Report Published July 28, 2021 · 23 minute read

Moving Beyond Free: A College Affordability Compact for the Next Generation

David H. Feldman, Ph.D. & Christopher R. Marsicano, Ph.D.

Free college programs have proliferated at the state and local levels over the past decade, focused primarily on the nation’s community colleges. President Biden’s $1.8 trillion American Families Plan includes funding to make community college tuition free for participating states, and the idea of federally supported tuition-free four-year public college education is also back in the spotlight. It is easy to see why: “free college” fits on a bumper sticker, and it offers a simple message that signals to low-income families and first-generation students that achieving a valuable post-secondary credential is possible for them. This can lead families to prioritize education earlier, in the middle school years, when young people are developing the skills needed to succeed in high school and college. It can also support the growing number of adult learners by reducing one big uncertainty about the cost of returning to pursue a college degree. Making a public college education tuition-free can indeed enhance access and covering non-tuition costs of college can also aid in completion.

But behind the bumper sticker, free college is rife with implementation, efficacy, and equity issues. Over time, free college programs may further erode the resources available to the nation’s most under-resourced institutions. Evidence from the COVID recession shows how this may play out. Free college proposals also create winners and losers among the states. When coupled with a lack of political will to budget for free college in a narrowly split Congress, policymakers should pursue alternative solutions that are more socially equitable, economically efficient, and politically viable.

There is a better mix of policy prescriptions that can achieve access and success for students most in need of federal support. Increasing the Pell Grant will target aid to students most in need without breaking the bank. Giving states that invest in their own higher education systems a block grant and subsidizing non-profit institutions with a history of success supporting low-income students will reward those trying to ensure access and success for low-income students. Establishing simple accountability measures that affect all schools will reward institutions that support students while reining in those that act in bad faith. A targeted, multi-faceted strategy has a greater chance of succeeding in politically volatile times, and offers future generations of students the nuanced, long-term college affordability compact they deserve.

The State of Free College Programs in the States

The 2008 financial crisis punctured state budgets, leading to higher tuition sticker prices at public institutions and more student debt. The rapid proliferation of college promise programs during the nation’s economic recovery shows one attempt by states and localities to tackle the student debt crisis and the rising cost of attendance. These programs “promise” a tuition-free college education to students who meet strict eligibility requirements and live in defined geographical areas. Generally implemented at the local level (as with Kalamazoo Promise in Michigan and Knox Achieves in Tennessee) or the state level (such as the Tennessee Promise and Oregon Promise programs), promise programs receive primary funding from state or local tax revenues or endowed private funds.1 Most focus on community college students, with very few such programs funding four-year degrees (New York’s Excelsior Scholarship being a notable exception). In all, there are around 300 promise programs across the country.2

The popularity of these free college programs at the state and local levels has led policymakers to consider free college programs at the federal level. Yet many proposals for a federal free college program don’t follow the playbook set out by the states (or the plan laid out by President Biden, who has made free two-year college a key part of his higher education agenda). Most state-based free college programs are last-dollar scholarships, meaning that scholarship funding kicks in only after all other grant aid is dispersed. This allows states to provide a free community college education at a relatively low expense because federal support already picks up most of the tab for low-income students. The plans touted by progressive members of Congress, on the other hand, are first-dollar programs that would require states to fully cover tuition before accounting for other aid, grants, and scholarships. The goal is to ensure that federal funding goes to cover living expenses for students, but implementation would come at a significant cost to many states.

Promise Programs During COVID-19

The performance of promise programs during the COVID-19 pandemic is instructive. The pandemic strained promise programs even though states do not shoulder the full burden of the program costs. Budget uncertainty in the early days of the pandemic even caused some states to make cuts or significant changes to their programs.3 The Oregon legislature, for example, cut the state’s promise by $3.6 million—and the cuts came after the free tuition awards were sent out, meaning the state had to revoke awards already given to students. Around 1,000 Oregon students lost their free community college tuition. Maryland’s appropriations to support the state’s two-year free college program have declined from $15 million two years ago to $8 million today. After disbursing all $8 million, 2,880 students were still on the waiting list.

Unlike every other state program, the well-known Tennessee Promise program is funded by an endowment developed from state lottery funds and is not reliant on state appropriations. The program’s $600 million endowment, most of which is invested in the stock market, rebounded after a dip at the beginning of the pandemic. And it is a good thing it did—total enrollment in the program is up 6% over last year. But Tennessee’s example is difficult to replicate, as few programs have been built with such sustained bipartisan support, and few state legislatures have the appetite to set aside hundreds of millions of tax dollars into an endowment. For every stable Tennessee Promise, there is a volatile Oregon Promise—how a state funds its promise program and the state’s economic conditions lead to very different outcomes across states.

Picking “Winners” and “Losers” in Designing a National Free College Program

The simplicity of free college makes it an appealing idea—but the devil is in the details. The design of the Tennessee Promise makes it fiscally stable, but program design at the federal level needs to focus on equity concerns across states and students, as well as on financial feasibility over the next generation. The truth is, not everyone wins in a federal free college program. These programs will have differential effects on people with different incomes and on states with differing levels of support for higher education. Those who most need financial support for college may instead get the smallest subsidy. Those states that spend the least on higher education would stand to gain the most under a federal free college program. And those who do not go to college will pay a portion of the tax bill. There are clear winners and losers in every free college program.

States that invest in higher education, lose. Those that spend less, win.

Using federal dollars to zero out tuition at public institutions counterintuitively rewards states that have chosen to appropriate smaller sums for public higher education and punishes states that more amply fund their public universities. In the 2018-19 academic year, the national average net tuition revenue at public universities for full-time equivalent students was $6,902.4 Using federal dollars to zero out tuition payments would require that sum per student to be set aside from the national tax base. Any state that receives more than that amount would get a net transfer from the tax base—that is, from other states.

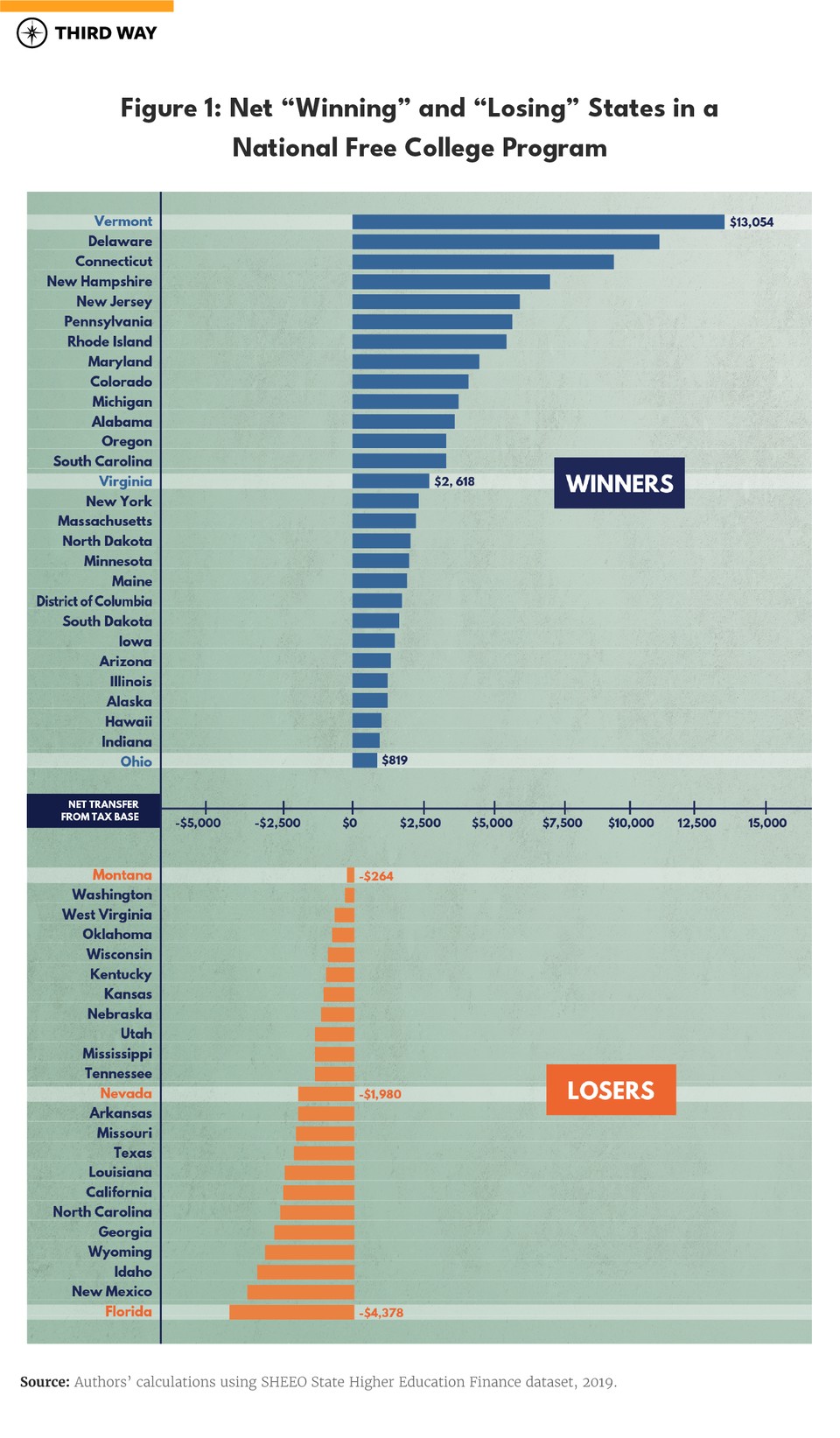

Senator Bernie Sanders’ original plan from 2016 called for states to finance one-third of the amount, with the federal government picking up the other two-thirds of the tab.5 Using Sanders’ percentages, Figure 1 shows the states that would be net winners under this arrangement, in order from greatest net positive transfer at the top of the graph (Vermont—Senator Sanders’ home state) to greatest net negative transfer at the bottom (Florida).

North Carolina and Virginia offer an instructive example of the political cleavages involved in implementing a national free college infrastructure. Virginia behaves “badly” relative to North Carolina, in that the Old Dominion appropriates only $5,701 per student to educate its 303,000 students. North Carolina, by contrast, appropriates $9,018 per student to educate its 392,000 students. Because net tuition at Virginia’s public colleges is so much higher ($9,720 versus $4,769), the state would get back almost $2,000 more per student than its share of the tax base (assuming that the federal government paid two-thirds of the cost). Meanwhile, North Carolina would be a net loser, receiving over $1,000 less than its per-student share of the tax base.

The political calculus of using federal dollars to eliminate public tuition is complex and doesn’t always fall along traditional partisan lines. The winners include blue states like Vermont and Massachusetts, purple states like New Hampshire and Michigan, and red states like South Carolina and Indiana. But a large number of blue and purple states also lose in this scenario. California is a blue state loser. Because of its sheer size it will pull in substantial revenues, though less than the state’s per-student share of the tax base. Washington and New Mexico are also blue net losers, along with electorally important battleground states like Florida, North Carolina, and Wisconsin.

This calculus is further complicated if states must pay a percentage of the cost. Net winner states are those that appropriate the least for higher education. These states will have to shift the largest amount of revenues into higher education, or raise taxes the most, to pay their share of the cost of free college. But these are the very states that have revealed over many years that they prioritize other things over higher education. Another cleavage is demographic. Other things equal, states with a larger percentage of young people in the college-age cohort will win, and states with older populations will lose. Because of these divides, building a coalition to pass a free college proposal out of Congress may require an impossible degree of bipartisanship (or an unfortunate amount of logrolling).

Broad-access institutions that are already under-resourced stand to lose the most revenue.

Federalizing the financing of today’s tuition revenues would almost surely exacerbate the underfunding of public higher education by states. State funding for higher education is only now recovering from its Great Recession decline. State funding per student was over $500 higher in 2008 than it is today, and over $1,200 higher at its peak in 2001 (in 2019 dollars). In tough economic times, states often choose to reduce investment in higher education, and with the grudging support of state legislatures, public institutions often respond in subsequent years by raising tuition and seeking out higher-paying out-of-state and international students.

To hold down the cost of a federal free college program, Congress would likely fix its subsidy commitment over time. Yet the cost of education is not fixed. Like most personal services from dental care to child daycare, the cost of providing higher education tends to grow more rapidly than inflation, and states that participate will no longer be able to use the tuition lever to add revenues to university budgets.6 Given the rising demands of health care, K-12 education, infrastructure, and other public needs, states are unlikely to change their basic postures toward higher education. The effect of revenue shortfalls likely will be concentrated at institutions that currently spend the least—schools like community colleges and broad access public universities that serve the nation’s most vulnerable students and have little access to private funds. This could have consequences for student outcomes, including graduation rates, since state support for higher education is closely linked with college completion.7

Rich students would get richer while low-income and non-traditional students would still face an affordability gap.

Much of the benefit of universally setting tuition and fees to zero will go to high-income families that have no financial need.8 Over the past three decades, families in the nation’s top income quintile have experienced earnings growth that has far outpaced increases in list price tuition, while lower-income families have seen rising tuition eat away at their earnings gains. Families at the top of the income distribution also own the bulk of the nation’s financial assets, and their children tend to graduate debt-free already. The Biden higher education plan would condition free college on family incomes less than $125,000. The plan would likely tie federal grants to states for free college programs to the income cap as a condition of receiving that federal support. Most other free college plans have no such income cap, preferring the simplicity of a universal free college approach—and recent estimates suggest that up to one-third of a blanket free college subsidy could go to students whose family incomes exceed $120,000 per year, compared with only 8% to families making under $35,000.9

This means that even if free college becomes a reality, lower-income families and older, independent students will still struggle to afford the remaining costs of attendance. For many students, room and board, books, transportation, and foregone wages are many times higher than the tuition and fees that they pay. For families in the lower half of the income distribution, purchasing an education is more like buying a house than like paying an electric bill. Unlike wealthier households with significant savings, they cannot afford to write a check to cover college expenses. When increases in college costs are not fully offset by new aid from the state or federal government or from colleges themselves, the educational door to advancement begins to close.

Lastly, free college also poses its own set of equity issues. College students are already heavily subsidized relative to young people who go into the trades and are likely to earn less over their working lifetime than most college graduates. Free college programs that target traditional higher education opportunities risk shifting would-be apprentices towards community college regardless of labor market needs or program fit.

A New Affordability Compact for the Next Generation

Republicans and Democrats alike want a higher education system that acts as a true engine of social mobility. To achieve that goal, we need targeted programs that improve access, affordability, and success. A good set of programs also needs to be cost effective and politically feasible in a world of slim majorities and limited resources. Here are four suggestions for Congress based on those criteria:

1. Expand Pell Grants to target aid to low- and middle-income families.

While free college programs finance all students, an enlarged Pell Grant program would target low- and middle-income families. It expands access without subsidizing the wealthy. The Biden administration’s proposed $1,400 increase in the Pell maximum is a down payment toward a larger Pell expansion. We support a larger increase and believe it should be nested within a broader package of policies that enhance college access while also supporting student success once enrolled.

Over half of all Pell recipients have annual family incomes of less than $20,000 per year, and over 80% come from families earning less than $40,000.10 As part of increasing the maximum Pell Grant, the eligibility formula could also be adjusted to allow more families in the middle of the income distribution to receive some grant support. In addition to improving affordability for middle-income families, this would help solidify political support for the program in a similar manner to free college ideas. More Pell support could also reduce borrowing for lower and middle-income families, or help these students match at colleges with a higher cost of attendance that better meet their needs. And as a first-dollar program, any Pell money a student receives above tuition charged can be used to cover other costs of attendance—which include tuition, room and board charges, books, and other expenses. This is an especially important feature for low-income students who attend low-tuition community colleges and regional public universities and for whom non-tuition costs are often the main barrier to accessing the higher education system.

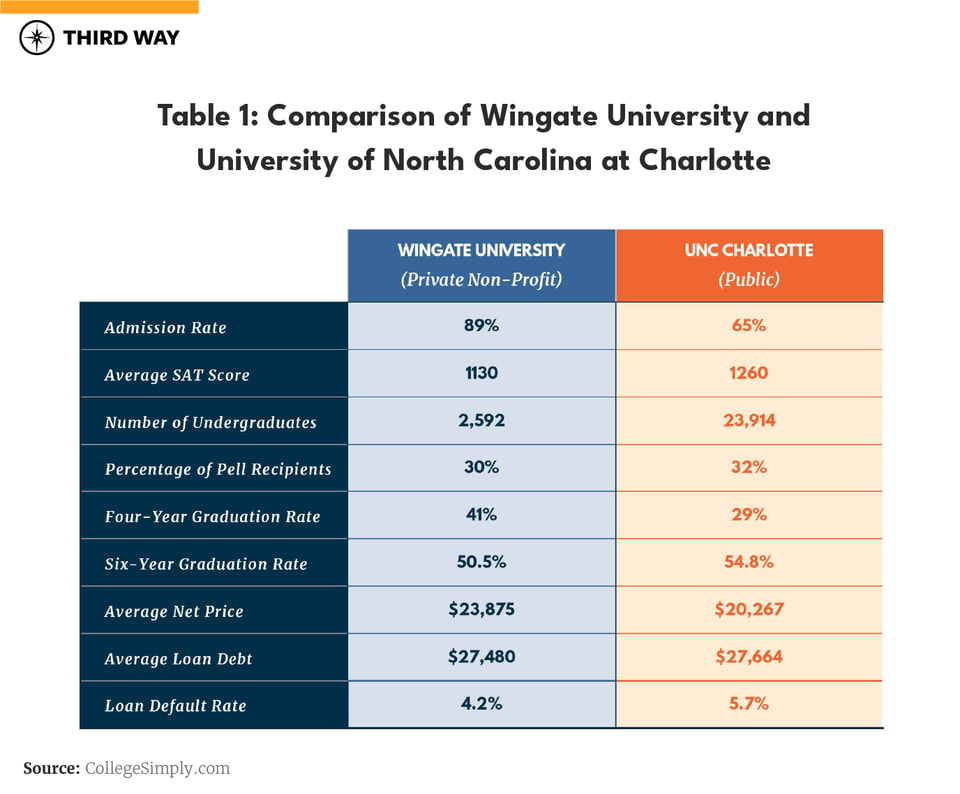

An expanded Pell Grant also offers students more educational options. One of the great features of the Pell Grant is that it travels with the student to any accredited higher education institution to defray the cost of attendance. In contrast, most free college programs cover only tuition at state chartered public institutions. Pell Grants, therefore, can provide students with a more resource-rich set of educational opportunities than a limited free college program. A private university may be a better curricular or personal match for a student’s interests than a public institution, and many such institutions admit more students and have higher completion rates than their public counterparts.

For example, UNC Charlotte is a large public university with almost 24,000 undergraduates. Wingate University is a small private institution on the outskirts of Charlotte serving fewer than 2,600 students. The average net price of attendance is similar at the two institutions, and they serve roughly equal percentages of Pell recipients (32% versus 30%). Wingate is less selective (and therefore more accessible) than UNC Charlotte. Wingate has a higher four-year graduation rate, while UNC Charlotte has a slightly higher six-year graduation rate. Students at both institutions leave with almost identical levels of loan debt. A low-income student should be able to choose which institution better meets their needs.

Like free college ideas, a significant Pell expansion can raise equity considerations. For many students attending community colleges and low-tuition public institutions, college is already tuition-free since the existing Pell maximum exceeds the list price tuition and fees—meaning low-income students can use excess funds for food and housing. On the other hand, young people who forego college do not receive similar subsidies and are likely to experience long-term income insecurity at higher rates than their college-going peers. Congress could address this potential equity issue directly by enlarging the reach of programing and investment under the Workforce Innovation and Opportunity Act (WIOA).

2. Encourage a federal-state partnership that rewards states that invest in higher education.

Using federal money to make public universities tuition-free is a form of a federal/state partnership. But it must not perversely reward states that have lowered their own investment in their higher education systems and pushed the cost of college onto families. A good federal-state partnership proposal would instead reward states that currently behave well, while encouraging those that currently put very few resources into public higher education to do more. Any state that appropriates at least a certain amount per full-time student could become eligible for a federal grant, with additional incentives to help states transition from low appropriation to higher appropriation levels.

Congress should consider these three elements in any partnership program it develops:

- Maintenance of effort. New federal dollars for higher education cannot simply displace money that states are currently spending. Any partnership agreement should require states that participate not to reduce current higher education appropriations once the federal money begins to flow.

- Block grants. Federal money should go to the states as block grants, allowing the states to determine the best allocation of funds among competing priorities within its higher education system, without being overly prescriptive.

- Safe harbor. Safe harbor provisions allow states to temporarily set aside rules like the maintenance of effort provisions when the economic weather turns stormy. The impact of COVID-19 on state budgets offers a clear demonstration of the importance of countercyclical federal support for state budgets in an economic contraction. A federal-state partnership should never pull resources out of higher education during an economic downturn. The safe harbor provision could also become a higher education stabilizer if the size of the block grant is adjusted upward whenever a state’s economy experiences negative growth. As the economy recovers, states should be required to fully restore any cuts made during the downturn or face penalties for not returning to pre-recession appropriations levels.

3. Provide a Pell top-off subsidy to under-resourced, high-impact institutions that work with the nation’s low-income students.

Resources matter for retention and completion, and students at any level of preparedness tend to be more successful in an institution with more educational resources.11 America’s higher education system is extremely stratified. Highly selective colleges and universities spend three to ten times as much per student on instruction, student support, and academic support as the nation’s less selective public and private colleges.12 Yet open-enrollment and minimally selective schools are where the majority of the nation’s lower-income and first-generation students go to college. Institutions accepting over 75% of their applicants account for 70% of all Pell Grant recipient enrollment.13 These students tend to have lower levels of college readiness and a greater need for instructional spending and student support services. Free college plans would likely exacerbate this problem over time by starving higher education systems of resources.

The federal government could help these under-resourced institutions by offering a Pell top-off subsidy that non-profit institutions could add to their operating budgets.14 This idea shares features with President Biden’s “Title 1 for Higher Education” proposal that Third Way championed in 2018.15 The subsidy should be based on the number of Pell dollars the school takes in, not the number of Pell students enrolled. Rewarding schools for taking a high share of Pell-eligible students encourages institutions to attract students who qualify for the Pell label, but who qualify for very little Pell money—in other words, the better-off Pell families. Institutional eligibility should depend on exhibiting greater than some minimum percentage of Pell-eligible students. Institutions should also be able to show that they serve low-income students well (through benchmarks like graduation rates, cohort default, and post-college earnings). The subsidy should also begin to phase out as the institution’s endowment per student passes a certain threshold level. These eligibility requirements would reduce the fiscal footprint of the program (likely around $2 billion per year) while giving universities the incentive to seek out, enroll, and support low-income students through their time in college.

4. Craft an accountability framework that focuses on improving outcomes for students.

Our first three proposals require an increased federal investment in higher education, so Congress and the public should reasonably expect colleges and universities to be held accountable for how effectively they use new resources. Yet successful accountability policies are difficult to construct, and bad policies often give schools perverse incentives.16 We recommend crafting accountability guidelines that emphasize student outcomes, apply to all institutions, offer positive incentives to more schools than just those close to the edge of the failing border, and are difficult for institutions to game.

Emphasizing outcomes does not lead the regulator too deeply into micromanaging the educational process. Applying outcome measures to all institutions may help build consensus to act since sub-sectors of the higher education industry are not singled out for differential treatment. Guidelines that affect very few institutions miss many opportunities to improve behavior across the higher education system. Together, these components of an integrated accountability framework can help cement public and political support for a policy package that creates access and facilitates student success better than a national free college program.

Current federal accountability measures work along two different tracks: providing information (low stakes) and threatening to revoke access to Title IV funding (high stakes). The College Affordability and Transparency Center is an example of the first track.17 The government provides an online repository of information (the College Scorecard) about what families likely will have to pay at a given school based on their family income, and about outcomes like graduation rates, student debt, and earnings. This information has significant limitations and must be interpreted with care, and the extent to which low-income students make good use of the Scorecard is unclear.18 The Center also compiles so-called “shame lists” of the most expensive institutions, though recent research suggests that inclusion on such lists had no effect on enrollment.19 Low-stakes informational mechanisms show little promise as standalone accountability measures. The second accountability track defines numerical targets and punishes schools that fail to meet them by cutting off access to Pell Grants and federal student loans. The 90/10 rule is a good example. For-profit institutions are required to take in at least 10% of their revenue from non-Title IV financial aid sources, such as tuition payments from students and families. This rule is an example of high stakes accountability, since crossing the line is a death sentence for a college or university, but it also affects very few schools since it applies only to for-profit institutions that are perilously close to the borderline.

Risk-sharing is one useful approach for holding colleges and universities accountable for student debt outcomes.20 At present, the risk of loan default is felt by the taxpayer and by students, who cannot easily discharge their loans in bankruptcy. If colleges had to repay a small fraction of loan balances in default, institutions would have an incentive to monitor student borrowing and help students minimize the likelihood of default. This incentive should apply to all schools, not just institutions near a failing borderline, and risk-sharing could work in tandem with other earnings-based accountability measures.

Strengthening the federal government’s response to bad actors in higher education can only increase accountability and improve student outcomes. By restricting student financial aid at institutions with low graduation rates and abysmal records of ensuring their students can repay loan balances upon graduation, we can encourage more students to attend the colleges and universities most likely to help them graduate and help them avoid crippling debt.

Conclusion

A federal free college program can improve access if it reduces the cost of attendance for students who would otherwise not seek a postsecondary education. But it would also inefficiently divert resources to families who have no need. More troubling, any likely federal bargain with the states to institute a free college program may reduce resource flows to colleges and universities over time. And spending caps are most likely to affect already under-resourced public institutions that serve the largest populations of low-income and first-generation students. With limited resources, higher education policy must target resources to the students with the greatest need and the institutions that serve them. There are better, more efficient, and more equitable ways to do this than a universal free college program.

As a nation, we want our higher education system to be accessible to students regardless of their ability to pay. We want students to succeed, so students should match with the best program for their needs. And we want higher education to generate social mobility, so federal money should support institutions that work effectively to help students from disadvantaged backgrounds achieve their full potential. The complexity of this set of policy proposals is not a bug, but a feature. Complex policy problems deserve nuanced solutions. While “free college” may fit on a bumper sticker, the alternative proposals offered here represent a more progressive and efficient approach to addressing longstanding issues of access—and keep students with the greatest need at the center of the conversation on college affordability.

David H. Feldman is a Professor of Economics at William & Mary. He is the author, with Robert B. Archibald, of the books “Why Does College Cost So Much?” and “The Road Ahead for America’s Colleges and Universities,” both published by Oxford University Press.

Christopher R. Marsicano is the Founding Director of the College Crisis Initiative and Assistant Professor of Educational Studies and Public Policy at Davidson College. His research focuses on higher education finance and policy.