Report Published May 1, 2010 · Updated May 1, 2010 · 15 minute read

Buying and Owning a Home

Cristy Gallagher, Jim Kessler, & Tess Stovall

Purchasing and owning a home is a true benchmark of middle-class success and has always been the embodiment of the American Dream. But when the bottom dropped out of the housing market, many middle-class families saw a staggering loss in their home equity, and some have even lost their homes to foreclosure. Even as first-time buyers come back into the market, they are finding it more difficult to secure the financing they need to buy a home. Buying and maintaining a home is not as easy as it used to be

THE PROBLEM

Buying and owning a home is increasingly difficult for the middle class.

The housing meltdown has eroded the value of middle-class Americans’ wealth.

For most families, their homes are their most valuable assets. The equity they build in their homes is an important part of their wealth and savings. People are able to borrow against the equity in their homes to make improvements in their lives, whether it is improving the standard of living, financing their child’s education, or paying the costs of caring for an elderly parent.

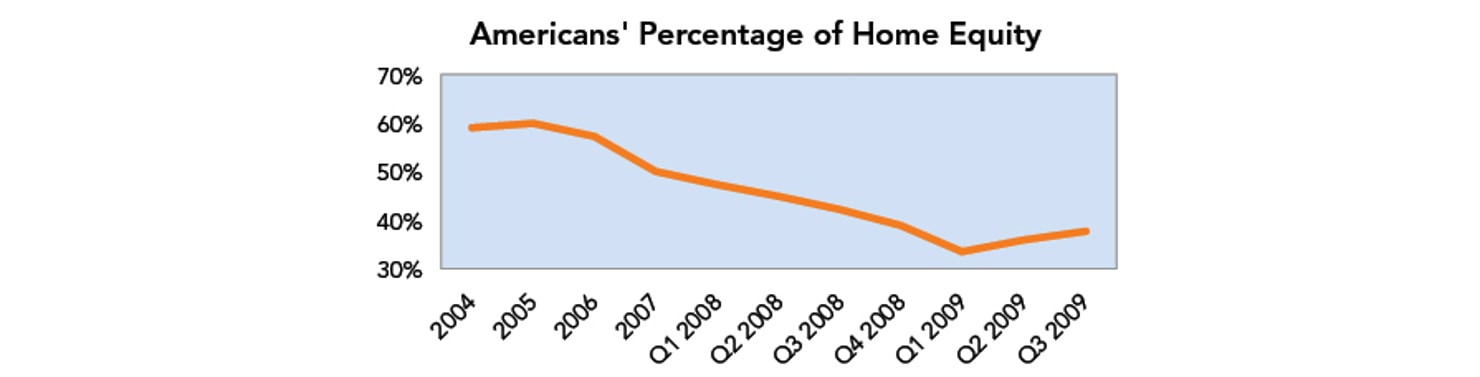

However, there has been a staggering loss of value in homes due to the collapse of the housing market. Since 2005, total equity in homes in the U.S. has dropped 43% to $7.9 trillion, down from $13.8 trillion.1 Moreover, for the first time since 1945, Americans’ percentage of equity in homes is below 50%,2 and during the 3rd quarter of 2009, equity was down to only 37.6% as the chart below shows.3 In fact, one in four mortgage borrowers are underwater on their mortgages, meaning they owe more on their mortgage than their home is worth.4

Source: Federal Reserve, Flow of Funds Accounts of the United States, Table B.100

Foreclosures are rising and affecting responsible homeowners, not just speculators.

When the housing decline began, foreclosures were mainly limited to borrowers who had risky loans such as adjustable-rate or interest-only mortgages.5 But in the past year, more and more foreclosures have been a result of unemployment rather than exotic mortgages and have even affected homeowners with traditional mortgages.6 In 2008, 40% of individuals reported unemployment as the main reason for their foreclosures. In 2009, that jumped to 65% of individuals facing foreclosures.7

In 2009, the total number of foreclosures reached 2.8 million which was a 21% increase over the previous year,8 and by 2014, it is projected that there will be 13 million more foreclosures.9 These foreclosures can have a significant impact on the home values on nearby property. In 2009 alone, more than 69 million homes lost property value because of nearby foreclosures, with an average amount lost per home of $7,200.10 In 2009, the total decline in property value was $502 billion.11

For those that don’t own a home, but want to, making such a purchase is harder than ever.

First-time home buyers have always made up a significant section of the home buying market, but with the decline of home prices and the federal first-time home buyer tax credit available in 2009, they have increased their presence. In 2009, first-time home buyers comprised 47% of all home sales, up from 41% in 2008 and the highest level since 1981.12 Nearly eight in ten first-time buyers see their homes as a good investment and more than 50% see it as a better investment than stocks.13

During the housing boom, many lending standards loosened. In fact, over the past twenty years, the average down payment for first-time homebuyers dropped dramatically. In 1989, the average down payment for first-time homebuyers was 10%, but in 2007, it was only 2%.14 The financial crisis has led to a tightening of lending standards—much of it necessary, some of it not so. A down payment has now nearly become a requirement, not just something that is nice to have. In 2009, the percentage of individuals that did not put anything down dropped from 23% in 2008 to only 15%.15 Many couples that once had no problem finding multiple mortgage options are now having trouble securing a mortgage at all. Though it is beneficial to the housing market to have first-time buyers, it is becoming more and more difficult for them to secure the credit and financing they need.

Governors and states can help individuals achieve middle-class success by helping families purchase and own a home. Below is a list of nine ideas that governors can use to reduce the property taxes of middle-class families, help first-time buyers purchase their first home, increase the values of homes in their states, and create construction and retrofitting jobs.

THE SOLUTIONS

Successfully purchasing and owning a home.

1. Freeze property tax rates for three years after home and business improvements.

Since many homeowners have seen a decline in their home values in recent years, some would like to make improvements on their house to help increase its value. From making the home more energy efficient to finally renovating the 1970s-era kitchen, more home improvements could spur activity in the hard-hit areas of the construction industry and also keep or create jobs in this sector. However, homeowners may be hesitant to jump into a home renovation project because of the downturn in the economy and uncertainty that comes with it. To spur home renovation and job creation, governors can freeze property tax increases for three years if a homeowner or a small business owner renovates and adds value to their homes or offices. The property tax freeze could apply to buyers who renovate foreclosed or abandoned properties as well.

This freeze would have little to no budgetary scoring impact since it is a prospective tax break for improvements not yet done. And like other popular programs (Cash for Clunkers or a sales tax holiday), this is easy to understand and homeowners will feel like they are getting a bargain.

2. Create an emergency mortgage bridge loan program.

Over the last year, many home foreclosures occurred not because of sub-prime mortgages but because of the increase in the unemployment rate. Many economists and housing experts predict that as the unemployment rate continues to remain high, more and more homeowners with traditional, fixed-rate mortgages will lose their homes to foreclosure if they become unemployed.16 A governor can help stem the unemployment foreclosure crisis by creating an emergency mortgage bridge loan program. Homeowners who are unemployed can apply for a short-term “bridge” loan to cover six-months worth of mortgage payments while the homeowner looks for work. The loan could be added onto the principal of the mortgage or repayment once the house is refinanced or sold.

Best Practices

- In Delaware, Governor Markell introduced the Delaware Emergency Mortgage Assistance Program (DEMAP) to provide homeowners with mortgage payments to prevent foreclosures that result from circumstances beyond the homeowner’s control. Loans are available up to a maximum of $15,000 or 12 months of mortgage payments to borrowers that are at least 90 days delinquent. Loans come with a fixed 3% simple interest rate and can be distributed in a lump sum to bring a mortgage current or in smaller sums to provide assistance with monthly mortgage payments.17

- In Pennsylvania, the Homeowners’ Emergency Mortgage Assistance Program, which has been in existence since 1983, provides a loan for up to 24 months, with a maximum loan amount of $60,000, to help owners keep their mortgages current. The loans are available to individuals struggling to keep current on their mortgages for reasons beyond their control. Individuals are required to pay 40% of their net income toward their total housing expenses. Lenders are required to tell borrowers about the assistance program if they are at least 60 days delinquent.18

- Maryland’s Bridge to HOPE Loan Program provides assistance to borrowers while they work on a permanent solution to their mortgage affordability issues. The loan, up to a maximum of $15,000, can be used to bring a mortgage current or help with up to 24 months of mortgage payments. The loans have a 0% interest rate, and the repayment of the loan is deferred until the mortgage is refinanced or the house is sold.19

- North Carolina20 and Ohio21 also have emergency home mortgage assistance program

3. Encourage first-time home buyers to buy foreclosed properties with below market-rate mortgages.

The Center for Responsible Lending estimated that in 2009, 69 million homes in the U.S. were negatively affected by foreclosed homes nearby.22 It was estimated that these homes saw a total loss in home value of $502 billion, or an average of $7,200 per home.23 In order to stabilize neighborhoods that are struggling with scores of abandoned homes while helping first-time home buyers purchase their first home, governors can provide below-market rate conventional loans to home buyers to purchase homes in specific hard-hit areas.

Best Practices

- In California, Governor Schwarzenegger announced a $200 million Community Stabilization Home Loan Program in July 2008 which provides eligible first-time home buyers with below market-rate, conventional loans to purchase a foreclosed home in certain hard-hit real estate areas. The program is administered by the California Housing Finance Agency. It was estimated that between 800 and 1,000 first-time homebuyers would be able to purchase homes through the program.24

4. Create a temporary first-time home buyer tax credit.

Purchasing a home is a big investment for many young people, and the need for upfront funds to cover the closing costs and down payment can limit the individuals who might be well-qualified to purchase a home. On average, closing costs add up to $2,732, with Texas being the highest at nearly $4,000.25 And the current support that first-time home buyers do receive, through the federal first-time home buyer credit, is expiring on April 30, 2010,26 leaving would-be first-time buyers to cover the closing costs by themselves. Governors can introduce a first-time home buyer credit to help young people purchase their first home and get the housing market moving again. If foreclosures are an issue in the state, a governor can limit the credit to only those individuals who buy a foreclosed or abandoned home.

Best Practices

- Washington, DC has a $5,000 first-time home buyer credit available to individuals looking to purchase a home in the District of Columbia. The credit is available for individuals who have not owned a home in the District for at least one-year prior.27

- California instituted a $10,000 home buyer tax credit available to individuals purchasing a new home from March 1, 2009 to March 1, 2010.28 The home buyers do not have to be first-time purchasers, but the homes need to be new construction. $100 million was allocated for this credit, but within four months of the credit being available, all of the funds were used.29 Governor Schwarzenegger proposed to establish another home buyer tax credit in 2010 that would be available to use when purchasing both a new and an existing home.30

5. Create a mediation program to help borrowers renegotiate their mortgages with their banks.

Many homeowners have found themselves in a very undesirable situation. Nearly one in four homeowners with a mortgage are underwater,31 and it is estimated that 10% of all homeowners with a mortgage have seen their home values drop to only 75% of the mortgage balance.32 There are homeowners in these situations that would like to stay in their homes, but many realize that it will take them years before they ever build any equity. In order to stay in their homes, individuals want to renegotiate the terms of their mortgages including reducing the interest rate, extending the repayment period, and reducing the principal balance. Additionally, there are homeowners facing foreclosure who want to stay in their homes but are unable to get a response from the lender. But there are many lenders that have no financial incentive to come to the table to renegotiate with borrowers. In order to facilitate this process, states can set up mediation programs, conducted by third-party mediators, to meet with both borrowers and lenders to work toward an agreement on new mortgage terms. Governors can also require a mediation to occur before a foreclosure proceeds.

Best Practices

- The Delaware Residential Mortgage Foreclosure Mediation Program provides an opportunity to homeowners who are behind on their mortgage payments to request a mediation session with their lenders. The borrower meets with a certified housing counselor with the U.S. Department of Housing and Urban Development to prepare a good faith estimate of what they can afford to pay. Then the borrower, the counselor and the lender will meet to discuss the estimate and try to come to an agreement on new terms of the mortgage.33

- The New Jersey Judiciary Foreclosure Mediation Program encourages individuals facing foreclosure on their homes to meet with a housing counselor and work with a neutral mediator to negotiate a work-out with the lender.34

- The Florida Supreme Court directed the state’s judges to refer all foreclosure cases to managed mediation. The mediation brings together a trained negotiator, the homeowner, and the bank to try to come to a resolution. The Collins Center for Public Policy in Florida estimates that 65% of the homeowners who choose mediation reached settlements with their lenders.35

- At least nine other states, including California, Connecticut, Indiana, Maine, Michigan, Nevada, New Mexico, New York, and Oregon also have variations of mediation programs.36

6. Create an independent commission to investigate abusive lending practices.

As the housing market soared, some lenders began to employ unethical lending practices such as encouraging potential homebuyers to take out loans they couldn’t afford or agree to high-priced mortgages. To be sure, there were homebuyers that did not do their own due diligence and walked out with mortgages they knowingly couldn’t afford. However, there are quite a number of homeowners currently holding onto mortgages that they never should have had in the first place. Governors can set up an independent commission to investigate the mortgage practices that went on in the state for the past decade and make recommendations to the state as to how the practices can be avoided in the future.

Best Practices

- Texas created the Residential Mortgage Fraud Task Force in 2007 that was meant to improve coordination and collaboration between law enforcement and mortgage regulators. The task force investigates and determines the best way to track and prevent mortgage fraud and is made up of the attorney general and real estate, banking and other regulators.37 The task force also produced a report in 2009 detailing its activities and findings since its creation.38

7. Create a state clearinghouse to match up local organizations that want to revitalize homes.

As the foreclosure crisis continues to persist, more and more homeowners are living on blocks with one or more abandoned homes. These abandoned homes are not only an eyesore bringing down neighboring home values but are also potentially dangerous places. Many times the banks that own the properties don’t have the personnel or the means to revitalize the homes. A state could create a clearinghouse to match up banks that have foreclosed properties with local community organizations willing to purchase and then update and revitalize the properties. This program would help the banks by taking foreclosed properties off of their hands, but also help individuals looking for affordable revitalized homes.

Best Practices

- Massachusetts created a Massachusetts Foreclosed Properties Initiative to connect banks that own foreclosed homes with non-profits or other community organizations that will purchase the property and revitalize and upgrade the properties for low to moderate income families. A non-profit, Citizens’ Housing and Planning Association, will serve as a clearinghouse to connect banks with the local organizations.39

8. Require students to take financial education classes to prepare them to make good financial decisions.

As we’ve learned in the past couple of years, one wrong financial decision can have devastating effects on an individual’s future. Basic financial skills and savvy are a must in today’s economy. It used to be that the only option for home mortgages was a 30-year, fixed-rate loan, but today, there are many more options, some with potentially negative results. But high school and college students today admit they are not prepared for their future financial decisions. A governor can require that high school students or college students take a financial education course in order to graduate. This curriculum could be a stand-alone class or weaved into an economics or social studies class.

Best Practices

- Currently only three states, Tennessee, Missouri and Utah require at least a one semester course on personal finances be taught in school.40 Utah’s requirement was instituted in 2008 after the state ranked first in bankruptcy filings based on population size, and in a survey of students who took the course, 53% stated that the class improved their financial behavior.41

- The University of Oklahoma Board of Regents discussed in early 2009 creating a financial education requirement for college freshman. The requirement would focus on topics such as how to handle a credit card or understanding interest rates.42

9. Create a fund to help local libraries and community centers hold housing finances 101 courses for would-be home buyers.

For most middle-class families, the purchase of a home is the most significant expense of their lives. And while purchasing and owning a home is a key to middle-class success, many first-time home buyers know little about the process of purchasing a home, increasing the likelihood of making a poor financial decision or getting scammed. A governor can create an education fund to give resources to local libraries and community centers to hold seminars on home buying 101. The seminars can discuss the current market for mortgage rates, potential pit-falls to look for, and other necessities for future home buyers.

Best Practices

Since 1998, Montana’s Homeownership Network has provided homeowner education to over 10,000 families and created over 3,000 homeowners.43 The Network partners with 14 organizations across the state to administer home buyer education and housing counseling to Montana residents. In some of the more remote areas, the sessions are held via video conferencing.44