Memo Published January 11, 2024 · 7 minute read

Transparency Is the Name of the Game for Graduate Students

Ben Cecil

Takeaways

- Information on graduate programs is incomplete—at students’ expense.

- Graduate school is expensive, with little to no real information available about likely post-graduate debt.

- Increased transparency around graduate program outcomes is popular, bipartisan, and common sense.

As a proverbial ticket to higher-paying jobs and increased opportunity, graduate education has long been synonymous with increased return on investment (ROI) beyond the bachelor’s degree. But graduate programs are a large investment, requiring an upfront understanding of total cost to degree and what students can expect following graduation—information they often cannot access before deciding to enroll.

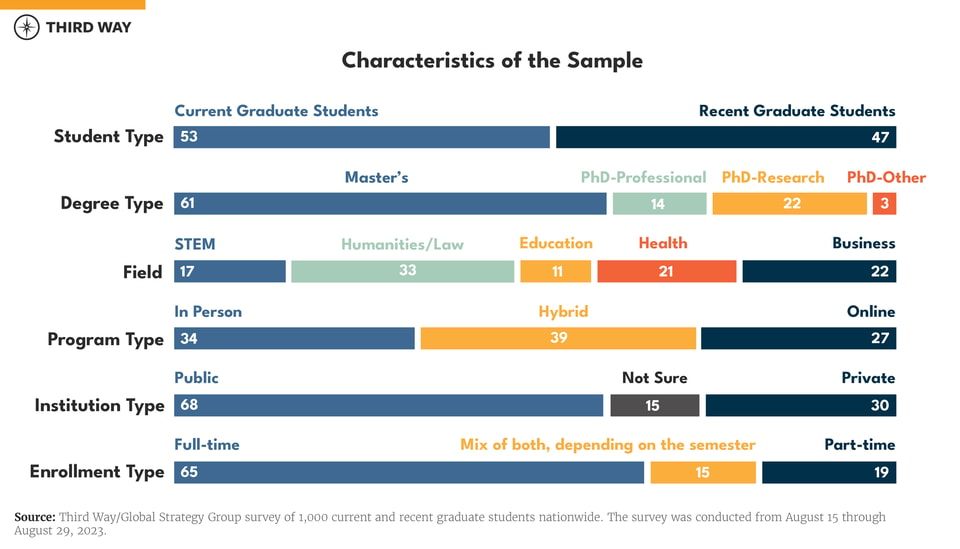

Third Way partnered with Global Strategy Group to survey 1,000 current or recent graduate students to gain clarity on graduate education from application through completion. We asked students to tell us about their experience, their borrowing behavior, and whether they felt like their graduate school was transparent about cost and likely outcomes. The overarching sentiment was clear: students want more transparency from their graduate schools and for schools to be held accountable for poor outcomes. With loans to graduate students soon eclipsing half of the outstanding federal student loan balance, these data highlight how transparency and ROI for both graduate students and taxpayers are increasingly important areas of focus for policymakers and higher education researchers.1

Information on Graduate Programs is Incomplete—at Students’ Expense

The cost of a graduate degree varies widely depending on the degree type—ranging from a few thousand dollars for a one-year master’s degree to six-figure tuition for a law or medical degree. The cost is substantial no matter how you slice it, and students pursuing graduate education often still carry debt loads from their undergraduate degrees. In this survey, 50% percent of students took out loans for graduate school (with a plurality of 43% borrowing between $20,000 and $60,000), and 62% held undergraduate loans. Deciding when and where to attend graduate school may look different by nature of when graduate school occurs in a student’s educational lifecycle—making it all the more necessary to arm potential students with the data they need to make the best decision about their continued education.

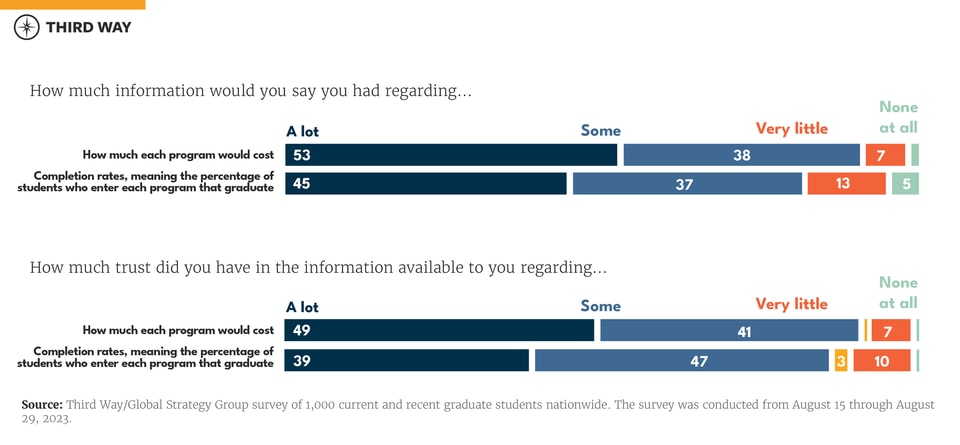

When asked about the amount of information they had about their graduate programs pre-enrollment and how much they trusted it, 53% of students felt that they had “a lot” of information, and 49% said that they had “a lot” of trust in information related to cost. Forty-five percent of students felt they had “a lot” of information about programs’ completion rates, a commonly used metric to assess program quality, while over half (55%) noted having only “some,” “very little,” or “no information at all” about completion rates. And less than half of students (39%) had “a lot” of trust in the information about completion rates made available to them.

Prospective students should also be able to consider likely post-graduate outcomes to figure out what their life, job, and finances may look like after attending a graduate program. Yet students told us they had limited awareness of their program’s post-graduation employment rates, likely projected earnings, or the average debt level held by graduates—with just 37%, 31%, and 28% noting they had “a lot” of information, respectively, about these important metrics (and similarly low levels of trust). These information gaps and lack of trust further complicate a student’s ROI calculation when making decisions about whether and where to enroll in a graduate program.

Across the board, opening Pandora’s box and committing to a graduate education without transparency into likely post-graduation outcomes is a financially risky proposition. For students, it’s the equivalent of taking a blind leap of faith, trusting a system that currently has few accountability metrics to ensure that they will see the full potential of their investment. For taxpayers, it provides federal student loan dollars to programs that keep getting more expensive and have questionable long-term ROI. Having trustworthy data available is an important guardrail to protect both students enrolling in graduate education and taxpayers funding the student loan program.

Graduate School is Expensive, with Little to No Real Information Available about Likely Post-Graduate Debt

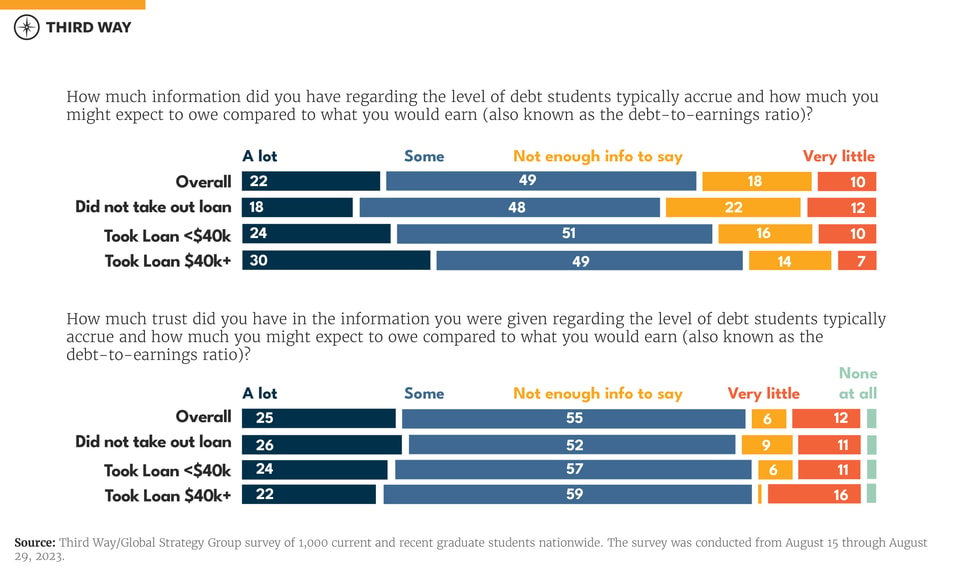

Even in today’s age of information at your fingertips, there’s a ton that we don’t know about graduate students, including how much students borrow to finance their education and their repayment outcomes.2 Having a full picture of post-graduate outcomes requires important information—for example, what a student’s educational debt load will look like compared to their potential earnings with a graduate credential. Knowing the level of debt students typically accrue and expected earnings after graduation is common-sense information, but it is often unavailable from the institution or government sources for students to consider.

Just over one in five students (22%) said they had “a lot” of information about graduates’ typical debt loads compared to their earnings, while an aggregate total of 28% of students had “very little” information or “none at all.” Among students who borrowed more than $40,000 for graduate school, over one in five (21%) had “very little information” or “none at all” about a potential debt load compared to postgraduate earnings. Nearly one in five graduate students—18%—who took on over $40,000 in debt had “very little” trust to “none at all” in the information they were given about their level of debt compared to their potential earnings.

There are clear consequences from these gaps in information and trust, particularly for the 50% of students who borrowed to attend graduate school. Nearly half of students who borrowed (46%) indicated the total amount they owe in graduate student loans is more than they initially expected, and 54% said that repaying their loans will take more time than expected.

Increased Transparency around Graduate Program Outcomes is Popular, Bipartisan, and Common Sense

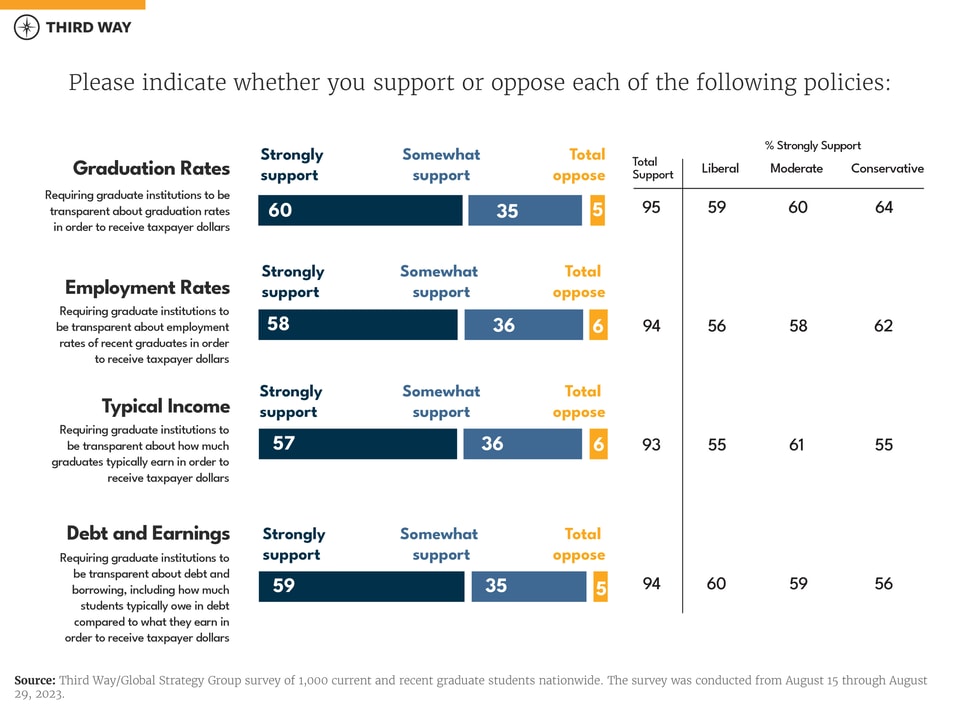

Over 90% of students “strongly support” or “somewhat support” increased transparency around information like graduation rates, employment rates, typical income of graduates, and debt-to-earnings ratios as conditions for schools to receive taxpayer dollars. This consensus crosses political ideologies, with conservative students showing the greatest support for requiring institutions to be transparent about their graduation rates and employment rates in order to receive taxpayer dollars. Transparency in higher education has bipartisan support and is an area in which Congress may be able to find common ground.

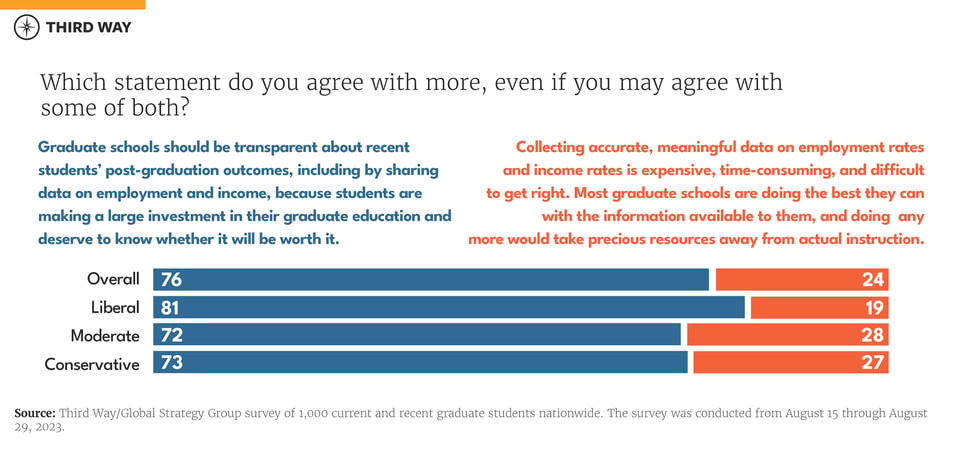

The trade-off of increased transparency for students may be some added reporting burden for institutions. Still, when asked about these trade-offs, students overwhelmingly responded in favor of the argument for increased transparency about outcomes (76%) with only a quarter believing the burden would be too much and institutions are currently doing the best they can with the information available to them. These results are also consistent across political ideology.

Institutions rely heavily on the belief that graduate school is worth the time and investment needed for a graduate degree, excusing skyrocketing tuition prices with the promise of a better future. Yet the lack of information and low trust in available sources prevents students from making fully-informed decisions about their graduate education—a challenge for both institutions and the federal government to tackle. It matters not only that information is available, but that it is reliable and accurate. We’ve seen positive steps in data collection with additions of some graduate program data in the College Scorecard and the Department of Education’s Financial Value Transparency rule.3 However, our findings show that students want more information to make better decisions and weigh costs, postgraduate outcomes, and ROI—and that they expect graduate schools to play a role in providing greater transparency upfront.

Conclusion

The key takeaway from these data is clear: most students want more transparency from graduate schools, and those findings hold across enrollment status, race and ethnicity, field of study, and satisfaction with their graduate school experience. Transparency for students is common-sense policy that helps them make effective decisions that are the best for them—financially or otherwise. As things stand today, students are making one of the biggest investments of their lives without data that assures a worthwhile investment. Business as usual will no longer suffice, and policymakers can rely on bipartisan support for increasing transparency around graduate programs and providing more information in the best interest of both students and taxpayers.

Methodology

Global Strategy Group conducted an online survey of 1,000 current and recent graduate students who are registered voters nationwide. The survey was conducted August 15 through August 29, 2023. The precision of online surveys is measured using a confidence interval; in this case, the interval at the 95% confidence level is +/- 3.1%.

To view the topline results, click here.