% near-zero emissions steel by volume by 2030. This pledge includes both primary and secondary steel, utilizing a sliding scale to account for carbon emissions based on the amount of scrap used. The companies who have pledged to purchasing clean steel include American giants such as Ford Motor Company, General Motors, and Johnson Controls. Their involvement is positioning America at the forefront of an emerging global market and ensures US firms help shape the direction of the industry.

- Driving Demand Through Public Procurement: Several government agencies are taking a proactive role in helping reduce industrial emissions. The IRA also provided $2.15 billion to the General Services Administration (GSA) and $2 billion to the Federal Highway Administration (FHWA) to aid in procurement of low-carbon construction materials. GSA is leveraging $338 million of its funds specifically for low-carbon steel. This significant investment demonstrates the government's commitment to utilizing clean steel and helping to build confidence in the industry, encouraging US firms to continue investing in clean steel technologies.

- Helping US Companies Calculate and Compare Emissions: The IRA provided $250 million in funding to EPA to aid industry in the development of product labels that quantify emissions (specifically, using Environmental Product Declarations (EPDs). On July 16, 2024, EPA announced 38 recipients from across the country of $160 million in grant funding. One grant for over $6 million will go to a project being led by the University of Massachusetts Amherst with project partners the American Iron and Steel Institute (AISI) and the American Institute of Steel Construction (AISC). The project will improve access and provide educational outreach on EPD generation for a broad range of manufacturers and fabricators, with a particular focus on small businesses. It will also create a public-facing EPD repository. These efforts will improve data quality and transparency, helping US businesses both supply and procure lower carbon construction materials.

Other Examples of US Leadership

In addition to fostering markets and offtake demand for clean steel, the US is taking steps to establish and expand supply through public and private sector investments in innovative clean steel production. Here are some of the wins the US is starting to put on the board:

Demonstrating and Scaling Low-Carbon Manufacturing Technologies: The US Department of Energy (DOE) received $6.3 billion in IRA and BIL funding for industrial demonstrations. Demonstrations of new technologies are a very important (and very expensive) step in the path to full commercialization. Six of the projects selected for negotiation for over $1.5 billion in funding are in the iron and steel sector. Let’s highlight two of the biggest wins for clean iron and steel manufacturing:

- SSAB: $500 million for their Hydrogen-Fueled Zero Emissions Steel Making demonstration project. This pioneering initiative will create the US’s first commercial-scale facility using HYBRIT® technology—which makes fossil-free Direct Reduced Iron (DRI) with 100% hydrogen—in Perry County, Mississippi. The project will also expand SSAB’s Montpelier, Iowa facility to utilize the hydrogen-reduced DRI. SSAB has signed a letter of intent with Hy Stor Energy to supply green hydrogen to produce their DRI.

- Cleveland Cliffs: $500 million for their Hydrogen-Ready Direct Reduced Iron Plant and Electric Melting Furnace Installation The Ohio-based company will install a hydrogen-ready flex-fuel direct reduced iron plant and two electric melting furnaces in their Middletown Works facility.

Disrupting and Competing Within the Industry: In addition to the federally funded examples above, which are accompanied by private sector cost sharing, there are new entrants using new technologies worth keeping an eye on such as Boston Metal and Electra.

- Boston Metal: Over the past ten years, Boston Metal has been working to commercialize a process called Molten Oxide Electrolysis (MOE), which uses a single-step process in a modular cell to turn any grade of iron ore into liquid steel. Through deployment of renewable electricity for power, Boston Metal aims to produce steel with zero CO2 emissions in 2026. With research and development based at their facilities in Woburn, Massachusetts, they have also begun deploying their technology in Brazil to clean up waste from mining.

- Electra: This company uses a low-temperature process that can start with low-grade ores and be powered by intermittent renewable energy (meaning it can turn its process on and off depending on when the cleanest and cheapest electricity is available). In March 2024, they announced the commissioning of their first Pilot plant in Boulder, CO.

So, What’s Next?

To sustain and build on our competitive edge in the clean steel industry and outpace global competitors, both the public and the private sector need to continue to invest in groundbreaking research, development, demonstration, and deployment.