Memo Published July 23, 2024 · 6 minute read

Status Report: America’s Competitive Advantage in Long-Duration Energy Storage

Mary Sagatelova & Ryan Fitzpatrick

As countries shift towards cleaner energy sources and reduce their reliance on fossil fuels, maintaining a stable and reliable electrical grid has become increasingly urgent and complex. For clean electricity to function effectively, it must be supported by robust solutions for long-duration energy storage (LDES).

Designed to store energy for extended periods of time–providing storage for between 8 hours and several days—LDES provides a reliable backup for the electrical grid when intermittent sources like wind and solar do not produce enough power. This capability is crucial for balancing supply and demand, preventing blackouts, and ensuring a consistent energy flow as we rapidly electrify all aspects of the global economy.

As demand for storage solutions grows, the US has an opportunity to create a strong foothold in this emerging market. The electrochemical category of LDES technologies, an emerging and versatile form of energy storage, on its own has a projected value of over $3 trillion between now and 2050, making it worth the effort to secure a share for US companies and workers. Our existing infrastructure, strong regulatory framework, and established industry practices position American firms to attract significant investment. However, other countries like China, South Korea, and Japan are already strong players in this field. To stay in the game, we must fully leverage our current advantages.

This memo spotlights federal policies that are helping the US establish an edge in the growing LDES industry and showcases milestones of how America is strengthening its competitiveness.

How Federal Investments are Boosting America's LDES Industry

Landmark provisions across the Bipartisan Infrastructure Law (BIL), CHIPS and Science Act, the Inflation Reduction Act (IRA) are playing a pivotal role in establishing a resilient and robust American LDES supply chain. When it comes to growing the LDES industry, long-term planning is essential. These laws provide that necessary stability and support, enabling the private sector to plan and invest with confidence. Importantly, they create pathways for small companies to attract additional investments, allowing them to transition from early-stage technologies to larger-scale operations. Some of the most impactful federal incentives include:

- Eligibility for billions of dollars in investment tax credits for clean power;

- Access to $10 billion in manufacturing tax credits to support manufacturing;

- And, $8 billion in funding to support energy storage manufacturing and demonstration projects.

These federal investments will pay dividends over the next the decade and beyond. And based on our analysis of Rhodium Group and MIT CEEPR’s Clean Investment Monitor, it’s clear that these policies are already working. Public and private investment in energy storage technologies in just the past three years has reached over $43 billion.

Road to Victory: Building on US Leadership in LDES Technologies

Although LDES is still a relatively nascent technology, its ability to provide essential backup during periods when other renewable sources are not producing enough power makes it a crucial component for achieving a zero-carbon grid. Recognizing this pivotal role in the future energy landscape, countries worldwide are fiercely competing to lead in LDES development.

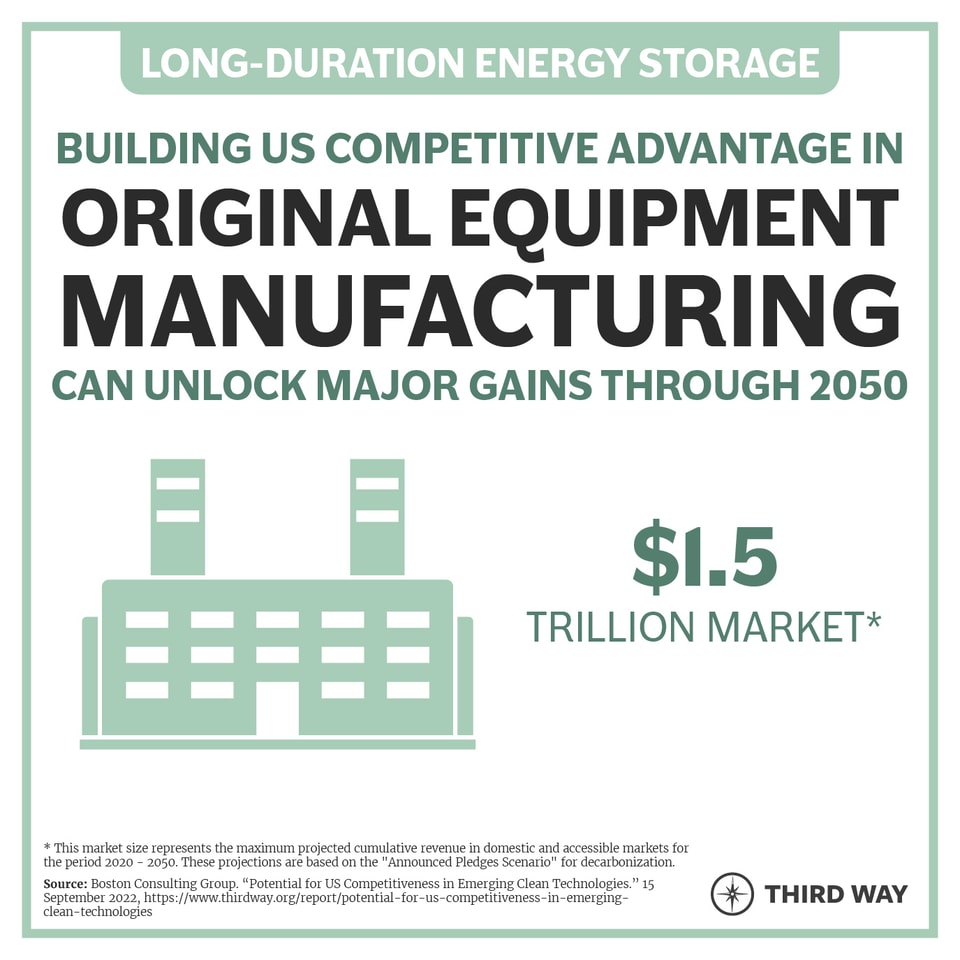

Third Way’s landmark analysis, in partnership with Breakthrough Energy and Boston Consulting Group, found that original equipment manufacturing (OEM) is the segment of the LDES value chain where the US should make the most effort to build its advantage. This segment was identified based on market size and the potential for American leadership—and we’re already seeing significant progress in this particular area.

Original Equipment Manufacturing

When it comes to manufacturing energy storage components and LDES technology, the US holds a distinct advantage. Not only do US firms maintain an edge in patent volume for technologies like flow batteries and metal-air batteries, but that innovation is backed by substantial investment. American companies see six times more capital invested than their nearest rivals in China. The combination of technological leadership and significant financial resources ensures the US is well-positioned to lead in a global market valued at $1.5 trillion. Below are just a few examples of how we’re already seeing American leadership emerge:

- Meeting Demand with American Innovation: Antora Energy, in partnership with BlackRock and Temasek, opened its first large-scale thermal battery manufacturing facility in San Jose, California. Leveraging funding from the Department of Energy’s ARPA-E office and the State of California, Antora is ramping up production of factory-made thermal batteries to help meet the energy demands of heavy industry. Antora is bridging the gap between renewable energy and industrial manufacturing with American-made batteries, reinforcing US leadership in advanced energy solutions.

- Lowering Costs with American Supply Chains: Form Energy is constructing a new iron-air battery manufacturing plant, producing batteries capable of storing electricity for up to 100 hours. Utilizing iron, water, and air instead of the less-abundant metal lithium, Form’s technology relies almost entirely on domestic suppliers. Form is using this approach to reduce costs to a tenth of lithium-ion batteries and creating 750 well-paying permanent jobs in the process.

- Reaching Economies of Scale: Eos Energy Enterprises received a $400 million conditional loan guarantee from the Department of Energy to expand its manufacturing plant for zinc-powered energy storage systems. This funding supports the construction of up to four state-of-the-art production lines in Turtle Creek, Pennsylvania, helping Eos overcome scaling challenges and compete in the global market.

Other Value Chain Segments

Broadly, the US has achieved significant progress in the LDES sector. The Department of Energy’s LDES Demonstration program is a prime example, funding a diverse array of energy storage technologies to help overcome technical and institutional barriers. This program will enable full-scale deployment of storage technologies across various geographies and climates. Here are some standout projects:

- Showcasing Scalable Storage Solutions: Xcel Energy, in partnership with Form Energy, is spearheading the deployment of two 10MW 100-hour energy storage systems in Minnesota and Colorado. Integrated into retiring coal plants, this groundbreaking project is set to fast-track commercialization and showcase how innovative storage technology can be deployed widely and cost-effectively where needed.

- Fortifying Against Natural Disasters: Faraday Microgrids and Redflow are install battery systems at Valley Children’s Hospital in Madera, California. Located in an underserved community, they are demonstrating how battery storage can provide critical power backup for acute care hospitals in the US and areas increasingly threatened by power outages from fires, storm surges, floods, extreme heat, and earthquakes.

So, What’s Next?

When paired with other clean energy solutions, LDES technologies are set to play an important role in our clean energy future. The US is currently well-positioned to lead in this emerging industry, but other countries offer fierce competition. To strengthen our leadership, the US must continue to support our burgeoning LDES market through targeted policymaking to spur innovation and investment. The reward is worth it: potential market share would be lucrative and opportunity-rich for American firms and workers.