Report Published November 12, 2015 · Updated November 12, 2015 · 10 minute read

Housing Finance Part 1: The Basics on Housing Securitization

Tanner Daniel

In a recent New York Times op-ed, Bethany McLean writes of the twin zombies Fannie Mae and Freddie Mac. Not completely alive and not entirely dead, everyone knows something should be done with them. But that’s where the agreement ends. They have been under conservatorship for years, which can’t last forever. They cost the taxpayers a bundle of money, but now they are making the taxpayer an even larger bundle of money. And since the housing crisis of last decade, these not-quite-alive, but certainly-not-dead government-sponsored enterprises are a bigger part of housing finance than ever.

Standing in the way of Fannie and Freddie reform is inertia and complexity. The inertia is that nothing seems particularly urgent in housing right now, though nothing seems quite exactly right either. The housing market has recovered, but it is still tight—probably too tight. Credit for many would-be homebuyers is hard to come by. The pendulum of homeownership rates has swung back to its lowest level since 1989, a bungee cord drop of six points since the overheated days of 2005.1 And the private secondary market for mortgages is virtually nonexistent at the moment.

And then there’s the complexity of housing finance. Replacing the plain vanilla mortgage market of the past is the labyrinth of securitization, the secondary market, and the implicit and explicit government guarantees of the present. Against the backdrop of the housing crisis are the conflicting public policy goals of maximizing homeownership, stabilizing housing prices, minimizing taxpayer expenses, and preserving the uniquely American 30-year, fixed-rate, affordable, pre-payable mortgage.

In order to help demystify this crucial but complex topic, we have published a trio of housing finance papers. In this first paper, we explain securitization—how it works, why it’s necessary, and the hazards it can create. Paper two describes the three big risks in mortgage finance and the guarantees that the government and private capital has set up to mitigate those risks. Paper three looks at the twin zombies, Fannie and Freddie, and poses the questions policymakers must answer in order to reform them.

What Happens When You Take Out a Home Loan?

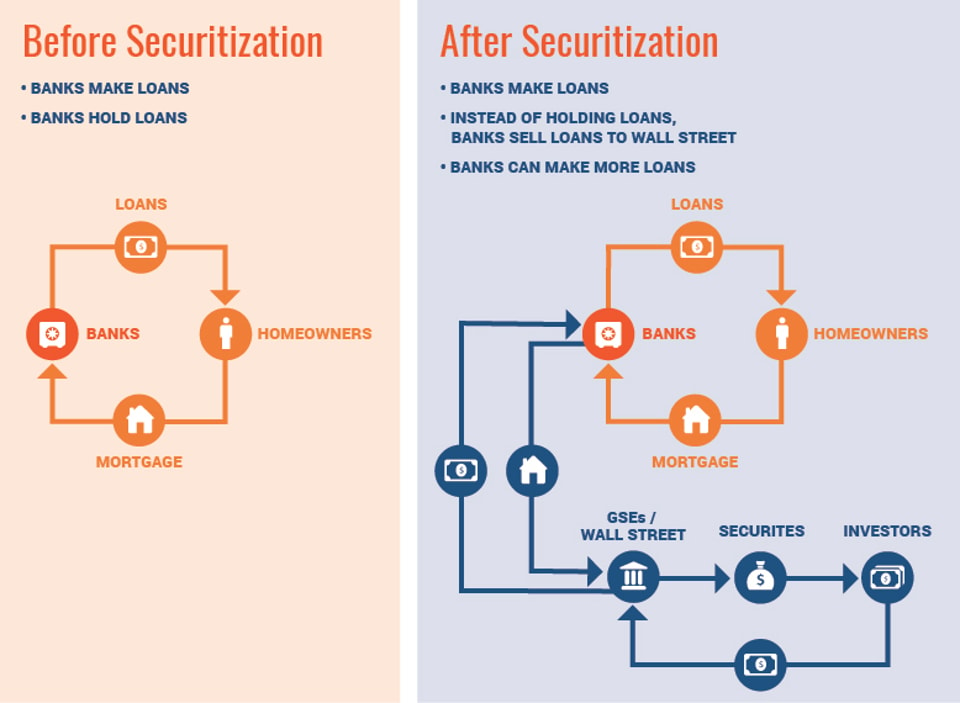

The home financing process always begins the same way: a person gets a loan from a lender to buy a home. When a prospective homeowner takes out a mortgage, the purchased house is pledged as collateral for the loan. In the most straightforward of scenarios, the bank would next hold onto the mortgage, and each month the homeowner would pay the bank interest, plus a sliver of their principal, until maturity. This is called an amortizing loan.

However, the world of housing finance isn’t straightforward. And, in fact, if this were the only way homes were financed, both banks and consumers would lose out. To explain, let’s assume a bank has $10 million in total deposits in its portfolio. If that lender only made $100,000 home loans, it would tap out of funds once they made their 90th loan (reserve requirements hold that banks can only lend out 90% of deposits). In order to finance another loan, the lender would have to wait until it built up enough deposits to make another loan. In a booming economy, when homeowner demand is off the charts, regional economies suffer because banks can’t lend out enough to meet demand. This leaves creditworthy borrowers on the sidelines, or worse, lenders charge higher rates, making mortgages more expensive.

Even though this method of financing homes has its downsides, as of January 2015, around 27% of all new home loans—a significant chunk of the market—followed this traditional method of housing finance.2 The remaining 73% of home loans are financed using what is called the secondary mortgage market. This market was established to provide mortgage lenders the opportunity to sell their mortgages to other entities, such as large institutional investors and government-sponsored enterprises. By offloading them to the secondary mortgage market, lenders free up funds allowing them to issue more mortgages.

Before the establishment of the secondary mortgage market, staples of the U.S. housing market—the 30-year fixed-rate mortgage and amortizing loans—were nonexistent.3 It wasn’t until New Deal-era laws established a series of reforms (the creation of the Federal Home Loan Banking System in 1932, Federal Housing Administration in 1934 and Fannie Mae in 1938) that our housing finance sector had a robust and fully operational secondary mortgage market. Moreover, without the establishment of this infrastructure, these staples (i.e. 30-year fixed-rate mortgages and amortizing loans) would make little economic sense for lenders and likely wouldn’t exist as prominently as they do today. In fact, our federal government’s tremendous commitment to subsidizing the housing market puts the United States in a very small group of countries worldwide that offer affordable 30-year fixed-rate mortgages abundantly.4

A major impetus that transformed our housing finance system was the advent of securitization in the 1970s. What makes securitization different from the traditional financing process is financial intermediaries (either large financial institutions or government-sponsored enterprises) first buy mortgages on the secondary market in bulk.5 These intermediaries then pool the loans together into a trust and issue a mortgage-backed security (MBS) to sell to investors.6 This process is illustrated below by the parts of the diagram colored gray. In the diagram, financial intermediaries (labeled “GSE / Wall Street”) start by exchanging cash with the banks for the bulk purchase of mortgages. After pooling these mortgages, the trustees exchange cash with investors for securities—completing the circle in the diagram.

Investors who purchase MBS do not own the underlying mortgages, but are instead buying the right to receive a future stream of interest payments that come from homeowners paying down their mortgages. So in this system, when the homeowner makes a mortgage payment, the servicer collects payments and remits them to the trustees who then distribute them to the investors.

The History of GSEs

When Fannie Mae was created in 1938, the government-sponsored enterprises’ (GSEs) mission was singular: purchase loans in bulk from lenders in order to establish a healthy secondary mortgage market. Even though this mission remains, a series of policy changes have morphed (and made more complicated) the role GSEs play in the mortgage market. One noteworthy change came in the aftermath of the Savings & Loans (S&L) Crisis of the 1980s. Before the S&L crisis, the GSEs’ primary role was to provide insurance for their credits. After the S&L crisis, the GSEs were required by law (the Federal Housing Enterprises Finance Safety and Soundness Act of 1992) to support mortgages for low- and moderate-income families. This mission change was significant since it meant the GSEs now had competing directives from Congress—maintain a healthy mortgage market, while also making sure low-income families (who often are considered high-risk by creditors) have access to mortgage credit.

What Is Good About Securitization?

When lenders tie up their assets in mortgages, they take on three types of risk: the risk of default (credit risk), the risk that interest rates will go up or down (interest rate risk), and the risk the mortgage is paid off too early (prepayment risk).7 With the help of securitization, lenders can now offload these risks to other parties. For loans that are bought by GSEs on the secondary market, the credit risk is absorbed by the government. Thanks to securitization, the interest rate and prepayment risk are absorbed by the investors who purchase MBS.

Additionally, securitization provided a platform for more capital to enter the housing markets. With an active secondary mortgage market and large amounts of MBS being issued (again, thanks to securitization), now investors can easily gain exposure to the housing market by buying bite-sized, highly diversified slices of a trust, or MBS. Previously, if investors wanted to get involved with the housing markets, they were forced to purchase large, illiquid mortgages. The appetite for this “bite-sized” exposure to the housing markets was huge and meant a larger influx of capital entered the housing market from investors, both large and small. The influx of capital meant more affordable home loans for Americans. And more affordable loans meant millions more Americans became homeowners.

What Is Bad About Securitization?

In two words: moral hazard.

To explain, it’s important to first understand the difference between agency MBS and non-agency MBS. Agency MBS are those securities issued from either Fannie Mae or Freddie Mac. Non-agency MBS are any other securities issued in the private market. The difference is that agency MBS have a credit guarantee while non-agency MBS do not. This credit guarantee is the implicit or explicit assurance that even if loans default, payment streams continue. Thus, these credit guarantees provide a framework for moral hazard—in this example: moral hazard means investors can finance risky loans without having to face the consequences when things turn south. Moral hazard, arguably, was a huge contributor to the financial crisis.

Securitization works fine just so long as the underlying assets are solid, high-quality mortgages. Prior to the 2000s, this was the case for non-agency MBS because private lenders steered clear of subprime mortgages. That all changed with the housing bubble. Private financial institutions took a giant leap by issuing MBS composed of subprime mortgages. This leap meant a lot of money was being made on mortgages that once were considered too risky to issue in the first place. Demand grew so large, Fannie and Freddie were compelled to loosen their normally strict lending standards in order to stay competitive. The result was that highly toxic subprime mortgages oozed into the securitization process through both agency and non-agency MBS. When the housing bubble burst, interest payments slowed, and these assets lost significant value.

Lastly, another drawback to securitization is its ability to diffuse responsibility of issuing sound mortgages. The process of slicing and dicing mortgages meant everyone in the system could now easily pass the buck, skirting the responsibility and consequences of poor underwriting standards. But to be clear, securitization is not the sole reason for the 2008 crisis, it is one of the many contributing factors. Dodd-Frank has helped reduce the inherent moral hazard problems that come with securitization.8

Conclusion

Securitization in housing is indispensable, but the crisis has shown that securitization only works when the underlying assets are of good quality. Since the crisis, the federal government has played a much bigger role than normal in the securitization issuance market—in the month of January 2015, 97.5% of newly issued MBS was from Fannie Mae, Freddie Mac, or with the support of a government agency like the Federal Housing Administration and the Department of Veterans Affairs.9 Many argue that this imbalance needs to be fixed and is unhealthy for the economy, putting us at risk for another taxpayer-funded bailout. They say that without some level of private sector risk sharing, another catastrophic downturn in housing prices would put the government on the hook yet again.

In the next paper, we discuss this imbalance and the role of the government guarantee in the mortgage market.