Report Published June 5, 2024 · 7 minute read

The Financial Returns of Online Graduate Programs

Chazz Robinson

Americans are busy balancing work, family, and school pressures to survive in today’s economy. These competing priorities have led to an interest in online programs that can provide flexible pathways to education credentials.

In theory, online programs should help alleviate some of the struggles associated with attending class in person such as transportation, child care, and work schedule conflicts. Yet, policy influencers have been raising concerns about program quality, outsourcing, and whether these programs have true value.1 In the meantime, students are increasingly questioning if the additional debt is worth it.2 Graduate students are set to own nearly half of the federal student debt portfolio, despite constituting just a fifth of total enrollment in higher education.3 These factors have led researchers, the Department of Education (Department), and Congress to turn an eye toward graduate student debt and begin exploring the value of graduate programs.4

Until recently, policymakers had scrutinized the value of undergraduate programs, including online programs, but largely overlooked graduate programs. That is beginning to change. Graduate enrollment has increased, and many students are attending graduate school expecting these programs to help them advance in their careers and earn more money.5 Many also welcome the convenience of online education. But so far, no one has looked closely at online graduate programs and evaluated whether the juice is worth the squeeze.

This report is the first to address this increasingly important question. To explore this lesser-known aspect of graduate education, we used the College Scorecard to analyze the financial returns that 1,723 graduate programs provide to their students. The findings clarify that many online graduate degrees—including ones funded by taxpayers— don’t always pay off.

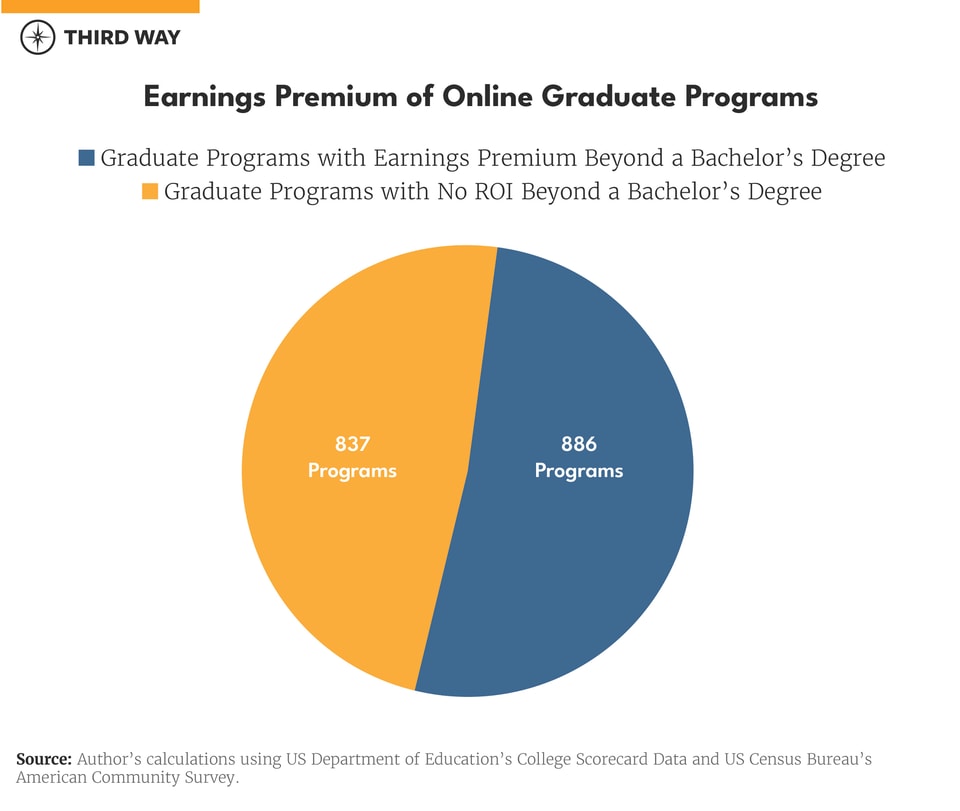

Nearly Half of Online Graduate Programs Fail to Boost Earnings

Our analysis shows that 837 of the 1,723 graduate programs we examined—roughly half—leave graduate students with no earnings boost beyond what a bachelor’s degree holder earns four years after graduation. We identify these as no-return-on-investment (“No ROI”) programs. Graduate students make significant sacrifices to attend graduate school with the expectation of a financial return. Yet, those who attend their programs online have a barely 50/50 chance of earning more than they would with a bachelor’s degree. While both online and in-person programs raise questions about ROI, our analysis finds that online degrees are a slightly riskier bet for students and taxpayers: a smaller (yet still concerning) proportion—43%—of in-person master’s programs failed to boost students’ income beyond a bachelor’s degree.6

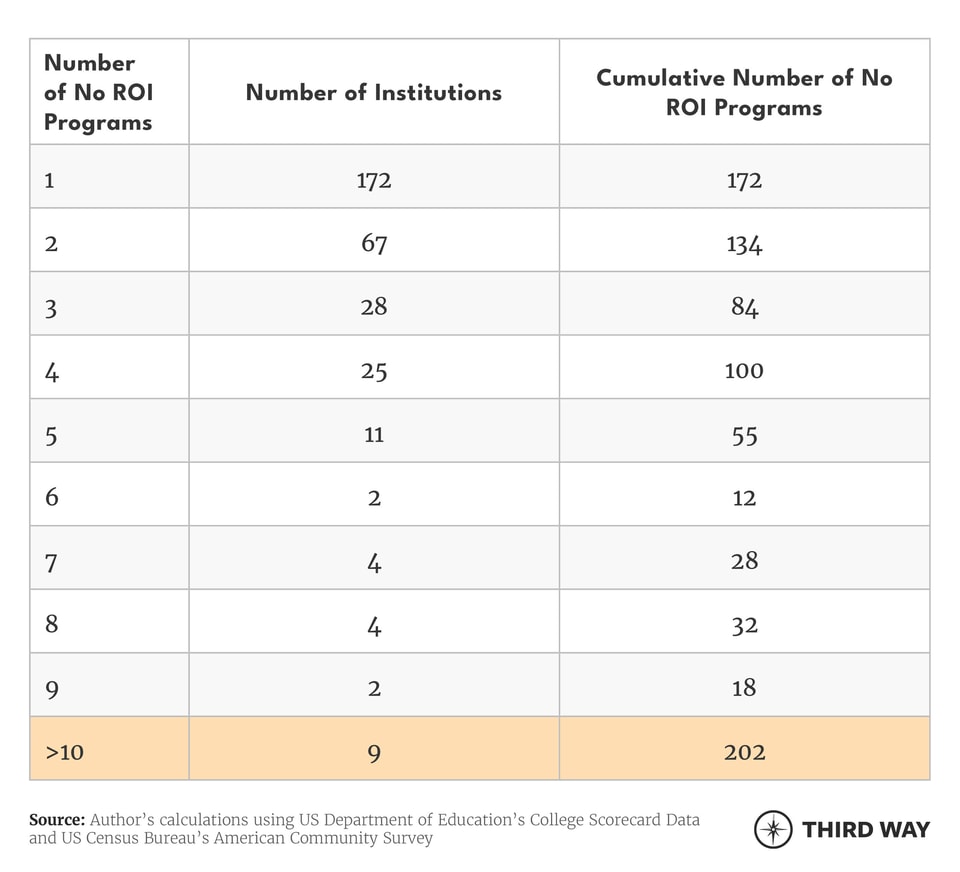

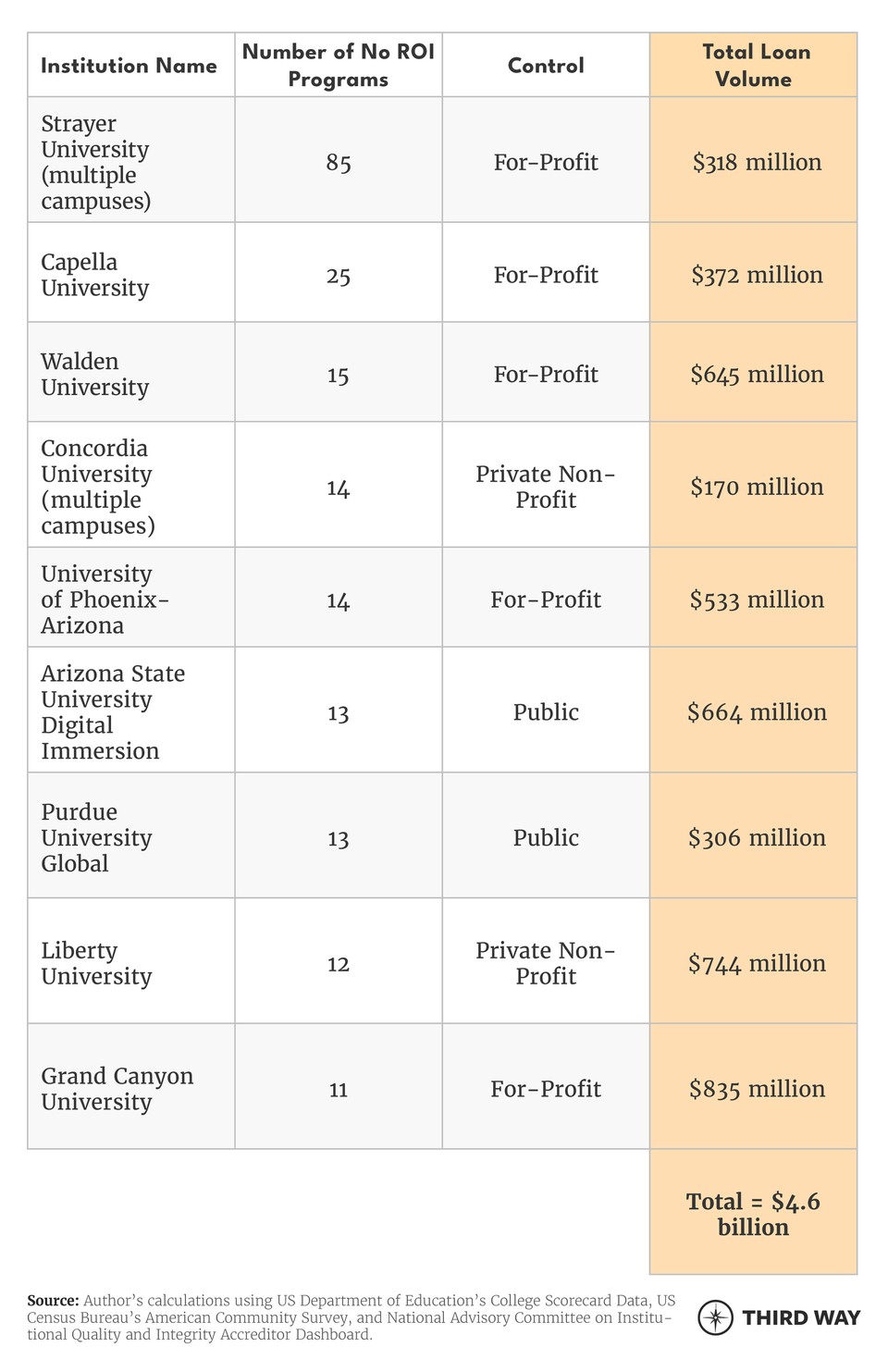

The 837 programs with no ROI are spread across 324 institutions. About 20% of these—172 institutions—housed just a single No ROI program. These risky programs should be addressed, but of far larger concern is the fact that a large share of No ROI programs are concentrated in just a handful of institutions. Nine institutions offer 10 or more programs that provide no ROI for students. Nearly a quarter (202) of online graduate programs with no ROI are concentrated among these nine institutions alone.

When a school offers 10 or more No ROI programs, this indicates there could be a systemic quality issue across their online graduate programs. If nothing else, it commands a closer look. To better understand what might be happening at these institutions, we analyzed the nine schools with the largest share of No ROI programs, which we refer to as “High No ROI” institutions.

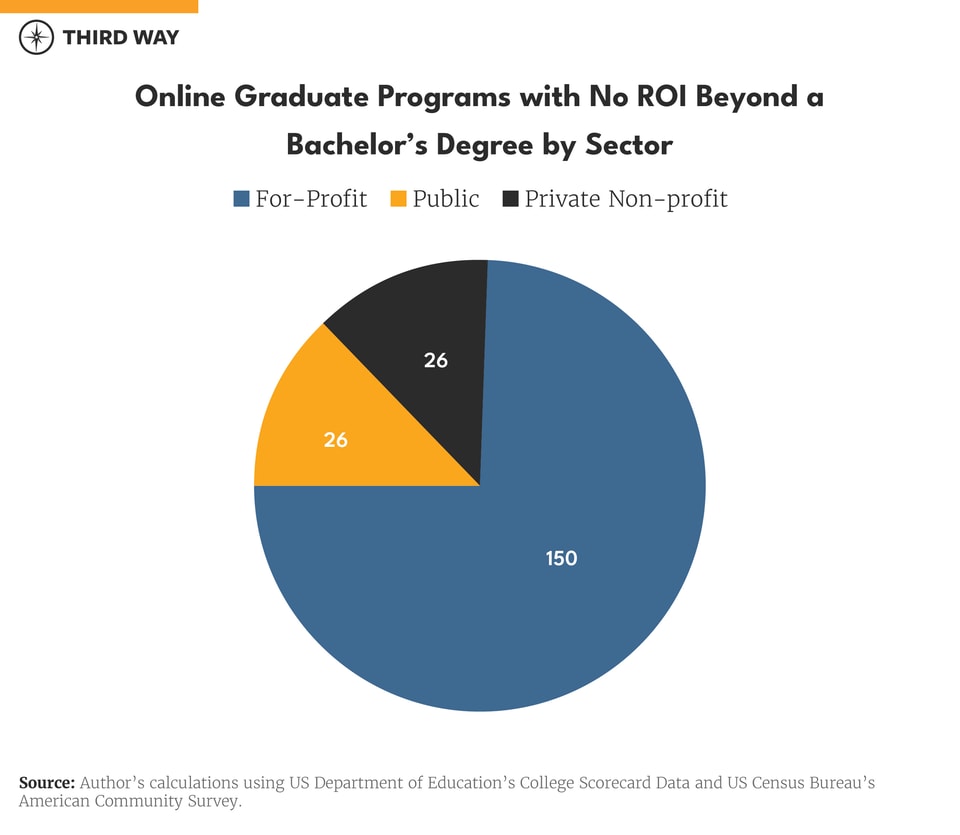

A Disproportionate Number of High No ROI Institutions Are For-Profit

The nine High No ROI Institutions include five for-profit, two private non-profit, and two public institutions. Of the 202 No ROI programs these nine schools collectively offer, 74% (150) are housed within the five for-profit institutions. The remaining No ROI programs are divided equally between public and private non-profit institutions (26 programs each). To put this in perspective, for-profit institutions offered just 344 (19%) of the 1,723 online graduate programs we analyzed—the smallest share of any sector.

For-profit colleges are already often a risky bet for students. They are more likely than institutions in other sectors to have students who default on their student loans, deceptively promote programs with high costs and low returns for students, and leave large portions of students of color without any return on their educational investments.7 These issues have resulted in some for-profit graduate programs facing disciplinary actions from the Department (including programs at Grand Canyon University, one of the nine High No ROI institutions).8

To be sure, there are No ROI programs at public and private non-profit institutions. But looking at the repeat offenders reveals that for-profit online graduate programs present the riskiest bet for online graduate students and taxpayer dollars.

Billions of Taxpayer Dollars are Financing High No ROI Institutions

The nine top-offending institutions alone take in $4.6 billion in taxpayer-funded student loans. Limited data make it impossible to break down how much of this funding is given to each No ROI online graduate program, but at a time when graduate borrowing has drastically increased and average earnings for graduate degrees have stagnated, this is an alarm bell.9 If graduate students borrow more for programs only to receive no financial return, they are more likely to default on student loans or postpone life milestones such as marriage or purchasing a home.

Taxpayer dollars should go to proven graduate programs that help their students fare well post-graduation. That $4.6 billion could help institutions invest in proven practices and programs for their students. But gambling graduate students' futures and taxpayer dollars on programs that provide no economic mobility risks straining the student loan system and setting students back. Sustainability in our knowledge economy depends on institutions being good stewards of taxpayer dollars. One way to improve student outcomes is to invest in educational systems that provide quality education that helps boost economic mobility.

Future Areas of Research

Graduate education will be the next hot topic in education policy. Student debt has been one of the most polarizing topics in education for the past few years, and policymakers cannot ignore the demographic that holds nearly half of the federal student loan portfolio. But at the moment, we don’t have the data we need to make informed policy decisions around graduate education. In some cases, this is because the right questions about graduate education aren’t being asked; in others, it is because schools are not required to report relevant data. Reports and studies on graduate education are based on very limited data sets, which can cause inconsistent findings.

We need to know three things if we want to improve the effectiveness of graduate programs and better inform potential students about the value of these programs. First, program-level earnings data are limited, making it difficult to examine economic outcomes from any particular graduate program. Second, data about total program costs are nonexistent, making it impossible to determine how much graduate students truly pay for their programs. Last, graduate programs do not consistently collect and report detailed demographic information about the students they enroll and graduate. This means we cannot assess their disaggregated student outcomes. The more we know about these issues, the better we will be able to evaluate graduate education and advance meaningful reforms.

Conclusion

Students and taxpayers want federally-funded higher education institutions to prove they add value. Graduate students’ perceptions of value are guided by how well their programs provide economic advancement.10 With graduate debt rapidly rising, it’s time for more accountability and data transparency for graduate education. To date, attention to online education has focused on undergraduate populations, while online graduate programs have largely flown under the radar. As the federal government begins to eyeball graduate education, this report clarifies that online graduate programs need ample attention and policy solutions.

Methodology

To examine graduate degree outcomes, we used the most recent College Scorecard release from April 2023 (which reflects master’s program-level data from the 2020-2021 academic year), the US Census Bureau’s American Community Survey (2022 five-year estimates), and the National Advisory Committee on Institutional Quality and Integrity Accreditation Dashboards.

Using available data, we focused on the median earnings of graduates with an online master’s degree (four years after attending) in each program and the median earnings of bachelor’s degree holders. We limited our analysis to online master’s programs to capture students who most likely enrolled online. Since an online student can be enrolled anywhere in the country, we used the national median earnings for a bachelor’s degree holder. Programs that were not offered online or didn’t have available data were excluded from this analysis.

We calculated the earnings premium of each program using this formula: